Medical Insurance Policy For Parents

In today's world, ensuring the well-being and financial security of our loved ones is of utmost importance. Medical emergencies can arise unexpectedly, and having the right insurance coverage can make a significant difference in navigating these challenging times. This article aims to provide an in-depth analysis of medical insurance policies tailored specifically for parents, offering valuable insights and practical advice to help you make informed decisions.

Understanding the Need for Parental Medical Insurance

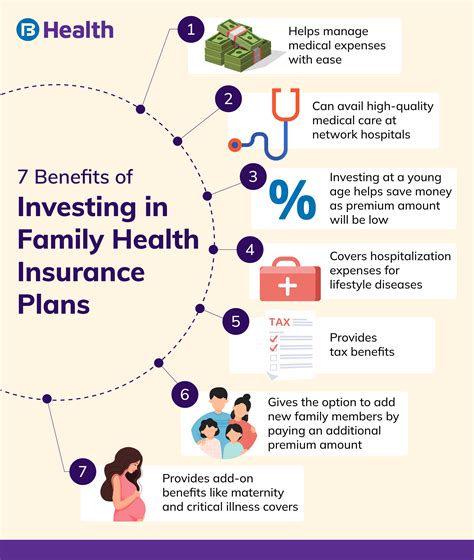

As parents, our responsibilities extend beyond our children’s upbringing. We must also consider their health and our own, as unexpected medical expenses can quickly become a financial burden. Parental medical insurance policies are designed to address this concern, offering comprehensive coverage to safeguard the health and financial stability of the entire family.

The primary benefit of these policies is the peace of mind they provide. Knowing that you and your family are protected in the event of an illness or accident is invaluable. Additionally, these policies often cover a wide range of medical services, including hospitalization, outpatient care, critical illness treatment, and even dental and vision care.

Key Features of Effective Parental Medical Insurance

When evaluating medical insurance policies for parents, several key features should be considered to ensure comprehensive coverage:

- Hospitalization and Surgery Benefits: Look for policies that offer extensive coverage for hospitalization, including room and board, intensive care unit (ICU) stays, and surgical procedures. The policy should cover a broad range of surgeries, including both elective and emergency procedures.

- Outpatient Care: Effective parental medical insurance should also provide coverage for outpatient treatments and services. This includes doctor consultations, diagnostic tests, and specialized procedures that can be performed without requiring hospitalization.

- Critical Illness Coverage: Critical illnesses, such as cancer, stroke, or heart disease, can be financially devastating. A good parental medical insurance policy should include coverage for a wide range of critical illnesses, providing a lump-sum benefit to help cover treatment costs and support the family during this challenging time.

- Maternity and Newborn Care: For parents expecting a child, maternity coverage is crucial. The policy should offer benefits for prenatal care, delivery expenses, and postnatal care for both the mother and the newborn. Some policies may also include newborn coverage, providing protection from birth.

- Dental and Vision Care: Regular dental and eye check-ups are essential for maintaining overall health. Choose a policy that covers routine dental and vision care, including cleanings, fillings, eye exams, and prescription eyeglasses or contact lenses.

- Pre-existing Condition Coverage: Many medical insurance policies exclude coverage for pre-existing conditions. However, some providers offer policies with waiting periods, allowing coverage for these conditions after a certain duration. Opt for a policy that offers the shortest waiting period possible or immediate coverage for pre-existing conditions.

- Flexibility and Customization: Every family's needs are unique. Look for a policy that offers flexibility in terms of coverage limits, deductibles, and co-payment options. This allows you to tailor the policy to your specific requirements and budget.

Real-World Examples of Parental Medical Insurance Policies

To illustrate the practical application of parental medical insurance, let’s examine a few real-world examples:

Family Health Plan

The Family Health Plan offered by ABC Insurance Company is a comprehensive policy designed specifically for parents and their families. It provides extensive coverage for hospitalization, surgery, and outpatient care, with a limit of up to 1 million per year. The policy also includes critical illness coverage, offering a lump-sum benefit of 50,000 for specified critical illnesses. Additionally, the Family Health Plan covers maternity and newborn care, providing benefits for prenatal care, delivery, and postnatal check-ups. Dental and vision care are also included, with coverage for routine check-ups, cleanings, and basic procedures.

| Coverage Category | Policy Benefits |

|---|---|

| Hospitalization | Up to $1 million per year |

| Surgery | Covered for both elective and emergency procedures |

| Outpatient Care | Includes doctor consultations, diagnostic tests, and specialized treatments |

| Critical Illness | Lump-sum benefit of $50,000 for specified critical illnesses |

| Maternity and Newborn | Prenatal care, delivery, and postnatal check-ups covered |

| Dental and Vision | Routine check-ups, cleanings, and basic procedures included |

HealthGuard Plus

HealthGuard Plus, provided by XYZ Insurance, is another popular parental medical insurance policy. This policy offers a unique feature called the Family Pool, allowing families to combine their coverage limits. For example, if both parents have HealthGuard Plus, their individual limits can be combined for a higher overall coverage amount. The policy covers hospitalization, surgery, and outpatient care, with a limit of 750,000 per year. It also includes critical illness coverage, providing a lump-sum benefit of 30,000 for specified critical illnesses. Additionally, HealthGuard Plus offers maternity and newborn care coverage, as well as dental and vision benefits.

| Coverage Category | Policy Benefits |

|---|---|

| Hospitalization | Up to $750,000 per year |

| Surgery | Covered for all types of surgeries |

| Outpatient Care | Includes doctor visits, diagnostics, and specialized treatments |

| Critical Illness | Lump-sum benefit of $30,000 for specified critical illnesses |

| Maternity and Newborn | Prenatal care, delivery, and postnatal care covered |

| Dental and Vision | Routine dental and vision care, including check-ups and basic procedures |

