Driving Insurance Quotes

In the realm of vehicle ownership, navigating the complexities of insurance is an essential aspect that impacts every driver. Obtaining accurate and affordable driving insurance quotes is a critical step towards ensuring financial protection and peace of mind on the road. This comprehensive guide delves into the world of driving insurance, exploring the factors that influence quotes, the process of obtaining them, and strategies to secure the best coverage at an optimal price.

Understanding Driving Insurance Quotes

Driving insurance quotes serve as an estimate of the cost of your vehicle insurance policy. These quotes are based on various factors unique to your driving profile and the vehicle you intend to insure. Insurance companies use a sophisticated system to assess these factors and calculate a personalized quote, which can vary significantly between individuals.

Key Factors Influencing Quotes

- Driver Profile: Your age, gender, driving history, and the number of years you’ve held a license play a significant role. Younger drivers, especially males, often face higher premiums due to statistical risks associated with this demographic.

- Vehicle Type and Usage: The make, model, and age of your vehicle are crucial. High-performance or luxury cars tend to attract higher premiums. Additionally, the purpose of your vehicle (commuting, business, or pleasure) and the annual mileage can influence quotes.

- Location and Usage Patterns: Where you live and work, and the areas you frequently drive through, can impact your insurance costs. High-traffic or high-crime areas often result in higher premiums.

- Claims History: A clean driving record with no claims can lead to more favorable quotes. Conversely, multiple claims, especially those involving accidents, can significantly increase your insurance costs.

