Insurance Replacement Cost

Insurance replacement cost is a critical aspect of any insurance policy, particularly for property and homeowners' insurance. It is an essential consideration for policyholders as it directly impacts the financial protection and coverage they receive in the event of a loss or damage to their insured property. This article aims to provide an in-depth exploration of insurance replacement cost, its significance, and how it affects policyholders. By understanding this concept, individuals can make informed decisions when selecting insurance coverage and ensure they have adequate protection for their assets.

Understanding Insurance Replacement Cost

Insurance replacement cost is the amount an insurance company agrees to pay to replace or repair a damaged or destroyed insured property, ensuring it is restored to its pre-loss condition. This cost is typically based on the actual cash value of the property, which considers factors such as depreciation and the property’s current market value. In simpler terms, it’s the money needed to bring the property back to its original state, taking into account any changes in value over time.

The replacement cost is determined by several factors, including the type of property, its location, the construction materials used, and any unique features or upgrades. For example, a custom-built home with high-end finishes and unique architectural elements will have a different replacement cost than a standard residential property. Similarly, commercial properties, such as factories or office buildings, may have specialized equipment and systems that contribute to their replacement cost.

Key Considerations in Determining Replacement Cost

When establishing the replacement cost for a property, insurance companies consider a range of variables. These may include the property’s square footage, the cost of building materials in the area, local labor rates, and any applicable building codes and regulations. For instance, a property located in an area with strict seismic building codes will likely have a higher replacement cost due to the specialized construction requirements.

Additionally, the replacement cost can vary based on the scope of coverage selected by the policyholder. Some policies offer basic replacement cost coverage, which may only cover the cost of repairing or rebuilding the structure itself. However, more comprehensive policies often include additional coverage for personal belongings, debris removal, and even temporary living expenses while the property is being repaired or rebuilt.

| Coverage Type | Description |

|---|---|

| Replacement Cost Coverage | Pays the full cost to replace or repair the insured property without deducting for depreciation. |

| Actual Cash Value Coverage | Provides coverage based on the property's current value, considering depreciation. |

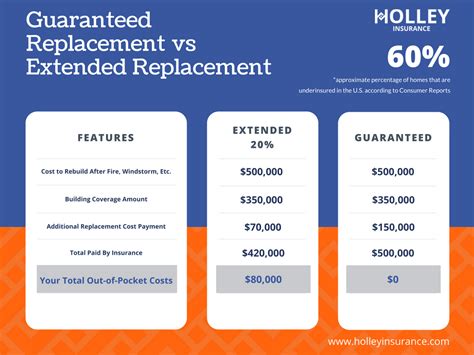

| Extended Replacement Cost Coverage | Offers a higher limit than the policy's base coverage, providing extra funds for unexpected costs. |

The Impact of Insurance Replacement Cost on Policyholders

Insurance replacement cost has a significant impact on policyholders, particularly in the event of a claim. Here’s how it can affect individuals:

Adequate Protection and Financial Security

Opting for a policy with appropriate replacement cost coverage provides policyholders with peace of mind, knowing that they have sufficient financial protection in the event of a loss. This coverage ensures that they can fully restore their property to its pre-loss condition without bearing significant out-of-pocket expenses. It is especially crucial for individuals who have invested heavily in their properties, as it helps them avoid financial strain during a challenging time.

Avoiding Underinsurance and its Consequences

Underinsurance occurs when a policy’s coverage limits are insufficient to cover the cost of replacing or repairing the insured property. This can lead to significant financial losses for policyholders, as they may be responsible for paying the difference out of pocket. By understanding the importance of insurance replacement cost and selecting an adequate coverage amount, individuals can avoid the pitfalls of underinsurance and ensure they have the necessary financial resources to rebuild their lives after a loss.

The Role of Policy Adjustments and Reviews

Insurance replacement cost is not a static figure; it can change over time due to factors such as inflation, changes in building materials costs, or modifications to the property itself. Therefore, it is essential for policyholders to regularly review and adjust their insurance policies to ensure their coverage remains up-to-date and adequate. Failure to do so may result in unexpected gaps in coverage or insufficient funds to cover the actual replacement cost.

