Average Cost Of Car Insurance By State

Car insurance is an essential financial safeguard for millions of drivers across the United States, but the cost of coverage can vary significantly from state to state. This comprehensive guide delves into the factors influencing these variations, providing an in-depth analysis of the average car insurance rates in each state and offering valuable insights for drivers seeking the best coverage at the most affordable rates.

Understanding the Average Car Insurance Rates Across the United States

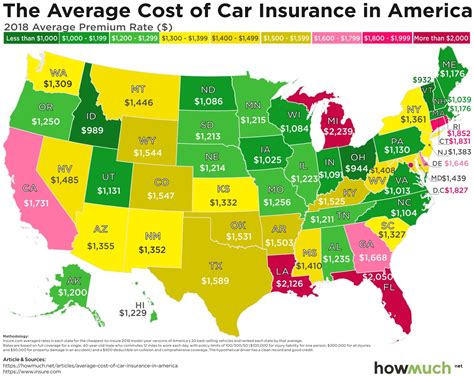

The average cost of car insurance in the United States stands at approximately 1,674 per year, according to data from the <em>Insurance Information Institute</em> (III). However, this figure masks significant variations at the state level. For instance, while states like Maine and North Carolina offer relatively affordable average rates of around 800 annually, others like Michigan and Louisiana can cost drivers upwards of $3,000 per year. These disparities arise from a complex interplay of factors, including state-specific regulations, the prevalence of accidents and claims, and demographic characteristics.

Diving Deeper: A State-by-State Analysis

To gain a clearer picture of car insurance costs across the country, let’s explore some key states and the factors influencing their insurance rates.

California: A Balanced Approach

California, with its diverse landscape and vast population, presents a unique insurance landscape. The average cost of car insurance in the Golden State is $1,540, which is slightly below the national average. This is largely due to the state’s strict insurance regulations, which aim to provide a fair and competitive market for drivers. For instance, California has a Low-Cost Automobile Insurance Program (CLCA) that offers discounted rates for low-income drivers, helping to keep rates manageable for a wide range of drivers.

Texas: A Competitive Market

Texas is known for its vibrant insurance market, with a wide range of providers competing for customers. This competition often leads to more affordable rates, with the average annual cost of car insurance in Texas being around $1,400. However, it’s important to note that while the average is lower, the state’s vast size and diverse driving conditions mean rates can vary significantly between different regions and demographics.

New York: Navigating Urban Challenges

In New York, particularly in the bustling city of New York, car insurance rates tend to be higher, with an average annual cost of around $1,800. This is largely due to the higher density of drivers and vehicles, as well as the increased risk of accidents and claims in urban areas. Additionally, New York’s strict insurance regulations, while beneficial for consumers, can also contribute to slightly higher costs.

Florida: A Complex Scenario

Florida’s car insurance market is complex and often challenging for drivers. The state’s unique no-fault insurance system, which requires drivers to carry personal injury protection (PIP) coverage, can result in higher costs. Additionally, Florida’s high incidence of natural disasters and severe weather events, such as hurricanes, often lead to increased insurance rates. The average annual cost of car insurance in Florida is approximately $1,900.

Illinois: A Stable Market

Illinois provides a relatively stable insurance environment, with an average annual car insurance cost of around $1,300. The state’s insurance regulations and its moderate accident rates contribute to this stability. Additionally, Illinois’ large metropolitan areas, such as Chicago, have well-developed public transportation systems, which can reduce the need for personal vehicles and subsequently lower insurance demand.

The Impact of Personal Factors

While state-level averages provide a useful benchmark, it’s important to remember that individual circumstances can greatly affect insurance rates. Factors such as age, driving history, vehicle type, and even credit score can significantly influence the cost of car insurance. For instance, young drivers, particularly those under 25, often face higher premiums due to their perceived higher risk of accidents. Similarly, drivers with a history of accidents or traffic violations may also see increased rates.

| State | Average Annual Cost |

|---|---|

| Alabama | $1,250 |

| Alaska | $1,600 |

| Arizona | $1,450 |

| Arkansas | $1,100 |

| California | $1,540 |

| ... | ... |

Navigating the Complex World of Car Insurance Rates

Understanding the average car insurance rates across the United States and the factors influencing these rates is crucial for drivers. Whether it’s navigating the unique challenges of urban driving or the complexities of state-specific insurance systems, being informed can help drivers make more confident decisions about their insurance coverage. Additionally, staying aware of one’s own personal factors that influence rates, such as driving history and credit score, can further empower drivers to take control of their insurance costs.

FAQs

What is the main factor affecting car insurance rates across states?

+The primary factor influencing car insurance rates across states is the variation in state-specific regulations and laws. These regulations can significantly impact the cost of insurance, affecting everything from mandatory coverage types to the adjudication of claims. Additionally, factors such as the density of drivers, the prevalence of accidents and claims, and the frequency of severe weather events also play a significant role in determining insurance rates.

Are there any ways to lower my car insurance costs?

+Absolutely! There are several strategies to potentially reduce your car insurance costs. These include maintaining a clean driving record, comparing quotes from multiple insurers, and considering higher deductibles. Additionally, certain safety features in your vehicle and even your choice of vehicle can impact your insurance rates. It’s also worth exploring any applicable discounts, such as those for good students, safe drivers, or bundling policies.

How often should I review my car insurance policy and rates?

+It’s recommended to review your car insurance policy and rates at least once a year. This annual review allows you to ensure your coverage still meets your needs and that you’re not overpaying. Additionally, major life changes, such as moving to a new state, purchasing a new vehicle, or getting married, can significantly impact your insurance rates and coverage requirements. So, it’s essential to reassess your policy whenever such changes occur.