Dental Insurance Plans

Dental insurance plans are an essential aspect of modern healthcare, offering individuals and families peace of mind when it comes to their oral health. With rising dental costs, these plans provide financial protection and encourage regular dental check-ups, ensuring better oral hygiene and overall well-being. In this comprehensive guide, we will delve into the world of dental insurance, exploring the various types, their benefits, and how they can impact your dental health and wallet.

Understanding Dental Insurance Plans

Dental insurance is a type of health insurance designed specifically to cover dental care expenses. These plans aim to make dental treatments more affordable and accessible, helping individuals maintain their oral health without breaking the bank. They typically cover a wide range of services, from routine check-ups and cleanings to more complex procedures like root canals and orthodontics.

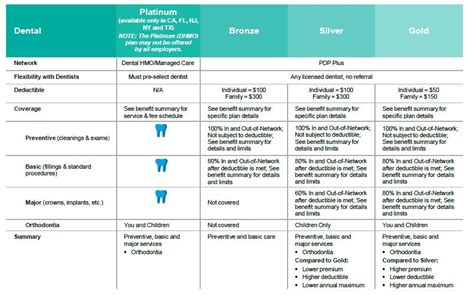

Types of Dental Insurance Plans

There are several types of dental insurance plans available, each with its own set of features and coverage limits. The most common types include:

- Indemnity Plans: These traditional plans allow you to choose any dentist you wish, providing a certain level of coverage for each service. You typically pay a portion of the cost (co-payment) while the insurance covers the rest up to a specified limit.

- Preferred Provider Organization (PPO) Plans: PPO plans offer a network of preferred dentists who have negotiated lower rates with the insurance company. You can visit any dentist, but you'll save more by staying within the network. These plans often have higher annual limits and cover a wider range of services.

- Health Maintenance Organization (HMO) Plans: HMO plans require you to choose a primary dentist from their network. You typically need to obtain a referral from your primary dentist to see a specialist. While HMO plans may have lower premiums, they often have stricter guidelines and may not cover all procedures.

- Dental Discount Plans: Instead of insurance, these plans offer discounts on dental services. You pay a membership fee and receive reduced rates at participating dentists. While they don't cover the full cost of treatment, they can still save you money.

Key Components of Dental Insurance

To understand how dental insurance works, it’s crucial to grasp the following key components:

- Premiums: The amount you pay regularly (usually monthly) to maintain your dental insurance coverage.

- Deductibles: The initial out-of-pocket expense you must pay before your insurance starts covering the costs. Some plans have annual deductibles, while others may have per-procedure deductibles.

- Co-payments (Co-pays): The fixed amount you pay for a covered service, usually at the time of treatment. Co-pays vary depending on the type of service and your insurance plan.

- Coinsurance: This is your share of the costs for a covered service, calculated as a percentage of the total cost. For instance, your insurance might cover 80% of the cost, leaving you to pay the remaining 20% as coinsurance.

- Annual Maximum: The maximum amount your insurance plan will pay out in a year. Once you reach this limit, you'll be responsible for all additional dental costs.

- Waiting Periods: Some plans have waiting periods before certain procedures are covered. For instance, there might be a 6-month waiting period for major restorative work.

Benefits of Dental Insurance

Dental insurance offers a multitude of benefits, making it an invaluable asset for maintaining good oral health:

Financial Protection

One of the primary advantages of dental insurance is the financial security it provides. Routine dental care can be costly, and unexpected dental emergencies can lead to significant expenses. With dental insurance, you can access quality dental care without worrying about breaking your budget. The coverage helps offset the costs of check-ups, cleanings, fillings, and other common procedures, making oral health maintenance more affordable.

Encouraging Regular Check-Ups

Dental insurance plans often cover routine check-ups and cleanings at little to no cost to the insured. This incentive encourages individuals to prioritize their oral health by scheduling regular visits to the dentist. By detecting and addressing dental issues early on, individuals can prevent more serious and costly problems down the line.

Covering Essential Procedures

Dental insurance typically covers a wide range of essential procedures, including root canals, extractions, and periodontal treatments. These procedures are often necessary to maintain oral health and prevent more severe complications. With insurance coverage, individuals can access these treatments without facing financial hardship.

Orthodontic Care

Many dental insurance plans also offer coverage for orthodontic treatments, such as braces and clear aligners. Orthodontic care is crucial for correcting misaligned teeth and jaws, improving not only oral health but also overall well-being and self-confidence. With insurance, individuals can access these treatments at a more manageable cost, making a healthier smile more attainable.

Emergency Dental Care

Dental emergencies can happen at any time, and the costs associated with them can be substantial. Dental insurance plans often cover emergency dental services, providing individuals with peace of mind during unexpected situations. Whether it’s a severe toothache, a broken tooth, or an accident requiring immediate dental attention, insurance can help alleviate the financial burden.

Choosing the Right Dental Insurance Plan

Selecting the right dental insurance plan involves careful consideration of your specific needs and circumstances. Here are some key factors to keep in mind:

Coverage Needs

Assess your current and potential future dental needs. If you have a history of dental issues or are considering orthodontic treatment, ensure the plan covers these procedures. Additionally, consider any pre-existing conditions and their potential impact on your coverage.

Network of Dentists

Check if your preferred dentist is in the insurance plan’s network. If not, you may want to consider a plan with a more extensive network or opt for an indemnity plan that allows you to choose any dentist.

