Private Insurance Plans Texas

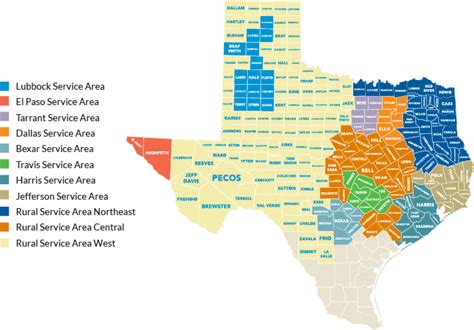

Private insurance plans in Texas offer a range of options for individuals and families seeking comprehensive healthcare coverage. With a diverse healthcare landscape, Texas residents have the flexibility to choose from various private insurance providers, allowing them to tailor their coverage to their specific needs. In this comprehensive guide, we will delve into the world of private insurance plans in Texas, exploring key aspects such as plan types, coverage options, costs, and the factors influencing insurance decisions in the Lone Star State.

Understanding Private Insurance Plans in Texas

Private insurance plans in Texas serve as a crucial component of the state’s healthcare system, providing individuals with access to a wide array of medical services and treatments. These plans, offered by private insurance companies, enable Texans to secure coverage for themselves and their families, ensuring access to quality healthcare. The state’s insurance market boasts a competitive landscape, with numerous providers offering a diverse range of plans to cater to varying needs and budgets.

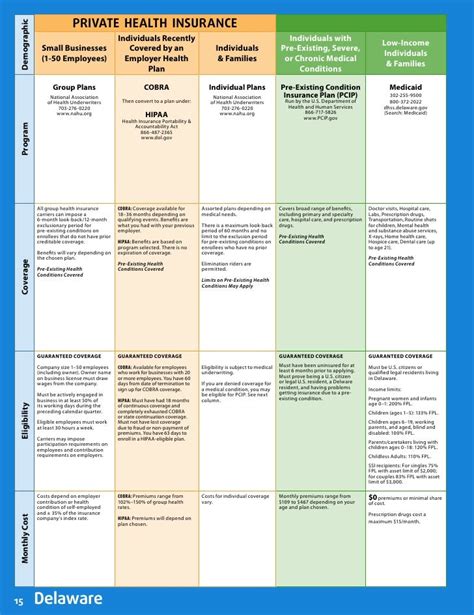

Plan Types and Coverage Options

Texas residents have a plethora of private insurance plan options to choose from, each designed to meet specific healthcare requirements. These plans can be broadly categorized into:

- Health Maintenance Organizations (HMOs): HMOs are popular in Texas, known for their cost-effectiveness. These plans typically require members to select a primary care physician (PCP) who coordinates their healthcare needs. Referrals are often necessary for specialist care.

- Preferred Provider Organizations (PPOs): PPO plans offer more flexibility, allowing members to choose their healthcare providers without a PCP. While out-of-network care is covered, in-network providers offer better rates and benefits.

- Exclusive Provider Organizations (EPOs): EPO plans are similar to PPOs, but members are restricted to in-network providers, except in emergencies. This plan type often provides comprehensive coverage with cost-effective benefits.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. Members can choose their healthcare path, either through a PCP or directly to specialists, with varying levels of coverage and costs.

- High-Deductible Health Plans (HDHPs): HDHPs are designed to be paired with Health Savings Accounts (HSAs). These plans have higher deductibles, but members can save pre-tax dollars in their HSA for future healthcare expenses.

Each plan type offers unique benefits and considerations, allowing Texans to choose a plan that aligns with their healthcare needs and preferences. Additionally, these plans can be customized with various coverage options, including:

- Medical Coverage: This includes coverage for doctor visits, hospital stays, surgeries, and prescription medications.

- Preventive Care: Plans often cover preventive services like annual check-ups, immunizations, and screenings to maintain good health.

- Mental Health and Substance Abuse Coverage: Many plans provide coverage for mental health services and substance abuse treatment, recognizing the importance of holistic healthcare.

