Average Cost Of Family Health Insurance

Securing quality healthcare for your family is a paramount concern, especially when navigating the complex landscape of health insurance options. The average cost of family health insurance can vary significantly depending on several factors, including your location, the plan's coverage, and the age and health status of your family members. Understanding these costs is crucial for making informed decisions about your family's healthcare coverage.

Factors Influencing Family Health Insurance Costs

The price of family health insurance is not a uniform figure but rather a dynamic metric influenced by various elements. Let’s delve into these factors to provide a comprehensive understanding.

Geographical Location

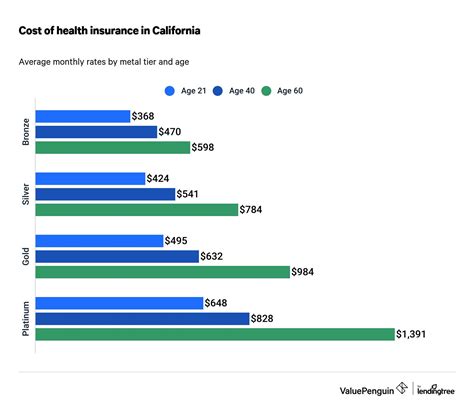

The region in which you reside can significantly impact your health insurance costs. Healthcare expenses can vary across states and even within different counties due to varying costs of living, medical facility rates, and local regulations. For instance, urban areas often have higher healthcare costs than rural areas, which can reflect in insurance premiums.

Plan Coverage and Benefits

The level of coverage and the benefits included in your chosen health insurance plan are key determinants of the cost. Plans offering comprehensive coverage for a wide range of services, including specialist care, prescriptions, and preventive measures, tend to be more expensive. Conversely, plans with limited coverage and higher deductibles or co-pays may be more cost-effective but might not provide the desired level of financial protection in case of significant health issues.

Family Size and Age

The size and age of your family are significant factors in determining the cost of health insurance. Generally, the more family members you have, the higher the premium. Additionally, the age of your family members plays a role, with younger individuals often paying lower premiums and older individuals requiring higher premiums due to potentially increased health risks and medical needs.

Health Status and Pre-existing Conditions

The health status of your family members can influence the cost of insurance. Individuals with pre-existing conditions or chronic illnesses may face higher premiums or be subject to waiting periods before certain conditions are covered. However, it’s important to note that under the Affordable Care Act (ACA), insurers are prohibited from denying coverage or charging more to individuals with pre-existing conditions.

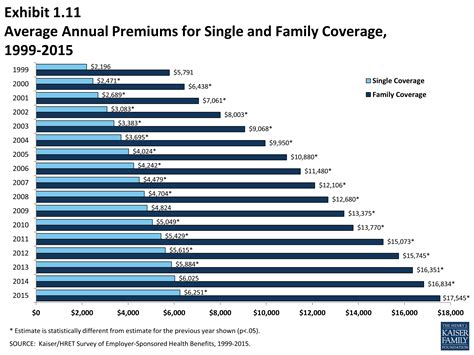

Average Costs: A Snapshot

According to recent industry reports, the average cost of a family health insurance plan in the United States can range from approximately 500 to 2,000 per month. This wide range reflects the diversity of plans available and the factors influencing their cost.

| Plan Type | Average Monthly Cost |

|---|---|

| Gold Plan (Comprehensive Coverage) | $1,500 - $2,000 |

| Silver Plan (Moderate Coverage) | $1,000 - $1,500 |

| Bronze Plan (Basic Coverage) | $500 - $1,000 |

These averages are based on plans purchased through the Health Insurance Marketplace. The actual cost for a family can vary based on the factors mentioned earlier, such as location and the specific plan's coverage and benefits.

Strategies for Managing Family Health Insurance Costs

Navigating the complexities of family health insurance doesn’t have to be daunting. Here are some strategies to help manage costs effectively.

Assess Your Family’s Healthcare Needs

Begin by evaluating your family’s unique healthcare requirements. Consider factors such as the frequency of doctor visits, the need for specialized care, prescription medication usage, and any known or potential health concerns. This assessment will guide you in selecting a plan that provides adequate coverage without unnecessary expenses.

