Nationwide Insurance Make A Payment

Making a payment to Nationwide Insurance is a straightforward process that offers several convenient options to suit different preferences and circumstances. Whether you're looking for an easy online payment, the flexibility of paying by phone, or the traditional method of mailing a check, Nationwide provides a range of secure and accessible payment channels. This guide will walk you through the various methods, offering step-by-step instructions and tips to ensure a smooth and timely payment experience.

Online Payment

The online payment method is one of the quickest and most efficient ways to pay your Nationwide Insurance bill. It allows you to make payments directly from your bank account or credit card, ensuring a secure and convenient transaction. Here’s how to do it:

Step-by-Step Guide

-

Visit the Nationwide Payment Portal: Go to the official Nationwide Insurance website and navigate to the “Make a Payment” section, usually found under the “Policy Services” or “Billing” tab.

-

Log In to Your Account: Enter your policy number and the last name of the policyholder to access your account. If you don’t have a policy number, you may need to create an account using your email address and other relevant details.

-

Choose Your Payment Method: Nationwide typically offers several options, including direct bank account transfers (ACH) and major credit cards such as Visa, MasterCard, American Express, and Discover.

-

Enter Payment Details: Provide the required information, such as your bank account number and routing number for ACH payments or your credit card number, expiration date, and CVV for credit card payments.

-

Review and Confirm: Carefully review the payment amount, date, and method. Ensure all the details are accurate before finalizing the transaction.

-

Receive Confirmation: Once your payment is processed, you should receive a confirmation message or email. Save this for your records and as proof of payment.

Tips for Online Payment

-

Ensure you have the necessary payment information, such as your bank account details or credit card information, readily available before starting the process.

-

Consider setting up automatic payments or enrolling in a payment plan if you prefer a hands-off approach or need to spread out your payments.

-

Keep an eye on your email for payment confirmations and any important updates or notifications from Nationwide.

Pay by Phone

If you prefer a more personal approach or need assistance with your payment, Nationwide offers a dedicated phone line for payment inquiries and transactions. Here’s how to make a payment over the phone:

Step-by-Step Guide

-

Call Nationwide’s Payment Line: Dial the customer service number provided on your insurance documents or on the Nationwide website. You can typically find this number under the “Contact Us” or “Customer Service” section.

-

Provide Policy Information: When connected to a representative, be ready to provide your policy number and the last name of the policyholder. This information is necessary to access your account.

-

Choose Payment Method: The representative will guide you through the available payment options, which may include credit card payments, electronic checks (e-checks), or even setting up a payment plan.

-

Give Payment Details: Share your payment information, such as your credit card number or bank account details, as requested by the representative. Ensure you provide accurate and complete information.

-

Confirm and Receive Receipt: After providing your payment details, verify the amount and method with the representative. Once the payment is processed, you should receive a confirmation number or a receipt via email or postal mail.

Tips for Phone Payments

-

Have your policy information and payment details ready before calling to expedite the process.

-

If you have any questions or concerns about your payment or policy, the customer service representative can provide real-time assistance and guidance.

-

Consider using this method if you prefer a more personalized experience or need help navigating the payment process.

Mail-In Payment

For those who prefer the traditional method or who may not have access to online banking or a credit card, mailing a check or money order is a reliable option. Here’s how to make a payment by mail:

Step-by-Step Guide

-

Prepare Your Payment: Make out a check or money order to “Nationwide Insurance” for the full amount due. Ensure that your policy number is clearly written on the memo line of the check or money order.

-

Include Payment Coupon: If you received a payment coupon with your billing statement, include it with your payment. If not, you can usually print a coupon from the Nationwide website by logging into your account and navigating to the billing section.

-

Address the Envelope: Use the pre-printed address label on the payment coupon, if available. If not, address the envelope to the “Nationwide Insurance Payment Center” at the address provided on your billing statement or on the Nationwide website.

-

Mail Your Payment: Send your payment via regular mail or consider using a trackable service for added security. Allow sufficient time for your payment to reach Nationwide before the due date to avoid late fees.

-

Keep a Record: Once you’ve mailed your payment, make a note of the date and amount, and keep a copy of your check or money order for your records.

Tips for Mail-In Payments

-

Allow ample time for your payment to reach Nationwide, especially if you’re mailing it close to the due date.

-

Consider using a trackable mailing service to ensure your payment arrives safely and on time.

-

Keep records of your payment, including the check number, date, and amount, for future reference and to prove timely payment if needed.