- Maternity and Newborn Care: Expecting parents can find plans that offer comprehensive coverage for pregnancy, childbirth, and newborn care.

- Dental and Vision Care: Some plans include dental and vision coverage, ensuring comprehensive eye and oral health.

Cost and Factors Influencing Insurance Decisions

The cost of private insurance plans in Texas can vary significantly based on several factors, including the plan type, coverage options, and individual health needs. Here’s a breakdown of the key cost components:

| Cost Component | Description |

|---|---|

| Premium | The monthly cost of the insurance plan. This can vary based on the plan type, coverage level, and individual health status. |

| Deductible | The amount an individual must pay out-of-pocket before the insurance coverage kicks in. Deductibles can range from a few hundred to several thousand dollars. |

| Copayment (Copay) | A fixed amount an individual pays for covered healthcare services, like doctor visits or prescription medications. Copays can vary based on the service and the plan's coverage. |

| Coinsurance | The percentage of costs an individual shares with the insurance company after the deductible is met. For instance, a 20% coinsurance means the individual pays 20% of the cost, while the insurance company covers the remaining 80%. |

| Out-of-Pocket Maximum | The maximum amount an individual will pay out-of-pocket in a year for covered services. This includes deductibles, copays, and coinsurance. Once this limit is reached, the insurance company covers 100% of the costs. |

When selecting a private insurance plan in Texas, individuals often consider factors such as their healthcare needs, budget, and desired level of flexibility. For instance, those with chronic health conditions may prioritize plans with lower out-of-pocket costs, while young and healthy individuals might opt for plans with lower premiums but higher deductibles.

Additionally, Texas residents can explore various ways to reduce their insurance costs, such as:

- Comparing plans and providers to find the best value.

- Enrolling in a Health Savings Account (HSA) to save pre-tax dollars for future healthcare expenses.

- Utilizing preventive care services to maintain good health and potentially reduce future healthcare costs.

- Exploring employer-sponsored plans, which often offer cost-effective options with additional benefits.

Navigating Private Insurance in Texas

Texas offers a robust insurance market with a wide range of private insurance plans, catering to the diverse healthcare needs of its residents. By understanding the different plan types, coverage options, and cost considerations, individuals can make informed decisions when selecting their private insurance plan.

Whether it's an HMO, PPO, EPO, or POS plan, Texans have the freedom to choose a plan that aligns with their healthcare goals and budget. Additionally, exploring the various cost-saving strategies and leveraging preventive care services can help residents optimize their insurance coverage and overall health.

Key Takeaways

- Private insurance plans in Texas offer a diverse range of options, including HMOs, PPOs, EPOs, and POS plans.

- Plan types vary in flexibility, coverage, and cost, allowing individuals to tailor their coverage to their specific needs.

- Coverage options include medical, preventive, mental health, maternity, and dental/vision care, ensuring comprehensive healthcare.

- Cost considerations include premiums, deductibles, copays, coinsurance, and out-of-pocket maximums, influencing insurance decisions.

- Texans can explore cost-saving strategies and leverage preventive care to optimize their insurance coverage and overall health.

Frequently Asked Questions

Can I customize my private insurance plan in Texas to include specific coverage options like dental or vision care?

+Yes, many private insurance plans in Texas offer the flexibility to customize coverage. You can choose add-on options like dental, vision, or even additional specialty care to create a plan that meets your specific needs.

Are there any tax benefits associated with private insurance plans in Texas?

+Yes, certain private insurance plans, like High-Deductible Health Plans (HDHPs), can be paired with Health Savings Accounts (HSAs). HSAs allow you to save pre-tax dollars for future healthcare expenses, providing a tax-efficient way to manage your healthcare costs.

How can I find the best private insurance plan for my family in Texas?

+To find the best plan for your family, consider your healthcare needs, budget, and desired level of flexibility. Compare plans from different providers, review coverage options, and assess the costs to find a plan that aligns with your family’s priorities.