Explore Different Plan Options

Health insurance plans vary widely in their coverage, benefits, and costs. Take the time to research and compare different plans, both within and across insurance providers. Consider plans with different levels of coverage, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each type offers varying degrees of flexibility and cost-effectiveness, so it’s essential to find the right balance for your family’s needs.

Utilize Government Programs and Subsidies

The Affordable Care Act (ACA) has introduced several initiatives to make health insurance more affordable and accessible. If your income falls within a certain range, you may be eligible for premium tax credits or cost-sharing reductions, which can significantly lower your monthly premiums and out-of-pocket expenses. Additionally, certain government programs like Medicaid or Children’s Health Insurance Program (CHIP) can provide comprehensive coverage at little to no cost for eligible families.

Take Advantage of Employer-Sponsored Plans

Many employers offer health insurance plans as part of their benefits package. These plans can often provide significant cost savings, as employers often contribute a portion of the premium cost. Additionally, employer-sponsored plans may offer a wider range of coverage options and more comprehensive benefits compared to individual plans.

The Future of Family Health Insurance

The landscape of family health insurance is continually evolving, driven by changes in healthcare policy, technological advancements, and shifts in consumer preferences. Let’s explore some of the trends and developments that may shape the future of family health insurance.

Rise of Telehealth and Digital Health Solutions

The COVID-19 pandemic accelerated the adoption of telehealth services, allowing individuals to access healthcare remotely. This trend is expected to continue, offering increased convenience and accessibility, especially for families in rural or underserved areas. Additionally, the integration of digital health technologies, such as wearables and mobile health apps, is likely to play a larger role in preventive care and chronic disease management, potentially reducing overall healthcare costs.

Focus on Value-Based Care and Population Health

The healthcare industry is shifting towards a value-based care model, which focuses on providing high-quality, cost-effective care. This approach aims to improve health outcomes and patient satisfaction while reducing unnecessary costs. Health insurance plans may increasingly incorporate value-based care initiatives, such as rewarding providers for keeping patients healthy and offering incentives for healthy lifestyle choices.

Expansion of High-Deductible Health Plans (HDHPs)

High-deductible health plans, often paired with Health Savings Accounts (HSAs), have gained popularity due to their potential tax benefits and cost-saving advantages. These plans have higher deductibles but lower premiums, making them attractive to families who anticipate limited healthcare needs. However, it’s essential to carefully consider your family’s healthcare needs and financial situation before opting for an HDHP, as unexpected medical expenses could result in higher out-of-pocket costs.

Conclusion

Securing comprehensive and affordable family health insurance is a critical aspect of financial planning and ensuring the well-being of your loved ones. By understanding the factors that influence insurance costs and adopting strategies to manage these expenses, you can make informed decisions that align with your family’s healthcare needs and budget. Remember, the right health insurance plan is one that provides peace of mind and financial protection, ensuring your family receives the care they deserve.

What is the Affordable Care Act (ACA) and how does it affect family health insurance costs?

+The Affordable Care Act (ACA), also known as Obamacare, is a federal law that introduced significant reforms to the U.S. healthcare system. The ACA aims to make health insurance more affordable and accessible by requiring most Americans to have health insurance and providing subsidies to help cover the cost. It also prohibits insurers from denying coverage or charging more based on pre-existing conditions. For families, the ACA has led to more affordable insurance options and greater protections.

Are there any tax benefits associated with family health insurance plans?

+Yes, certain health insurance plans can offer tax benefits. For instance, High-Deductible Health Plans (HDHPs) can be paired with Health Savings Accounts (HSAs), allowing individuals to save pre-tax dollars for qualified medical expenses. Additionally, premium tax credits and cost-sharing reductions under the ACA can provide significant tax savings for eligible families.

How can I determine if a health insurance plan is right for my family’s needs?

+When evaluating health insurance plans, consider factors such as your family’s typical healthcare needs, the cost of premiums and out-of-pocket expenses, the plan’s coverage limits and exclusions, and the network of healthcare providers. It’s also essential to review the plan’s customer satisfaction ratings and claims handling process. By carefully assessing these aspects, you can choose a plan that provides adequate coverage and aligns with your family’s financial situation.