Insurance Company

The insurance industry is an integral part of the global financial system, providing individuals and businesses with the financial protection and security they need to navigate life's uncertainties. With its diverse range of products and services, the insurance sector plays a pivotal role in managing risks, offering peace of mind, and contributing to economic stability. In this comprehensive article, we delve into the intricate world of insurance, exploring its historical evolution, diverse offerings, and the profound impact it has on our lives and the economy.

The Evolution of Insurance: A Historical Perspective

The concept of insurance has a rich history, dating back to ancient civilizations. Early forms of insurance can be traced to practices in China, Babylon, and Greece, where merchants and traders sought ways to mitigate the risks associated with their ventures. Over the centuries, insurance evolved, with the establishment of marine insurance in the 14th century being a significant milestone. This marked the beginning of a more formalized approach to risk management, as ship owners and traders sought to protect their investments against the perils of the sea.

The modern insurance industry, as we know it today, emerged during the 17th and 18th centuries in Europe. The establishment of Lloyd's of London in 1688 played a pivotal role in shaping the industry. Lloyd's acted as a marketplace for underwriters, brokers, and insurers, facilitating the exchange of risk and the development of innovative insurance products. This period also saw the emergence of life insurance, with the first life assurance policies being issued in the late 17th century.

The industrial revolution further propelled the growth of insurance, as the complexities of modern life and business demanded more comprehensive risk management solutions. The 19th and 20th centuries witnessed a rapid expansion of insurance coverage, with the development of various types of insurance, including property, casualty, health, and disability insurance. The industry's evolution was marked by a continuous drive to innovate and adapt to changing societal and economic needs.

The Diverse Landscape of Insurance Products

Today, the insurance industry offers an extensive array of products tailored to meet the diverse needs of individuals and businesses. Here’s an overview of some of the key insurance categories and their significance:

Life Insurance

Life insurance provides financial protection to policyholders and their beneficiaries in the event of the policyholder’s death. It serves as a crucial safety net, ensuring that loved ones are provided for and that financial obligations are met. Life insurance policies can be structured in various ways, offering term life, whole life, universal life, and variable life options, each catering to different financial goals and needs.

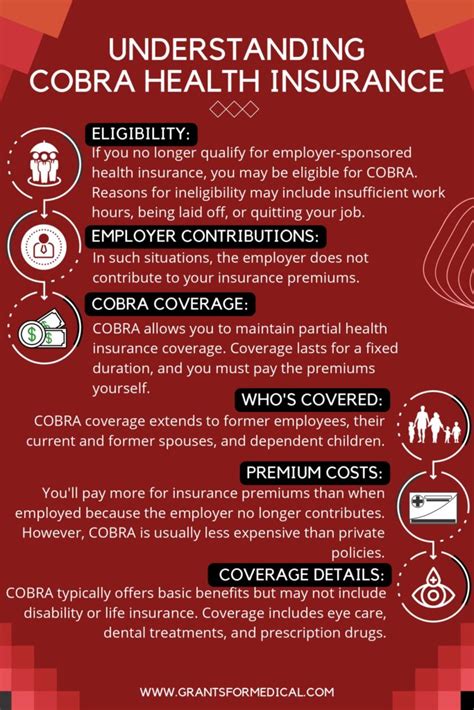

Health Insurance

Health insurance is essential in covering the costs associated with medical care, including doctor visits, hospital stays, prescription medications, and preventive care. With rising healthcare expenses, health insurance plays a vital role in making quality medical treatment accessible and affordable. It is a cornerstone of healthcare systems worldwide, promoting preventive care and ensuring financial protection during times of illness or injury.

Property and Casualty Insurance

Property and casualty insurance provides coverage for a wide range of assets and liabilities. Property insurance protects against damages or losses to tangible assets like homes, buildings, and personal belongings. Casualty insurance, on the other hand, covers liabilities arising from accidents, injuries, or legal claims. This category includes auto insurance, homeowners’ insurance, and liability insurance, all of which are crucial in safeguarding individuals and businesses from financial risks.

Business Insurance

Business insurance is designed to protect commercial enterprises from a variety of risks. It encompasses a wide range of policies, including commercial property insurance, product liability insurance, professional liability insurance (often referred to as errors and omissions insurance), and workers’ compensation insurance. These policies help businesses manage risks associated with their operations, protect their assets, and ensure the well-being of their employees.

Specialty Insurance

The insurance industry also offers a plethora of specialty insurance products tailored to unique needs. These include pet insurance, travel insurance, fine art insurance, cyber insurance, and more. Specialty insurance provides coverage for specific risks that may not be adequately addressed by traditional insurance policies. These policies ensure that individuals and businesses can protect their interests in areas that require specialized coverage.

