Better Home Insurance

When it comes to safeguarding your home and ensuring peace of mind, having the right home insurance is paramount. In today's dynamic world, where unexpected events can occur, having comprehensive coverage is not just a luxury but a necessity. This in-depth guide will explore the intricacies of Better Home Insurance, a leading provider in the industry, and delve into the benefits, coverage options, and unique features that set it apart from the competition.

Revolutionizing Home Insurance with Better: A Comprehensive Overview

In an industry often plagued by complexity and confusion, Better Home Insurance stands out as a beacon of simplicity and innovation. Founded on the principles of transparency and customer-centricity, Better has redefined the home insurance landscape, offering policies that are not only comprehensive but also highly customizable to meet the unique needs of every homeowner.

Better's journey began with a simple yet powerful mission: to make home insurance not just a necessity but an asset that adds value to homeowners' lives. By leveraging cutting-edge technology and a deep understanding of the industry, they have crafted policies that are both accessible and affordable, without compromising on the level of coverage.

The Better Advantage: Tailored Coverage for Every Home

At the heart of Better’s success lies its ability to offer personalized coverage. Unlike traditional insurance providers that offer one-size-fits-all policies, Better recognizes that every home and its inhabitants have unique requirements. Whether you’re a homeowner with high-value possessions or a renter looking for basic liability coverage, Better has a policy tailored just for you.

One of the standout features of Better's policies is their flexible coverage limits. Homeowners can choose coverage amounts that accurately reflect the replacement cost of their homes and possessions, ensuring they are not overinsured or underinsured. This level of customization not only provides peace of mind but also helps keep premiums affordable.

Moreover, Better's policies extend beyond the physical structure of the home. They offer a range of optional coverages to address specific needs. For instance, homeowners can opt for coverage for high-value items like jewelry, art, or electronics, which often have limits under standard policies. Additionally, Better provides coverage for unique situations such as identity theft, service line repairs, and even coverage for temporary living expenses in case of a disaster.

| Coverage Category | Coverage Details |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home, including walls, roof, and permanent fixtures. |

| Personal Property Coverage | Covers the loss or damage of your belongings, including furniture, electronics, and clothing. |

| Liability Coverage | Protects you against lawsuits and medical claims for injuries that occur on your property. |

| Additional Living Expenses | Provides reimbursement for temporary living expenses if your home becomes uninhabitable due to a covered loss. |

Better's commitment to personalization doesn't stop at coverage limits. They also offer customizable deductibles, allowing homeowners to choose a deductible that aligns with their budget and risk tolerance. This level of control empowers homeowners to make informed decisions about their insurance, ensuring they get the right balance of coverage and cost.

The Digital Edge: Simplifying the Insurance Experience

In an era where digital convenience is king, Better has leveraged technology to streamline the insurance process. Their user-friendly online platform allows homeowners to easily compare policies, get quotes, and manage their insurance from the comfort of their homes. This digital approach not only saves time but also simplifies a process that is often daunting and complex.

Better's digital platform offers a seamless experience, from the initial quote process to the final policy purchase. Homeowners can input their details and receive an instant quote, complete with a detailed breakdown of the coverage and costs. This transparency ensures homeowners understand exactly what they're paying for and the level of protection they'll receive.

Furthermore, Better's platform offers a range of tools to help homeowners better understand their insurance needs. These include risk assessment calculators, which help homeowners identify potential risks and the level of coverage required, and interactive coverage guides that explain the ins and outs of different policy options.

The digital convenience extends beyond the initial purchase. Better's platform allows for easy policy management, with homeowners able to make changes, add endorsements, and renew their policies with just a few clicks. This level of accessibility and ease of use has been a key driver of Better's success, attracting a new generation of digitally savvy homeowners.

A Customer-Centric Approach: Going Beyond Coverage

Better Home Insurance understands that providing exceptional coverage is just the first step. Their commitment to their customers goes far beyond the policy, with a focus on delivering an unparalleled level of service and support.

One of the standout features of Better's customer service is their dedicated agent support. Unlike many online-only insurance providers, Better offers a human touch, with licensed agents available to guide homeowners through the insurance process. These agents are not just sales representatives but trusted advisors, helping homeowners navigate the complexities of insurance and ensuring they make informed decisions.

Better's agents are highly trained and knowledgeable, with a deep understanding of the insurance industry and the specific needs of homeowners. They are there to answer questions, provide personalized recommendations, and ensure that homeowners fully comprehend their coverage. This level of personalized support has been instrumental in building trust and loyalty among Better's customer base.

Beyond their agents, Better offers a range of support resources to empower homeowners. Their website features an extensive knowledge base with articles, guides, and FAQs, covering a wide range of insurance-related topics. This resource library is a go-to destination for homeowners looking to deepen their understanding of insurance and make more informed decisions.

Additionally, Better provides regular updates and educational content through their blog and social media platforms. These platforms not only keep homeowners informed about the latest industry developments but also offer practical tips and advice on home maintenance, safety, and risk mitigation. By providing this level of educational support, Better empowers homeowners to take a more proactive approach to insurance and homeownership.

Claims Process: Seamless and Stress-Free

In the unfortunate event of a claim, Better’s goal is to make the process as seamless and stress-free as possible. Their efficient claims process is designed to minimize the hassle and maximize the support provided to policyholders.

