Cheapest Renter Insurance

Renters insurance is an essential yet often overlooked form of coverage for individuals who lease or rent their living spaces. It provides protection against various risks and liabilities, offering peace of mind and financial security. This article aims to delve into the world of renters insurance, exploring its benefits, understanding the factors that influence its cost, and uncovering the cheapest options available to renters.

Understanding Renters Insurance: A Comprehensive Overview

Renters insurance is a type of policy specifically designed for individuals who do not own the property they reside in. It is distinct from homeowners insurance, which caters to property owners. Renters insurance primarily offers coverage for personal belongings and provides liability protection in case of accidents or injuries that occur within the rented premises.

The coverage provided by renters insurance can be tailored to individual needs, ensuring that tenants have the right amount of protection for their specific circumstances. Here's a breakdown of the key components of a typical renters insurance policy:

- Personal Property Coverage: This covers the cost of replacing or repairing your belongings if they are damaged, destroyed, or stolen. It can include furniture, electronics, clothing, and other personal items.

- Liability Coverage: In the event that someone is injured on your rental property or their property is damaged due to your negligence, liability coverage can help cover the associated costs, including medical expenses and legal fees.

- Additional Living Expenses: If your rental property becomes uninhabitable due to a covered incident, this coverage can reimburse you for additional living expenses, such as temporary housing and meals.

- Medical Payments to Others: This coverage provides payment for medical expenses if someone is injured on your rental property, regardless of fault.

- Loss of Use: If a covered incident, such as a fire or storm, renders your rental property unlivable, this coverage can reimburse you for additional living expenses while you're unable to occupy your home.

It's important to note that renters insurance typically does not cover damage to the actual structure of the rental property, as that is the responsibility of the landlord or property owner. However, it offers valuable protection for your personal belongings and provides a safety net against potential liabilities.

Factors Influencing the Cost of Renters Insurance

The cost of renters insurance can vary depending on several factors. Understanding these factors can help renters make informed decisions and potentially find the cheapest options available.

Location and Property Type

The location of your rental property plays a significant role in determining the cost of renters insurance. Areas with higher crime rates, natural disaster risks, or a history of frequent claims may result in higher insurance premiums. Additionally, the type of property you rent, whether it’s an apartment, condo, or house, can also impact the cost.

Coverage Amount and Deductibles

The amount of coverage you choose for your personal belongings directly affects the cost of your renters insurance. Higher coverage limits will result in higher premiums. Additionally, selecting a higher deductible (the amount you pay out of pocket before insurance coverage kicks in) can lower your overall insurance cost.

Credit History and Claims History

Insurance companies often consider an individual’s credit history when determining insurance premiums. A good credit score may result in lower insurance rates. Additionally, a history of insurance claims can impact the cost, as insurers may perceive a higher risk of future claims.

Discounts and Bundling

Insurance companies frequently offer discounts to renters who take certain precautions, such as installing security systems or smoke detectors. Additionally, bundling renters insurance with other policies, like auto insurance, can often lead to significant savings.

Finding the Cheapest Renters Insurance

Now that we understand the factors influencing the cost of renters insurance, let’s explore some strategies to find the cheapest options available:

Shop Around and Compare Quotes

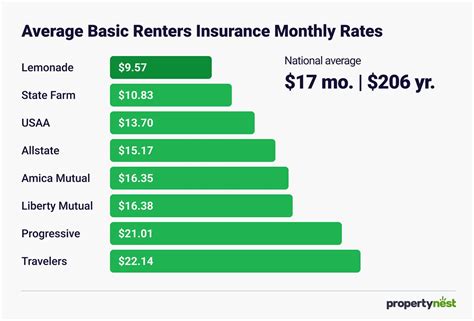

One of the most effective ways to find cheap renters insurance is to compare quotes from multiple insurance providers. Different companies have varying pricing structures, and by shopping around, you can identify the most competitive rates for your specific needs.

Utilize Online Comparison Tools

Online insurance comparison websites can be a valuable resource for finding the cheapest renters insurance. These platforms allow you to input your details and receive multiple quotes from various insurers, making it easier to compare and choose the most affordable option.

Consider Bundle Discounts

As mentioned earlier, bundling your renters insurance with other policies, such as auto insurance, can result in significant savings. Many insurance companies offer discounts when you combine multiple policies, so it’s worth exploring this option.

