Quote Landlord Insurance

When it comes to safeguarding your investment as a landlord, having the right insurance coverage is crucial. Landlord insurance provides comprehensive protection for your rental properties, ensuring peace of mind and financial security. In this article, we will delve into the world of landlord insurance, exploring its features, benefits, and how to obtain a tailored quote that meets your specific needs.

Understanding Landlord Insurance

Landlord insurance is a specialized form of property insurance designed specifically for individuals who own and rent out residential or commercial properties. It goes beyond the typical homeowner’s insurance, offering additional coverage to address the unique risks and liabilities associated with being a landlord.

Here are some key aspects of landlord insurance that set it apart:

- Property Protection: Landlord insurance provides coverage for your rental property, including the building itself and its contents. This protection extends to damage caused by various perils, such as fire, theft, vandalism, and natural disasters.

- Liability Coverage: One of the critical components of landlord insurance is liability protection. It safeguards you against claims arising from accidents or injuries that occur on your rental property. This coverage is essential to protect your assets and financial well-being.

- Loss of Rental Income: In the event that your rental property becomes uninhabitable due to covered perils, landlord insurance often includes loss of rental income coverage. This ensures that you continue to receive rental income while repairs are being made.

- Legal Expenses: Some landlord insurance policies offer coverage for legal expenses related to tenant disputes or eviction processes. This can provide valuable support in navigating legal challenges.

- Optional Add-Ons: Landlord insurance policies often allow you to customize your coverage with optional add-ons. These may include coverage for increased rent, rent guarantee, and even protection for high-value items within the property.

Obtaining a Quote for Landlord Insurance

To obtain a quote for landlord insurance, it is essential to work with reputable insurance providers who specialize in this field. Here’s a step-by-step guide to help you through the process:

Step 1: Research Insurance Providers

Start by researching insurance companies that offer landlord insurance. Look for providers with a strong reputation and a track record of providing comprehensive coverage for rental properties. Read reviews and seek recommendations from other landlords or property management professionals.

Step 2: Gather Property Information

Before requesting a quote, gather detailed information about your rental property. This includes the type of property (residential or commercial), its location, the number of units, and any unique features or amenities. Having accurate information will ensure an accurate quote.

Step 3: Assess Your Coverage Needs

Take the time to assess your specific coverage needs as a landlord. Consider the potential risks associated with your property and the level of protection you require. Evaluate factors such as the value of the property, the type of tenants you attract, and any additional coverage options that may be beneficial.

Step 4: Request Quotes

Contact the insurance providers you have identified and request quotes for landlord insurance. Provide them with the necessary information about your property and your coverage requirements. Be prepared to answer questions about the property’s condition, any previous claims, and the nature of your rental business.

Step 5: Compare Quotes and Policy Details

Once you have obtained multiple quotes, take the time to compare them thoroughly. Pay attention to the coverage limits, deductibles, and any exclusions mentioned in the policy documents. Ensure that the quotes align with your assessed coverage needs and budget.

Step 6: Seek Professional Advice

If you are unsure about the intricacies of landlord insurance or have specific concerns, consider seeking advice from an insurance broker or an experienced landlord who has navigated the insurance landscape. They can provide valuable insights and help you make an informed decision.

Factors Influencing Landlord Insurance Quotes

Several factors can impact the cost of your landlord insurance quote. Understanding these factors can help you prepare for the quotation process and potentially negotiate better rates.

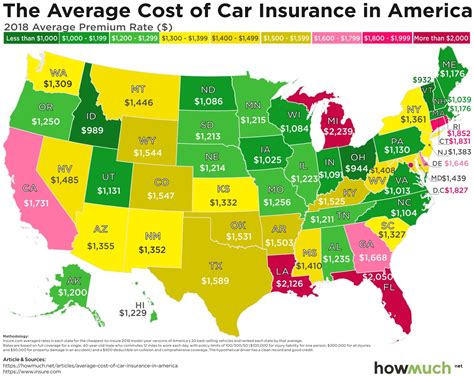

- Property Location: The location of your rental property plays a significant role in determining insurance rates. Areas with higher crime rates, natural disaster risks, or a history of frequent claims may result in higher premiums.

- Property Type and Size: The type and size of your rental property can affect insurance costs. Larger properties or those with unique features may require specialized coverage, leading to higher premiums.

- Claim History: Your insurance provider will consider your claim history when determining your quote. A clean claim record may result in more favorable rates, while multiple claims in the past could impact your premiums.

- Security Features: Implementing security measures such as burglar alarms, CCTV cameras, or secure entry systems can positively influence your insurance quote. These features reduce the risk of theft and vandalism, making your property more attractive to insurers.

- Tenant Screening: The thoroughness of your tenant screening process can impact your insurance rates. Insurers may view rigorous screening practices as a sign of responsible property management, potentially leading to lower premiums.

