Dmv Proof Of Insurance

In the world of vehicle ownership and registration, the Department of Motor Vehicles (DMV) plays a crucial role in ensuring road safety and compliance with insurance regulations. One common requirement for vehicle owners is to provide proof of insurance to the DMV. This proof serves as evidence that you have met the mandatory insurance coverage requirements set by your state, which is a critical aspect of responsible driving.

Understanding the process and requirements for providing proof of insurance to the DMV is essential for any vehicle owner. In this comprehensive guide, we will delve into the specifics of what proof of insurance is, why it's necessary, and the steps you need to take to ensure you are in compliance with your state's regulations. By the end of this article, you should have a clear understanding of the importance of proof of insurance and how to navigate this process with ease.

Understanding Proof of Insurance

Proof of insurance, as the name suggests, is documentation that verifies you have valid and active insurance coverage for your vehicle. This proof is typically provided by your insurance company and serves as a legal requirement for registering and operating a vehicle on public roads. It ensures that in the event of an accident or other unforeseen circumstances, there is financial protection in place to cover potential damages or liabilities.

The specific requirements for proof of insurance vary by state, but the general concept remains the same. Each state has its own minimum insurance coverage requirements, which typically include liability coverage for bodily injury and property damage. Additionally, some states may require additional coverage, such as personal injury protection (PIP) or uninsured/underinsured motorist coverage.

Types of Proof of Insurance

There are several forms that proof of insurance can take, depending on your state and insurance provider. The most common types include:

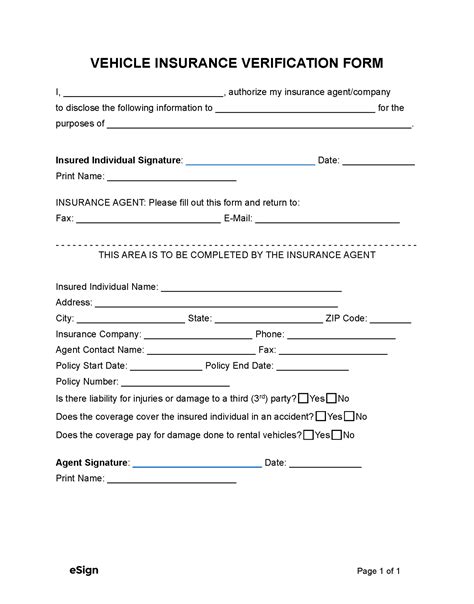

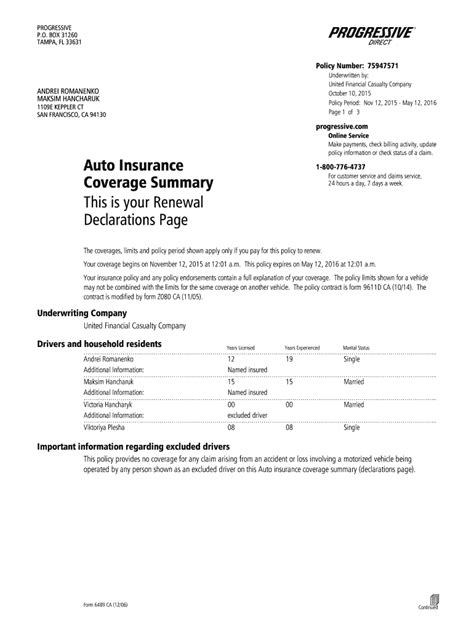

- Insurance Card: Many insurance companies provide their policyholders with a physical or digital insurance card. This card typically includes the policyholder's name, policy number, vehicle information, and the effective dates of coverage. It serves as a convenient form of proof that can be easily presented to law enforcement or the DMV.

- Insurance Policy Document: The actual insurance policy document can also be used as proof of insurance. This comprehensive document outlines the coverage limits, policy terms, and conditions. While it may not be as convenient as an insurance card, it provides detailed information about your coverage.

- Electronic Verification: In some states, electronic verification systems are in place. These systems allow law enforcement and the DMV to instantly access insurance information through a database. Policyholders may receive a confirmation number or a unique identifier that can be used for electronic verification purposes.

Why is Proof of Insurance Required by the DMV?

The requirement for proof of insurance is not arbitrary; it serves several important purposes:

- Financial Protection: Proof of insurance ensures that vehicle owners have the financial means to cover potential damages or liabilities in the event of an accident. This protects not only the policyholder but also other drivers, passengers, and pedestrians involved.

- Legal Compliance: Most states have made it mandatory for vehicle owners to carry insurance coverage. By requiring proof of insurance, the DMV ensures that drivers are complying with the law and maintaining the necessary coverage.

- Road Safety: Adequate insurance coverage promotes safer driving practices. Knowing that they have financial protection, drivers may be more cautious and responsible on the road, leading to reduced accidents and better overall road safety.

- Registration and Licensing: Proof of insurance is often a prerequisite for registering a vehicle and obtaining a driver's license. It ensures that only properly insured vehicles are allowed on the roads, reducing the risk of uninsured drivers causing accidents and financial losses.

