Marketplace Insurance Washington

In the dynamic landscape of healthcare, the role of insurance marketplaces is pivotal, especially within the context of Washington state. The Washington Health Benefit Exchange, commonly known as WA HealthPlan Finder, stands as a cornerstone in the state's healthcare infrastructure. This platform empowers residents to navigate the complex world of health insurance, offering a streamlined process to compare and select plans that best align with their needs and financial capabilities.

As the healthcare industry evolves, so too do the offerings and regulations surrounding insurance. This comprehensive guide aims to provide an in-depth exploration of the Washington Health Benefit Exchange, shedding light on its origins, functionalities, and the profound impact it has on the state's healthcare landscape.

The Evolution of Health Insurance in Washington

The history of health insurance in Washington is a narrative of progressive reform and adaptation. In response to the growing demand for accessible and affordable healthcare, the state embarked on a journey to establish a robust insurance marketplace.

The genesis of the Washington Health Benefit Exchange can be traced back to the Affordable Care Act (ACA), a landmark legislation that aimed to reform the U.S. healthcare system. Under the ACA, states were given the flexibility to create their own health insurance marketplaces or utilize the federal marketplace. Washington state opted for the former, recognizing the unique healthcare needs of its residents and the potential for a state-run marketplace to better serve those needs.

The WA HealthPlan Finder officially opened its virtual doors in 2013, marking a significant milestone in Washington's healthcare journey. Since its inception, the platform has undergone continuous refinement, adapting to the evolving healthcare landscape and the changing demands of its users.

Today, the Washington Health Benefit Exchange serves as a one-stop shop for individuals, families, and small businesses seeking health insurance. It offers a wide array of plans from various insurers, providing a competitive marketplace where consumers can make informed choices about their healthcare coverage.

Key Features and Benefits of the Washington Health Benefit Exchange

The WA HealthPlan Finder is designed with the user experience at its core, offering a seamless and intuitive platform for navigating the complexities of health insurance.

Plan Comparison and Selection

At the heart of the Washington Health Benefit Exchange is its comprehensive plan comparison tool. Users can input their personal details, including age, location, and household size, to receive a tailored list of insurance plans. These plans are categorized based on their metal level, from Bronze to Platinum, indicating the coverage and cost-sharing ratios.

| Metal Level | Description |

|---|---|

| Bronze | Lower premiums, higher deductibles and out-of-pocket costs. |

| Silver | Balanced plans with moderate premiums and cost-sharing. |

| Gold | Higher premiums, but lower out-of-pocket costs. |

| Platinum | Premium plans with the lowest out-of-pocket expenses. |

Each plan's details, including provider networks, covered services, and cost estimates, are clearly presented, allowing users to make informed decisions based on their specific healthcare needs and financial considerations.

Financial Assistance and Subsidies

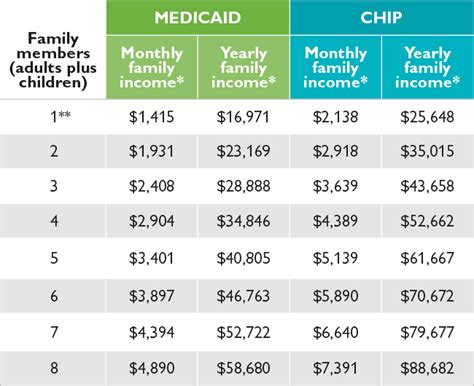

One of the standout features of the Washington Health Benefit Exchange is its ability to connect eligible individuals with financial assistance and subsidies. The platform calculates potential tax credits and cost-sharing reductions based on users’ income, household size, and other qualifying factors.

For instance, individuals with annual incomes between 100% and 400% of the Federal Poverty Level (FPL) may qualify for premium tax credits, significantly reducing the cost of their insurance premiums. Additionally, those with incomes below 250% of the FPL may be eligible for cost-sharing reductions, which lower their out-of-pocket expenses for deductibles, copayments, and coinsurance.

Small Business Solutions

The Washington Health Benefit Exchange also caters to the unique needs of small businesses. The platform offers a dedicated section for employers to explore group health insurance plans, providing a range of options to offer their employees.

Small businesses can compare plans based on their employees' demographics and healthcare needs, ensuring they find a plan that offers the right balance of coverage and cost. The platform also provides resources and guidance on understanding and complying with the state's health insurance regulations for employers.

Consumer Protections and Rights

The WA HealthPlan Finder operates under strict guidelines to ensure consumer protection and fair practices. All insurance plans offered on the exchange must comply with the essential health benefits outlined in the ACA, ensuring that consumers receive a comprehensive level of coverage.

Furthermore, the platform educates users about their rights, including the right to appeal coverage decisions and the right to privacy and confidentiality of their personal health information. This commitment to consumer protection fosters trust and confidence in the insurance marketplace.

Performance and Impact

The impact of the Washington Health Benefit Exchange on the state’s healthcare landscape is profound and far-reaching. Since its launch, the platform has consistently facilitated the enrollment of hundreds of thousands of Washington residents into health insurance plans each year.

A recent study by the Washington State Office of the Insurance Commissioner revealed that the WA HealthPlan Finder has been instrumental in increasing the state's overall insurance coverage rates. The study found that the exchange has successfully connected a significant portion of the state's previously uninsured population with affordable health insurance options.

Moreover, the platform's user-friendly design and robust comparison tools have empowered consumers to make informed choices about their healthcare coverage. This has led to a higher level of satisfaction and engagement with the state's healthcare system, fostering a culture of proactive healthcare management among Washington residents.

Future Outlook and Innovations

As the healthcare industry continues to evolve, the Washington Health Benefit Exchange is poised to adapt and innovate to meet the changing needs of its users.

Looking ahead, the platform is exploring ways to enhance its digital capabilities, leveraging emerging technologies to provide an even more seamless and personalized user experience. Potential innovations include the integration of artificial intelligence for more accurate plan recommendations and the development of mobile applications for on-the-go access to healthcare coverage information.

Furthermore, the WA HealthPlan Finder team is committed to staying abreast of healthcare policy changes at the state and federal levels. This proactive approach ensures that the platform remains compliant with the latest regulations and can swiftly adapt to any changes in healthcare law, protecting the interests of its users.

In conclusion, the Washington Health Benefit Exchange stands as a beacon of accessibility and innovation in the state's healthcare landscape. Its commitment to empowering residents with the tools to navigate and understand their health insurance options has not only increased coverage rates but has also fostered a more engaged and informed populace.

How do I enroll in a health insurance plan through the Washington Health Benefit Exchange?

+Enrollment in a health insurance plan through the Washington Health Benefit Exchange, or WA HealthPlan Finder, can be done online, by phone, or in person. The process involves creating an account, providing personal and household information, and selecting a plan that best suits your needs. You can also receive assistance from trained navigators or certified application counselors if needed.

What are the eligibility criteria for financial assistance through the exchange?

+Eligibility for financial assistance through the Washington Health Benefit Exchange depends on various factors, including your annual income, household size, and age. Generally, individuals with incomes between 100% and 400% of the Federal Poverty Level may qualify for premium tax credits, while those with incomes below 250% of the FPL may be eligible for cost-sharing reductions. It’s advisable to use the exchange’s calculator to determine your potential eligibility.

Can I switch my health insurance plan during the year?

+In most cases, health insurance plans through the Washington Health Benefit Exchange are designed for a full year. However, there are certain qualifying life events, such as a move, change in household composition, or loss of other health coverage, that may allow you to switch plans outside of the regular Open Enrollment Period. It’s important to check the exchange’s guidelines and consult with a trained navigator if you’re considering a mid-year plan change.