Low Income Health Insurance Texas

For those living in Texas, navigating the healthcare system and finding affordable insurance coverage can be a challenging task, especially for individuals and families with low incomes. Fortunately, there are various options and programs available to ensure that residents have access to quality healthcare services without breaking the bank. This comprehensive guide aims to shed light on the specific avenues and resources that Texans can explore to secure health insurance coverage tailored to their financial circumstances.

Understanding Low-Income Health Insurance Options in Texas

Texas has a unique healthcare landscape, offering a range of insurance options for low-income residents. Understanding these options is crucial to making informed decisions about coverage. Let’s delve into the specifics of each program and how they cater to the needs of Texans with limited financial means.

Medicaid: A Safety Net for Texans

Medicaid is a critical program in Texas, providing healthcare coverage to millions of low-income residents. This federally and state-funded program is designed to ensure that even those with limited financial resources have access to essential medical services. The eligibility criteria for Medicaid in Texas are based on factors such as income, family size, and disability status.

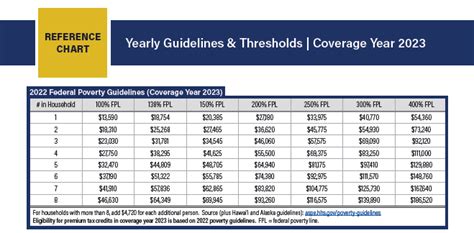

To give a clearer picture, let's look at some real-world examples: for a single adult without children, the income limit for Medicaid eligibility in Texas is approximately $17,774 per year. However, this limit varies depending on the number of people in the household. For instance, a family of four with an annual income below $42,480 may also qualify for Medicaid coverage.

The benefits covered by Medicaid in Texas include a wide range of essential healthcare services, such as doctor visits, hospital stays, prescription medications, and even mental health services. Additionally, Medicaid often covers preventive care measures, ensuring that Texans can maintain their health and catch potential issues early on.

| Benefit | Coverage |

|---|---|

| Doctor Visits | Covers routine check-ups and specialist referrals |

| Hospital Care | Includes emergency and inpatient services |

| Prescription Drugs | Provides access to necessary medications |

| Mental Health Services | Offers counseling and treatment for various mental health conditions |

Applying for Medicaid in Texas is a straightforward process. Residents can apply online through the YourTexasBenefits website, where they can also check their eligibility and track the status of their application. It's important to note that certain life changes, such as a job loss or the birth of a child, may qualify individuals for expedited enrollment, ensuring they receive coverage as soon as possible.

CHIP: Covering Texas’s Children

The Children’s Health Insurance Program (CHIP) is another vital initiative in Texas, focusing specifically on providing healthcare coverage for children in low-income families. CHIP bridges the gap for families who earn too much to qualify for Medicaid but still face financial challenges in affording private health insurance.

In Texas, CHIP eligibility is determined by income and family size. For instance, a family of three with an annual income below $51,500 may qualify for CHIP coverage. This program ensures that children receive the necessary medical care, including regular check-ups, immunizations, and dental services.

The benefits covered by CHIP are comprehensive and include:

- Routine doctor visits and check-ups

- Prescription medications

- Emergency care

- Vision and dental services

- Mental health and substance abuse treatment

Enrolling in CHIP is simple. Families can apply online through the YourTexasBenefits website or by calling the CHIP Enrollment Center. It's worth noting that CHIP offers a streamlined application process, especially for families already enrolled in Medicaid, making it easier for children to receive the healthcare they need.

Marketplace Insurance: Affordable Plans for Low-Income Texans

For Texans who don’t qualify for Medicaid or CHIP, the Health Insurance Marketplace offers a range of affordable insurance plans. These plans, often referred to as Qualified Health Plans (QHPs), are designed to provide comprehensive coverage at a lower cost, with the added benefit of potential tax credits to reduce monthly premiums.

