Renters Insurance Companies

Renters insurance is a crucial aspect of financial planning for individuals who live in rental properties. It provides protection and peace of mind, ensuring that tenants are covered in case of unforeseen circumstances. With the right insurance policy, renters can safeguard their belongings and personal liability, making it an essential consideration for anyone leasing a home or apartment.

Understanding Renters Insurance

Renters insurance, also known as tenants insurance, is a type of property insurance that specifically caters to individuals who rent their living spaces. It is designed to protect the policyholder’s personal property and provide liability coverage in case of accidents or damages caused to others. Unlike homeowners insurance, which covers the structure of a house, renters insurance focuses on the contents within the rental unit and the potential risks associated with living in a shared building.

One of the key benefits of renters insurance is the protection it offers against property loss or damage. This coverage ensures that if your belongings are stolen, damaged by a covered peril (such as fire, flood, or vandalism), or destroyed due to a natural disaster, you will be reimbursed for the cost of replacing them. Renters insurance typically covers a wide range of personal items, including furniture, electronics, clothing, and jewelry.

Additionally, renters insurance provides liability protection. This means that if someone is injured in your rental unit or you accidentally cause damage to someone else's property, your insurance policy will cover the resulting legal fees and settlement costs. This protection extends beyond your rental unit, offering coverage for accidents that occur anywhere in the world.

It's important to note that renters insurance does not cover certain perils, such as earthquakes or floods, unless additional coverage is purchased. Additionally, high-value items like jewelry or artwork may have separate limits or require additional riders to be fully covered.

Key Components of Renters Insurance

Renters insurance policies are tailored to meet the specific needs of tenants and typically consist of the following key components:

- Personal Property Coverage: This covers the cost of repairing or replacing your belongings if they are damaged or lost due to a covered event.

- Liability Coverage: Provides protection if you are held legally responsible for bodily injury or property damage caused to others.

- Additional Living Expenses: If your rental unit becomes uninhabitable due to a covered loss, this coverage will reimburse you for the additional costs of temporary housing and meals.

- Medical Payments Coverage: Pays for reasonable medical expenses for injuries sustained by others on your rental property, regardless of fault.

- Loss of Use Coverage: Covers the cost of necessary expenses incurred when your rental unit is uninhabitable due to a covered loss, such as hotel stays and restaurant meals.

The specific coverage limits and exclusions can vary depending on the insurance company and the policy chosen. It's essential to review the policy documents and discuss any concerns with your insurance provider to ensure you have the appropriate coverage for your needs.

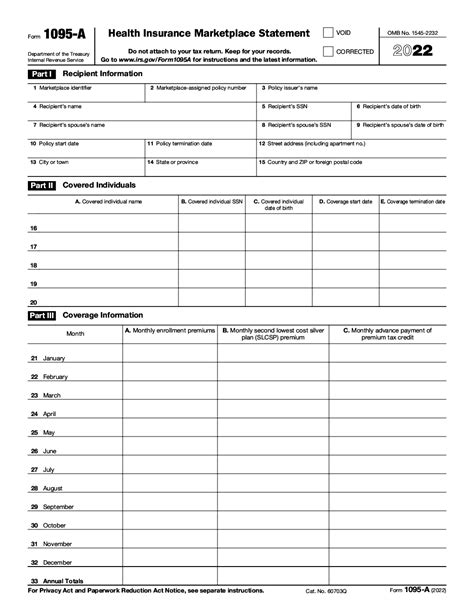

| Coverage Type | Description |

|---|---|

| Personal Property | Reimburses for damaged or lost belongings due to covered perils. |

| Liability | Protects against legal liability for bodily injury or property damage caused to others. |

| Additional Living Expenses | Covers temporary living costs if your rental unit is uninhabitable. |

| Medical Payments | Pays for medical expenses for injuries sustained by others on your rental property. |

| Loss of Use | Reimburses for necessary expenses incurred during temporary displacement. |

Top Renters Insurance Companies

When it comes to choosing a renters insurance company, there are several reputable options available in the market. Here’s an overview of some of the top providers, along with their unique features and coverage offerings:

