Home And Auto Insurance Bundle

In the ever-evolving world of insurance, understanding the benefits and intricacies of bundling your home and auto insurance policies is essential for making informed decisions about your financial protection. Bundling, or combining multiple insurance policies with the same insurer, offers a range of advantages that can significantly impact your coverage and premiums. This comprehensive guide will delve into the world of home and auto insurance bundles, exploring the benefits, the process of obtaining them, and the key considerations to ensure you make the right choice for your specific needs.

The Benefits of Bundling Home and Auto Insurance

Bundling home and auto insurance policies offers a plethora of advantages that extend beyond the mere convenience of managing multiple policies with a single insurer. These benefits can significantly enhance your coverage and provide financial savings, making it a popular choice for many homeowners and vehicle owners.

Discounts and Cost Savings

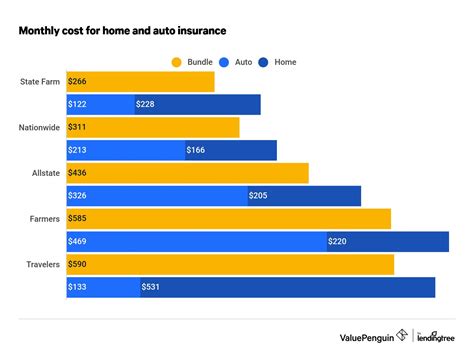

One of the most appealing aspects of bundling is the potential for substantial discounts. Insurance companies often reward customers who bundle their policies by offering multi-policy discounts. These discounts can range from 5% to 25% off your total premium, depending on the insurer and the specific policies involved. For instance, a study by InsuranceQuotes revealed that bundling home and auto insurance policies resulted in an average savings of 15% on annual premiums. This can translate to hundreds of dollars in savings each year, making it a financially prudent decision for many.

Additionally, bundling can simplify your insurance management. Instead of dealing with multiple insurers, bill dates, and policy renewals, you have a single point of contact and a streamlined process. This not only saves time but also reduces the likelihood of missing payments or policy lapses, providing peace of mind.

Enhanced Coverage and Benefits

Bundling also opens the door to enhanced coverage and benefits. Many insurers offer exclusive perks to bundled policyholders. These can include increased liability limits, expanded coverage options, and even additional services. For example, some insurers provide identity theft protection or roadside assistance as part of a bundled policy, adding extra layers of protection beyond the traditional home and auto coverage.

Furthermore, bundling can lead to improved claims experiences. When you have multiple policies with the same insurer, they have a more comprehensive understanding of your insurance needs and can provide faster and more efficient claims processing. This is particularly beneficial in situations where a claim involves both your home and auto insurance, such as a natural disaster that damages both your home and vehicle.

Customized Coverage Solutions

Bundling allows you to tailor your insurance coverage to your unique needs. Insurance providers can offer personalized solutions by combining home and auto insurance. This means you can choose the specific coverage limits, deductibles, and endorsements that best suit your circumstances. Whether you require higher liability limits for your auto insurance or additional coverage for high-value items in your home, bundling provides the flexibility to create a comprehensive protection package.

For instance, if you own a classic car, you can bundle it with your home insurance policy, ensuring it receives the specialized coverage it requires. This level of customization ensures that your insurance portfolio is aligned with your specific risks and assets, providing a more holistic approach to protection.

Improved Risk Assessment

Insurance companies assess risk based on a variety of factors, including your insurance history, claims experience, and the specific policies you hold. By bundling your home and auto insurance, insurers can gain a more comprehensive view of your risk profile. This can lead to more accurate assessments and, in some cases, better rates. Insurers may view you as a lower risk when they see a long-term commitment and a stable insurance history.

Moreover, bundling can be particularly advantageous for high-risk drivers or homeowners. Insurers may offer more favorable terms and rates for bundled policies, as they are able to spread the risk across multiple lines of coverage. This can be a significant benefit for individuals who face challenges obtaining insurance due to their risk profile.

The Process of Obtaining a Home and Auto Insurance Bundle

Securing a home and auto insurance bundle is a straightforward process that involves careful consideration and comparison of insurers and their offerings. Here’s a step-by-step guide to help you navigate the process effectively.

Research and Comparison

Start by researching and comparing insurance providers in your area. Look for companies that offer both home and auto insurance and have a reputation for quality service and financial stability. Consider factors such as their financial strength ratings, customer satisfaction scores, and the range of coverage options they provide. Online resources, consumer reviews, and industry reports can be valuable tools in this initial phase.

Once you've identified a shortlist of insurers, delve deeper into their specific offerings. Compare the coverage limits, deductibles, and any additional benefits or perks they provide for bundled policies. Pay attention to the fine print and understand any exclusions or limitations that may apply.

Obtain Quotes

Contact the insurers on your shortlist and request quotes for both your home and auto insurance. Provide accurate and detailed information about your home, vehicles, and personal circumstances. Be honest and thorough in your disclosures to ensure you receive accurate quotes.

When obtaining quotes, ask about any multi-policy discounts or bundling incentives they offer. Compare the quotes side by side, considering not only the cost but also the coverage limits and any additional benefits included. Don't hesitate to ask questions to clarify any aspects of the policies.

Review and Analyze

Take the time to carefully review and analyze the quotes you’ve received. Consider not only the premium amounts but also the coverage details and any potential discounts or perks. Evaluate the insurers’ financial stability, claims handling reputation, and customer service record. It’s essential to find a balance between cost and comprehensive coverage.

If you have specific needs or concerns, such as a high-value home or a classic car, discuss these with the insurers. They may be able to provide customized solutions or offer additional coverage options to address your unique circumstances.