Strategies for Managing Insurance Replacement Cost

Policyholders have several strategies at their disposal to effectively manage insurance replacement cost and ensure they have adequate coverage:

Regular Policy Reviews and Updates

Conducting annual or biennial policy reviews is crucial to assess whether the current coverage limits align with the property’s replacement cost. During these reviews, policyholders should consider any changes to the property, such as renovations or upgrades, and inform their insurance provider to ensure the coverage reflects the updated value.

Utilizing Insurance Professionals and Experts

Consulting with insurance professionals, such as brokers or agents, can provide valuable insights into determining the appropriate replacement cost for a property. These experts have access to industry data and tools that can help accurately estimate the cost of rebuilding or repairing the insured property. Additionally, they can guide policyholders through the process of selecting the right coverage limits and options to meet their specific needs.

Understanding Policy Limitations and Exclusions

While replacement cost coverage is essential, it’s equally important for policyholders to understand the limitations and exclusions of their policies. Some policies may have restrictions on the types of losses covered or the maximum payout limits. Being aware of these limitations can help policyholders make informed decisions about additional coverage options or taking extra precautions to mitigate potential risks.

The Future of Insurance Replacement Cost

The insurance industry is continuously evolving, and the concept of insurance replacement cost is no exception. As technology advances and data becomes more accessible, insurance companies are leveraging innovative tools and techniques to more accurately estimate replacement costs. This includes the use of artificial intelligence, machine learning, and advanced analytics to assess property values and predict replacement costs with greater precision.

Additionally, the increasing focus on sustainability and environmental considerations is shaping the future of insurance replacement cost. As more properties adopt green technologies and energy-efficient systems, insurance companies are adjusting their replacement cost calculations to account for these factors. This shift towards sustainable practices not only benefits the environment but also provides policyholders with incentives to make eco-friendly choices, as these upgrades may lead to reduced replacement costs and lower insurance premiums.

The Rise of Digitalization and Data Analytics

The digital transformation of the insurance industry is revolutionizing the way replacement costs are estimated. With the advent of smart home technologies, insurance companies can now gather real-time data on property conditions, occupancy patterns, and even potential risks. This data-driven approach enables more accurate and personalized replacement cost assessments, taking into account the unique characteristics of each insured property.

Collaborative Efforts and Industry Standards

To enhance the accuracy and consistency of insurance replacement cost calculations, industry associations and regulatory bodies are working together to establish standardized methodologies and guidelines. These collaborative efforts aim to ensure that insurance providers across the board are utilizing fair and transparent practices when determining replacement costs. By setting industry-wide standards, policyholders can have greater confidence in the accuracy and fairness of their insurance coverage.

Conclusion

Insurance replacement cost is a critical component of any property insurance policy, directly impacting the financial protection and coverage policyholders receive. By understanding the significance of replacement cost and actively managing their insurance policies, individuals can ensure they have adequate coverage to protect their assets. As the insurance industry continues to evolve, policyholders can expect more accurate and personalized replacement cost assessments, driven by technological advancements and data analytics.

Remember, staying informed and proactive in managing your insurance coverage is key to mitigating potential financial risks and ensuring a secure future for your assets.

What happens if the replacement cost exceeds the policy limits?

+If the replacement cost of a property exceeds the policy limits, policyholders may be responsible for paying the difference out of pocket. To avoid this scenario, it’s crucial to regularly review and update your insurance coverage to ensure it aligns with the current replacement cost of your property.

How often should I review my insurance policy for replacement cost coverage?

+It’s recommended to review your insurance policy annually or whenever significant changes are made to your property, such as renovations or upgrades. This ensures that your coverage remains up-to-date and aligns with the current replacement cost of your insured assets.

Can I negotiate the replacement cost with my insurance provider?

+While insurance providers typically have standardized methodologies for determining replacement costs, you can discuss your concerns or provide additional information that may impact the calculation. It’s important to have an open dialogue with your insurance provider to ensure your policy accurately reflects the value of your property.