What Insurance Covers Mounjaro

The introduction of Mounjaro (Tirzepatide), a groundbreaking medication for type 2 diabetes management, has sparked significant interest in the healthcare industry and among patients alike. As an innovative therapy, it has prompted many to wonder about its accessibility and coverage under different insurance plans. This article aims to provide a comprehensive guide to understanding the insurance coverage for Mounjaro, exploring its mechanisms, benefits, and the factors that influence insurance coverage decisions.

Understanding Mounjaro: A Revolutionary Treatment for Diabetes

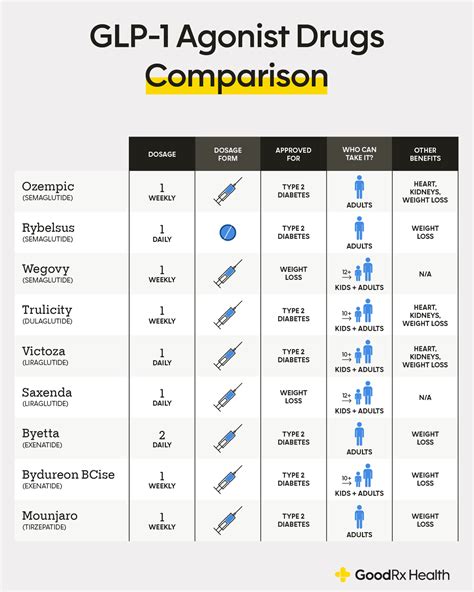

Mounjaro, developed by Eli Lilly and Company, is a once-weekly injectable medication that has shown remarkable efficacy in managing type 2 diabetes. It belongs to a class of drugs known as glucagon-like peptide-1 (GLP-1) receptor agonists, which work by stimulating insulin production and suppressing glucagon release in response to elevated blood sugar levels. This mechanism of action not only helps regulate blood glucose but also promotes weight loss, making it a highly promising treatment option for individuals with type 2 diabetes.

In clinical trials, Mounjaro demonstrated exceptional results, leading to its approval by the U.S. Food and Drug Administration (FDA) in May 2022. The medication was found to significantly lower blood sugar levels and promote substantial weight loss in patients, with some individuals even achieving remission of type 2 diabetes. These outcomes have positioned Mounjaro as a game-changer in diabetes management, offering new hope to patients struggling with this chronic condition.

Insurance Coverage for Mounjaro: Navigating the Landscape

The availability of insurance coverage for Mounjaro can vary significantly depending on several factors, including the specific insurance plan, the individual’s medical history, and the policies of the insurance provider. Understanding these factors is crucial for patients and healthcare providers alike when determining the accessibility and affordability of this innovative treatment.

Insurance Plan Coverage

Insurance plans typically have different tiers or levels of coverage for medications. These tiers are often categorized based on the medication’s cost and its perceived value in treating a particular condition. Here’s a breakdown of how Mounjaro may be classified within different insurance plans:

| Tier | Description | Likely Placement for Mounjaro |

|---|---|---|

| Tier 1 | Generic or preferred brand medications, often with the lowest copays. | Since Mounjaro is a brand-new medication, it is unlikely to be classified in this tier. |

| Tier 2 | Preferred brand medications or non-preferred generic drugs, with slightly higher copays. | Mounjaro might be placed in this tier, especially if the insurance plan prioritizes newer, innovative treatments. |

| Tier 3 | Non-preferred brand medications, typically with the highest copays. | Some insurance plans may categorize Mounjaro as a non-preferred brand, especially if they have not yet negotiated preferred pricing with Eli Lilly. |

It's important to note that insurance plans may also have a separate category for specialty medications like Mounjaro, which often come with their own unique cost-sharing structures.

Prior Authorization and Step Therapy

Many insurance plans have policies in place to manage the prescription of high-cost medications like Mounjaro. These policies can include prior authorization and step therapy requirements.

- Prior Authorization: This process requires the prescribing healthcare provider to obtain approval from the insurance company before the medication can be dispensed. The provider must submit clinical information and justify why Mounjaro is the appropriate treatment for the patient. The insurance company then reviews this information and decides whether to approve or deny coverage.

- Step Therapy: Also known as "fail first," this policy requires patients to try and respond inadequately to one or more standard treatments before approving a newer, more expensive medication like Mounjaro. In the context of diabetes management, this might mean first trying and failing with oral medications or insulin therapy before considering Mounjaro.

Both prior authorization and step therapy processes can delay the start of treatment and add administrative burdens for healthcare providers and patients. However, they are common practices used by insurance companies to manage costs and ensure that medications are prescribed appropriately.

Formulary Status and Negotiated Prices

The formulary is a list of medications that an insurance plan agrees to cover. Formularies are typically divided into tiers, as mentioned earlier, and can vary greatly between insurance plans. The formulary status of Mounjaro will influence its coverage and out-of-pocket costs for patients.

Insurance companies negotiate prices with pharmaceutical manufacturers, including Eli Lilly in this case, to determine the cost of medications. These negotiated prices can vary widely and influence the tier placement and cost-sharing requirements for Mounjaro. Patients and healthcare providers should be aware that the out-of-pocket costs for Mounjaro can differ significantly between insurance plans, even for those with the same formulary status.

