Progressive Southeastern Insurance Company

Welcome to an insightful exploration of the Progressive Southeastern Insurance Company, a renowned player in the insurance industry. This article delves deep into the company's operations, strategies, and impact, offering a comprehensive understanding of its role in the dynamic world of insurance.

Unveiling Progressive Southeastern Insurance Company: A Comprehensive Overview

The Progressive Southeastern Insurance Company, headquartered in Atlanta, Georgia, is a leading provider of insurance solutions across the southeastern region of the United States. With a rich history spanning over three decades, the company has established itself as a trusted partner for individuals and businesses seeking comprehensive insurance coverage. Their expertise lies in offering a diverse range of insurance products, from auto and home insurance to commercial and specialty coverages, catering to the unique needs of their diverse clientele.

Progressive Southeastern's success story is underpinned by its commitment to innovation and customer-centricity. They have consistently pioneered new approaches to insurance, leveraging technology to enhance the customer experience and streamline their operations. This dedication to staying ahead of the curve has positioned them as a forward-thinking industry leader.

A Journey through Progressive Southeastern’s Key Milestones

The company’s journey began in 1992 with a vision to revolutionize the insurance landscape. Over the years, they have achieved numerous milestones, solidifying their position in the market.

One of their most notable achievements was the launch of their online platform in 2008. This platform revolutionized the way customers interact with their insurance provider, offering a seamless and efficient experience. Customers could now purchase and manage their policies entirely online, a significant advancement that set the company apart from its competitors.

In 2016, Progressive Southeastern made headlines with the introduction of their AI-powered claims processing system. This innovative system accelerated the claims process, ensuring faster payouts and enhancing customer satisfaction. This technology not only improved operational efficiency but also demonstrated the company's commitment to leveraging cutting-edge solutions.

More recently, in 2022, they expanded their product portfolio to include specialty insurance coverages tailored for niche industries. This strategic move allowed them to cater to a broader range of clients, solidifying their position as a comprehensive insurance provider.

| Key Milestone | Year |

|---|---|

| Launch of Online Platform | 2008 |

| AI-Powered Claims Processing | 2016 |

| Introduction of Specialty Coverages | 2022 |

The Impact of Progressive Southeastern’s Insurance Solutions

Progressive Southeastern’s insurance solutions have had a profound impact on the communities they serve. Their comprehensive range of insurance products offers peace of mind and financial security to individuals, families, and businesses.

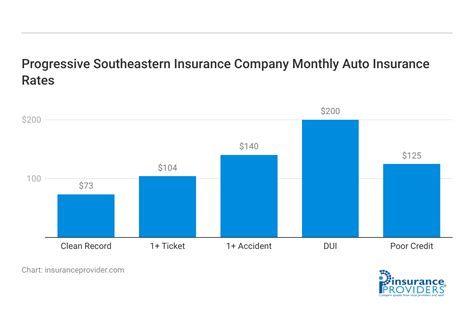

Auto Insurance: Protecting the Roads of the Southeast

Progressive Southeastern’s auto insurance policies provide extensive coverage for vehicle owners across the southeastern states. With competitive rates and a range of customizable options, they ensure that drivers can tailor their insurance to their specific needs.

One of their unique offerings in the auto insurance space is the "Safe Driver Reward Program". This program incentivizes safe driving behaviors by offering discounts to policyholders who maintain a clean driving record. This initiative not only promotes safer roads but also aligns with the company's commitment to customer value.

Home Insurance: Securing Homes and Peace of Mind

For homeowners in the Southeast, Progressive Southeastern offers comprehensive home insurance policies. These policies provide coverage for a range of potential risks, including natural disasters common to the region, such as hurricanes and floods.

In addition to standard home insurance, they also offer specialized coverage for high-value homes and collectibles. This niche offering caters to the unique needs of homeowners with valuable assets, providing customized coverage and peace of mind.

Commercial Insurance: Supporting Businesses’ Success

Progressive Southeastern’s commercial insurance division plays a vital role in supporting the region’s businesses. They offer a wide array of commercial insurance products, including general liability, business owners’ policies (BOPs), and workers’ compensation insurance.

Their small business insurance packages are particularly noteworthy. These packages are designed to provide comprehensive coverage at affordable rates, recognizing the unique challenges faced by small businesses. This initiative has been instrumental in fostering the growth and sustainability of small enterprises across the Southeast.

Specialty Insurance: Tailored Solutions for Unique Needs

Progressive Southeastern’s foray into specialty insurance has been a game-changer for niche industries in the region. Their specialty insurance offerings include coverage for professional services, construction, maritime, and aviation industries.

