How To Find Cheapest Car Insurance

Securing affordable car insurance is a top priority for many drivers, as it can significantly impact their monthly expenses and overall financial well-being. With a myriad of insurance providers offering different rates and coverage options, finding the cheapest car insurance that suits your needs can be a challenging task. This comprehensive guide aims to provide you with the tools and knowledge to navigate the complex world of car insurance, helping you identify the most cost-effective policies available.

Understanding Car Insurance Costs

The cost of car insurance can vary widely, influenced by a combination of factors unique to each driver and their vehicle. These factors include:

- Demographics: Age, gender, marital status, and location can all affect insurance rates. Younger drivers, for instance, are often considered higher risk and may face higher premiums.

- Vehicle Type: The make, model, and year of your car play a role in determining insurance costs. Sports cars and luxury vehicles, known for their higher repair costs, typically command higher insurance rates.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or moving violations may result in higher insurance costs.

- Coverage Level: The level of coverage you choose—liability-only or comprehensive coverage—will impact your insurance costs. Comprehensive coverage offers more protection but comes at a higher price.

- Deductibles: Opting for higher deductibles can lower your monthly premiums, but you'll need to pay more out-of-pocket if you make a claim.

- Discounts: Many insurance companies offer discounts for various reasons, such as good student discounts, safe driver discounts, or discounts for bundling multiple policies.

Comparing Insurance Providers

Comparing rates and coverage options from multiple insurance providers is essential to finding the cheapest car insurance. Here's a step-by-step guide to help you through the process:

Step 1: Gather Information

Before you start shopping around, ensure you have the following information readily available:

- Your driver's license number and state.

- The VIN (Vehicle Identification Number) of your car.

- Details about your driving history, including any accidents or violations.

- The make, model, and year of your vehicle.

- The current insurance policy (if you have one), including coverage levels and deductibles.

Step 2: Research Insurance Companies

Start by researching reputable insurance companies that offer car insurance in your state. Consider both large, well-known providers and smaller, regional companies. Check online reviews and customer satisfaction ratings to get a sense of their reputation and service quality.

Step 3: Get Quotes

Request quotes from at least three to five insurance companies. Most providers offer online quote tools, making it convenient to get an estimate quickly. Be sure to provide accurate and consistent information to ensure an accurate quote.

Step 4: Compare Coverage and Prices

Once you have a few quotes, compare the coverage levels and prices. Ensure you're comparing apples to apples by reviewing the same coverage options across different providers. Look for any additional perks or benefits that may influence your decision, such as roadside assistance or rental car coverage.

Step 5: Consider Discounts

Insurance companies offer various discounts to attract and retain customers. Common discounts include:

- Multi-Policy Discounts: If you bundle your car insurance with other policies, such as homeowners or renters insurance, you may qualify for a discount.

- Safe Driver Discounts : Maintaining a clean driving record for a certain period can earn you a safe driver discount.

- Good Student Discounts : Students with a good academic record may be eligible for a discount.

- Pay-in-Full Discounts : Some providers offer a discount if you pay your premium in full upfront rather than in installments.

- Loyalty Discounts : Staying with the same insurer for an extended period may result in loyalty discounts.

Step 6: Review Payment Options

Different insurance companies offer various payment plans. Some may provide discounts for paying your premium in full, while others may offer flexible monthly payment options. Consider which payment plan works best for your financial situation.

