Auto Insurance Quote On Line

Obtaining an auto insurance quote online has become a convenient and efficient way for individuals to assess their insurance options. With the advancement of technology and the increasing digital presence of insurance companies, the process of comparing rates and coverage has evolved significantly. In this comprehensive guide, we will delve into the world of online auto insurance quotes, exploring the steps, factors, and considerations involved in securing the best coverage for your vehicle.

Understanding Auto Insurance Quotes Online

The concept of auto insurance quotes online revolves around the idea of providing potential policyholders with an estimate of their insurance costs based on various factors. These quotes are generated through a combination of advanced algorithms and real-time data, offering a personalized snapshot of the insurance landscape. By utilizing online platforms, individuals can quickly compare rates from multiple providers, making informed decisions about their coverage needs.

The Process of Getting an Online Quote

Securing an auto insurance quote online typically involves a straightforward process. Here’s a step-by-step guide to help you navigate through the procedure:

Step 1: Choose a Reputable Insurance Provider

The first step is to identify reputable insurance companies that offer online quote services. Research and compare different providers based on their reputation, customer reviews, and the range of coverage options they provide. Consider factors such as financial stability, customer service ratings, and the availability of specialized coverage for unique needs.

Step 2: Gather Necessary Information

Before initiating the quote process, gather all the relevant information required by insurance providers. This typically includes personal details like your name, date of birth, and contact information. Additionally, you’ll need vehicle-specific data such as the make, model, year, and vehicle identification number (VIN). Having this information readily available will streamline the quote process.

Step 3: Access the Online Quote Platform

Visit the chosen insurance provider’s website and locate the dedicated section for obtaining quotes. Most reputable providers have user-friendly interfaces designed to guide you through the quote process seamlessly. Look for options like “Get a Quote” or “Estimate Your Insurance Costs” to initiate the process.

Step 4: Provide Vehicle and Driver Information

The online quote platform will prompt you to enter detailed information about your vehicle and driving history. This may include details such as the primary driver’s age, gender, driving record, and any previous claims or accidents. Accurate and honest disclosure of this information is crucial, as it directly impacts the quote’s accuracy.

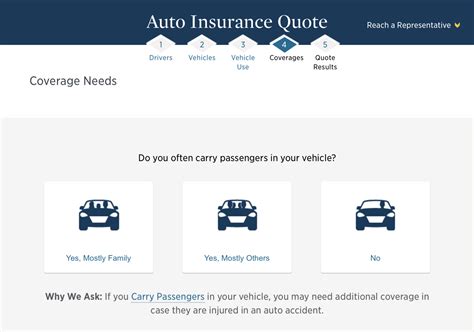

Step 5: Customize Your Coverage

Online quote platforms often allow you to customize your insurance coverage to align with your specific needs. You can choose from various coverage options, including liability, collision, comprehensive, personal injury protection (PIP), and additional add-ons. Take the time to understand each coverage type and select the ones that provide the best protection for your circumstances.

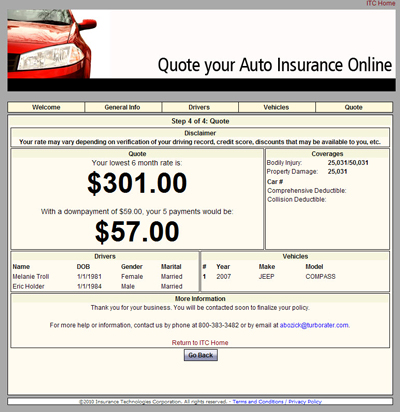

Step 6: Receive and Review Your Quote

Once you’ve provided all the necessary information and customized your coverage preferences, the insurance provider’s system will generate a quote based on your inputs. Review the quote carefully, paying attention to the coverage limits, deductibles, and any additional fees or discounts applied. Ensure that the quote aligns with your expectations and meets your insurance requirements.

Step 7: Compare and Make an Informed Decision

Don’t settle for the first quote you receive. Take advantage of the online quote process by comparing rates from multiple providers. Consider factors such as price, coverage limits, customer service ratings, and the overall reputation of the insurance company. By evaluating multiple quotes, you can make a well-informed decision about which provider offers the best value for your insurance needs.

Factors Influencing Online Auto Insurance Quotes

Several factors contribute to the calculation of auto insurance quotes online. Understanding these factors can help you anticipate the potential costs and make strategic decisions to optimize your coverage. Here are some key factors that influence online auto insurance quotes:

Driver’s Age and Gender

Insurance providers often consider the age and gender of the primary driver when calculating quotes. Young drivers, particularly those under 25, tend to be associated with higher risk, resulting in increased insurance premiums. Similarly, male drivers may face slightly higher rates due to statistical data suggesting a higher propensity for accidents.

Driving Record and Claims History

Your driving record plays a significant role in determining your insurance quote. A clean driving record with no accidents or violations is generally rewarded with lower premiums. Conversely, a history of accidents, traffic violations, or insurance claims can lead to higher rates, as insurance providers view these factors as indicators of increased risk.

Vehicle Type and Usage

The type of vehicle you drive and its intended usage impact your insurance quote. Factors such as the make, model, year, and engine size of your vehicle are considered. Additionally, the purpose for which you use your vehicle, whether it’s primarily for commuting, business, or pleasure, can influence the quote. Insurance providers assess the risk associated with different vehicle types and usage patterns to determine appropriate rates.

