Cheap Monthly Car Insurance

Finding affordable car insurance that suits your needs and budget can be a challenging task. With numerous options available in the market, it's crucial to understand the factors that influence insurance rates and how to secure the best possible deal. This guide aims to provide an in-depth analysis of cheap monthly car insurance, offering valuable insights to help you make informed decisions.

Understanding the Factors that Affect Insurance Premiums

Insurance companies use a variety of criteria to assess risk and determine insurance premiums. These factors include your age, driving history, the make and model of your vehicle, and even your credit score. Understanding how these elements impact your rates is the first step towards securing cheaper insurance.

Age and Driving Experience

Insurance providers often offer more affordable rates to older drivers with a longer driving history, as they are considered lower-risk. Conversely, younger drivers, especially those under 25, are often charged higher premiums due to their lack of experience on the road. However, some insurers offer discounts for young drivers who maintain good grades in school or complete a defensive driving course.

Additionally, age-related discounts may be available for senior drivers. These discounts recognize the lower accident rates and more mature driving behavior often associated with older drivers.

Vehicle Make and Model

The type of car you drive plays a significant role in determining your insurance rates. Factors such as the car's make, model, year, and safety features are considered. For instance, sports cars or high-performance vehicles generally attract higher insurance premiums due to their association with higher risk and potential for costly repairs.

On the other hand, smaller, more economical vehicles often come with lower insurance costs. These cars are typically considered less risky and may even offer better fuel efficiency, which can be an additional selling point for insurers.

Driving History and Credit Score

Your driving record is a critical factor in insurance pricing. A clean driving history with no recent accidents or traffic violations can lead to lower insurance rates. Conversely, if you have a history of accidents or traffic citations, your insurance premiums are likely to be higher.

Furthermore, your credit score can also impact your insurance rates. Many insurers use credit-based insurance scores to assess the risk of insuring a particular individual. A higher credit score may result in lower insurance premiums, as it's seen as an indicator of financial responsibility.

Strategies for Securing Cheap Monthly Car Insurance

Now that we've explored the factors that influence insurance rates, let's delve into some strategies to help you find affordable monthly car insurance.

Shop Around and Compare Quotes

One of the most effective ways to secure cheap car insurance is to shop around and compare quotes from multiple insurers. Each company uses its own formula to calculate premiums, so getting quotes from several providers can give you a good idea of the range of prices available.

Utilize online comparison tools or directly contact insurance companies to obtain quotes. Make sure to provide consistent information to each insurer for an accurate comparison. Consider the coverage levels and policy features offered by each company to find the best balance between price and value.

Bundle Your Policies

If you have multiple insurance needs, such as home, life, or health insurance, consider bundling your policies with the same insurer. Many insurance companies offer discounts to customers who bundle their policies, as it's more cost-effective for the insurer to manage all your coverage under one roof.

By bundling your policies, you not only simplify your insurance management but also potentially save a significant amount on your monthly premiums. This strategy is particularly effective if you're already satisfied with the service and coverage provided by your current insurer.

Take Advantage of Discounts

Insurance companies offer a variety of discounts to their customers. These discounts can significantly reduce your insurance premiums, so it's worth exploring the options available to you.

- Safe Driver Discounts: If you have a clean driving record, you may be eligible for safe driver discounts. These rewards are often given to drivers who have not had accidents or traffic violations for a certain period.

- Multi-Car Discounts: If you insure more than one vehicle with the same insurer, you may qualify for a multi-car discount. This discount acknowledges the reduced risk associated with insuring multiple vehicles.

- Loyalty Discounts: Many insurance companies offer loyalty discounts to customers who have been with them for an extended period. This reward encourages customer retention and is often significant, so it's worth considering.

- Good Student Discounts: If you're a young driver, having good grades in school can qualify you for a good student discount. This incentive is designed to encourage academic excellence and reward responsible behavior.

Choose the Right Coverage Levels

While it's tempting to opt for the cheapest insurance option, it's essential to ensure that you have adequate coverage. Liability coverage, which covers damage to other people's property or injuries to other people in an accident that you cause, is the minimum required by law in most states. However, it's often a good idea to consider additional coverage, such as collision coverage and comprehensive coverage, to protect yourself against a wider range of potential risks.

Collision coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, covers damage to your vehicle caused by non-collision events, such as theft, vandalism, or natural disasters. These additional coverages can provide significant peace of mind and financial protection.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to car insurance that uses technology to monitor your driving behavior and reward safe driving habits. With this type of insurance, you can potentially save a significant amount on your premiums.

Usage-based insurance typically involves installing a small device in your vehicle that tracks your driving habits, such as mileage, time of day driven, and braking patterns. Based on this data, the insurance company can offer discounts to drivers who exhibit safe driving behaviors.

