New Auto Insurance Quote

The world of car insurance is ever-evolving, with insurance companies offering a wide range of policies to cater to diverse needs. Getting a new auto insurance quote can be a daunting task, especially with the myriad of options available. This guide aims to provide an in-depth analysis of the process, helping you navigate the complexities and make informed decisions to secure the best coverage for your vehicle.

Understanding the Basics: What is an Auto Insurance Quote?

An auto insurance quote is an estimate of the cost of your car insurance policy. It is provided by insurance companies based on the information you give them about yourself, your vehicle, and your driving history. This quote serves as a crucial starting point for your insurance journey, as it helps you understand the coverage and costs associated with different policies.

When requesting a quote, you'll typically provide details such as your age, gender, marital status, location, type of vehicle, and driving record. This information allows the insurance company to assess your risk profile and offer a personalized quote. It's important to note that the quote is not a final contract; it's an estimate that can be refined as you discuss your specific needs with the insurer.

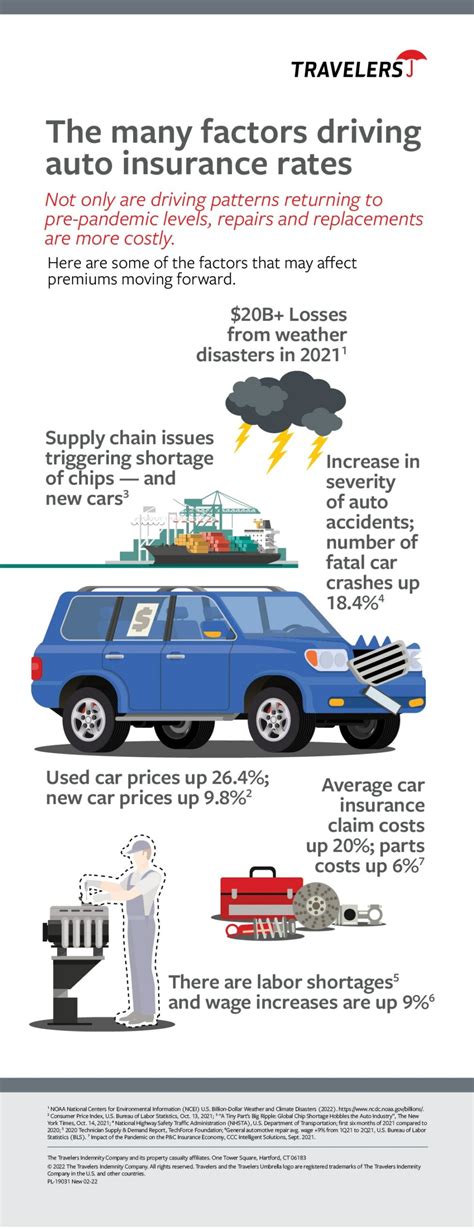

Factors Influencing Your Quote

Several factors come into play when an insurance company calculates your quote. These include:

- Demographic Factors: Your age, gender, marital status, and location can all impact your quote. For instance, younger drivers are often considered higher risk and may pay more for insurance.

- Vehicle Type and Usage: The make, model, and year of your car, as well as how you use it (e.g., daily commute, pleasure driving, or business use), can affect your quote. Sports cars or luxury vehicles may have higher insurance costs.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance premiums. Conversely, a history of accidents or traffic violations may result in higher quotes.

- Coverage Options: The type and level of coverage you choose will impact your quote. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, may cost more than basic liability coverage.

- Discounts and Bundles: Insurance companies often offer discounts for various reasons, such as good driving records, multiple vehicles insured, or bundling your auto insurance with other policies like home insurance.

The Quote Process: Step-by-Step

Obtaining a new auto insurance quote involves a series of steps. Here’s a detailed breakdown of the process:

Step 1: Research and Compare Insurance Providers

Start by researching different insurance companies. Look for reputable providers with a solid track record and good customer service. Compare their offerings, coverage options, and customer reviews to narrow down your choices.

Consider using online tools and comparison websites that allow you to enter your details once and receive quotes from multiple insurers. This can save you time and effort, providing a quick overview of the market.

Step 2: Gather Necessary Information

Before requesting quotes, ensure you have all the required information. This includes your driver’s license number, vehicle registration details, make and model of your car, and your driving history (including any accidents or traffic violations). If you’re unsure about any of these details, contact your current insurer or review your vehicle registration documents.

Step 3: Request Quotes

With your research complete and your information ready, it’s time to request quotes. You can do this online, over the phone, or in person at an insurance agency. Many insurance companies offer instant online quotes, allowing you to get a quick estimate of your potential insurance costs.

When requesting quotes, be as accurate as possible with your information. Any discrepancies between the quote and your actual circumstances could lead to problems down the line. It's also a good idea to ask about any additional fees or charges that may not be included in the initial quote.