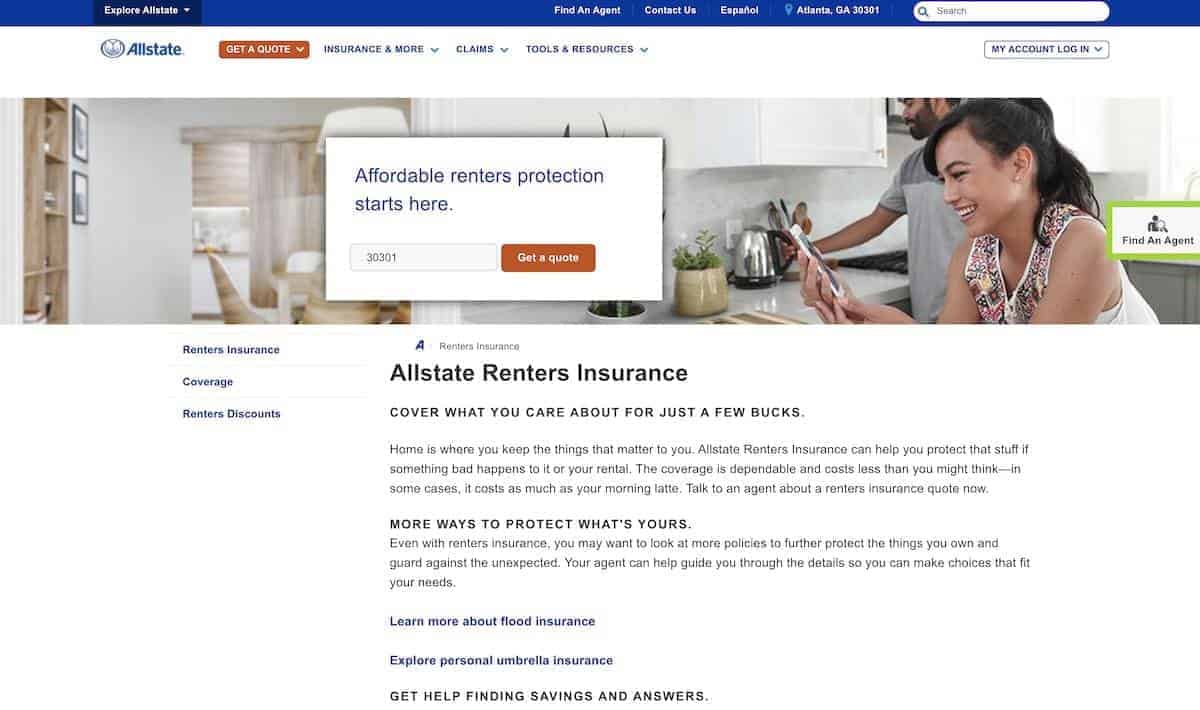

Allstate

Allstate is a well-known insurance company that offers a comprehensive renters insurance policy. Their Allstate Deluxe Renters Package provides extensive coverage, including personal property, liability, and additional living expenses. Additionally, Allstate offers optional coverages for valuable items and identity protection.

Key Features:

- Competitive rates and customizable coverage options.

- Discounts for bundling renters insurance with other Allstate policies.

- 24/7 customer service and claims support.

- Flexible payment plans and online account management.

State Farm

State Farm is another leading insurance provider with a strong presence in the renters insurance market. Their State Farm Renters Insurance policy offers a range of coverage options, including personal property, liability, and additional living expenses. State Farm also provides optional coverage for high-value items and identity restoration services.

Key Features:

- Personalized coverage options and competitive rates.

- Discounts for multiple policies and loyalty rewards.

- 24-hour claims assistance and local agent support.

- Online account management and mobile app for policy management.

Progressive

Progressive is a popular insurance company known for its innovative approach and comprehensive coverage options. Their Progressive Renters Insurance policy provides protection for personal property, liability, and additional living expenses. Progressive also offers optional coverages for high-value items and identity theft protection.

Key Features:

- Flexible payment options and discounts for bundling policies.

- 24/7 claims reporting and assistance.

- Online policy management and mobile app for convenience.

- Customizable coverage limits and optional add-ons.

Liberty Mutual

Liberty Mutual is a trusted insurance provider that offers a range of insurance products, including renters insurance. Their Liberty Mutual Renters Insurance policy provides coverage for personal property, liability, and additional living expenses. Liberty Mutual also offers optional coverage for valuable items and identity fraud expense coverage.

Key Features:

- Personalized coverage options and competitive rates.

- Discounts for multiple policies and safe home features.

- 24-hour claims support and local agent availability.

- Online account management and resources for policyholders.

Geico

Geico is a well-recognized insurance company known for its competitive rates and comprehensive coverage options. Their Geico Renters Insurance policy provides protection for personal property, liability, and additional living expenses. Geico also offers optional coverages for high-value items and identity theft protection.