Customizing Your Landlord Insurance

One of the advantages of landlord insurance is the ability to tailor your coverage to your specific needs. Here are some options to consider when customizing your policy:

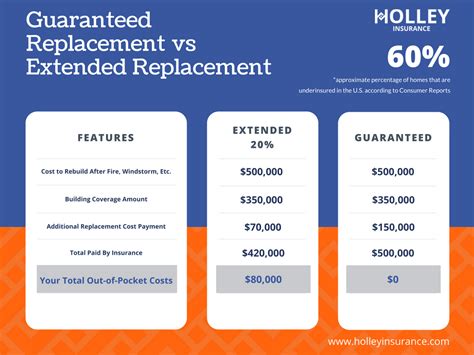

- Liability Limits: Adjust the liability coverage limits to match the value of your assets and the potential risks associated with your rental property. Higher liability limits provide greater protection but may increase your premiums.

- Additional Coverage: Explore optional add-ons such as coverage for high-value items, increased rent protection, or legal expense coverage. These additions can enhance your policy and provide peace of mind for specific situations.

- Deductibles: Consider choosing a higher deductible to reduce your insurance premiums. While this means you will pay more out-of-pocket in the event of a claim, it can result in significant savings on your overall insurance costs.

- Multi-Policy Discounts: If you own multiple rental properties or have other insurance needs, inquire about multi-policy discounts. Bundling your insurance policies with the same provider can often lead to cost savings.

The Benefits of Landlord Insurance

Investing in landlord insurance brings several advantages that go beyond financial protection. Here are some key benefits:

- Peace of Mind: With comprehensive landlord insurance, you can rest easy knowing that your investment is protected. You won't have to worry about unforeseen circumstances affecting your rental income or exposing you to significant financial liabilities.

- Financial Security: Landlord insurance provides financial stability by covering the costs associated with property damage, liability claims, and loss of rental income. This ensures that you can continue operating your rental business without significant financial strain.

- Professional Reputation: By maintaining adequate insurance coverage, you demonstrate your commitment to responsible property management. This can enhance your reputation as a reliable landlord and attract quality tenants.

- Legal Compliance: Depending on your jurisdiction, landlord insurance may be a legal requirement. Obtaining the appropriate coverage ensures that you comply with local regulations and avoid any potential penalties or legal issues.

Real-World Examples and Case Studies

Let’s explore a couple of real-world scenarios to illustrate the importance of landlord insurance and how it can benefit property owners:

Case Study 1: Natural Disaster Protection

Imagine you own a rental property in an area prone to hurricanes. Despite taking precautions, a powerful storm strikes, causing extensive damage to your property. Without landlord insurance, you would be responsible for covering the costly repairs out of pocket. However, with comprehensive coverage, your insurance policy would provide the necessary funds to repair the property, ensuring your tenants can return to a safe and habitable home.

Case Study 2: Tenant Liability Claim

Suppose one of your tenants sustains an injury on the rental property due to a defective staircase. The tenant files a liability claim against you, seeking compensation for their medical expenses and lost wages. Without landlord insurance, you would be personally liable for these costs. However, with adequate liability coverage, your insurance provider would step in to defend and settle the claim, protecting your assets and financial well-being.

Conclusion

Landlord insurance is an indispensable tool for any property owner looking to protect their investment and mitigate risks. By understanding the features, benefits, and factors influencing quotes, you can make informed decisions when selecting the right insurance coverage. Remember, a tailored landlord insurance policy provides peace of mind, financial security, and the ability to navigate potential challenges with confidence.

Frequently Asked Questions

How much does landlord insurance typically cost?

+The cost of landlord insurance can vary depending on several factors, including the location, size, and type of your rental property, as well as your claim history. On average, landlord insurance premiums range from a few hundred to several thousand dollars annually. It’s important to obtain quotes from multiple providers to find the most competitive rates for your specific circumstances.

Can I bundle my landlord insurance with other policies to save money?

+Yes, many insurance providers offer multi-policy discounts when you bundle your landlord insurance with other policies, such as homeowner’s insurance or auto insurance. Bundling can result in significant savings, so it’s worth exploring this option to maximize your cost efficiency.

What happens if I don’t have landlord insurance and a tenant makes a claim against me?

+If you do not have landlord insurance and a tenant files a liability claim against you, you would be personally responsible for covering the costs associated with the claim. This could result in significant financial strain and potentially impact your ability to continue operating your rental business. Landlord insurance provides the necessary protection to shield your assets in such situations.

Are there any tax benefits associated with landlord insurance premiums?

+Yes, landlord insurance premiums may be tax-deductible. As a landlord, you can typically deduct insurance costs as a business expense, reducing your taxable income. However, it’s important to consult with a tax professional to understand the specific rules and regulations in your jurisdiction.

Can I add my rental property to my existing homeowner’s insurance policy?

+Adding a rental property to your homeowner’s insurance policy may be possible, but it is not recommended. Homeowner’s insurance is designed for owner-occupied residences and may not provide adequate coverage for the unique risks associated with rental properties. Landlord insurance is specifically tailored to meet the needs of property owners, offering comprehensive protection and peace of mind.