Better's claims team is highly responsive, with a commitment to swift action and effective communication. Policyholders can report claims online or over the phone, with a dedicated claims representative assigned to guide them through the process. This representative acts as a single point of contact, ensuring that policyholders receive consistent and timely updates throughout the claims journey.

The claims process is streamlined and transparent, with Better providing clear guidelines and documentation requirements upfront. This helps policyholders understand what is expected of them and ensures a smooth and efficient resolution. Better's claims team works diligently to assess and settle claims promptly, with a focus on fair and accurate compensation.

Better also recognizes the importance of empathy and support during what can be a challenging time for homeowners. Their claims team is trained to provide not just efficient resolution but also emotional support, understanding that a claim can be a stressful and emotionally taxing experience. This human-centric approach to claims management has been a key differentiator for Better, setting them apart from competitors and fostering a deep sense of trust among policyholders.

Future Outlook: Leading the Industry with Innovation

As the home insurance landscape continues to evolve, Better Home Insurance is poised to lead the way with its commitment to innovation and customer-centricity. With a track record of success and a deep understanding of the industry, Better is well-positioned to address the changing needs of homeowners and stay at the forefront of the industry.

Looking ahead, Better plans to continue enhancing its digital platform, leveraging the latest technologies to further streamline the insurance experience. This includes integrating artificial intelligence and machine learning to provide even more personalized recommendations and risk assessments. By leveraging these cutting-edge technologies, Better aims to offer an even more tailored and efficient insurance solution.

Better is also committed to expanding its coverage options, keeping pace with the evolving needs of homeowners. This includes exploring new coverages for emerging risks, such as cyber threats and climate-related disasters, and developing innovative solutions to address these challenges. By staying ahead of the curve, Better aims to provide homeowners with the peace of mind that comes with comprehensive and forward-thinking coverage.

Furthermore, Better is dedicated to fostering a culture of continuous improvement and learning. This involves regular customer feedback, market research, and collaboration with industry experts to identify areas for enhancement and ensure that their policies and services remain best-in-class. By staying connected with their customers and the industry, Better is able to adapt and evolve, ensuring they remain a trusted and reliable partner for homeowners.

In conclusion, Better Home Insurance stands as a beacon of innovation and customer service in the home insurance industry. With its commitment to transparency, personalization, and digital convenience, Better has redefined what it means to be a leading insurance provider. As the industry continues to evolve, Better is poised to lead the way, offering homeowners not just insurance policies but a partner they can trust to protect their homes and their futures.

What types of homes does Better Home Insurance cover?

+

Better Home Insurance offers coverage for a wide range of residential properties, including single-family homes, condos, townhomes, and even mobile homes. They specialize in providing tailored coverage options to meet the unique needs of each homeowner.

How does Better determine the cost of my home insurance policy?

+

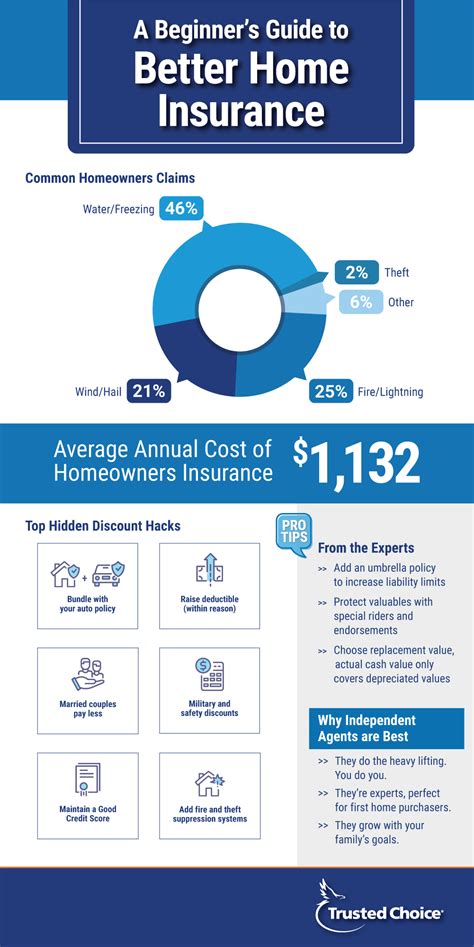

The cost of your home insurance policy is determined by a variety of factors, including the location and size of your home, the replacement cost of your belongings, your chosen coverage limits, and your deductible amount. Better uses advanced risk assessment tools to provide accurate and competitive quotes.

Can I bundle my home and auto insurance with Better Home Insurance?

+

Yes, Better Home Insurance offers the option to bundle your home and auto insurance policies, providing a convenient and cost-effective solution. By bundling your policies, you may be eligible for significant discounts and streamlined policy management.

What happens if I need to file a claim with Better Home Insurance?

+

In the event of a claim, Better Home Insurance has a dedicated claims team ready to assist you. You can report your claim online or over the phone, and a claims representative will guide you through the process. Better aims to provide a swift and seamless resolution, ensuring you receive the support and compensation you’re entitled to.

How can I get a quote from Better Home Insurance?

+

Getting a quote from Better Home Insurance is simple and convenient. You can visit their website, fill out a short online form, and receive an instant quote. The quote process is transparent and provides a detailed breakdown of your coverage and costs, ensuring you understand your policy.