Which Insurance Covers Wegovy

Wegovy, the brand name for the medication semaglutide, has been making headlines in the medical and wellness industries due to its remarkable effectiveness in weight management and potential benefits for those with obesity or type 2 diabetes. As its popularity grows, many individuals are curious about the insurance coverage options for this prescription medication. This article aims to provide a comprehensive overview of which insurance plans typically cover Wegovy, offering valuable insights for those seeking clarity on their insurance benefits.

Understanding Wegovy and Its Medical Applications

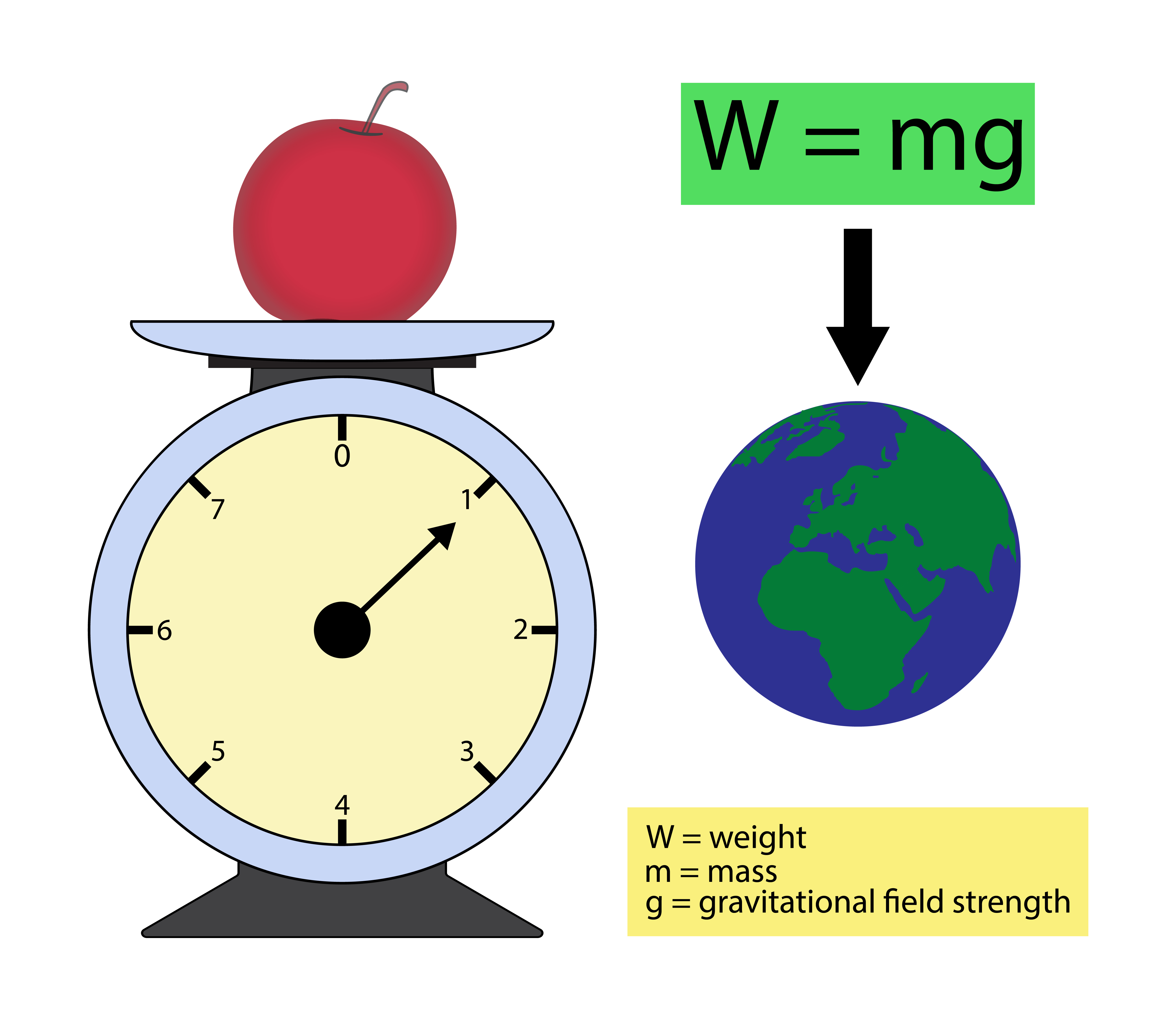

Wegovy is a once-weekly injectable prescription medication primarily prescribed for weight management in adults with a body mass index (BMI) of 30 or higher, or for those with a BMI of 27 or higher who have at least one weight-related health condition, such as type 2 diabetes or high blood pressure. Semaglutide, the active ingredient in Wegovy, belongs to a class of drugs called glucagon-like peptide-1 (GLP-1) receptor agonists. These medications work by mimicking the action of a hormone in the body that helps control blood sugar and appetite, ultimately leading to weight loss.

Semaglutide was first approved by the U.S. Food and Drug Administration (FDA) in 2017 under the brand name Ozempic® for the treatment of type 2 diabetes. Later, in 2021, the FDA approved Wegovy specifically for chronic weight management in adults with obesity or overweight, marking a significant development in the field of obesity treatment.