Location and Geographic Factors

Your geographic location is a critical factor in auto insurance quotes. Insurance providers analyze data related to accident rates, crime statistics, and traffic congestion in different areas. Regions with higher accident frequencies or a higher incidence of car theft may result in increased insurance premiums. Additionally, the availability of emergency services and repair facilities in your area can impact the overall cost of insurance.

Coverage Preferences and Deductibles

The coverage options you choose and the corresponding deductibles you select play a vital role in determining your insurance quote. Opting for higher coverage limits or adding specialized coverage types can increase your premium. Conversely, selecting higher deductibles, which means you pay more out of pocket before insurance coverage kicks in, can lead to lower premiums. It’s essential to find the right balance between coverage and cost to suit your individual needs.

Tips for Optimizing Your Online Auto Insurance Quote

To ensure you secure the best auto insurance quote online, consider the following tips and strategies:

Shop Around and Compare

Don’t settle for the first quote you receive. Take the time to shop around and compare quotes from multiple insurance providers. Utilize online comparison tools or directly visit the websites of reputable insurance companies to gather a comprehensive overview of available rates. By comparing quotes, you can identify the most competitive options and make informed choices.

Bundle Your Policies

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts and incentives for customers who bundle their coverage. By consolidating your insurance needs, you can potentially save money and streamline the management of your policies.

Explore Discounts and Savings Opportunities

Insurance providers often offer a variety of discounts and savings opportunities to attract customers. These discounts may be based on factors such as safe driving records, loyalty rewards, educational qualifications, or membership in certain organizations. Research and inquire about the available discounts to see if you qualify for any potential savings.

Maintain a Good Driving Record

A clean driving record is crucial for securing favorable auto insurance quotes. Avoid accidents, traffic violations, and reckless driving behaviors. Over time, a consistent record of safe driving can lead to reduced insurance premiums as insurance providers reward responsible drivers with lower rates.

Consider Usage-Based Insurance

Some insurance providers offer usage-based insurance programs that monitor your driving behavior and adjust your premiums accordingly. These programs may use telematics devices or smartphone apps to track factors such as mileage, driving speed, and braking habits. If you’re a safe and cautious driver, you may benefit from lower premiums through usage-based insurance programs.

Future Implications and Technological Advancements

The landscape of auto insurance is continuously evolving, driven by technological advancements and changing consumer preferences. As the digital age progresses, insurance providers are adopting innovative technologies to enhance the quote process and provide personalized coverage options. Here are some future implications and technological advancements to watch for in the auto insurance industry:

Artificial Intelligence and Machine Learning

Insurance providers are leveraging artificial intelligence (AI) and machine learning algorithms to improve the accuracy and efficiency of quote generation. These technologies enable providers to analyze vast amounts of data, including driving behavior, weather patterns, and traffic conditions, to deliver more precise quotes. AI-powered systems can also automate certain aspects of the claims process, enhancing overall efficiency.

Telematics and Connected Cars

The integration of telematics and connected car technologies is revolutionizing the auto insurance industry. Telematics devices installed in vehicles collect real-time data on driving behavior, such as speed, acceleration, and braking patterns. This data allows insurance providers to offer usage-based insurance policies that reward safe driving with lower premiums. Additionally, connected cars can facilitate direct communication between insurers and policyholders, streamlining the claims process and enhancing customer service.

Blockchain Technology

Blockchain technology has the potential to transform the auto insurance industry by enhancing data security, transparency, and efficiency. Blockchain can be used to create a secure and immutable record of insurance policies, claims, and payments, reducing the risk of fraud and streamlining administrative processes. Additionally, blockchain-based smart contracts can automate certain aspects of insurance, such as policy issuance and claims settlement, improving overall efficiency and reducing costs.

Digital Customer Engagement

Insurance providers are increasingly focusing on digital customer engagement to enhance the overall customer experience. This includes developing user-friendly mobile apps and online platforms that enable policyholders to manage their insurance policies, track claims, and access real-time information. By embracing digital technologies, insurance companies can provide convenient and personalized services, fostering customer loyalty and satisfaction.

Conclusion

Obtaining an auto insurance quote online has become a convenient and powerful tool for individuals seeking the best coverage options for their vehicles. By understanding the process, factors, and considerations involved, you can navigate the online quote landscape with confidence. Remember to compare quotes, explore discounts, and stay proactive in maintaining a safe driving record to secure the most favorable insurance rates. As the auto insurance industry continues to evolve with technological advancements, staying informed and embracing digital solutions will be key to optimizing your insurance experience.

How long does it take to receive an online auto insurance quote?

+The time it takes to receive an online auto insurance quote can vary depending on several factors. On average, you can expect to receive a quote within a few minutes to an hour. However, the process may take longer if you need to gather additional information or if the insurance provider requires further verification of your details.

Can I get an accurate quote without providing my Social Security number?

+Yes, you can obtain an accurate online auto insurance quote without providing your Social Security number. Insurance providers typically do not require this information for initial quotes. However, if you proceed with purchasing a policy, they may request your Social Security number for identification and verification purposes.

Are online auto insurance quotes binding?

+No, online auto insurance quotes are not binding. They serve as estimates of your potential insurance costs based on the information you provide. The actual policy and premium may vary once you proceed with purchasing the insurance. It’s important to carefully review the policy terms and conditions before finalizing your decision.