For instance, their construction insurance provides contractors with comprehensive liability and property coverage, addressing the unique risks associated with construction projects. This specialized coverage has been a boon for construction companies, allowing them to operate with greater financial security.

| Insurance Type | Key Features |

|---|---|

| Auto Insurance | Safe Driver Reward Program, Customizable Options |

| Home Insurance | Coverage for Natural Disasters, Specialized Coverage for High-Value Assets |

| Commercial Insurance | Small Business Insurance Packages, General Liability, BOPs, Workers' Comp |

| Specialty Insurance | Coverage for Professional Services, Construction, Maritime, and Aviation Industries |

Progressive Southeastern’s Commitment to Community and Sustainability

Beyond its core insurance offerings, Progressive Southeastern actively engages in community initiatives and sustainability efforts. They understand that their success is intertwined with the well-being of the communities they serve.

Community Engagement and Social Responsibility

The company has a long-standing commitment to giving back to the communities where its employees live and work. They actively support various charitable causes and initiatives, with a focus on education, environmental conservation, and disaster relief.

Each year, Progressive Southeastern organizes "Community Days", during which employees volunteer their time and skills to local non-profit organizations. These initiatives not only strengthen community bonds but also foster a sense of social responsibility among the company's workforce.

Sustainability Initiatives: A Commitment to a Greener Future

Progressive Southeastern recognizes the importance of environmental sustainability and has implemented various initiatives to reduce its ecological footprint.

They have adopted a paperless office policy, encouraging digital communication and documentation to minimize paper waste. Additionally, the company has invested in renewable energy sources, such as solar panels, to power their operations and reduce their carbon emissions.

Furthermore, their "Green Driving Initiative" promotes eco-friendly driving habits among policyholders. This initiative educates drivers on fuel-efficient practices and provides incentives for those who adopt more sustainable driving behaviors.

The Future of Progressive Southeastern: Insights and Predictions

As the insurance landscape continues to evolve, Progressive Southeastern is well-positioned to thrive in the years to come. Their commitment to innovation and adaptability will be crucial in navigating the challenges and opportunities of the future.

Leveraging Technology for Enhanced Customer Experience

Progressive Southeastern is likely to continue investing in technology to enhance its customer experience. This may include further development of their digital platforms, offering more intuitive and personalized insurance solutions.

They may also explore the potential of artificial intelligence and machine learning to provide more accurate risk assessments and predictive analytics. These advancements could lead to more efficient underwriting processes and tailored insurance offerings.

Expanding Global Reach: International Expansion Strategies

While currently focused on the southeastern region of the United States, Progressive Southeastern has the potential to expand its operations globally. With the right strategic partnerships and market research, they could enter new international markets, offering their comprehensive insurance solutions to a wider audience.

Sustainability as a Competitive Advantage

Progressive Southeastern’s sustainability initiatives are not only beneficial for the environment but also position them as a responsible and forward-thinking company. As consumers increasingly prioritize sustainability, the company’s eco-friendly practices could become a key differentiator, attracting environmentally conscious clients.

Conclusion: Progressive Southeastern’s Enduring Legacy

Progressive Southeastern Insurance Company has established itself as a cornerstone of the insurance industry in the southeastern United States. Through its commitment to innovation, customer-centricity, and community involvement, the company has not only provided essential insurance solutions but also contributed to the growth and well-being of the communities it serves.

As it continues to evolve and adapt to the changing insurance landscape, Progressive Southeastern is poised to leave an enduring legacy, shaping the future of insurance for generations to come.

How can I get a quote for Progressive Southeastern’s insurance products?

+You can request a quote directly from Progressive Southeastern’s official website. Simply visit their website, navigate to the “Get a Quote” section, and provide the necessary details about your insurance needs. Their online platform allows you to compare different coverage options and choose the one that best suits your requirements.

What sets Progressive Southeastern apart from other insurance providers?

+Progressive Southeastern stands out for its commitment to innovation and customer satisfaction. They offer a wide range of insurance products, from auto and home insurance to commercial and specialty coverages, ensuring that they can cater to a diverse clientele. Additionally, their use of technology to enhance the customer experience sets them apart, providing efficient and personalized service.

Does Progressive Southeastern offer any discounts on their insurance policies?

+Yes, Progressive Southeastern provides various discounts to their policyholders. These include discounts for safe driving, multi-policy bundles, and loyalty rewards. They also offer specialized programs like the “Safe Driver Reward Program” for auto insurance, which incentivizes safe driving behaviors with discounts.

How does Progressive Southeastern contribute to community development and sustainability?

+Progressive Southeastern actively engages in community initiatives and sustainability efforts. They support various charitable causes, organize volunteer programs, and invest in renewable energy sources. Their commitment to sustainability extends to their operations and insurance offerings, promoting eco-friendly practices and initiatives.