Cost and Premiums

Evaluate the premiums, deductibles, and co-pays associated with the plan. Consider your budget and whether the plan’s costs align with your financial situation. Remember that a higher premium may indicate better coverage and lower out-of-pocket expenses.

Waiting Periods

Review the plan’s waiting periods for various procedures. If you have an immediate need for specific treatments, ensure the plan doesn’t have long waiting periods that could delay your care.

Annual Maximums

Understand the annual maximum amount the plan will cover. If you anticipate significant dental expenses, choose a plan with a higher annual maximum to ensure your costs are covered.

Maximizing Your Dental Insurance Benefits

To make the most of your dental insurance plan, consider the following strategies:

Regular Check-Ups

Schedule routine dental check-ups and cleanings as recommended by your dentist. These visits are often covered at little to no cost and help maintain optimal oral health.

Understand Your Coverage

Familiarize yourself with your plan’s coverage details, including what procedures are covered, any exclusions, and any limits or waiting periods. This knowledge will help you plan your dental care effectively.

Stay Within the Network

If you have a PPO or HMO plan, utilize the network dentists to maximize your savings. Out-of-network providers may not offer the same level of coverage, leading to higher out-of-pocket expenses.

Pre-Authorization for Major Procedures

For complex or expensive procedures, obtain pre-authorization from your insurance provider. This step ensures that the procedure is covered and helps you avoid unexpected costs.

Maintain Good Oral Hygiene

Practice good oral hygiene habits, such as brushing twice a day, flossing regularly, and using mouthwash. By maintaining a healthy mouth, you can reduce the need for extensive dental work and maximize your insurance benefits.

Dental Insurance and Employer-Sponsored Plans

Many individuals obtain dental insurance through their employers as part of a benefits package. These employer-sponsored plans often provide comprehensive coverage and may offer additional perks, such as discounted rates or flexible payment options.

Advantages of Employer-Sponsored Plans

Employer-sponsored dental insurance plans can be highly advantageous. They typically offer a range of coverage options, allowing employees to choose a plan that best suits their needs. Additionally, employers often contribute to the cost of premiums, making the insurance more affordable for employees. These plans may also include additional benefits, such as vision or life insurance coverage.

Customized Coverage

Employers often work with insurance providers to design plans that cater to the specific needs of their workforce. This can result in customized coverage that addresses common dental issues among employees, such as orthodontics or periodontal treatments.

Convenience and Accessibility

With employer-sponsored plans, employees often have direct access to the insurance provider, making it easier to manage their coverage and address any concerns. The process of enrolling in and maintaining insurance is often streamlined, and employees can receive assistance from their HR department or dedicated insurance brokers.

The Future of Dental Insurance

The dental insurance industry is evolving to meet the changing needs of patients and providers. Here’s a glimpse into the future of dental insurance:

Digital Transformation

The digital age is transforming the way dental insurance operates. Online platforms and mobile apps are making it easier for patients to manage their insurance, schedule appointments, and track their benefits. Insurance providers are investing in technology to streamline processes, enhance customer service, and provide real-time updates on coverage and claims.

Teledentistry

Teledentistry, the practice of providing dental care remotely, is gaining traction. With teledentistry, patients can consult with dentists online, receive preliminary diagnoses, and even get prescriptions for certain medications. This innovation expands access to dental care, especially for individuals in remote areas or with limited mobility.

Focus on Prevention

The future of dental insurance lies in prevention. Insurance providers are recognizing the importance of proactive oral care and are incentivizing patients to prioritize preventive measures. This shift aims to reduce the overall cost of dental care by preventing more complex and expensive procedures down the line.

Integrated Dental and Medical Care

There’s a growing understanding of the link between oral health and overall systemic health. As a result, dental insurance providers are exploring ways to integrate dental care with medical care. This integration could lead to more holistic approaches to healthcare, where dental insurance plans coordinate with medical insurance to provide comprehensive coverage for patients with conditions that impact both oral and overall health.

Conclusion

Dental insurance plans are an essential tool for maintaining good oral health and managing dental costs. By understanding the various types of plans, their benefits, and how to choose the right one, individuals can make informed decisions about their oral healthcare. As the industry continues to evolve, we can expect more innovative solutions and an increasing focus on preventive care, ensuring that dental insurance remains a vital component of our healthcare system.

How much does dental insurance typically cost?

+The cost of dental insurance varies depending on the type of plan, the level of coverage, and the provider. On average, individual plans can range from 30 to 50 per month, while family plans can cost around 100 to 150 per month. However, these costs can be significantly lower or higher depending on various factors.

What procedures are typically covered by dental insurance plans?

+Most dental insurance plans cover a wide range of procedures, including preventive care like check-ups and cleanings, basic restorative work such as fillings and root canals, and even more extensive procedures like crowns, bridges, and dentures. Orthodontic treatments like braces are also commonly covered, although there may be age restrictions and annual maximums.

Can I choose any dentist with my dental insurance plan?

+It depends on the type of plan you have. Indemnity plans allow you to choose any dentist, while PPO and HMO plans typically have networks of preferred providers. With PPO plans, you can visit out-of-network dentists, but you’ll likely pay more out of pocket. HMO plans usually require you to choose a primary dentist from their network.

How often should I visit the dentist with dental insurance?

+Most dental insurance plans cover two check-ups and cleanings per year. However, your dentist may recommend more frequent visits depending on your oral health needs. It’s essential to follow your dentist’s advice to maintain optimal oral hygiene and catch any potential issues early on.