State Farm Proof Of Insurance Card

In the world of insurance, having proof of coverage is essential, especially when it comes to auto insurance. One of the leading insurance providers in the United States, State Farm, offers its policyholders a convenient way to carry their insurance information: the State Farm Proof of Insurance Card. This card serves as a vital document, providing crucial details about an individual's insurance policy and coverage. Let's delve into the specifics of this card and explore its importance, features, and how it can benefit State Farm customers.

Understanding the State Farm Proof of Insurance Card

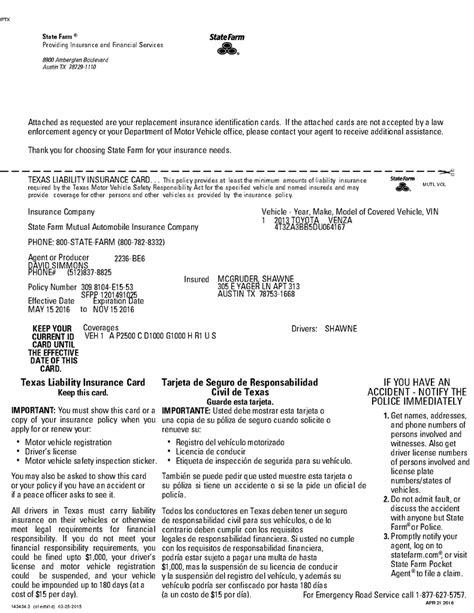

The State Farm Proof of Insurance Card is a compact and easily portable document that summarizes the key aspects of an insured individual's auto insurance policy. It serves as legal verification of the policyholder's insurance coverage and is often required by law enforcement officials during traffic stops or accidents. This card ensures that drivers can quickly and efficiently provide the necessary insurance information, helping to streamline the process and avoid any potential legal issues.

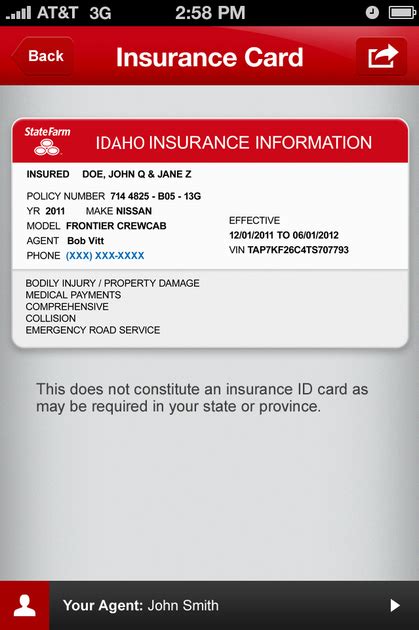

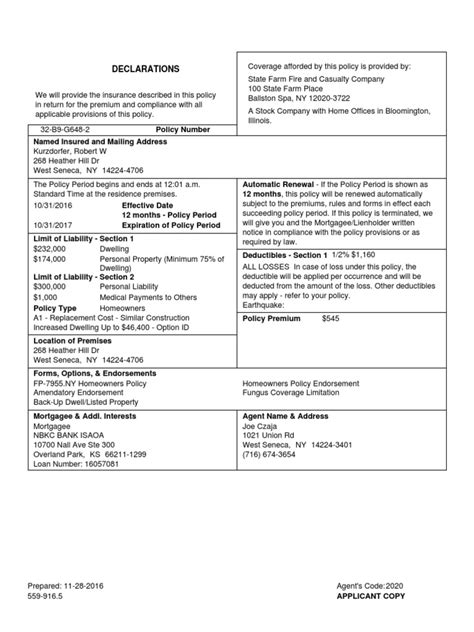

State Farm, known for its comprehensive insurance services and customer-centric approach, designs this card to be user-friendly and informative. It includes essential details such as the policyholder's name, policy number, vehicle information (make, model, and year), effective and expiration dates of the policy, and the types of coverage included in the policy. Additionally, the card may also display the policyholder's State Farm agent's contact information, making it convenient for policyholders to reach out for assistance or inquiries.

Key Features and Benefits

The State Farm Proof of Insurance Card offers several benefits and features that make it a valuable asset for policyholders:

- Convenience and Portability: The card's compact size allows policyholders to keep it in their wallet or glove compartment, ensuring easy access whenever needed. This portability is especially beneficial during unexpected situations, such as accidents or roadside assistance scenarios.