Insurance Coverage for Wegovy: A Comprehensive Overview

The question of whether insurance covers Wegovy is a complex one, as it depends on a multitude of factors, including the individual’s insurance plan, the specific prescription, and the medical necessity of the treatment. While there is no one-size-fits-all answer, understanding the general trends and guidelines can provide a clearer picture.

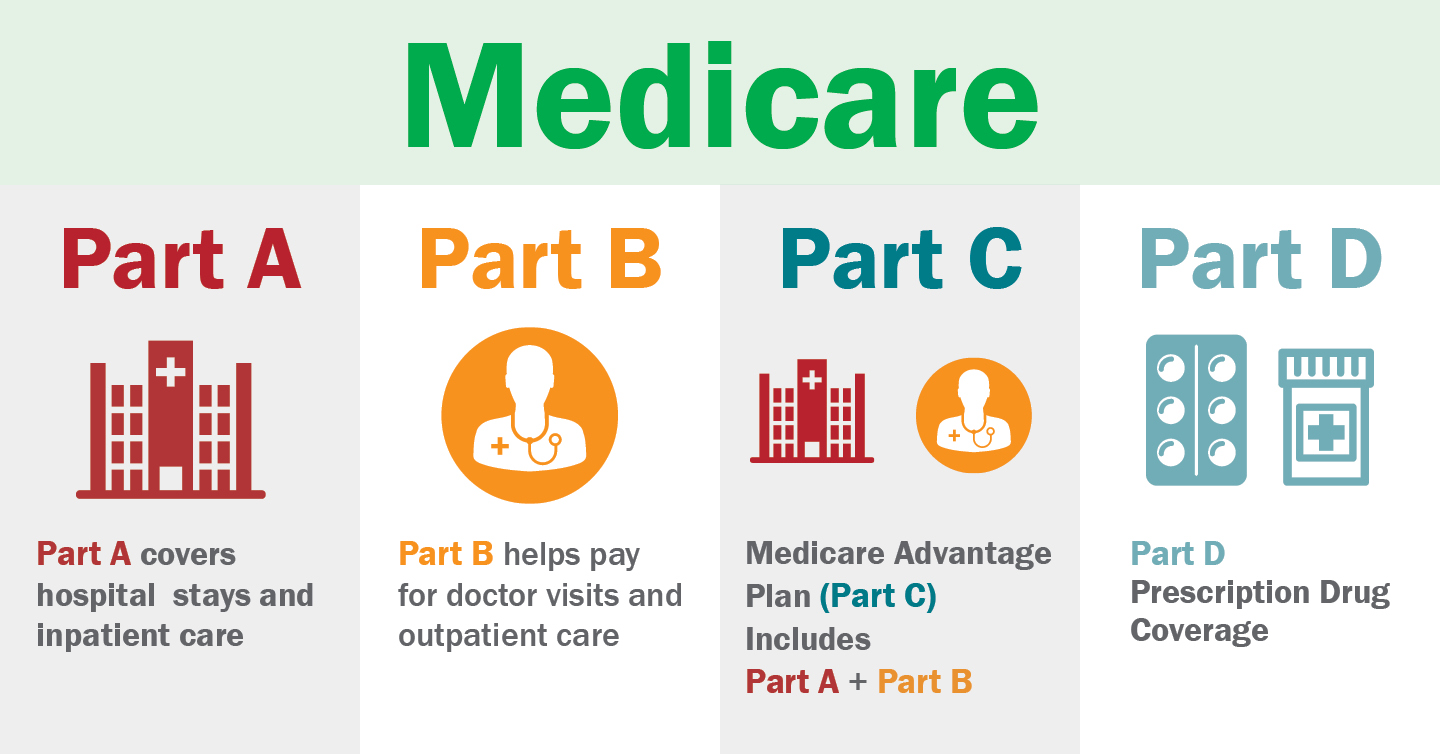

Medicare Coverage for Wegovy

Medicare, the federal health insurance program primarily for individuals aged 65 and older, offers coverage for Wegovy under certain conditions. Specifically, Medicare Part D, the prescription drug coverage component of Medicare, typically covers Wegovy when prescribed for the treatment of type 2 diabetes. However, it’s important to note that Medicare Part D plans can vary, and not all plans may cover Wegovy for weight management.

Additionally, Medicare Part B, which covers medical services and supplies, may cover Wegovy when it is administered by a healthcare provider in an outpatient setting. This coverage is more likely to be applicable for those using Wegovy for diabetes treatment rather than weight management.

| Medicare Part | Coverage for Wegovy |

|---|---|

| Part D | Covered for type 2 diabetes treatment; coverage for weight management varies by plan |

| Part B | Potential coverage for administration in outpatient settings; more likely for diabetes treatment |

Private Insurance Coverage

Private insurance plans, whether through an employer or purchased individually, generally offer more flexibility in covering Wegovy. Many private insurance plans recognize the medical necessity of Wegovy for individuals with obesity or overweight, especially when prescribed by a healthcare provider as part of a comprehensive weight management plan. However, the specific coverage can vary greatly depending on the insurance provider and the individual’s plan.

