Insurance Of Liability

Insurance of liability, also known as liability insurance, is a vital aspect of financial protection and risk management for individuals and businesses alike. In a world where unforeseen events and accidents can occur, having adequate liability coverage is essential to safeguard against potential financial ruin. This comprehensive guide will delve into the intricacies of insurance of liability, exploring its various facets, benefits, and real-world applications.

Understanding Insurance of Liability

Insurance of liability is a specialized type of insurance coverage designed to protect policyholders from financial losses arising from legal claims and lawsuits. It provides a safety net for individuals and entities by covering the costs associated with defending against such claims and compensating third parties for damages or injuries caused by the policyholder’s actions or negligence.

The principle behind liability insurance is simple: it shifts the financial burden of potential liabilities from the policyholder to the insurance company. By paying premiums, policyholders gain peace of mind, knowing that they are financially protected against the unpredictable nature of accidents and legal disputes.

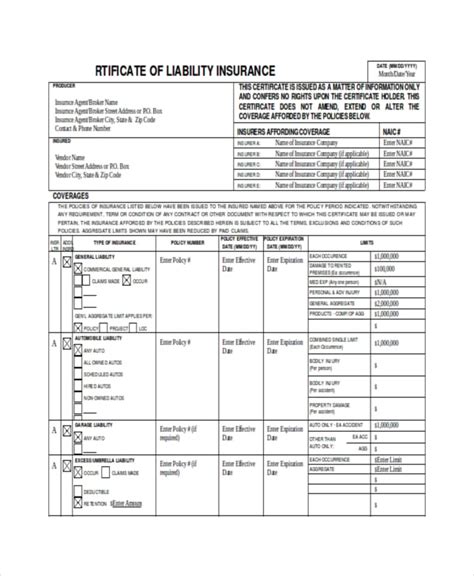

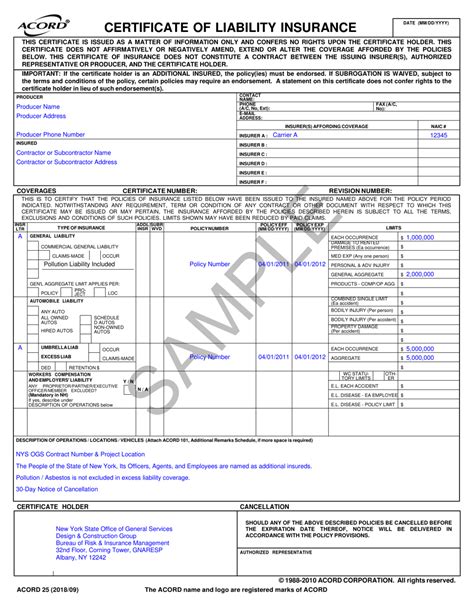

Key Components of Insurance of Liability

- Liability Coverage: This is the primary component of liability insurance, covering the costs of legal defense, settlements, and judgments resulting from covered claims.

- Third-Party Claims: Liability insurance is triggered when a third party, such as an individual or another entity, files a claim against the policyholder for damages or injuries.

- Negligence and Intentional Acts: Insurance of liability covers both negligent acts (unintentional mistakes) and, in certain policies, intentional acts that cause harm to others.

- Limits and Deductibles: Policyholders choose coverage limits, which set the maximum amount the insurance company will pay for a claim, and deductibles, which are the portion of the claim costs they must pay out of pocket.

Types of Liability Insurance

The insurance of liability market offers a wide range of policies to cater to different needs and industries. Here are some of the most common types:

General Liability Insurance

General liability insurance is a broad form of coverage that protects businesses and professionals from a variety of third-party claims, including bodily injury, property damage, personal and advertising injury, and medical payments. It is often the foundation of a business’s liability insurance portfolio.

Professional Liability Insurance (E&O Insurance)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is tailored for professionals such as doctors, lawyers, accountants, and consultants. It covers claims arising from mistakes or negligence in their professional services, protecting their reputation and financial stability.

Product Liability Insurance

Product liability insurance is essential for manufacturers, distributors, and retailers. It provides coverage for claims resulting from defective products that cause harm to consumers. In a product-centric industry, this insurance is crucial to mitigate the risks associated with product recalls and lawsuits.

Business Owner’s Policy (BOP)

A Business Owner’s Policy combines general liability insurance with property insurance, offering a comprehensive solution for small to medium-sized businesses. It provides coverage for a range of liabilities and property damages, making it an efficient choice for business owners.

Umbrella Insurance

Umbrella insurance is an additional layer of liability coverage that kicks in when the limits of an existing policy are exhausted. It provides higher limits of coverage and can be especially beneficial for individuals and businesses with significant assets to protect.