The Marketplace in Texas offers Bronze, Silver, Gold, and Platinum plans, each with varying levels of coverage and costs. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans have higher premiums but lower out-of-pocket expenses. The choice of plan depends on an individual's or family's specific healthcare needs and financial situation.

To illustrate, let's consider a single adult in Texas with an annual income of $25,000. This individual may qualify for a Silver plan with a monthly premium of $150 and a deductible of $2,000. However, with the available tax credits, the monthly premium could be reduced to as low as $50, making healthcare coverage more accessible.

Enrolling in a Marketplace plan can be done during the annual Open Enrollment Period, which typically runs from November to December. However, Texans may also qualify for a Special Enrollment Period if they experience certain life events, such as losing their job or getting married.

Discounted Healthcare Programs

In addition to insurance coverage, Texas offers various discounted healthcare programs that can benefit low-income residents. These programs provide access to medical services at reduced costs, ensuring that financial constraints don’t hinder necessary healthcare.

For example, the Texas Uninsured Program provides free or low-cost medical care to uninsured Texans who meet certain income requirements. This program covers a range of services, including primary care, specialty care, and even some dental and vision services. Similarly, Community Health Centers across the state offer sliding-scale fees based on income, ensuring that everyone can afford the healthcare they need.

How to Apply for Low-Income Health Insurance in Texas

Applying for low-income health insurance in Texas is a straightforward process, with several options available to ensure convenience and accessibility. Here’s a step-by-step guide to help Texans navigate the application journey:

Step 1: Determine Eligibility

The first step is to assess your eligibility for various health insurance programs in Texas. This involves understanding the income limits and other criteria for Medicaid, CHIP, and Marketplace plans. You can use online tools and calculators provided by the Health and Human Services Commission to estimate your eligibility.

Step 2: Gather Required Documents

Once you’ve determined your eligibility, it’s time to gather the necessary documents. This typically includes proof of identity, citizenship or immigration status, and income. Specific documents may vary depending on the program you’re applying for, so it’s important to refer to the program’s guidelines.

Step 3: Choose Your Application Method

Texas offers multiple ways to apply for health insurance, allowing you to choose the method that suits your preferences and circumstances. Here are the main application methods:

- Online Application: The most common and convenient method is to apply online through the YourTexasBenefits website. This platform allows you to fill out and submit your application, check your eligibility, and track the status of your application in real-time.

- Paper Application: If you prefer a physical application, you can download and print the necessary forms from the Health and Human Services Commission website. You can then mail or fax the completed forms to the appropriate address or fax number.

- In-Person Application: Texans can also apply for health insurance in person at a local Health and Human Services office. This option provides direct assistance and guidance, making it ideal for those who need extra support or have specific questions.

Step 4: Complete and Submit Your Application

Regardless of the application method you choose, it’s crucial to ensure that your application is complete and accurate. Double-check all the information you’ve provided and ensure you’ve included all the required documents. Incomplete applications may lead to delays or even denial of coverage.

Step 5: Track Your Application Status

After submitting your application, you can track its progress and stay informed about any updates or decisions. The YourTexasBenefits website provides a secure platform to check the status of your application, receive notifications, and view any correspondence related to your application.

Step 6: Enroll and Manage Your Coverage

Once your application is approved, you’ll receive information about your coverage, including details about your plan, benefits, and costs. It’s important to carefully review this information and understand your rights and responsibilities as a policyholder. You can also manage your coverage online, make changes to your plan, or renew your enrollment as needed.

Low-Income Health Insurance Resources in Texas

Texas offers a wealth of resources and support systems to assist residents in finding and managing their low-income health insurance. These resources are designed to provide guidance, answer questions, and ensure that Texans have the information they need to make informed decisions about their healthcare coverage.

Health Insurance Marketplace Assistance

The Health Insurance Marketplace in Texas provides a range of resources to help residents navigate the process of selecting and enrolling in a health insurance plan. These resources include:

- Online Tools: The Marketplace website offers interactive tools and calculators to help Texans estimate their eligibility for various plans and tax credits. These tools can provide a personalized estimate of costs and benefits based on individual circumstances.

