General Business Liability Insurance

General business liability insurance is an essential component of risk management for any business. It provides financial protection and peace of mind, covering a wide range of potential liabilities that businesses may face in their day-to-day operations. With an increasing focus on risk mitigation and the ever-changing legal landscape, understanding the nuances of general business liability insurance is crucial for business owners and managers.

The Importance of General Business Liability Insurance

In the dynamic world of business, unforeseen circumstances and potential liabilities are an inevitable part of the landscape. From customer injuries on your premises to property damage or even lawsuits stemming from professional services, the risks are manifold. This is where general business liability insurance steps in as a vital safety net.

This type of insurance is designed to safeguard businesses against a variety of claims and legal actions that could potentially result in significant financial losses. It offers coverage for bodily injury, property damage, personal and advertising injury, and even covers the legal costs associated with defending against such claims. By having general business liability insurance, companies can mitigate the financial impact of unexpected events and protect their hard-earned assets.

Protecting Your Business’s Reputation

Beyond the financial aspect, general business liability insurance plays a pivotal role in maintaining a company’s reputation. In today’s interconnected world, negative publicity can spread rapidly and have a devastating impact on a business’s public image and customer trust. By having adequate insurance coverage, businesses demonstrate their commitment to taking responsibility for their actions and mitigating potential harm to others.

For instance, consider a scenario where a customer slips and falls in your retail store, resulting in a serious injury. Without general liability insurance, your business could face not only the financial burden of medical bills and potential compensation but also the negative publicity and loss of customer trust that could accompany such an incident. With insurance in place, you can navigate such situations more smoothly, ensuring your business's long-term viability and reputation remain intact.

Coverage and Policy Options

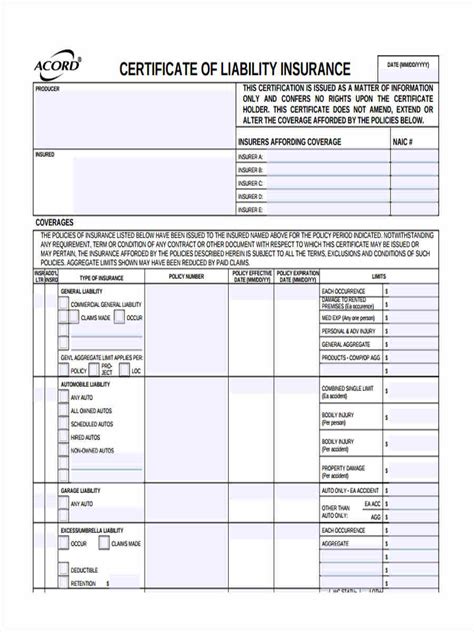

General business liability insurance offers a range of coverage options tailored to meet the diverse needs of different industries and business types. Here’s an overview of some key coverage areas:

Bodily Injury and Property Damage

This coverage protects your business from claims arising from accidents or incidents that result in bodily harm or property damage. For instance, if a customer trips over a loose cable in your office and breaks their arm, this coverage would help pay for their medical expenses and any legal fees associated with the claim.

Personal and Advertising Injury

Personal and advertising injury coverage protects your business against claims of defamation, copyright infringement, or other similar offenses that may arise from your advertising or marketing activities. This coverage is particularly important for businesses that rely heavily on their brand and reputation.

Product Liability

If your business manufactures, distributes, or sells products, product liability coverage is crucial. It protects your business from claims related to product defects or failures that cause harm to customers or their property. This coverage is essential for ensuring the long-term viability of product-based businesses.

Professional Liability (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed to protect businesses that provide professional services. It covers claims arising from negligence, errors, or omissions in the provision of those services. This type of coverage is essential for industries such as consulting, legal services, accounting, and more.

Key Considerations for Choosing the Right Policy

When selecting a general business liability insurance policy, there are several critical factors to consider. Here are some key points to keep in mind:

Industry-Specific Risks

Different industries face unique risks. For instance, a construction company may face higher risks of bodily injury or property damage claims compared to a software development firm. It’s essential to choose a policy that understands and caters to the specific risks associated with your industry.

Policy Limits and Deductibles

Policy limits refer to the maximum amount the insurance company will pay for a covered claim. Deductibles, on the other hand, are the amount you must pay out of pocket before the insurance coverage kicks in. Choosing the right policy limits and deductibles is a balance between affordability and adequate coverage. It’s important to consult with an insurance professional to determine the right levels for your business.

Additional Coverage Options

Beyond the standard coverage options, many policies offer additional endorsements or riders to tailor the coverage to your specific needs. For example, you might consider adding cyber liability coverage if your business handles sensitive data or has an online presence. Discuss these options with your insurance provider to ensure you have comprehensive coverage.

The Claims Process and Post-Incident Management

In the event of a claim, understanding the claims process and having a well-defined post-incident management strategy is crucial. Here’s an overview of what you can expect:

Reporting the Incident

As soon as an incident occurs, it’s important to document the details and report it to your insurance provider promptly. This helps ensure a smooth claims process and minimizes potential delays.

Investigating the Claim

The insurance company will initiate an investigation to determine the validity and scope of the claim. This may involve gathering evidence, interviewing witnesses, and reviewing relevant documentation. It’s important to cooperate fully with the investigation to facilitate a swift resolution.

Resolution and Settlement

Once the investigation is complete, the insurance company will determine the appropriate course of action. This may involve paying out the claim, negotiating a settlement, or denying the claim if it’s found to be outside the scope of coverage. Throughout this process, your insurance provider will guide you and ensure your business’s interests are protected.

Conclusion: A Comprehensive Approach to Risk Management

General business liability insurance is an integral part of a comprehensive risk management strategy for any business. By understanding the coverage options, key considerations, and the claims process, businesses can ensure they are adequately protected against potential liabilities. With the right insurance coverage in place, businesses can focus on their core operations and growth, knowing they are shielded from the financial and reputational risks that come with unforeseen events.

How much does general business liability insurance typically cost?

+

The cost of general business liability insurance can vary widely depending on factors such as your industry, business size, and specific coverage needs. On average, small businesses can expect to pay anywhere from 300 to 1,000 per year for basic liability coverage. However, the cost can increase significantly with additional coverage options and higher policy limits. It’s recommended to consult with insurance professionals to obtain accurate quotes tailored to your business.

Are there any situations where general business liability insurance may not be sufficient?

+

While general business liability insurance provides broad coverage, there may be specific risks or liabilities that fall outside its scope. For instance, employee-related injuries or claims arising from intentional acts may require additional coverage. It’s important to carefully review your policy and consult with insurance experts to ensure you have adequate coverage for all potential risks.

What happens if I need to make a claim, but my policy limits are insufficient to cover the entire cost?

+

If the policy limits of your general business liability insurance are insufficient to cover the full cost of a claim, you will be responsible for paying the remainder out of pocket. This is why it’s crucial to carefully consider your policy limits and choose coverage that aligns with your potential exposure. Regularly reviewing and updating your insurance coverage to reflect changes in your business operations is recommended.