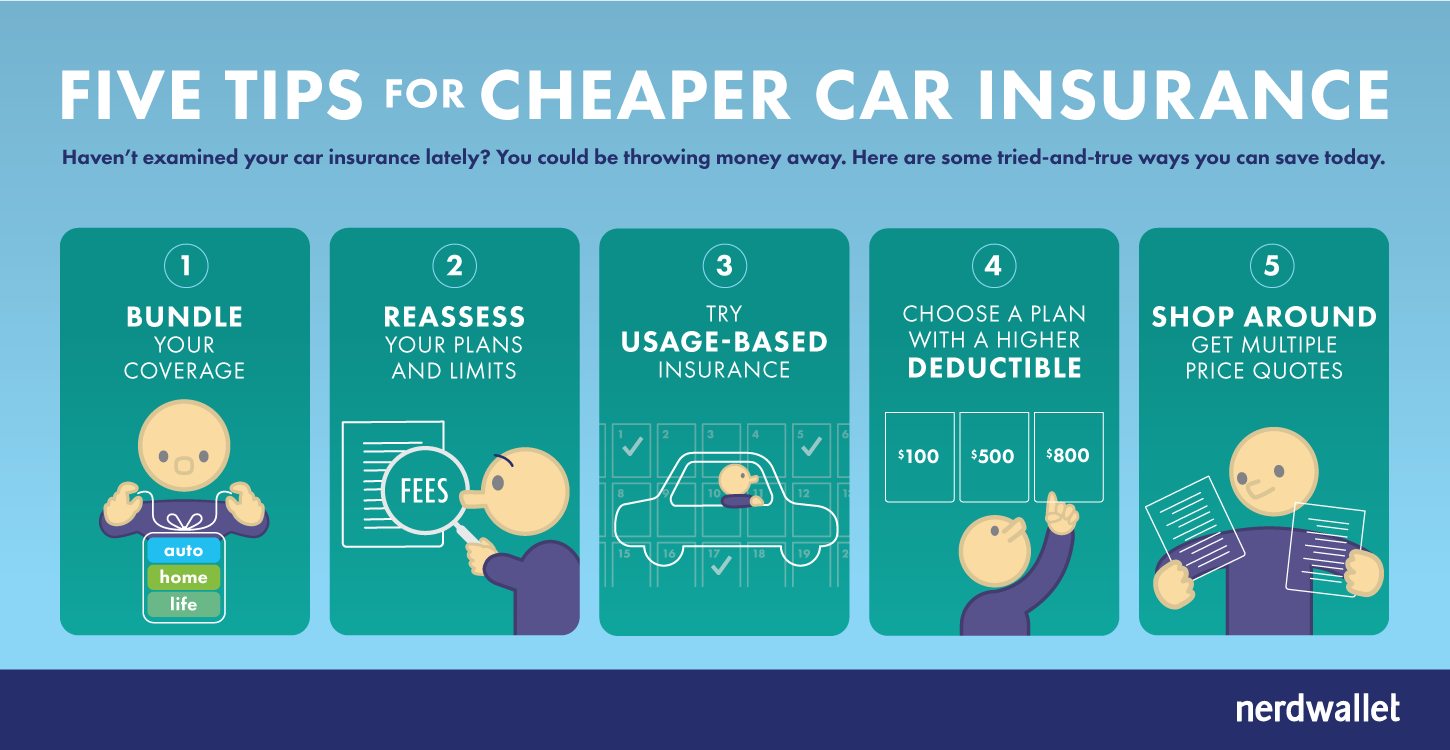

Optimizing Your Car Insurance Costs

In addition to shopping around and comparing quotes, there are several strategies you can employ to optimize your car insurance costs and potentially reduce your premiums.

Increase Your Deductible

Opting for a higher deductible can significantly reduce your monthly premiums. However, it's important to ensure that you can afford the higher out-of-pocket expense if you need to make a claim.

Maintain a Clean Driving Record

A clean driving record is one of the best ways to keep your insurance premiums low. Avoid traffic violations and accidents, as they can increase your rates for years.

Bundle Policies

If you have multiple insurance needs, such as car, home, or renters insurance, consider bundling your policies with the same provider. Bundling can often result in substantial savings.

Choose a Safer Vehicle

Insurance companies often offer lower rates for vehicles that are considered safer. This includes cars with advanced safety features and those that are less likely to be involved in accidents or sustain significant damage.

Take Advantage of Telematics

Some insurance companies offer telematics programs, where they track your driving behavior using a device or smartphone app. Safe driving habits, such as maintaining a steady speed and avoiding sudden braking, can lead to lower premiums.

The Future of Car Insurance

The car insurance landscape is constantly evolving, and several trends are shaping the future of the industry. Here's a glimpse into what the future may hold:

Usage-Based Insurance (UBI)

UBI programs, also known as pay-as-you-drive insurance, are becoming increasingly popular. These programs use telematics to track and charge drivers based on their actual driving behavior and mileage. This model rewards safe drivers with lower premiums.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning technologies are being leveraged by insurance companies to analyze vast amounts of data, predict risks more accurately, and personalize insurance offerings. This can lead to more precise risk assessments and potentially lower premiums for drivers.

Connected Car Technology

As vehicles become more connected, insurance companies can gather real-time data on driving behavior, vehicle diagnostics, and even road conditions. This data can be used to offer more dynamic and personalized insurance policies.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by enhancing transparency, security, and efficiency in claims processing. It can also enable peer-to-peer insurance models, where individuals can insure each other directly.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is expected to bring about significant changes in car insurance. Electric vehicles, with their advanced safety features and lower maintenance costs, may lead to reduced insurance premiums. Autonomous vehicles, once fully adopted, could potentially reduce accidents and insurance claims, further impacting insurance costs.

Frequently Asked Questions

How can I get car insurance quotes online?

+Most insurance companies offer online quote tools on their websites. Simply visit their website, enter your details, and you'll receive an instant quote. Alternatively, you can use comparison websites that aggregate quotes from multiple providers.

<div class="faq-item">

<div class="faq-question">

<h3>What factors determine my car insurance rates?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Your insurance rates are influenced by various factors, including your age, gender, location, driving record, vehicle type, coverage level, and deductibles. Insurance companies use these factors to assess your risk level and determine your premium.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I get a discount if I have multiple vehicles insured with the same company?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, many insurance companies offer multi-car discounts. Insuring multiple vehicles with the same provider can lead to significant savings, as you're considered a lower risk and more loyal customer.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is comprehensive car insurance, and do I need it?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Comprehensive car insurance covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. While it's not legally required, it's recommended if you want protection beyond the basic liability coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review and compare my car insurance rates?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's a good idea to review and compare your car insurance rates annually or whenever you experience a significant life change, such as getting married, moving to a new location, or purchasing a new vehicle. This ensures you're getting the best value and coverage for your needs.</p>

</div>

</div>

</div>

Finding the cheapest car insurance requires a combination of thorough research, comparison shopping, and an understanding of the factors that influence insurance costs. By following the steps outlined in this guide and staying informed about industry trends, you can make an informed decision and secure the most cost-effective car insurance policy for your needs.