Mounjaro’s Cost and Access: Real-World Examples

To illustrate the variations in insurance coverage and out-of-pocket costs for Mounjaro, let’s examine some real-world examples based on current insurance plans and their policies.

Example 1: Commercial Insurance Plan with Preferred Pricing

In this scenario, a commercial insurance plan has negotiated preferred pricing with Eli Lilly for Mounjaro. The medication is placed in Tier 2 of the formulary, indicating that it is a preferred brand medication. The patient’s out-of-pocket cost for a 30-day supply of Mounjaro is $100.

However, there is a catch. This insurance plan has a step therapy requirement in place for diabetes medications. The patient must first try and fail with at least one other diabetes medication, such as metformin, before Mounjaro can be approved. This process can take several months, delaying the start of treatment.

Example 2: Medicare Part D Plan with Standard Pricing

For a Medicare Part D plan, Mounjaro is likely to be classified as a specialty medication due to its high cost. These medications often have their own cost-sharing structure, which can be more complex than traditional tiers. In this case, the patient’s out-of-pocket cost for a 30-day supply of Mounjaro is $350, but this cost can vary depending on the patient’s specific Part D plan and their annual drug spending.

Additionally, Medicare Part D plans typically have a coverage gap, also known as the "donut hole," where patients temporarily have to pay more for their medications. Once the patient reaches the catastrophic coverage stage, their out-of-pocket costs for Mounjaro may decrease significantly.

Example 3: Medicaid Coverage

Medicaid coverage for Mounjaro can vary greatly depending on the state. Some states may cover Mounjaro without any additional requirements, while others may have prior authorization or step therapy policies in place. Out-of-pocket costs for Medicaid patients can range from minimal copays to higher costs if the medication is not covered under the state’s preferred drug list.

Tips for Navigating Insurance Coverage for Mounjaro

Navigating insurance coverage for Mounjaro can be complex, but there are several strategies that patients and healthcare providers can employ to optimize the process:

- Check Formulary Status: Patients should start by checking their insurance plan's formulary to determine the tier placement and potential cost-sharing requirements for Mounjaro. This information is typically available on the insurance provider's website or through a simple phone call to customer service.

- Understand Prior Authorization and Step Therapy: Be aware of any prior authorization or step therapy requirements for Mounjaro. Discuss these with your healthcare provider to ensure that all necessary steps are taken to obtain coverage.

- Explore Patient Assistance Programs: Eli Lilly, the manufacturer of Mounjaro, offers a patient assistance program called Lilly Cares. This program provides free or discounted medications to eligible individuals who lack prescription drug coverage. Patients can explore this option if they face financial barriers to accessing Mounjaro.

- Consider Mail-Order Pharmacies: Some insurance plans offer lower copays or discounts when medications are ordered through their preferred mail-order pharmacy. Patients can discuss this option with their healthcare provider or insurance company to potentially save on out-of-pocket costs.

- Advocate for Coverage: If Mounjaro is not covered by your insurance plan or if there are significant barriers to access, consider advocating for coverage. This can involve reaching out to your insurance company, providing clinical evidence of the medication's benefits, and highlighting how it aligns with your specific medical needs.

The Future of Mounjaro Coverage: Industry Insights

As a relatively new medication, the insurance coverage landscape for Mounjaro is still evolving. Here are some insights into how coverage may change over time:

Increased Adoption and Negotiated Prices

As more healthcare providers and patients become aware of Mounjaro’s benefits, its use is likely to increase. This increased adoption may lead to more negotiated prices between Eli Lilly and insurance companies, potentially lowering the cost of the medication and improving its accessibility.

Expanded Coverage and Reduced Barriers

With time, insurance companies may expand their coverage of Mounjaro, especially as more clinical data becomes available and the medication’s long-term benefits are established. This could lead to reduced barriers to access, such as the elimination of prior authorization or step therapy requirements.

Focus on Value-Based Care

The healthcare industry is shifting towards value-based care models, where payments are linked to the quality and outcomes of care provided. Mounjaro’s impressive clinical trial results and its potential to improve patient outcomes may position it as a valuable asset in these models. This could lead to improved coverage and reduced out-of-pocket costs for patients.

What is the cost of Mounjaro without insurance coverage?

+The wholesale acquisition cost (WAC) of Mounjaro is approximately $1,200 for a 30-day supply. However, patients without insurance coverage can explore options such as patient assistance programs or discounts offered by Eli Lilly or third-party organizations.

How can patients afford Mounjaro if their insurance doesn’t cover it or has high out-of-pocket costs?

+Patients can consider enrolling in the Lilly Cares patient assistance program, which provides free or discounted medications to eligible individuals. Additionally, some states have programs that help cover the cost of medications for low-income residents. Exploring these options can help patients access Mounjaro despite financial barriers.

Are there any ongoing clinical trials or studies investigating Mounjaro’s long-term effects and potential new indications?

+Yes, there are ongoing clinical trials and research studies investigating the long-term effects of Mounjaro and its potential use in other conditions beyond type 2 diabetes. These studies aim to provide more comprehensive data on the medication’s safety and efficacy, which could influence future insurance coverage decisions.