Some private insurance plans may cover Wegovy without any restrictions, while others may require prior authorization or have specific criteria that must be met for coverage. These criteria can include a certain BMI threshold, the presence of obesity-related health conditions, or participation in a weight management program.

Government-Sponsored Insurance Programs

Government-sponsored insurance programs, such as Medicaid and the Veterans Health Administration (VHA), also offer coverage for Wegovy, although the specifics can vary by state or region.

Medicaid, the federal and state-run insurance program for low-income individuals and families, often covers Wegovy for the treatment of type 2 diabetes and obesity. However, the extent of coverage can depend on the state's Medicaid program and the individual's eligibility.

The VHA, which provides healthcare services to military veterans, may cover Wegovy for eligible veterans with type 2 diabetes or obesity. The coverage decision is made on a case-by-case basis, considering the veteran's medical history and the potential benefits of the medication.

Factors Influencing Insurance Coverage for Wegovy

Several factors can influence whether an insurance plan covers Wegovy, including:

- Medical Necessity: Insurance plans are more likely to cover Wegovy when it is deemed medically necessary for the individual's health condition. This determination is often made by the individual's healthcare provider and may require documentation or a letter of medical necessity.

- Prior Authorization: Many insurance plans require prior authorization for Wegovy, meaning the healthcare provider must obtain approval from the insurance company before prescribing the medication. This process ensures that the medication is appropriate and necessary for the individual's condition.

- Formulary Status: Insurance plans typically maintain a list of covered medications, known as a formulary. Wegovy's position on this list can impact its coverage. Some plans may cover Wegovy at a higher tier, requiring a higher copay or coinsurance, while others may cover it at a lower tier with more affordable out-of-pocket costs.

- Individual Plan Benefits: The specific benefits and coverage of an individual's insurance plan play a significant role. Some plans may have limitations on the quantity or duration of Wegovy prescriptions, while others may have no such restrictions.

Navigating Insurance Coverage for Wegovy: Practical Tips

Understanding insurance coverage for Wegovy can be complex, but there are practical steps individuals can take to navigate the process effectively:

- Consult Your Healthcare Provider: Your healthcare provider can guide you through the insurance coverage process for Wegovy. They can provide documentation, letters of medical necessity, or prior authorization requests as needed.

- Check Your Insurance Plan: Review your insurance plan's benefits and coverage details, including the formulary and any restrictions on weight management medications. Understanding your plan's specifics can help you anticipate potential out-of-pocket costs.

- Contact Your Insurance Provider: Reach out to your insurance provider's customer service or pharmacy benefit manager to inquire about Wegovy coverage. They can provide information on prior authorization requirements, copays, and any additional steps needed to obtain coverage.

- Explore Financial Assistance Programs: If insurance coverage is limited or unavailable, consider financial assistance programs offered by the medication's manufacturer or other organizations. These programs can provide support for individuals facing financial barriers to accessing Wegovy.

- Consider Alternative Medications: If insurance coverage for Wegovy is not feasible, discuss alternative medications or treatment options with your healthcare provider. There may be other GLP-1 receptor agonists or weight management medications that are covered by your insurance plan.

The Future of Wegovy Coverage

As research continues to uncover the benefits of Wegovy and other GLP-1 receptor agonists, the landscape of insurance coverage for these medications is likely to evolve. Growing recognition of the medical necessity of weight management treatments and the potential for improved health outcomes could lead to broader insurance coverage in the future.

Furthermore, ongoing advocacy efforts and policy changes could play a significant role in expanding insurance coverage for Wegovy and similar medications. These initiatives aim to address the gap between the high cost of these medications and the limited financial resources of many individuals struggling with obesity or type 2 diabetes.

Conclusion

Determining insurance coverage for Wegovy can be a complex process, but with the right knowledge and resources, individuals can navigate this landscape effectively. By understanding the factors that influence coverage and taking proactive steps to advocate for their health needs, individuals can make informed decisions about their weight management journey.

Can I get Wegovy covered by my insurance if I don’t have a BMI of 27 or higher?

+The BMI threshold for Wegovy coverage can vary depending on your insurance plan and medical necessity. Some plans may cover Wegovy for individuals with a BMI of 27 or higher, while others may have a higher threshold. It’s important to consult with your healthcare provider and insurance provider to understand your specific coverage criteria.

Are there any restrictions on the duration of Wegovy prescriptions covered by insurance?

+Yes, some insurance plans may have restrictions on the duration or quantity of Wegovy prescriptions. These restrictions can vary widely, with some plans covering a certain number of doses per year or a specific treatment duration. It’s essential to review your insurance plan’s benefits or contact your insurance provider for specific details.

Can I switch from Ozempic to Wegovy if my insurance covers the former but not the latter?

+Switching from Ozempic to Wegovy may be possible, but it depends on your insurance coverage and the medical justification for the switch. Discuss this option with your healthcare provider, as they can provide a letter of medical necessity or prior authorization request to your insurance provider, explaining the clinical rationale for the switch.