- Quick Verification: In the event of a traffic stop or accident, having the Proof of Insurance Card readily available enables policyholders to provide quick and accurate verification of their insurance coverage. This saves time and helps avoid potential delays or complications during these stressful situations.

- Comprehensive Information: The card provides a concise yet comprehensive overview of the policyholder's insurance coverage. It includes essential details like policy limits, deductibles, and coverage types, ensuring that policyholders and law enforcement officials have the necessary information at hand.

- Digital Access: In addition to the physical card, State Farm offers digital versions of the Proof of Insurance Card. Policyholders can access their digital cards through the State Farm mobile app or online account, providing an added layer of convenience and accessibility.

- Policy Updates: State Farm ensures that the Proof of Insurance Card is regularly updated to reflect any changes in the policyholder's coverage. This includes adjustments to policy limits, additional vehicles, or changes in policy terms. Policyholders can rest assured that their card accurately represents their current insurance status.

Real-Life Scenario: The Benefits of Proof of Insurance

Let's consider a real-life scenario to understand the importance and benefits of the State Farm Proof of Insurance Card. Imagine you're driving on a busy highway when you get pulled over by a police officer for a minor traffic violation. As the officer approaches your vehicle, one of the first things they'll ask for is your insurance information.

In this scenario, having your State Farm Proof of Insurance Card readily available can make a significant difference. You can quickly present the card, providing the officer with all the necessary details about your insurance coverage. This not only saves time but also demonstrates your compliance with insurance laws. The officer can easily verify your coverage and ensure that you are driving legally, avoiding any potential fines or legal consequences.

Furthermore, in the unfortunate event of an accident, having the Proof of Insurance Card can streamline the process of exchanging insurance information with the other party involved. It eliminates the need for lengthy explanations or searching for policy documents, allowing you to focus on the more critical aspects of the situation.

| Feature | Description |

|---|---|

| Policyholder Name | Displays the name of the insured individual. |

| Policy Number | A unique identifier for the insurance policy. |

| Vehicle Information | Make, model, and year of the insured vehicle. |

| Effective Dates | The start and end dates of the insurance policy. |

| Coverage Types | A summary of the different types of coverage included in the policy. |

Conclusion: A Convenient and Essential Tool

The State Farm Proof of Insurance Card is a convenient and essential tool for policyholders, providing a quick and accessible way to verify their insurance coverage. Its compact size, comprehensive information, and digital accessibility make it a reliable companion for drivers. By carrying this card, State Farm policyholders can ensure compliance with insurance laws and streamline their interactions with law enforcement or in the event of an accident.

As a leading insurance provider, State Farm's commitment to customer service and convenience is evident through the design and implementation of the Proof of Insurance Card. It demonstrates their understanding of the importance of having easy-to-access insurance information and their dedication to ensuring a positive experience for their policyholders.

Frequently Asked Questions

Can I get a digital copy of my Proof of Insurance Card?

+Yes, State Farm offers digital versions of the Proof of Insurance Card. You can access your digital card through the State Farm mobile app or your online account. This provides added convenience and allows you to have your insurance information readily available on your smartphone.

How often should I update my Proof of Insurance Card?

+State Farm ensures that your Proof of Insurance Card is updated regularly to reflect any changes in your policy. However, it’s a good practice to review your card periodically, especially if you’ve made recent changes to your coverage or vehicle information. If you notice any discrepancies, contact your State Farm agent to request an updated card.

What happens if I lose my Proof of Insurance Card?

+If you misplace or lose your Proof of Insurance Card, you can easily request a replacement. Contact your State Farm agent or reach out to State Farm’s customer service to obtain a new card. They will guide you through the process and provide you with a replacement card promptly.

Can I use my Proof of Insurance Card as my primary insurance document?

+While the Proof of Insurance Card is a valuable tool for verifying your coverage, it is not a replacement for your actual insurance policy documents. Your policy documents contain detailed information about your coverage, limits, and terms. It’s essential to keep your policy documents in a safe and accessible place.

How can I ensure the accuracy of my Proof of Insurance Card information?

+To ensure the accuracy of your Proof of Insurance Card, regularly review your card against your policy documents. If you notice any discrepancies or changes in your coverage, contact your State Farm agent to have your card updated. It’s crucial to keep your insurance information up-to-date to avoid any potential issues.