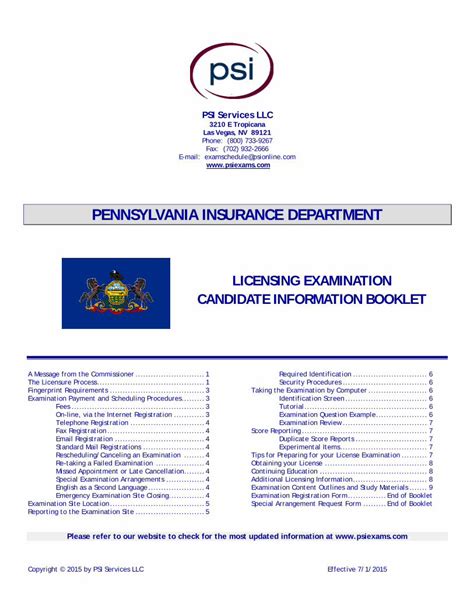

State Of Pa Insurance Department

The State of Pennsylvania Insurance Department, often referred to as the PA Insurance Department, is a vital regulatory body within the state government, tasked with overseeing and regulating the insurance industry to protect consumers and ensure fair practices. This department plays a crucial role in maintaining the integrity of the insurance market and promoting consumer confidence. In this article, we will delve into the various aspects of the PA Insurance Department, exploring its history, functions, services, and the impact it has on the insurance landscape of Pennsylvania.

A Brief History of the PA Insurance Department

The origins of the PA Insurance Department can be traced back to the late 19th century when the need for insurance regulation became evident as the industry grew. Pennsylvania, recognizing the importance of consumer protection, established the Insurance Department in 1899 through the passage of the Insurance Department Act.

Since its inception, the department has undergone several transformative changes to adapt to the evolving insurance landscape. Over the years, it has expanded its scope and responsibilities to encompass various insurance sectors, including property and casualty, life and health, and more recently, addressing emerging areas such as cybersecurity and digital insurance innovations.

Mission and Core Functions

The primary mission of the PA Insurance Department is to safeguard the interests of insurance consumers and ensure the financial stability of the insurance industry in Pennsylvania. To achieve this, the department undertakes a range of critical functions:

- Regulatory Oversight: The department supervises and regulates insurance companies, agencies, and professionals operating within the state. This includes licensing, monitoring compliance with state laws and regulations, and taking necessary actions to address violations.

- Consumer Protection: A key focus of the department is to educate and empower consumers. It provides resources and assistance to help individuals understand their insurance options, file complaints, and navigate the insurance process effectively.

- Market Stability: By ensuring that insurance companies maintain adequate financial reserves and operate in a sound manner, the department contributes to the stability of the insurance market. This prevents market disruptions and protects policyholders.

- Fraud Detection and Prevention: The PA Insurance Department actively works to detect and prevent insurance fraud, which can have severe consequences for both consumers and the industry. It investigates fraudulent activities and takes legal action when necessary.

- Policy and Legislation: The department plays a crucial role in shaping insurance-related policies and advocating for legislative changes that benefit consumers and promote a healthy insurance market.

Services and Resources for Consumers

The PA Insurance Department offers a wide array of services and resources to assist consumers in navigating the insurance landscape:

Consumer Assistance

The department provides a dedicated Consumer Services Division to help individuals with insurance-related inquiries, complaints, and disputes. Consumers can seek guidance on a range of issues, from understanding policy terms to resolving claims disputes.

The department’s website features a comprehensive Consumer Assistance section, offering resources such as:

- Filing Complaints: Step-by-step guidance on how to file complaints against insurance companies or agents, ensuring that consumer concerns are addressed promptly.

- Insurance Guides: Informative guides covering various insurance types, providing valuable insights into coverage options, policy terms, and consumer rights.

- Consumer Alerts: Timely alerts to inform consumers about potential scams, frauds, or emerging issues in the insurance industry, helping them make informed decisions.

Education and Outreach

Recognizing the importance of consumer education, the PA Insurance Department actively engages in outreach programs and initiatives to empower Pennsylvanians.

Some notable education and outreach efforts include:

- Workshops and Seminars: The department conducts educational workshops and seminars across the state, covering topics like understanding insurance policies, filing claims, and recognizing fraudulent practices.

- Social Media Campaigns: Utilizing social media platforms, the department shares valuable insurance-related content, tips, and updates, reaching a wider audience and fostering consumer awareness.

- Community Partnerships: Collaborating with community organizations and local initiatives, the department ensures that insurance education reaches diverse populations and underserved communities.

Regulatory Initiatives and Innovations

The PA Insurance Department remains at the forefront of regulatory initiatives, adapting to the changing dynamics of the insurance industry. Some notable regulatory efforts include:

Cybersecurity and Data Privacy

As digital technologies continue to transform the insurance landscape, the department has prioritized cybersecurity and data privacy to protect consumer information. It has implemented guidelines and best practices to enhance the security of insurance-related data and prevent cyber threats.

Emerging Technologies and Innovation

The department actively engages with emerging technologies such as artificial intelligence, blockchain, and telematics. It encourages innovation while ensuring that these technologies are deployed ethically and in compliance with regulatory standards.

Market Conduct Examinations

Regular market conduct examinations are conducted to assess the practices of insurance companies and ensure compliance with state laws. These examinations cover a wide range of areas, including claims handling, policy issuance, and consumer protection.

Impact and Contributions

The work of the PA Insurance Department has had a significant impact on the insurance industry and consumers in Pennsylvania. Its contributions are far-reaching and include:

- Consumer Empowerment: By providing accessible resources and education, the department has empowered consumers to make informed insurance choices, file complaints, and understand their rights, leading to a more equitable insurance landscape.

- Market Stability: Through its regulatory oversight, the department has fostered a stable insurance market, ensuring that companies operate responsibly and have adequate financial reserves to protect policyholders.

- Fraud Prevention: Active fraud detection and prevention efforts have saved consumers from financial losses and maintained the integrity of the insurance industry.

- Policy Advocacy: The department’s policy and legislative contributions have resulted in consumer-friendly insurance laws and regulations, shaping a fair and transparent insurance environment.

Conclusion

The State of Pennsylvania Insurance Department stands as a cornerstone of the state’s insurance ecosystem, working tirelessly to protect consumers and promote a robust insurance market. Through its regulatory functions, consumer services, and proactive initiatives, the department has played a pivotal role in shaping the insurance landscape of Pennsylvania. As the insurance industry continues to evolve, the PA Insurance Department remains dedicated to adapting its strategies and ensuring that the interests of Pennsylvanians remain at the heart of its mission.

How can I contact the PA Insurance Department for assistance or to file a complaint?

+You can reach out to the PA Insurance Department through their official website, which provides contact information and online forms for filing complaints. Additionally, you can call their Consumer Services Division at [Insert Phone Number] for personalized assistance.

What are some common consumer complaints addressed by the department?

+Common complaints include issues related to claims denials, delays in processing claims, unfair settlement offers, billing discrepancies, and concerns about policy cancellations or non-renewals. The department works to resolve these complaints promptly and fairly.

How does the PA Insurance Department regulate insurance rates and premiums?

+The department reviews and approves insurance rates to ensure they are reasonable and not excessive. It considers factors such as actuarial data, loss experience, and company expenses to determine whether proposed rates are justified. This process helps maintain affordability for consumers.