What Is The Difference Between Hmo And Ppo Insurance

Understanding Health Insurance: HMO vs. PPO

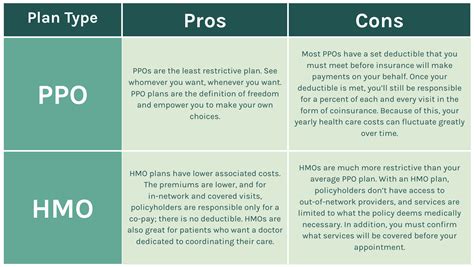

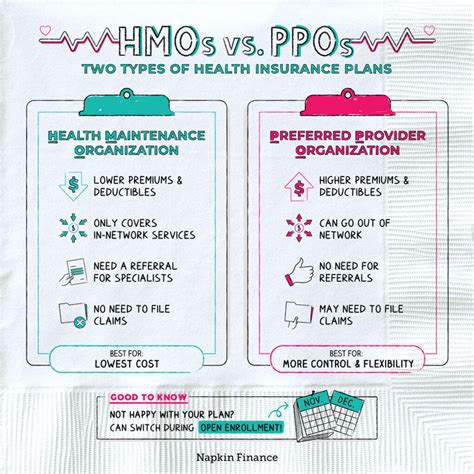

In the complex world of health insurance, two common terms that often come up are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). These are two distinct models of health coverage, each with its own set of benefits, limitations, and unique features. Understanding the difference between HMO and PPO insurance is crucial for individuals seeking the right healthcare plan that aligns with their needs and preferences.

HMOs and PPOs represent different approaches to healthcare management, offering varying levels of flexibility, cost, and provider networks. Let’s delve into the specifics of each type of insurance, explore their key differences, and provide a comprehensive analysis to help you make an informed decision.

Health Maintenance Organizations (HMOs)

Health Maintenance Organizations are insurance plans that aim to provide cost-effective healthcare by emphasizing preventative care and a coordinated approach to treatment. HMOs typically have a narrower network of healthcare providers, which means you have a limited choice of doctors and hospitals to visit. However, this restricted network also allows HMOs to negotiate lower rates with these providers, potentially resulting in lower overall costs for insured individuals.

Here’s a breakdown of key features and benefits of HMO plans:

- Primary Care Physician (PCP): HMOs require you to select a PCP who acts as your main point of contact for all your healthcare needs. This doctor coordinates your care and refers you to specialists within the HMO network when necessary.

- Referrals: To see a specialist, you need a referral from your PCP. This ensures that your healthcare is managed and coordinated, but it can also be a drawback if you prefer to have more direct access to specialists.

- In-Network Care: HMOs encourage you to stay within their network of providers. Out-of-network care is often not covered, or it comes with significantly higher out-of-pocket costs.

- Cost-Effective: HMO plans are generally more affordable than other types of insurance, especially for those who don’t require frequent specialist visits or extensive medical procedures.

- Preventative Care: HMOs often place a strong emphasis on preventative care, offering regular check-ups, screenings, and immunizations at little to no cost.

Pros and Cons of HMOs

HMOs can be an excellent choice for individuals who:

- Prefer a more structured healthcare approach with a designated PCP.

- Are generally healthy and don’t anticipate frequent visits to specialists.

- Value cost-effectiveness and appreciate the emphasis on preventative care.

However, HMOs may not be the best fit for those who:

- Require frequent access to specialists without the need for referrals.

- Prefer a wider range of healthcare providers to choose from.

- Have complex medical conditions that might require a team of specialists from different networks.

Preferred Provider Organizations (PPOs)

Preferred Provider Organizations offer a more flexible approach to healthcare, providing insured individuals with a broader network of healthcare providers to choose from. PPOs contract with a network of medical professionals, including doctors, specialists, and hospitals, and these providers agree to offer their services at discounted rates. Unlike HMOs, PPOs do not require you to select a primary care physician, and you can typically visit any provider within the network without a referral.