The Impact of Insurance on Society and the Economy

The insurance industry’s influence extends far beyond individual policyholders. It plays a critical role in supporting economic growth, stability, and development. Here’s a deeper look at the impact of insurance on society and the economy:

Economic Stability and Risk Mitigation

Insurance is a cornerstone of economic stability, providing a mechanism for individuals and businesses to transfer and manage risks. By spreading risks across a large pool of policyholders, insurance companies can offer financial protection to those who need it. This risk-sharing approach not only protects policyholders but also contributes to the overall stability of the economy. In times of uncertainty or catastrophe, insurance helps mitigate the financial impact on individuals, businesses, and even entire communities.

Facilitating Economic Growth

Insurance is a vital catalyst for economic growth. It provides the necessary financial security and stability for individuals and businesses to pursue their goals and aspirations. For example, life insurance and business insurance policies offer the confidence and support needed to start new ventures, expand existing businesses, or make significant investments. By reducing the fear of financial loss, insurance encourages entrepreneurship, innovation, and economic development.

Promoting Social Welfare

The insurance industry has a significant impact on social welfare. Health insurance, for instance, ensures that individuals have access to necessary medical care, regardless of their financial situation. This not only improves public health but also reduces the burden on public healthcare systems. Similarly, disability insurance and long-term care insurance provide essential financial support to those who are unable to work due to illness or injury, ensuring their financial well-being and independence.

Disaster Recovery and Resilience

In the face of natural disasters or catastrophic events, insurance plays a critical role in disaster recovery and resilience. Property and casualty insurance policies help individuals and businesses rebuild and recover from losses. This rapid recovery not only benefits those directly affected but also contributes to the overall resilience and strength of the economy. Insurance companies’ ability to provide timely payouts and support during such times is a testament to their role in fostering community resilience.

The Future of Insurance: Technological Disruption and Innovation

The insurance industry is not immune to the forces of technological disruption and innovation. In fact, it is experiencing a period of rapid transformation driven by advancements in technology and changing consumer expectations. Here’s a glimpse into the future of insurance and the trends shaping its evolution:

Digital Transformation

The digital revolution has swept through the insurance industry, transforming the way insurance products are developed, marketed, and delivered. Insurers are leveraging digital technologies to enhance the customer experience, streamline processes, and improve operational efficiency. Digital platforms and mobile apps have made it easier for consumers to compare policies, purchase insurance, and manage their coverage. Additionally, digital tools like telematics and wearable devices are providing insurers with valuable data to personalize coverage and offer innovative products.

Data Analytics and Artificial Intelligence

Data analytics and artificial intelligence (AI) are transforming the way insurance companies assess and manage risks. By analyzing vast amounts of data, insurers can make more accurate predictions, personalize coverage, and offer tailored products. AI-powered chatbots and virtual assistants are enhancing customer service, providing immediate support and answers to policyholders’ queries. Additionally, AI is being used to detect and prevent fraud, improving the overall efficiency and effectiveness of insurance operations.

Insurtech Partnerships

Insurtech startups, with their focus on innovation and technology, are disrupting the traditional insurance landscape. Insurers are increasingly partnering with these startups to leverage their expertise and bring new, digital-first insurance products to market. These partnerships are driving the development of innovative solutions, such as usage-based insurance, parametric insurance, and microinsurance, which are more accessible and flexible for consumers.

Blockchain and Smart Contracts

Blockchain technology and smart contracts are poised to revolutionize the insurance industry by enhancing transparency, security, and efficiency. Blockchain’s distributed ledger technology can streamline claims processing, reduce fraud, and improve data sharing between insurers and policyholders. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, have the potential to automate various insurance processes, making them faster and more accurate.

Personalized Insurance

The future of insurance is moving towards personalized coverage, tailored to the unique needs and circumstances of individual policyholders. By leveraging data analytics and emerging technologies, insurers can offer policies that are highly customized, providing the right coverage at the right price. This shift towards personalized insurance is driven by a deeper understanding of consumer behavior and preferences, allowing insurers to deliver more value-added products and services.

Conclusion

The insurance industry is a dynamic and evolving sector, playing a critical role in our lives and the economy. From its ancient origins to its modern-day innovations, insurance has continually adapted to meet the changing needs of society. With its diverse range of products and services, the insurance industry provides the financial protection and security that individuals and businesses need to thrive. As we look to the future, the industry’s embrace of technology and innovation promises to further enhance its impact, ensuring a more resilient and prosperous world.

What are the key benefits of insurance for individuals and businesses?

+Insurance offers financial protection, peace of mind, and stability. For individuals, it provides security for their loved ones and ensures they can meet financial obligations. For businesses, insurance protects their assets, helps manage risks, and supports their growth and expansion.

How does insurance contribute to economic stability?

+Insurance plays a crucial role in economic stability by spreading risks across a large pool of policyholders. This risk-sharing approach helps mitigate the financial impact of unexpected events, such as natural disasters or economic downturns, on individuals, businesses, and the overall economy.

What are some emerging trends in the insurance industry?

+Emerging trends include digital transformation, with insurers embracing technology to enhance the customer experience. Data analytics and AI are transforming risk assessment and management. Insurtech partnerships are driving innovation, and blockchain and smart contracts are poised to revolutionize insurance processes.