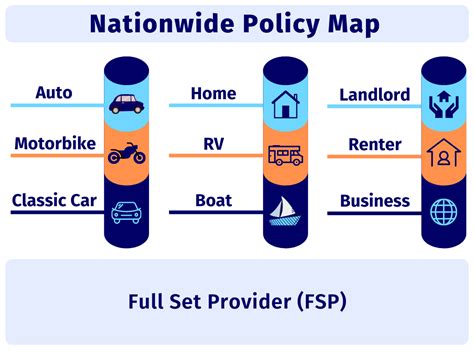

Other Payment Methods

In addition to the above methods, Nationwide may offer other payment options, depending on your specific policy and location. These could include:

-

Mobile Payment Apps: Some mobile banking apps or payment platforms like PayPal or Venmo may allow you to pay your Nationwide Insurance bill directly from your phone.

-

Agent Payments: If you work with a local insurance agent, they may be able to process payments on your behalf, either in person or over the phone.

-

Bank Bill Pay: Check with your bank to see if they offer a bill pay service that can be used to pay your Nationwide Insurance bill. This method often involves setting up an automatic payment from your bank account to Nationwide's account.

Tips for Exploring Additional Payment Methods

-

Check the Nationwide website or your policy documents for any specific instructions or guidelines related to these alternative payment methods.

-

Consider the fees, processing times, and any potential limitations associated with these methods before choosing one.

-

If you’re unsure about a particular payment method, contact Nationwide’s customer service for clarification and guidance.

Payment Deadlines and Late Fees

It’s crucial to understand Nationwide’s payment deadlines to avoid late fees and potential policy disruptions. Typically, Nationwide requires payments to be received by a certain date, often referred to as the “due date” or “payment deadline.”

Understanding Payment Deadlines

Your billing statement or policy documents will clearly indicate the due date for your payment. It’s essential to review this information carefully and plan your payment accordingly. If you’re paying online or by phone, the transaction should be completed before the due date to ensure timely processing.

Late Fees and Policy Implications

If you miss the payment deadline, Nationwide may assess a late fee, typically a percentage of the total premium due. Late fees can vary depending on your policy and state regulations. It’s important to note that repeated late payments or non-payment can lead to policy cancellation, so it’s crucial to stay on top of your payment schedule.

💡 Pro Tip: Set up automatic payments or payment reminders to ensure you never miss a payment deadline. This can be especially helpful if you have multiple insurance policies or bills to manage.

Payment Plan Options

For policyholders who prefer to spread out their payments over time, Nationwide offers flexible payment plan options. These plans can help make insurance premiums more manageable and budget-friendly.

Available Payment Plans

Nationwide typically provides a few payment plan options, including:

-

Monthly Installments: This plan allows you to pay your premium in equal monthly installments over a specified period, often 10-12 months.

-

Semi-Annual or Quarterly Payments: Some policies may offer the option to pay your premium in two or four installments over the course of a year.

-

Custom Payment Plans: In certain cases, Nationwide may work with policyholders to create a customized payment plan that aligns with their financial situation.

Enrolling in a Payment Plan

To enroll in a payment plan, you can typically do so online through your Nationwide account or by calling customer service. The enrollment process may involve providing additional financial information and agreeing to terms and conditions specific to the payment plan.

Benefits of Payment Plans

-

Budget Management: Payment plans can help you better manage your budget by spreading out the cost of your insurance premiums over time.

-

Flexibility: With various plan options, you can choose the one that best fits your financial situation and payment preferences.

-

Avoid Late Fees: By setting up a payment plan, you reduce the risk of late payments and associated fees.

Conclusion

Making a payment to Nationwide Insurance is a simple and flexible process, thanks to the variety of payment methods available. Whether you choose to pay online, by phone, through the mail, or by utilizing alternative payment options, Nationwide aims to accommodate different preferences and circumstances. Remember to stay organized, keep track of payment deadlines, and take advantage of payment plans to ensure a seamless and stress-free insurance experience.

Can I make a partial payment to Nationwide Insurance?

+While Nationwide may accept partial payments in some cases, it’s important to understand that full payment is generally required to avoid late fees and policy disruptions. Partial payments may still incur late fees, and repeated partial payments could lead to policy cancellation. It’s best to communicate with Nationwide’s customer service if you’re facing financial difficulties to explore potential solutions.

What happens if I miss a payment deadline with Nationwide Insurance?

+Missing a payment deadline with Nationwide Insurance can result in late fees and potential policy cancellation. It’s crucial to stay on top of your payment schedule to avoid these consequences. If you anticipate missing a payment, it’s recommended to contact Nationwide’s customer service to discuss your options and potentially arrange an extension or alternative payment plan.

How can I set up automatic payments with Nationwide Insurance?

+To set up automatic payments with Nationwide Insurance, you can typically do so online through your Nationwide account. Log in to your account, navigate to the billing or payment section, and look for the option to enroll in automatic payments. You’ll need to provide your bank account or credit card information and choose the frequency and amount of the payments. Automatic payments can help ensure timely payments and reduce the risk of late fees.