Term Vs Permanent Life Insurance

The Comprehensive Guide: Understanding the Differences and Benefits of Term and Permanent Life Insurance

In the world of financial planning and insurance, two primary types of life insurance policies stand out: Term and Permanent. These policies offer distinct advantages and cater to different life stages, financial goals, and personal circumstances. As a knowledgeable expert, I'll guide you through the intricacies of these policies, helping you make an informed decision that aligns with your unique needs.

Whether you're a young professional starting your career, a parent wanting to secure your family's future, or an established individual with complex financial objectives, understanding the nuances of Term and Permanent life insurance is essential. Let's delve into the details and explore how these policies can provide security and peace of mind during life's unpredictable journey.

Term Life Insurance: A Temporary Solution with Long-Term Benefits

Term life insurance is designed to provide coverage for a specified period, typically ranging from 10 to 30 years. It offers a cost-effective solution for individuals seeking financial protection during specific life stages, such as raising a family, paying off a mortgage, or covering other significant financial commitments.

Key Features of Term Life Insurance

- Affordability: Term life insurance is known for its competitive premiums, making it an attractive option for those on a budget. The cost remains relatively stable throughout the policy term, providing predictable financial planning.

- Flexibility: Policies can be tailored to meet individual needs, with the option to choose coverage amounts and term lengths that align with your goals. This flexibility allows for adjustments as your circumstances change.

- Simple Structure: Term policies are straightforward and easy to understand, with no cash value or investment component. The focus is solely on providing a death benefit to your beneficiaries.

- Renewal and Conversion Options: Many term policies offer the ability to renew or convert to a permanent plan, ensuring continued coverage even as your needs evolve.

Real-World Example: John's Term Life Insurance Journey

John, a 30-year-old with a young family, opts for a 20-year term life insurance policy with a $500,000 death benefit. He chooses this term length to cover his family's financial needs during the children's formative years and to pay off their mortgage. With affordable premiums, John secures peace of mind knowing his loved ones are protected during this critical life stage.

| Term Length | Death Benefit | Annual Premium |

|---|---|---|

| 20 years | $500,000 | $350 |

Permanent Life Insurance: Lifelong Protection and Financial Benefits

Permanent life insurance, as the name suggests, offers coverage for the entirety of your life, providing a death benefit to your beneficiaries regardless of when you pass away. This type of policy goes beyond simple financial protection, offering a range of additional benefits and features that make it an appealing choice for long-term financial planning.

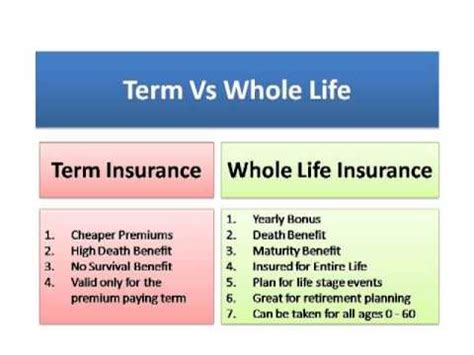

Types of Permanent Life Insurance

- Whole Life Insurance: This policy provides a fixed death benefit and accumulates cash value over time. Premiums remain level throughout the policy, offering stability and predictability.

- Universal Life Insurance: Offering flexibility, universal life policies allow you to adjust coverage amounts and premium payments. The cash value component can be used for various financial goals, such as retirement planning or funding business ventures.

- Variable Life Insurance: Similar to universal life, variable life insurance provides flexibility in coverage and premiums. However, the cash value is invested in separate accounts, offering potential for higher returns but also carrying investment risk.

Benefits of Permanent Life Insurance

- Lifetime Coverage: As the name suggests, permanent life insurance ensures you have coverage for your entire life, providing peace of mind that your beneficiaries will receive a death benefit regardless of your age or health.

- Cash Value Accumulation: Many permanent policies build cash value over time, which can be accessed through loans or withdrawals. This accumulated value can be used for various financial goals, such as funding education, supplementing retirement income, or covering emergency expenses.

- Tax Advantages: The cash value component of permanent life insurance policies often offers tax benefits, as gains are typically tax-deferred until withdrawal or policy surrender.

- Flexible Premiums: Unlike term policies, permanent life insurance allows for flexibility in premium payments. You can adjust the amount and frequency of payments to align with your financial situation and goals.

Exploring Universal Life Insurance: A Case Study

Sarah, a successful business owner, chooses a universal life insurance policy to protect her family's financial future and support her business ventures. With the flexibility of universal life, she can adjust her coverage and premiums as her business grows. The policy's cash value component provides a source of funds for investing in new business opportunities and funding her retirement.

| Policy Type | Death Benefit | Premium Flexibility | Cash Value Potential |

|---|---|---|---|

| Universal Life | Flexible | Highly Flexible | Significant |

Comparative Analysis: Term vs. Permanent Life Insurance

When deciding between term and permanent life insurance, it's essential to consider your unique financial situation and goals. Here's a breakdown of the key differences to help you make an informed choice.