Key Features:

- Affordable rates and customizable coverage options.

- Discounts for military members and federal employees.

- 24/7 claims service and online policy management.

- Convenient payment plans and mobile app for policyholders.

Factors to Consider When Choosing a Renters Insurance Company

When selecting a renters insurance company, it's essential to consider several factors to ensure you find the right fit for your needs. Here are some key considerations:

Coverage Options

Review the coverage options offered by each insurance company. Look for policies that provide comprehensive coverage for personal property, liability, and additional living expenses. Consider whether you require additional coverage for high-value items or identity protection.

Cost and Discounts

Compare the cost of renters insurance policies from different companies. Look for competitive rates and discounts. Many insurance providers offer discounts for bundling multiple policies, such as renters insurance with auto insurance. Consider your budget and choose a policy that provides adequate coverage at an affordable price.

Customer Service and Claims Support

Evaluate the customer service and claims support provided by the insurance company. Look for companies that offer 24⁄7 assistance, either through a dedicated customer service hotline or online platforms. Read reviews and testimonials to gauge the quality of their customer service and claims handling process.

Online Tools and Resources

In today’s digital age, online tools and resources can greatly enhance the insurance experience. Look for insurance companies that provide convenient online account management, mobile apps for policy management, and easy access to policy documents and claims forms. These features can simplify the insurance process and make it more accessible.

Policy Customization

Renters insurance policies should be customizable to meet your specific needs. Look for companies that offer a range of coverage limits and optional add-ons. This flexibility allows you to tailor your policy to your unique circumstances and ensure you have the right level of protection.

Comparing Renters Insurance Policies

To make an informed decision when choosing a renters insurance company, it’s beneficial to compare policies from multiple providers. Here’s a step-by-step guide to help you compare and evaluate renters insurance options:

Step 1: Identify Your Coverage Needs

Start by assessing your specific coverage needs. Consider the value of your personal belongings, the level of liability protection you require, and any additional coverages you may need, such as for high-value items or identity protection. Understanding your needs will help you narrow down the options and find policies that align with your requirements.

Step 2: Research Insurance Companies

Research and gather information about different renters insurance companies. Look for reputable providers with a strong financial standing and positive customer reviews. Consider their coverage options, discounts, and additional services they offer. Online resources, insurance comparison websites, and reviews can be valuable sources of information.

Step 3: Compare Coverage and Prices

Compare the coverage options and prices offered by each insurance company. Create a spreadsheet or use online comparison tools to analyze the key features, coverage limits, and premiums. Look for policies that provide the coverage you need at a competitive price. Remember to consider the value of comprehensive coverage over purely focusing on the lowest cost.

Step 4: Evaluate Customer Service and Claims Process

Research and evaluate the customer service and claims handling process of each insurance company. Look for companies with a strong reputation for prompt and efficient claims settlement. Read customer reviews and testimonials to understand their experiences with the company’s customer service and claims support.

Step 5: Consider Additional Benefits and Discounts

Explore the additional benefits and discounts offered by each insurance company. Look for policies that provide flexible payment options, online tools for policy management, and rewards or loyalty programs. Consider whether the company offers discounts for bundling multiple policies or for specific safety features in your rental unit.

Step 6: Seek Professional Advice

If you’re unsure about which renters insurance company to choose or have specific coverage concerns, consider seeking advice from an insurance professional or broker. They can provide expert guidance based on your needs and help you navigate the complexities of insurance policies.

What is the average cost of renters insurance?

+

The average cost of renters insurance can vary depending on factors such as location, coverage limits, and any additional endorsements. On average, renters insurance policies can range from 15 to 30 per month, with some providers offering even lower rates. It’s important to compare quotes from multiple insurers to find the best coverage at an affordable price.

Are there any discounts available for renters insurance?

+

Yes, many insurance companies offer discounts for renters insurance. Common discounts include multi-policy discounts (bundling renters insurance with other policies like auto insurance), safety discounts (for having certain safety features in your rental unit), and loyalty discounts for long-term customers. It’s worth exploring these options to potentially save on your renters insurance premium.

How do I choose the right coverage limits for my renters insurance policy?

+

Choosing the right coverage limits for your renters insurance policy involves assessing the value of your personal belongings and considering your liability exposure. Start by creating an inventory of your belongings and estimating their replacement cost. Additionally, evaluate your liability risk, such as whether you frequently host guests or have valuable assets. Consult with an insurance professional to determine the appropriate coverage limits based on your specific circumstances.