Adjust Your Coverage and Deductibles

Reviewing your coverage limits and deductibles can impact the cost of your renters insurance. Increasing your deductible can lower your premiums, but it’s essential to choose a deductible amount that you can comfortably afford in case of a claim.

Explore Discounts and Special Offers

Insurance companies often provide discounts for various reasons, such as being a loyal customer, having multiple policies with the same insurer, or belonging to specific organizations or associations. Research and inquire about these discounts to potentially reduce your insurance costs.

Seek Expert Advice

Consulting with an insurance agent or broker can provide valuable insights into finding the cheapest renters insurance. They can guide you through the process, offer personalized advice, and help you understand the fine print of different policies.

Real-World Examples and Case Studies

To further illustrate the strategies for finding cheap renters insurance, let’s explore a couple of real-world examples:

John’s Experience: Savings through Bundling

John, a recent college graduate, was renting his first apartment and wanted to find affordable renters insurance. He decided to bundle his renters insurance with his auto insurance policy. By doing so, he was able to save 20% on his overall insurance costs, resulting in significant savings over the course of a year.

Sarah’s Story: Adjusting Coverage and Deductibles

Sarah, a young professional, was looking to reduce her renters insurance expenses. After reviewing her policy, she realized that her coverage limits were higher than necessary for her personal belongings. She adjusted her coverage downward and increased her deductible, resulting in a 15% reduction in her annual insurance premium.

| Real-World Example | Savings |

|---|---|

| John's Bundling Strategy | 20% |

| Sarah's Coverage and Deductible Adjustments | 15% |

💡 Pro Tip: When adjusting your coverage or deductibles, it's crucial to strike a balance between cost savings and adequate protection. Ensure that you still have sufficient coverage for your personal belongings and liabilities.

Future Implications and Industry Trends

The renters insurance industry is continuously evolving, and several trends and developments are shaping the future of this coverage:

Digitalization and Online Platforms

The rise of digital technology and online insurance platforms has made it easier than ever for renters to compare and purchase insurance policies. Insurers are investing in online platforms and mobile apps to provide a seamless and convenient experience for policyholders.

Personalized Coverage Options

Insurance companies are increasingly offering personalized coverage options, allowing renters to tailor their policies to their specific needs. This flexibility ensures that individuals only pay for the coverage they require, making renters insurance more affordable and accessible.

Increased Focus on Preventative Measures

Insurance providers are placing greater emphasis on preventative measures to reduce the risk of claims. This includes offering discounts for renters who install security systems, smoke detectors, and other safety measures. By incentivizing renters to take proactive steps, insurers can potentially reduce the frequency and severity of claims, leading to lower insurance costs.

Integration of Technology

The integration of technology, such as smart home devices and sensors, is revolutionizing the renters insurance industry. These devices can monitor and detect potential hazards, such as water leaks or fire, and notify renters and insurance companies in real-time. This early detection can help prevent significant damage and reduce the overall cost of insurance claims.

Conclusion: Empowering Renters with Affordable Protection

Renters insurance is an essential safeguard for individuals who rent their living spaces. By understanding the factors that influence insurance costs and implementing strategic approaches, renters can find the cheapest options available. Whether it’s through bundling policies, adjusting coverage and deductibles, or taking advantage of discounts, there are numerous ways to make renters insurance more affordable.

As the industry continues to evolve, renters can expect to see increased digitalization, personalized coverage options, and a greater focus on preventative measures. By staying informed and taking advantage of these developments, renters can empower themselves with affordable protection, ensuring peace of mind and financial security in their rented homes.

How much does renters insurance typically cost?

+The cost of renters insurance can vary depending on factors such as location, coverage amount, and deductibles. On average, renters insurance policies can range from 15 to 30 per month, but this can differ based on individual circumstances.

Are there any additional benefits or coverage options available with renters insurance?

+Yes, renters insurance policies often offer additional coverage options such as personal liability coverage, medical payments coverage, and loss of use coverage. These additional benefits can provide further protection and peace of mind.

What should I consider when choosing renters insurance coverage limits?

+When selecting coverage limits for renters insurance, it’s important to consider the replacement cost of your personal belongings and the potential liability risks associated with your rental property. Assessing the value of your possessions and the likelihood of accidents or injuries can help you determine appropriate coverage limits.