While usage-based insurance may not be suitable for everyone, it can be a great option for those who drive relatively infrequently or who are confident in their safe driving habits. It's worth considering if you're looking for ways to reduce your insurance costs.

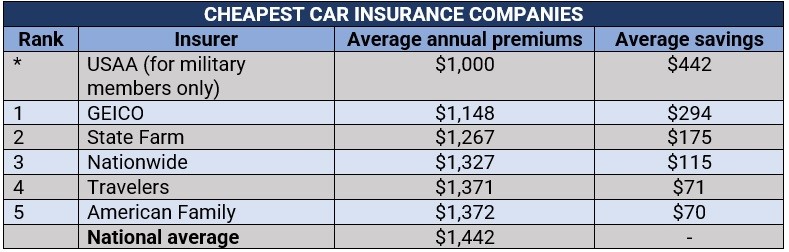

Performance Analysis of Cheap Monthly Car Insurance Options

To help you make an informed decision, we've analyzed several popular car insurance providers that offer competitive monthly rates. Here's a comparison of their features, coverage options, and pricing.

| Insurance Provider | Coverage Options | Average Monthly Premium | Discounts Offered |

|---|---|---|---|

| Company A | Comprehensive coverage, roadside assistance, rental car reimbursement | $120 | Safe driver, multi-car, loyalty, good student |

| Company B | Liability, collision, comprehensive, medical payments | $110 | Usage-based, safe driver, good student |

| Company C | Liability, collision, uninsured motorist | $130 | Multi-car, loyalty, accident forgiveness |

| Company D | Liability, personal injury protection, roadside assistance | $100 | Safe driver, good student, paperless billing |

Note that these averages are based on a sample of policies and may not reflect the exact rates you'll receive. Your individual rates will depend on a variety of factors, including your location, driving history, and the make and model of your vehicle.

Future Implications and Industry Trends

The car insurance industry is continually evolving, and several trends are shaping the future of auto insurance. Here are some key developments to watch out for:

Increasing Use of Telematics

The use of telematics technology in insurance is expected to grow significantly in the coming years. As more drivers embrace usage-based insurance, insurers will have access to more data to assess risk and offer personalized insurance products. This trend may lead to more accurate pricing and increased competition in the market, potentially benefiting consumers with cheaper insurance options.

Rise of Digital Insurance Providers

Digital insurance providers, also known as insurtech companies, are disrupting the traditional insurance market with their innovative use of technology. These companies often offer more affordable insurance options by streamlining the insurance process and reducing overhead costs. They may also provide more flexibility in coverage options and payment plans, catering to the needs of modern consumers.

Focus on Customer Experience

Insurance companies are increasingly recognizing the importance of customer experience in a competitive market. Many providers are investing in enhancing their digital platforms and mobile apps to provide more convenient and efficient services. This focus on customer satisfaction may lead to improved claim processes, better policy management tools, and more personalized insurance offerings.

💡 Expert Insight: As a consumer, it's important to stay informed about industry trends and developments. By keeping up with the latest innovations, you can make more informed decisions about your insurance choices and potentially benefit from new, more affordable options.

Frequently Asked Questions

What is the average cost of monthly car insurance in the United States?

+The average cost of monthly car insurance in the U.S. varies significantly depending on factors such as location, driving history, and the make and model of your vehicle. However, based on recent data, the average monthly premium for car insurance nationwide is around $150.

Are there any car insurance providers that offer extremely low rates?

+While it’s tempting to seek out the lowest-priced insurance, it’s important to remember that the cheapest option may not always provide adequate coverage. Some insurance providers may offer very low rates, but these policies often have significant coverage limitations or high deductibles. It’s crucial to balance price with the level of coverage you need to ensure you’re adequately protected.

How can I get a better deal on my car insurance if I have a poor driving record?

+If you have a poor driving record, it can be challenging to find affordable car insurance. However, there are still options available. Consider shopping around and comparing quotes from multiple insurers, as rates can vary significantly. Additionally, look for insurers that specialize in high-risk drivers or offer accident forgiveness programs. These options may provide more affordable coverage, even with a less-than-perfect driving history.

Is it worth paying for comprehensive coverage if I have an older vehicle?

+Whether or not comprehensive coverage is worth it for an older vehicle depends on several factors. If your car is older and has a lower market value, comprehensive coverage may not be as necessary as it is for newer, more valuable vehicles. However, if your car is in good condition and you rely on it for daily transportation, comprehensive coverage can provide valuable protection against risks such as theft, vandalism, or natural disasters. Consider your vehicle’s value and your personal circumstances to make an informed decision.