Car Repairs Insurance

Car repairs can be a daunting and expensive endeavor, especially when unexpected issues arise. It's a common concern for many vehicle owners, as the cost of maintenance and repairs can quickly add up. This is where car repair insurance comes into play, offering a financial safety net to protect drivers from unforeseen expenses. In this comprehensive guide, we'll delve into the world of car repair insurance, exploring its benefits, how it works, and why it's an essential consideration for vehicle owners.

Understanding Car Repair Insurance

Car repair insurance, often referred to as vehicle service contracts or extended warranties, provides coverage for unexpected repairs and maintenance needs beyond the scope of a standard manufacturer’s warranty. It offers peace of mind by ensuring that vehicle owners are financially prepared for unforeseen mechanical or electrical failures.

While regular vehicle maintenance is crucial for safety and longevity, unexpected issues can arise at any time. Car repair insurance aims to alleviate the financial burden associated with these unforeseen repairs, making it an attractive option for many drivers.

Benefits of Car Repair Insurance

Car repair insurance offers a range of benefits that can significantly impact vehicle ownership:

1. Financial Protection

The primary advantage of car repair insurance is financial protection. It provides coverage for a wide range of repairs, including engine repairs, transmission issues, electrical failures, and more. By covering these expenses, car repair insurance ensures that vehicle owners don’t have to bear the full financial burden of unexpected repairs.

For instance, a major engine repair can cost thousands of dollars, but with car repair insurance, policyholders can have their repair costs covered or substantially reduced.

2. Peace of Mind

Knowing that you’re financially prepared for unexpected repairs brings a sense of peace of mind. Car repair insurance takes away the stress and anxiety associated with potential mechanical failures. Drivers can focus on their daily lives without constantly worrying about the financial implications of a sudden breakdown.

3. Enhanced Vehicle Lifespan

Regular maintenance and timely repairs are crucial for extending the lifespan of a vehicle. Car repair insurance encourages owners to address issues promptly, ensuring their vehicles remain in optimal condition. This proactive approach not only improves safety but also enhances the overall performance and longevity of the car.

4. Budgeting Flexibility

Car repair insurance allows vehicle owners to budget more effectively. Instead of facing sudden, large repair expenses, policyholders can spread out their costs over time through affordable premiums. This budgeting flexibility is particularly beneficial for those on a tight budget or with limited financial resources.

How Car Repair Insurance Works

Car repair insurance operates similarly to traditional insurance policies. Here’s a step-by-step breakdown of how it works:

1. Policy Selection

Vehicle owners can choose from various car repair insurance policies offered by different providers. These policies may cover specific vehicle components, systems, or offer comprehensive coverage. It’s essential to review the policy terms, exclusions, and coverage limits before making a decision.

2. Premium Payment

Once a policy is selected, the vehicle owner pays a premium, typically on a monthly or annual basis. The premium amount varies based on factors such as the vehicle’s make, model, age, mileage, and the chosen coverage level.

3. Repair Coverage

When a covered repair is needed, the vehicle owner contacts the insurance provider to initiate a claim. The provider will guide the owner through the claims process, which may involve taking the vehicle to an authorized repair facility or obtaining pre-approval for repairs.

The insurance company will then cover the repair costs according to the policy terms. Some policies may require the owner to pay a deductible, while others may have a set maximum payout for each repair.

4. Authorized Repair Facilities

Car repair insurance policies often specify authorized repair facilities where policyholders must take their vehicles for repairs. These facilities are typically chosen for their expertise and quality of service. Using authorized facilities ensures that repairs are performed correctly and to the standards set by the insurance provider.

Choosing the Right Car Repair Insurance

Selecting the appropriate car repair insurance policy involves careful consideration of various factors:

1. Vehicle Age and Mileage

The age and mileage of your vehicle play a significant role in determining the right policy. Older vehicles or those with high mileage may require more comprehensive coverage to address potential issues.

2. Coverage Options

Review the coverage options available, including the components and systems covered. Ensure that the policy aligns with your vehicle’s specific needs and potential vulnerabilities.

3. Deductibles and Limits

Consider the deductibles and maximum payout limits for each repair. Higher deductibles may result in lower premiums, but they also mean you’ll have to pay more out of pocket for each claim. Evaluate your financial situation and choose a policy that suits your budget.