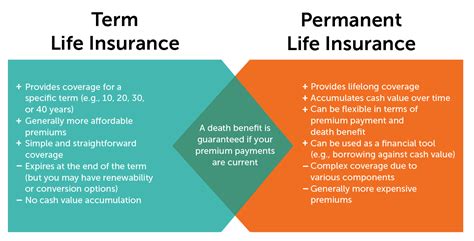

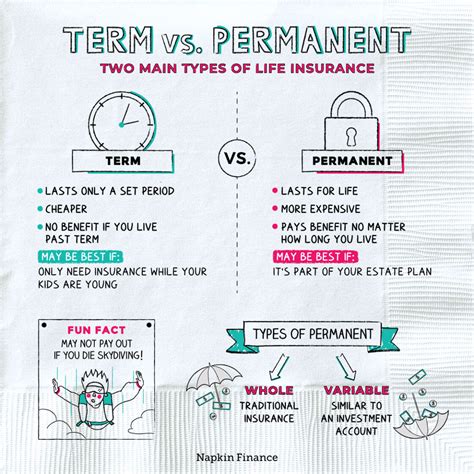

Coverage Period

- Term Life: Offers coverage for a specified period, typically 10-30 years.

- Permanent Life: Provides coverage for your entire life, ensuring protection regardless of age or health.

Cost and Premiums

- Term Life: Known for its affordability, with stable premiums throughout the term.

- Permanent Life: Premiums can be higher but remain level, and the policy accumulates cash value over time.

Flexibility and Customization

- Term Life: Offers flexibility in choosing coverage amounts and term lengths but has limited options for adjustments.

- Permanent Life: Provides extensive flexibility with adjustable coverage and premium payments, making it suitable for evolving financial needs.

Cash Value and Investment

- Term Life: Does not accumulate cash value, focusing solely on providing a death benefit.

- Permanent Life: Builds cash value over time, offering potential investment opportunities and tax advantages.

Renewal and Conversion Options

- Term Life: Many policies offer the ability to renew or convert to permanent plans, ensuring continued coverage.

- Permanent Life: No need for renewal or conversion, as coverage is guaranteed for life.

Choosing the Right Policy: A Personalized Approach

The decision between term and permanent life insurance is highly personal and depends on your financial goals, life stage, and risk tolerance. Here are some factors to consider when making your choice:

- Financial Goals: Are you seeking temporary coverage for a specific period, or do you have long-term financial objectives that require lifelong protection and flexibility?

- Budget and Affordability: Term life insurance is generally more affordable, making it an excellent choice for those on a budget. Permanent life insurance offers stability and potential investment opportunities but may have higher initial costs.

- Life Stage: Your age, family situation, and health can influence your decision. Term life insurance is often a good fit for younger individuals with growing families, while permanent life insurance provides comprehensive coverage for those with established financial goals.

- Health and Longevity: If you have concerns about your long-term health or want to ensure your loved ones are protected regardless of your age, permanent life insurance may be the better choice.

Future Implications and Considerations

As you navigate the world of life insurance, it's essential to stay informed about the evolving landscape. Here are some key considerations and trends to keep in mind:

Rising Healthcare Costs

With healthcare costs on the rise, the financial burden of unexpected medical expenses can be significant. Having adequate life insurance coverage can help alleviate the financial strain on your loved ones, ensuring they have the resources to manage these costs.

Changing Family Dynamics

Family structures and financial needs evolve over time. Whether you're starting a family, experiencing an empty nest, or supporting aging parents, your life insurance needs will likely change. Regularly reviewing and adjusting your policy ensures it remains aligned with your evolving circumstances.

Tax Implications

The tax landscape can impact the benefits and drawbacks of different life insurance policies. Stay informed about tax laws and consult with professionals to ensure you're maximizing the tax advantages of your chosen policy.

Emerging Trends in Insurance

The insurance industry is constantly innovating, with new products and services emerging to meet changing consumer needs. Stay abreast of these developments, as they may offer enhanced protection or more tailored solutions for your specific circumstances.

In Conclusion

Term and permanent life insurance policies each offer unique benefits and cater to different financial journeys. By understanding the nuances of these policies and assessing your specific needs, you can make an informed decision that provides the security and peace of mind you and your loved ones deserve. Remember, life insurance is an essential component of comprehensive financial planning, and choosing the right policy is a crucial step toward a secure future.

How do I determine the right amount of coverage for my term life insurance policy?

+Determining the right coverage amount involves considering your financial obligations, such as outstanding debts, mortgage payments, and the income needed to support your family. A general rule of thumb is to aim for 10-15 times your annual income, but it’s essential to assess your unique situation with the help of a financial advisor.

What are the potential drawbacks of permanent life insurance?

+Permanent life insurance can have higher initial costs and may require a longer commitment. Additionally, the cash value component carries investment risk, and policyholders must ensure they understand and manage these risks effectively.

Can I switch from term to permanent life insurance if my needs change?

+Many term life insurance policies offer conversion options, allowing you to switch to a permanent plan without undergoing a new medical exam. However, it’s essential to review your policy and consult with your insurance provider to understand the specific terms and conditions of your conversion rights.