Homeowners Insurance And Water Damage

Water damage is a prevalent and costly issue that homeowners face, and understanding how it intersects with their insurance policies is crucial. Water damage can occur due to various reasons, from natural disasters like floods and storms to unexpected events such as burst pipes or appliance failures. This comprehensive guide aims to delve into the world of homeowners insurance, specifically focusing on the coverage and implications of water damage. By the end of this article, you'll have a clear understanding of what's typically covered, what's not, and the steps to take to protect your home and finances.

The Complexity of Water Damage Coverage

Homeowners insurance policies are intricate documents, and water damage coverage is one of the most nuanced aspects. While most policies offer some level of protection against water damage, the devil is in the details. Understanding the fine print is essential to avoid any unpleasant surprises should you ever need to file a claim.

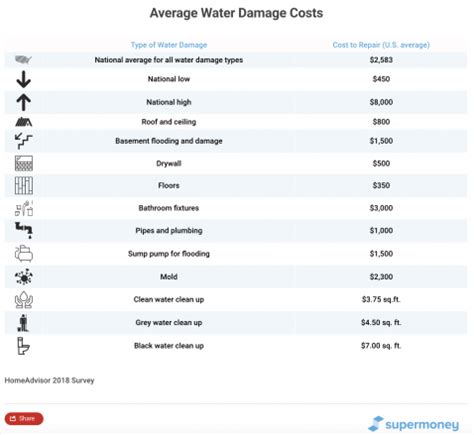

Water damage coverage can be broadly categorized into two main types: covered perils and excluded perils. Covered perils are the events or incidents that your policy explicitly states it will provide protection for. These can include sudden and accidental water damage, such as a pipe bursting or a roof collapsing during a heavy storm. On the other hand, excluded perils are the events for which your policy provides no coverage. These typically include gradual water damage, like a slow leak that goes unnoticed for months, or damage resulting from flooding.

Understanding the Policy Exclusions

One of the most common exclusions in homeowners insurance policies is flood damage. Flooding is often considered an act of nature and is, therefore, excluded from standard homeowners insurance policies. Instead, you would need a separate flood insurance policy to cover damages caused by rising water levels, heavy rainfall, or other flood-related events. This policy is typically provided through the National Flood Insurance Program (NFIP), which is backed by the federal government.

Another common exclusion is sewer backup. While some policies may offer an optional rider or endorsement to cover this, it's not automatically included. Sewer backup can be a significant issue, especially in older homes or areas with aging infrastructure. It's important to review your policy to understand if this is covered and consider adding this coverage if it's not already included.

Additionally, many policies exclude gradual water damage, which can be a result of long-term issues like a leaking roof or a slow leak in a plumbing system. These types of damage are often considered preventable and are, therefore, not covered. Homeowners are expected to regularly maintain their homes and address any potential issues promptly.

| Policy Exclusion | Description |

|---|---|

| Flood Damage | Rising water levels, heavy rainfall, or other flood-related events are typically not covered by standard homeowners insurance. |

| Sewer Backup | This is often an optional add-on to your policy and not automatically included. |

| Gradual Water Damage | Long-term issues like a leaking roof or slow plumbing leaks are usually excluded. |

What’s Covered: The Fine Print

While exclusions are important to understand, it’s also crucial to know what your policy does cover when it comes to water damage. Most policies will provide coverage for sudden and accidental water damage, such as a burst pipe or a damaged roof from a storm. This coverage typically extends to the structure of your home, as well as your personal belongings, such as furniture, electronics, and clothing.

Some policies may also include coverage for emergency services and temporary living expenses in the event of severe water damage that renders your home uninhabitable. This can be a lifesaver if you suddenly find yourself in need of a place to stay while your home is being repaired.

Additionally, many policies offer coverage for water damage caused by appliances, such as a washing machine or dishwasher leaking. This can provide peace of mind, as appliance failures can be unexpected and costly to repair.

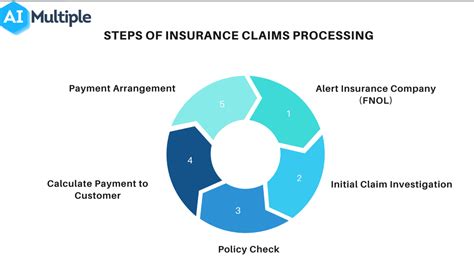

Filing a Water Damage Claim: The Process

If you find yourself facing water damage in your home, it’s important to know the steps to take to file a claim and potentially receive coverage. The process can vary depending on your insurance provider, but there are some general steps you can expect.