Real-World Applications and Benefits

Insurance of liability has proven its worth in numerous real-world scenarios, offering invaluable protection to policyholders. Here are some practical examples:

Slip and Fall Accidents

Imagine a customer slips and falls in a retail store due to a wet floor. General liability insurance would cover the medical expenses of the injured customer and potentially compensate them for their injuries, protecting the store owner from financial liability.

Professional Negligence

A patient sues a doctor for a misdiagnosis that led to further complications. Professional liability insurance would step in to cover the legal costs and potential damages, ensuring the doctor’s practice remains financially stable.

Product Defect Claims

A manufacturer of electronic devices is faced with a class-action lawsuit due to a faulty component that caused fires in consumers’ homes. Product liability insurance would provide the necessary coverage to manage the legal proceedings and potential settlements.

Cyber Liability and Privacy Breaches

In today’s digital age, businesses are vulnerable to cyber attacks and data breaches. Cyber liability insurance offers protection against the financial fallout of such incidents, covering legal fees, notification costs, and potential damages.

| Liability Insurance Type | Key Benefits |

|---|---|

| General Liability | Broad coverage for various business operations |

| Professional Liability | Protection for professionals against service-related claims |

| Product Liability | Covers product-related injuries and damages |

| Business Owner's Policy | Combined liability and property insurance for small businesses |

| Umbrella Insurance | Additional high-limit coverage for severe claims |

Risk Management and Mitigation

Insurance of liability is not only about reacting to claims but also about proactive risk management. Policyholders can work with insurance providers to identify potential risks and implement measures to reduce the likelihood of incidents.

Risk management strategies may include employee training, safety protocols, regular equipment maintenance, and adopting best practices specific to the industry. By minimizing risks, policyholders can lower their insurance premiums and potentially avoid costly claims altogether.

Future Implications and Industry Trends

The insurance of liability industry is continuously evolving to keep pace with changing risks and emerging technologies. Here are some key trends and future implications to consider:

Emerging Risks

With the rise of new technologies and business models, such as the gig economy and e-commerce, insurers are adapting to cover emerging risks. This includes cyber risks, privacy breaches, and liability associated with autonomous vehicles and artificial intelligence.

Data-Driven Underwriting

Insurers are leveraging advanced analytics and data science to improve underwriting processes. By analyzing vast amounts of data, they can more accurately assess risks and tailor policies to individual needs, leading to more efficient and effective coverage.

Digital Transformation

The insurance industry is undergoing a digital transformation, with insurers adopting digital platforms and technologies to enhance customer experience and streamline operations. This includes online policy management, real-time claims processing, and the use of artificial intelligence for faster and more accurate claim assessments.

Collaborative Risk Management

Insurers are increasingly partnering with their clients to provide holistic risk management solutions. This collaborative approach involves sharing risk insights, providing loss control services, and offering risk management resources to help policyholders mitigate potential liabilities.

Environmental and Social Responsibility

As sustainability and social responsibility become increasingly important, insurers are developing products and initiatives to support these efforts. This includes offering coverage for environmental liabilities, promoting green practices, and supporting social impact initiatives.

Conclusion

Insurance of liability is a critical tool for individuals and businesses to navigate the complexities of modern life and commerce. By understanding the various types of liability insurance, their benefits, and real-world applications, policyholders can make informed decisions to protect their financial well-being.

As the insurance industry continues to evolve, staying abreast of emerging risks and industry trends is essential. With the right coverage and proactive risk management, individuals and businesses can focus on their core objectives with confidence, knowing they are protected against unforeseen liabilities.

How much does liability insurance cost?

+The cost of liability insurance varies based on several factors, including the type of policy, coverage limits, industry, and location. On average, general liability insurance for small businesses ranges from 500 to 1,000 per year. However, premiums can be higher for businesses with higher risks or more complex operations.

What happens if I don’t have liability insurance and a claim is filed against me?

+Without liability insurance, you would be personally responsible for covering the costs associated with a claim, including legal fees, settlements, and judgments. This could result in significant financial strain and potentially ruinous consequences.

Can I customize my liability insurance policy to meet my specific needs?

+Yes, liability insurance policies can be customized to align with your unique risks and requirements. Insurance providers offer various endorsements and policy options to tailor coverage to your specific industry, operations, and potential liabilities.

How often should I review and update my liability insurance policy?

+It is recommended to review your liability insurance policy annually or whenever there are significant changes to your business, such as expansion, new products or services, or increased risks. Regular policy reviews ensure your coverage remains adequate and up-to-date.