Key features and benefits of PPO plans include:

- Freedom of Choice: PPOs allow you to choose any in-network provider without needing a referral. This flexibility is particularly beneficial for those who prefer to have direct access to specialists or have specific healthcare providers they trust.

- Wider Network: PPOs typically have a larger network of healthcare providers, giving you more options when it comes to choosing doctors and hospitals.

- Out-of-Network Coverage: While it’s generally more expensive, PPOs often provide some level of coverage for out-of-network care. This can be advantageous if you have a preferred provider who is not in the PPO network.

- Cost: PPO plans are generally more expensive than HMOs, as they offer more flexibility and a wider range of providers. However, the cost can vary depending on the specific plan and the level of coverage chosen.

- Co-Pays and Deductibles: PPOs often have higher co-pays and deductibles compared to HMOs. This means you may pay more out-of-pocket for healthcare services, especially if you frequently require specialist care.

Pros and Cons of PPOs

PPOs are a good fit for individuals who:

- Value the freedom to choose their healthcare providers without restrictions.

- Have complex medical needs that require access to a range of specialists.

- Are willing to pay higher premiums for the flexibility and broader network.

On the other hand, PPOs might not be the best choice for those who:

- Prefer a more structured healthcare approach with coordinated care.

- Are looking for the most cost-effective insurance option.

- Don’t anticipate frequent specialist visits or extensive medical procedures.

Key Differences: HMO vs. PPO

| Feature | HMO | PPO |

|---|---|---|

| Provider Network | Narrower, restricted network | Broader network with more options |

| Referrals | Required for specialists | Not required |

| Cost | Generally more affordable | Typically more expensive |

| Out-of-Network Coverage | Little to no coverage | Some coverage, but at a higher cost |

| Freedom of Choice | Restricted to in-network providers | Freedom to choose any in-network provider |

| Primary Care Physician (PCP) | Required, coordinates care | Not required |

Choosing the Right Plan

The decision between an HMO and a PPO plan depends on your individual healthcare needs, preferences, and budget. Here are some factors to consider:

- Healthcare Needs: If you anticipate frequent specialist visits or have complex medical conditions, a PPO plan might offer the flexibility you need. On the other hand, if you prioritize cost-effectiveness and preventative care, an HMO plan could be a better fit.

- Budget: HMOs are generally more budget-friendly, especially if you don’t anticipate extensive medical procedures. PPOs, with their broader networks and more flexible coverage, often come with higher premiums and out-of-pocket costs.

- Provider Preferences: Consider whether you have specific healthcare providers you prefer or trust. PPOs offer more freedom in this regard, while HMOs may require you to change providers.

Conclusion

Understanding the differences between HMO and PPO insurance plans is crucial for making informed decisions about your healthcare coverage. Both models have their unique advantages and considerations, and the right choice ultimately depends on your individual needs and circumstances. By thoroughly evaluating your healthcare requirements, budget, and personal preferences, you can select a plan that provides the coverage and flexibility you desire.

Frequently Asked Questions

Can I switch between HMO and PPO plans if my needs change?

+Yes, you can switch between HMO and PPO plans, but it often depends on your specific insurance provider and the open enrollment periods they offer. Some providers may allow changes outside of open enrollment for qualifying life events, such as a job change or marriage.

Do HMOs and PPOs cover pre-existing conditions?

+Under the Affordable Care Act (ACA), insurance providers are required to cover pre-existing conditions without discrimination. Both HMOs and PPOs must comply with this regulation, ensuring that individuals with pre-existing conditions can access the same level of coverage as those without pre-existing conditions.

What happens if I need to see a specialist outside of my HMO or PPO network?

+If you need to see a specialist outside of your HMO or PPO network, the cost and coverage will depend on your specific insurance plan. Generally, out-of-network care is more expensive and may not be fully covered. It’s essential to review your plan’s details and consider the potential costs before seeking out-of-network care.