4. Reputable Providers

Choose a reputable insurance provider with a track record of reliable service and positive customer reviews. Research the company’s claims process, customer support, and overall reputation to ensure a positive experience.

Real-World Examples and Case Studies

Let’s explore some real-world scenarios to illustrate the benefits of car repair insurance:

Case Study 1: Engine Repair

Imagine a driver with a 5-year-old sedan experiences engine issues, resulting in a costly repair estimate of $3,000. Without car repair insurance, they would have to bear this entire expense. However, with a comprehensive policy in place, the insurance provider covers the majority of the repair cost, leaving the driver with a manageable deductible.

Case Study 2: Transmission Failure

A truck owner with a 10-year-old vehicle encounters transmission problems, requiring a replacement that costs upwards of $5,000. With car repair insurance, the policyholder can have this repair covered, saving them from a significant financial burden.

Case Study 3: Electrical System Malfunction

A hybrid car owner experiences an electrical system malfunction, leading to a repair bill of $2,500. Thanks to their car repair insurance policy, they receive coverage for the repair, ensuring their vehicle is back on the road without straining their finances.

Performance Analysis and Metrics

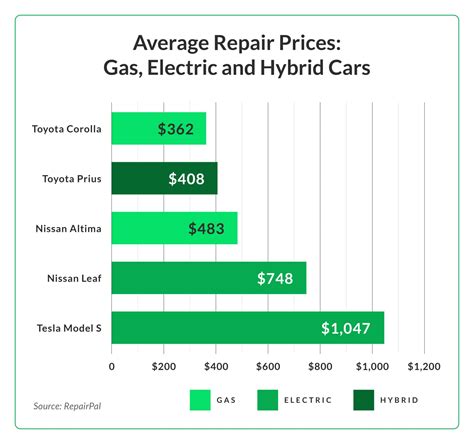

To assess the effectiveness of car repair insurance, we can analyze industry data and metrics:

| Metric | Description |

|---|---|

| Average Repair Costs | The average cost of vehicle repairs, including common issues like engine repairs, brake replacements, and electrical repairs. |

| Claim Satisfaction Rates | The percentage of policyholders who are satisfied with their insurance provider's claims process and coverage. |

| Customer Retention Rates | The percentage of policyholders who renew their car repair insurance policies, indicating overall satisfaction and trust. |

| Average Savings per Policy | The estimated average savings per policyholder over a specific period, showcasing the financial benefits of car repair insurance. |

Future Implications and Industry Trends

The car repair insurance industry is evolving, and several trends are shaping its future:

1. Technological Advancements

With the increasing integration of technology in vehicles, car repair insurance providers are adapting to cover emerging technologies. This includes coverage for advanced driver-assistance systems (ADAS), electric vehicle components, and infotainment systems.

2. Digital Transformation

The industry is embracing digital technologies to streamline the claims process. Online claim submission, real-time claim tracking, and digital documentation are becoming more common, enhancing the overall customer experience.

3. Data-Driven Insights

Insurance providers are leveraging data analytics to identify trends and patterns in vehicle repairs. This data-driven approach allows for more accurate risk assessment and tailored coverage options, benefiting both policyholders and insurance companies.

How much does car repair insurance typically cost?

+The cost of car repair insurance varies based on factors like the vehicle’s make and model, age, mileage, and the level of coverage chosen. Premiums can range from a few hundred to several thousand dollars annually. It’s advisable to obtain quotes from multiple providers to find the best fit for your budget and coverage needs.

Does car repair insurance cover regular maintenance?

+Car repair insurance typically covers unexpected repairs and failures. Regular maintenance, such as oil changes, tire rotations, and scheduled services, is generally not included in the policy. It’s essential to maintain your vehicle through regular maintenance to avoid potential issues.

What happens if I need a repair but don’t have car repair insurance?

+Without car repair insurance, you’ll be responsible for paying the full cost of the repair out of pocket. This can result in significant financial strain, especially for expensive repairs. It’s beneficial to have insurance coverage to mitigate such unexpected expenses.

Can I customize my car repair insurance policy?

+Yes, many car repair insurance providers offer customizable policies. You can choose the level of coverage, deductibles, and specific components or systems to be included. Customization allows you to tailor the policy to your vehicle’s unique needs and your budget.