- Contact Your Insurance Provider: As soon as you discover the water damage, contact your insurance company. Most providers have a 24/7 claims hotline, so you can reach out at any time. Provide as much detail as possible about the incident and the extent of the damage.

- Document the Damage: Take photos and videos of the damage, both close-ups and wider shots. This documentation will be crucial when it comes to assessing the extent of the damage and determining the value of your claim.

- Mitigate Further Damage: If it's safe to do so, take steps to prevent further damage. For example, if a pipe has burst, turn off the water supply. If there's standing water, use a pump or wet/dry vacuum to remove it. Your insurance company may also provide guidance on how to proceed.

- Wait for an Adjuster: An insurance adjuster will be assigned to your case. They will schedule a time to visit your home and assess the damage. Be prepared to answer their questions and provide any additional documentation they may request.

- Receive a Claim Decision: Once the adjuster has completed their assessment, they will provide a decision on your claim. If it's approved, they will also provide an estimate for the repairs and replacement of any damaged items.

- Choose a Contractor: If your claim is approved, you'll need to choose a contractor to carry out the repairs. Your insurance company may have a list of preferred contractors, but you are typically free to choose your own as well. Be sure to get multiple quotes to ensure you're getting a fair price.

- Oversee the Repairs: Stay involved throughout the repair process. Regularly check in with the contractor and your insurance company to ensure the work is being done to your satisfaction and that payments are being made as expected.

Tips for a Smooth Claims Process

To ensure a smooth claims process, consider the following tips:

- Keep all your insurance documents, including your policy, in a safe and easily accessible place.

- Review your policy regularly to understand your coverage and exclusions.

- Take preventative measures to reduce the risk of water damage, such as regular home maintenance and installing water leak detection systems.

- If you're considering a home renovation, check with your insurance provider to ensure any changes to your home are still covered.

- Consider adding additional coverage, such as a sewer backup endorsement, if it's not already included in your policy.

The Future of Water Damage Protection

As climate change continues to impact weather patterns and increase the frequency and severity of natural disasters, the risk of water damage to homes is only expected to rise. This has led to a growing focus on resilience and adaptation in the insurance industry.

Insurance providers are increasingly incorporating climate resilience into their policies and practices. This involves using advanced data analytics and modeling to assess and mitigate the risks of water damage, especially in areas prone to flooding or severe weather events. By understanding these risks, insurance companies can better manage their exposure and offer more accurate and tailored coverage to homeowners.

Additionally, there's a growing trend towards risk-based pricing in homeowners insurance. This means that insurance premiums are becoming more closely tied to the actual risk of water damage in a particular area. Homeowners in high-risk areas may see their premiums increase, while those in low-risk areas may benefit from lower rates. This shift towards risk-based pricing encourages homeowners to take steps to reduce their risk, such as implementing resilience measures or moving to safer areas.

Furthermore, the use of technology and data is transforming the insurance industry. Advanced analytics and machine learning algorithms are being used to more accurately assess and predict the risk of water damage. This data-driven approach allows insurance providers to offer more precise coverage and pricing, while also identifying potential issues before they become major problems.

For homeowners, this means a greater need to be proactive in understanding and managing their water damage risk. Regular home maintenance, installing modern water detection systems, and staying informed about local weather and climate risks are all essential steps to take. By staying ahead of potential issues, homeowners can not only protect their homes and finances but also potentially benefit from lower insurance premiums.

Conclusion

Water damage is a significant concern for homeowners, and understanding your insurance coverage is crucial. While homeowners insurance policies typically provide coverage for sudden and accidental water damage, it’s important to be aware of the exclusions and take steps to mitigate your risk. By staying informed and taking proactive measures, you can protect your home and ensure a smoother claims process should the need ever arise.

What should I do if my home sustains water damage?

+If your home sustains water damage, take immediate action to prevent further damage. Contact your insurance provider, document the damage with photos and videos, and take steps to mitigate the damage, such as turning off the water supply or removing standing water. Notify your insurance provider as soon as possible and await their guidance on the next steps, which may include an adjuster visit and a claim decision.

Are flood damages covered by standard homeowners insurance policies?

+No, flood damages are typically excluded from standard homeowners insurance policies. You would need a separate flood insurance policy, which is usually provided through the National Flood Insurance Program (NFIP), to cover flood-related damages.

What is a sewer backup endorsement, and why might I need it?

+A sewer backup endorsement is an optional add-on to your homeowners insurance policy that provides coverage for damages caused by sewer backups. While it’s not automatically included, it’s worth considering if you live in an area with older infrastructure or if you have concerns about the potential for sewer backups. It can provide additional peace of mind and financial protection.