Select the Right Insurer

Based on your research, quotes, and analysis, select the insurer that best meets your needs and provides the most value. Consider factors such as cost, coverage, reputation, and any additional benefits you may receive by bundling. Remember that the right insurer for you may not necessarily be the one offering the lowest premium.

Once you've made your decision, reach out to the chosen insurer and express your interest in bundling your home and auto insurance policies. They will guide you through the application process and help you finalize the details of your bundled policy.

Finalize the Bundle

During the application process, provide all the necessary information and documentation to complete the bundling process. This may include details about your home, vehicles, and personal information. Ensure that you understand the terms and conditions of the bundled policy, including any exclusions or limitations.

Review the policy documents carefully, paying close attention to the coverage limits, deductibles, and any additional benefits or services included. Ask questions if any aspects are unclear, and don't hesitate to seek clarification from the insurer. Once you are satisfied with the policy terms, sign the necessary documents to finalize the bundle.

Key Considerations for Home and Auto Insurance Bundles

While bundling home and auto insurance policies offers numerous benefits, there are some key considerations to keep in mind to ensure you make the right choice for your specific circumstances. These considerations can help you navigate the bundling process with confidence and find the best solution for your insurance needs.

Understand Your Insurance Needs

Before diving into the world of bundles, it’s crucial to have a clear understanding of your insurance needs. Assess your unique circumstances, including the value of your home, the number and type of vehicles you own, and any specific coverage requirements. Consider factors such as your location, the age and condition of your property, and any high-value items or unique assets you wish to protect.

By understanding your insurance needs, you can tailor your bundled policy to provide the right level of protection. This ensures that you're not paying for coverage you don't need while also avoiding any gaps in coverage that could leave you vulnerable.

Shop Around for the Best Deal

While bundling can offer significant savings, it’s essential to shop around and compare quotes from multiple insurers. Don’t assume that the first insurer you approach will provide the best deal. Take the time to request quotes from several companies and compare their offerings side by side. This competitive research will help you identify the insurer that offers the most comprehensive coverage at the most competitive price.

Consider using online comparison tools or working with an insurance broker who can provide quotes from multiple insurers. This approach allows you to leverage the power of choice and find the best possible deal for your home and auto insurance bundle.

Consider Additional Coverage Options

Bundling often opens the door to a range of additional coverage options and benefits. Take the time to explore these options and consider whether they align with your needs. For example, some insurers offer enhanced liability coverage, rental car reimbursement, or coverage for high-value items as part of a bundled policy.

Evaluate the potential benefits of these additional coverage options and determine if they provide value for your specific circumstances. While these add-ons can enhance your protection, they may also come at an additional cost. Weigh the benefits against the increased premium to make an informed decision.

Read the Fine Print

When comparing quotes and reviewing policy documents, it’s crucial to pay close attention to the fine print. Understand the coverage limits, deductibles, and any exclusions or limitations that apply to your bundled policy. Don’t be afraid to ask questions if any aspects are unclear.

Review the policy wording carefully, ensuring that you comprehend the terms and conditions. This attention to detail can help you avoid surprises down the line and ensure that your expectations align with the actual coverage provided.

Assess the Insurer’s Reputation

The reputation of the insurer you choose for your home and auto insurance bundle is a critical factor to consider. Research and evaluate the insurer’s track record, financial stability, and customer satisfaction ratings. Look for reviews and testimonials from existing customers to gain insights into their claims handling processes and overall customer service.

A reputable insurer with a strong financial foundation and a positive customer reputation can provide peace of mind. They are more likely to be reliable and responsive when it comes to paying claims and providing support during times of need. Don't underestimate the value of a positive insurer reputation when making your decision.

Review and Adjust as Needed

Your insurance needs may evolve over time, and it’s important to regularly review and adjust your bundled policy accordingly. Life events such as home renovations, the purchase of a new vehicle, or changes in your personal circumstances can impact your insurance requirements.

Periodically assess your coverage to ensure it remains adequate and aligned with your current needs. Reach out to your insurer to discuss any changes and explore options for updating your policy. This proactive approach ensures that your home and auto insurance bundle continues to provide the comprehensive protection you require as your life circumstances evolve.

Frequently Asked Questions

How much can I expect to save by bundling my home and auto insurance policies?

+

The savings from bundling home and auto insurance policies can vary depending on factors like the insurer, coverage limits, and your specific circumstances. On average, you can expect to save around 10-15% on your annual premiums. However, some insurers offer even higher discounts, reaching up to 25% for bundled policies.

Can I bundle my insurance policies with any insurer, or do I need to find a specialized provider?

+

Most insurance companies offer the option to bundle home and auto insurance policies, making it convenient to manage your coverage with a single provider. You can typically find bundling options with major insurers, local providers, and even online insurance platforms.

Are there any disadvantages to bundling my home and auto insurance policies together?

+

While bundling offers many benefits, there are a few potential drawbacks to consider. For instance, if you have a preferred insurer for one type of insurance but not the other, you may need to compromise on your choice. Additionally, some insurers may have limitations or exclusions on bundled policies, so it’s important to review the fine print.

What happens if I need to file a claim under my bundled home and auto insurance policy? Will it affect both policies?

+

When you file a claim under your bundled policy, the impact on your coverage depends on the specific circumstances and the terms of your policy. In some cases, a claim may only affect one policy (e.g., a car accident claim impacting your auto insurance), while in others, it could impact both policies if the incident involves both your home and vehicle (e.g., a natural disaster causing damage to both).