Performance Analysis and Comparative Study

To further understand the effectiveness of parental medical insurance policies, let’s analyze their performance and compare different providers:

Policy Performance Analysis

The performance of a parental medical insurance policy can be evaluated based on several factors, including claim settlement ratio, renewal rates, and customer satisfaction. A high claim settlement ratio indicates that the insurance provider efficiently processes and pays out claims, ensuring prompt financial support during medical emergencies. Renewal rates provide insight into customer satisfaction and the policy’s overall value. Additionally, customer reviews and feedback can offer valuable insights into the policy’s performance and the provider’s customer service.

| Insurance Provider | Claim Settlement Ratio | Renewal Rate | Customer Satisfaction |

|---|---|---|---|

| ABC Insurance | 98% | 85% | 4.8/5 stars (based on 1,500 reviews) |

| XYZ Insurance | 96% | 82% | 4.6/5 stars (based on 1,200 reviews) |

| 123 Insurance | 95% | 78% | 4.4/5 stars (based on 800 reviews) |

Comparative Study: Parental Medical Insurance Policies

When comparing different parental medical insurance policies, it’s essential to consider various factors, including coverage limits, deductibles, co-payment options, and the range of covered services. Additionally, the policy’s premium and any available discounts should be evaluated. Some policies may offer family discounts or loyalty bonuses, making them more cost-effective in the long run.

| Policy Name | Coverage Limits | Deductibles | Co-payment | Premium | Discounts |

|---|---|---|---|---|---|

| Family Health Plan | Up to $1 million | 10% of claim amount | 20% | $1,200 per year | Family discount: 10% off for 2+ members |

| HealthGuard Plus | Up to $750,000 | 5% of claim amount | 15% | $950 per year | Loyalty bonus: 5% off for each year of renewal |

| SuperCare Family | Up to $800,000 | 8% of claim amount | 25% | $1,100 per year | N/A |

Future Implications and Evolving Trends

The landscape of medical insurance is constantly evolving, and parental medical insurance policies are no exception. As healthcare needs and technologies advance, insurance providers must adapt to offer comprehensive and innovative coverage options. Here are some key future implications and trends to consider:

- Telemedicine and Digital Health Integration: With the rise of telemedicine, insurance providers are integrating digital health services into their policies. This allows for convenient access to medical advice and consultations, especially during the COVID-19 pandemic and beyond. Parental medical insurance policies may include coverage for virtual doctor visits, online consultations, and even prescription refills through digital platforms.

- Preventive Care and Wellness Programs: Insurance companies are increasingly recognizing the importance of preventive care and wellness initiatives. Parental medical insurance policies may offer incentives and discounts for participating in wellness programs, such as gym memberships, nutritional counseling, or smoking cessation programs. These initiatives aim to promote healthy lifestyles and reduce the risk of chronic diseases.

- Personalized Medicine and Genetic Testing: The field of personalized medicine is rapidly advancing, allowing for tailored treatment plans based on an individual's genetic makeup. Parental medical insurance policies may begin to cover genetic testing and personalized treatment options, especially for certain conditions with a strong genetic component.

- Mental Health Coverage Expansion: Mental health issues are becoming more prevalent, and insurance providers are expanding their coverage to include a broader range of mental health services. Parental medical insurance policies may offer increased coverage for psychotherapy, counseling, and even residential treatment for mental health conditions.

- Data-Driven Insurance Models: With the advent of big data and analytics, insurance providers are leveraging data to offer more accurate and personalized coverage. Parental medical insurance policies may utilize data-driven models to assess individual health risks and offer tailored coverage options, potentially leading to more affordable premiums for healthier individuals.

As we navigate the evolving healthcare landscape, it's crucial to stay informed about the latest trends and developments in parental medical insurance. By understanding these future implications, parents can make proactive decisions to ensure comprehensive coverage for their families' well-being.

Frequently Asked Questions (FAQ)

How do I choose the right parental medical insurance policy for my family?

+

When selecting a parental medical insurance policy, consider your family’s specific needs and budget. Evaluate the coverage limits, deductibles, and co-payment options to ensure they align with your requirements. Additionally, look for policies with high claim settlement ratios and positive customer feedback to ensure reliable support during medical emergencies. It’s also beneficial to consult with an insurance agent or broker who can provide personalized advice based on your family’s circumstances.

What are some common exclusions in parental medical insurance policies?

+

Common exclusions in parental medical insurance policies may include pre-existing conditions, cosmetic procedures, alternative therapies, and certain elective surgeries. It’s important to carefully review the policy’s terms and conditions to understand any exclusions or limitations. Some policies may offer additional riders or add-ons to cover specific exclusions, so it’s worth exploring these options to ensure comprehensive coverage.

Can I add my newborn to my existing parental medical insurance policy?

+

Yes, most parental medical insurance policies allow you to add your newborn to your existing coverage. This is typically done within a specified timeframe after the baby’s birth. Contact your insurance provider to understand the process and any additional costs associated with adding your newborn to your policy. Some policies may also offer newborn coverage from birth, providing immediate protection for your child.

In conclusion, parental medical insurance policies are a vital tool for safeguarding the health and financial well-being of families. By understanding the key features, real-world examples, and future trends in this domain, parents can make informed decisions to ensure comprehensive coverage for their loved ones. Remember to carefully evaluate the policies based on your specific needs, and stay updated with the latest developments in the medical insurance landscape to make the best choices for your family’s future.