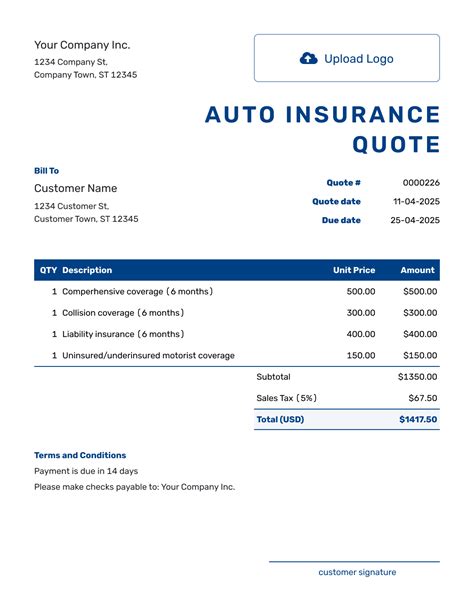

Step 4: Evaluate and Customize Your Quote

Once you have received quotes from several insurers, it’s time to evaluate them. Compare the coverage, costs, and any additional benefits or discounts offered. Ensure you understand what each policy covers and any exclusions or limitations.

You may also want to consider customizing your quote to better suit your needs. For example, you might add optional coverage for rental car reimbursement or roadside assistance. Or, if you have a clean driving record, you could consider increasing your deductible to lower your monthly premiums.

Step 5: Make an Informed Decision

After evaluating your quotes and customizing them to your liking, it’s time to make a decision. Choose the insurer that offers the best combination of coverage, cost, and customer service. Remember, the cheapest quote may not always be the best option, especially if it lacks the coverage you need.

Once you've made your choice, finalize the policy and make the necessary payments. Your insurance company will provide you with the necessary documents and information, including your policy number and details of your coverage.

Tips for Getting the Best Auto Insurance Quote

Here are some additional tips to help you get the most accurate and competitive auto insurance quotes:

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple insurers to ensure you're getting the best deal.

- Be Honest: Provide accurate and truthful information when requesting quotes. Misrepresenting your circumstances could lead to problems with your policy later on.

- Consider Bundling: If you have multiple insurance needs (e.g., auto, home, and life insurance), consider bundling them with the same insurer. This can often lead to significant discounts.

- Review Your Policy Regularly: Your circumstances and needs may change over time. Review your policy annually to ensure it still meets your requirements and to take advantage of any new discounts or coverage options.

- Improve Your Driving Record: A clean driving record can lead to lower insurance premiums. If you have a history of accidents or violations, consider taking a defensive driving course to improve your record and potentially lower your insurance costs.

The Future of Auto Insurance Quotes

The auto insurance industry is constantly evolving, and the way quotes are generated and provided is no exception. With advancements in technology and data analytics, insurers are now able to offer more personalized and accurate quotes. Here’s a glimpse into the future of auto insurance quotes:

Telematics and Usage-Based Insurance

Telematics is the use of technology to monitor a vehicle’s movement, behavior, and performance. Usage-Based Insurance (UBI) is an innovative approach where insurance premiums are calculated based on how, when, and where a vehicle is driven. This technology allows insurers to offer personalized rates to drivers, rewarding safe driving habits and providing more accurate quotes.

Artificial Intelligence and Machine Learning

AI and machine learning are being increasingly used by insurance companies to analyze vast amounts of data and provide more accurate quotes. These technologies can identify patterns and trends, helping insurers to better assess risk and offer more competitive rates.

Digitalization and Online Quoting

The rise of digital technology has made it easier than ever to obtain auto insurance quotes online. Insurers are investing in user-friendly platforms and apps, allowing customers to get quotes, compare policies, and purchase insurance with just a few clicks. This trend is set to continue, with more insurers embracing digital transformation to enhance the customer experience.

The Role of Big Data

Big data analytics is playing a crucial role in the auto insurance industry. Insurers are using vast amounts of data, including driver behavior, vehicle performance, and even weather patterns, to more accurately assess risk and provide personalized quotes. This data-driven approach is expected to continue shaping the industry in the future.

Conclusion

Getting a new auto insurance quote is an important step in ensuring you have adequate coverage for your vehicle. By understanding the factors that influence your quote, following a structured process, and staying informed about the latest trends, you can make informed decisions and secure the best possible insurance policy for your needs. Remember, your auto insurance quote is just the beginning; it’s the foundation for a comprehensive insurance plan tailored to your unique circumstances.

How often should I review my auto insurance policy and quotes?

+It’s recommended to review your auto insurance policy and quotes at least once a year, or whenever your circumstances change significantly. This ensures your coverage remains up-to-date and reflects your current needs.

What if I have multiple vehicles? Can I get a single quote for all of them?

+Yes, many insurance companies offer multi-vehicle discounts. When requesting quotes, be sure to mention that you have multiple vehicles and ask about potential discounts.

Are there any additional fees or charges I should be aware of when getting an auto insurance quote?

+Yes, some insurance companies may charge additional fees for things like policy administration, late payments, or specific coverage options. It’s important to ask about these fees when getting a quote to ensure there are no surprises later on.