- Educational Materials: The Marketplace provides a wealth of educational resources, including articles, videos, and infographics, to explain the basics of health insurance, the different plan options, and how to choose the right plan for your needs.

- Navigator Programs: Texas has a network of certified navigators who provide free, unbiased assistance to residents seeking health insurance coverage. Navigators can help with eligibility assessments, plan comparisons, and enrollment, ensuring that Texans receive the support they need to make informed decisions.

Medicaid and CHIP Information

For those exploring Medicaid and CHIP options, Texas offers dedicated resources to guide residents through the application and enrollment process. These resources include:

- YourTexasBenefits Website: This comprehensive website provides a one-stop shop for all things related to Medicaid and CHIP in Texas. Residents can apply online, check their eligibility, and manage their benefits. The website also offers a wealth of educational materials and resources to help understand the programs and their benefits.

- Call Centers: Texas operates call centers dedicated to Medicaid and CHIP enrollment and assistance. These call centers provide real-time support and guidance, answering questions and providing information to residents. Call center staff can assist with eligibility assessments, application completion, and enrollment, ensuring that Texans receive the help they need.

Community Health Centers and Clinics

Community Health Centers and Clinics play a vital role in providing accessible and affordable healthcare to Texans, especially those with low incomes. These centers offer a range of services, often at reduced costs or on a sliding scale based on income. Here’s how they can assist with low-income health insurance:

- Healthcare Services: Community Health Centers provide a wide array of medical services, including primary care, specialty care, dental care, mental health services, and more. They often have partnerships with local healthcare providers and specialists, ensuring that residents have access to a comprehensive network of care.

- Financial Assistance: Many Community Health Centers offer financial assistance programs to make healthcare more affordable for low-income residents. These programs may include discounted fees, sliding-scale payments based on income, or even free services for those who qualify. Centers may also have programs to assist with prescription medication costs or provide access to low-cost generic medications.

- Insurance Navigation: Community Health Centers often have staff dedicated to helping residents navigate the insurance landscape. These staff members can provide guidance on eligibility for various programs, assist with application processes, and even help residents understand their insurance coverage and benefits. They can be a valuable resource for those seeking affordable healthcare options.

FAQ: Low-Income Health Insurance in Texas

What if I don’t qualify for Medicaid or CHIP?

+

If you don’t qualify for Medicaid or CHIP, you may still be eligible for affordable insurance plans through the Health Insurance Marketplace. These plans offer various coverage levels and potential tax credits to reduce costs. You can explore your options and compare plans during the annual Open Enrollment Period or during a Special Enrollment Period if you experience a qualifying life event.

Can I apply for low-income health insurance online?

+

Yes, applying for low-income health insurance in Texas can be done conveniently online through the YourTexasBenefits website. This platform allows you to apply for Medicaid, CHIP, or Marketplace plans, check your eligibility, and track the status of your application in real-time.

Are there any discounts or financial assistance programs for healthcare in Texas?

+

Yes, Texas offers several discounted healthcare programs and financial assistance initiatives. These include the Texas Uninsured Program, which provides free or low-cost medical care to uninsured residents who meet income requirements, and Community Health Centers that offer sliding-scale fees based on income, ensuring affordable healthcare for all.

How do I know if I’m eligible for low-income health insurance in Texas?

+

Eligibility for low-income health insurance in Texas depends on factors such as income, family size, and disability status. You can use online tools and calculators provided by the Health and Human Services Commission to estimate your eligibility for Medicaid, CHIP, or Marketplace plans. These tools consider your specific circumstances to provide a personalized assessment.

What documents do I need to apply for low-income health insurance in Texas?

+

The specific documents required for a low-income health insurance application in Texas may vary depending on the program you’re applying for. Generally, you’ll need proof of identity, citizenship or immigration status, and income. It’s best to refer to the guidelines of the specific program you’re interested in to ensure you have all the necessary documents.