Consequences of Not Providing Proof of Insurance

Failing to provide proof of insurance to the DMV can have serious consequences. These may include:

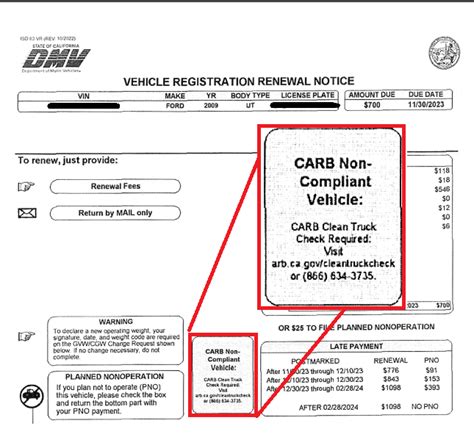

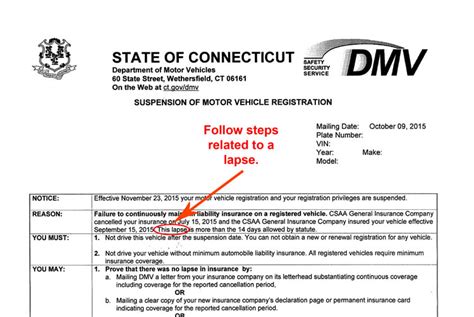

- Registration Denial: Your vehicle registration may be denied or suspended if you cannot provide valid proof of insurance.

- Fines and Penalties: You may face significant fines and penalties for operating a vehicle without the required insurance coverage.

- License Suspension: In some states, driving without insurance can result in the suspension of your driver's license.

- Legal Liability: If you are involved in an accident without insurance, you may be held personally liable for all damages and injuries, which can lead to substantial financial burdens.

How to Obtain and Maintain Proof of Insurance

Ensuring that you have up-to-date proof of insurance is a straightforward process. Here are the key steps to follow:

Step 1: Purchase Insurance Coverage

If you do not already have insurance coverage for your vehicle, the first step is to purchase an insurance policy from a reputable insurance provider. Compare different policies and coverage options to find the one that best suits your needs and budget.

Step 2: Receive Your Proof of Insurance

Once you have purchased an insurance policy, your insurance company will provide you with proof of insurance. This can be in the form of an insurance card, policy document, or electronic verification. Make sure to keep this proof in a safe and easily accessible place.

Step 3: Renew Your Insurance

Insurance policies typically have a set duration, after which they need to be renewed. It is crucial to renew your insurance coverage before the expiration date to avoid any gaps in coverage. Your insurance company will notify you about the renewal process and provide updated proof of insurance.

Step 4: Keep Your Information Updated

If there are any changes to your vehicle, such as a change in ownership, vehicle modification, or a move to a different state, inform your insurance company. These changes may impact your insurance coverage and require updates to your policy and proof of insurance.

Electronic Verification and its Benefits

Electronic verification systems have been implemented in many states to streamline the process of providing proof of insurance. These systems offer several advantages:

- Convenience: With electronic verification, you no longer need to carry physical proof of insurance. Law enforcement and the DMV can instantly access your insurance information through a secure database.

- Real-Time Updates: Electronic verification systems are updated in real-time, ensuring that your insurance information is always accurate and up-to-date.

- Reduced Fraud: Electronic verification minimizes the risk of fraud and forgery, as it relies on secure databases and digital signatures.

- Efficient Process: Instead of manually presenting proof of insurance, electronic verification allows for a faster and more efficient process during vehicle inspections and registration.

States with Electronic Verification Systems

The adoption of electronic verification systems varies by state. Some states that have implemented this system include:

- California

- Texas

- Florida

- New York

- Illinois

Check with your state's DMV to determine if electronic verification is available and how it works in your specific location.

Frequently Asked Questions (FAQ)

What happens if I lose my insurance card?

+If you lose your insurance card, contact your insurance provider immediately. They can provide you with a replacement card or offer alternative forms of proof, such as a digital copy or a printed document.

Can I use a smartphone screenshot as proof of insurance?

+While a smartphone screenshot may be convenient, it is not always accepted as official proof of insurance. Some states and insurance companies may accept digital copies, but it's best to check with your insurance provider and the DMV to ensure compliance.

How often do I need to provide proof of insurance to the DMV?

+The frequency of providing proof of insurance varies by state. Some states require it annually during vehicle registration, while others may only require it upon initial registration or when requested by law enforcement. Check your state's regulations for specific requirements.

What if my insurance coverage changes during the policy period?

+If your insurance coverage changes, such as adding or removing a driver, modifying the vehicle, or changing coverage limits, inform your insurance provider. They will update your policy and provide you with updated proof of insurance reflecting the changes.

Can I use my insurance card as proof of insurance for renting a car?

+While your insurance card may be accepted as proof of insurance for personal vehicles, it may not be sufficient for renting a car. Rental car companies often have specific requirements for proof of insurance, so it's best to check with the rental company and your insurance provider for guidance.

Providing proof of insurance to the DMV is a critical aspect of vehicle ownership and responsible driving. By understanding the requirements, obtaining the necessary proof, and maintaining your insurance coverage, you can ensure compliance with state regulations and contribute to a safer road environment. Remember to stay informed about your state’s specific insurance requirements and always keep your proof of insurance readily available.