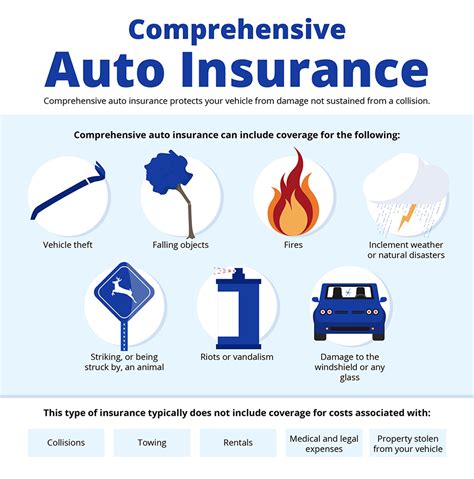

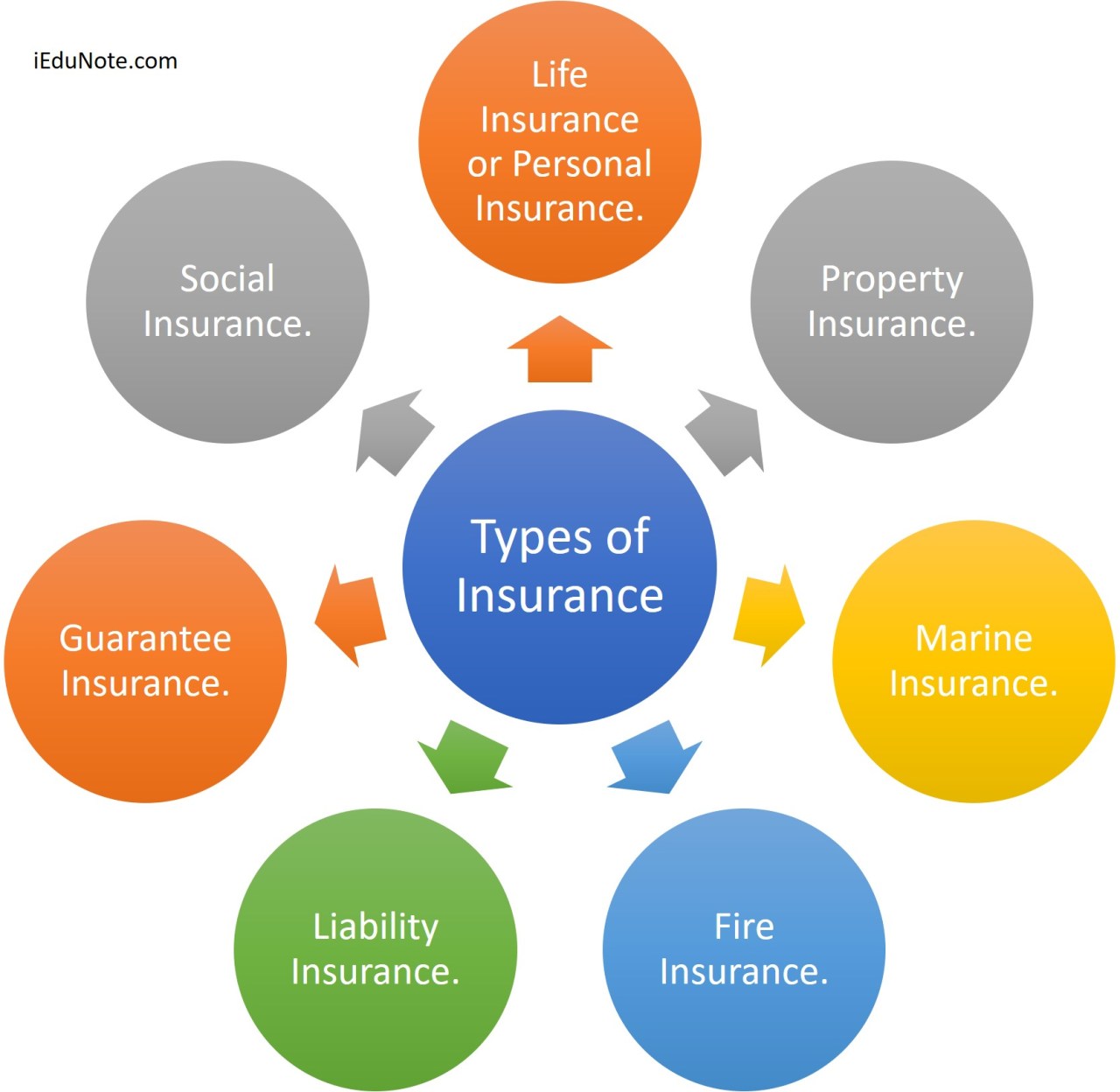

- Optional Coverages: The level of coverage you choose (comprehensive, collision, liability-only, etc.) will impact your quote. Adding optional coverages like rental car reimbursement or roadside assistance can increase the overall cost.

The Process of Obtaining Driving Insurance Quotes

Obtaining driving insurance quotes has become more accessible and efficient thanks to online tools and comparison websites. Here’s a step-by-step guide to help you navigate the process:

Step 1: Prepare Your Information

Before you begin, gather the necessary information about yourself, your driving history, and your vehicle. This includes:

- Personal details: Name, date of birth, gender, and contact information.

- Driving history: Details of any accidents, claims, or traffic violations in the past 5 years.

- Vehicle details: Make, model, year, VIN (Vehicle Identification Number), and any modifications.

- Coverage preferences: The type and level of coverage you’re seeking.

Step 2: Compare Quotes

Utilize online comparison tools or visit insurance company websites to obtain quotes. Most platforms will guide you through a series of questions to gather the necessary information and provide you with a personalized quote.

Consider comparing quotes from at least three to five different insurance providers to get a comprehensive view of the market.

Step 3: Evaluate the Quotes

When comparing quotes, pay attention to the following aspects:

- Coverage: Ensure that the quotes provide the level of coverage you desire. Compare the limits and deductibles to understand the potential out-of-pocket costs in the event of a claim.

- Premiums: Compare the annual or monthly premiums to understand the cost of the policy. Keep in mind that the cheapest quote might not always be the best value if it provides insufficient coverage.

- Discounts: Look for potential discounts such as multi-policy discounts (if you bundle your auto insurance with other policies like home or renters insurance), good student discounts, or loyalty discounts.

- Reputation and Financial Strength: Research the reputation and financial stability of the insurance provider. A strong financial rating ensures that the company can pay out claims in the future.

- Customer Service and Claims Handling: Consider the provider’s track record for customer satisfaction and claims handling. Positive reviews and a good reputation can indicate a smoother experience if you ever need to file a claim.

Strategies for Securing the Best Driving Insurance Quotes

While the factors influencing driving insurance quotes are largely out of your control, there are strategies you can employ to optimize your quote and secure the best coverage at an affordable price.

Shop Around and Compare

Don’t settle for the first quote you receive. Shopping around and comparing quotes from multiple providers is essential to finding the best deal. Online comparison tools can be particularly useful for this.

Improve Your Driving Record

A clean driving record can lead to significant savings. Avoid traffic violations and focus on safe driving practices. If you’ve had a less-than-stellar driving record in the past, consider taking a defensive driving course to demonstrate your commitment to safe driving and potentially qualify for a discount.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, renters, or life insurance, consider bundling your policies with the same provider. Many insurance companies offer multi-policy discounts that can significantly reduce your overall insurance costs.

Increase Your Deductible

Opting for a higher deductible can lower your insurance premiums. However, this strategy requires careful consideration, as a higher deductible means you’ll have to pay more out of pocket in the event of a claim.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, uses telematics devices to monitor your driving habits and calculate your insurance premium based on actual usage. This can be an excellent option for safe, low-mileage drivers, as it rewards good driving habits with lower premiums.

Maintain a Good Credit Score

In many states, insurance companies use credit-based insurance scores to help determine your insurance premium. Maintaining a good credit score can lead to lower insurance costs, as it indicates financial responsibility and a lower risk of claims.

The Future of Driving Insurance Quotes

The landscape of driving insurance is evolving rapidly, driven by technological advancements and changing consumer expectations. Here are some trends that are shaping the future of driving insurance quotes:

Telematics and Usage-Based Insurance

Telematics technology is becoming increasingly prevalent, allowing insurance companies to gather real-time data about driving habits. This data-driven approach enables more accurate risk assessment and personalized pricing, rewarding safe drivers with lower premiums.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are being used to analyze vast amounts of data, including driving behavior, vehicle performance, and even weather conditions, to predict risks more accurately. This technology can lead to more precise pricing and better risk management for insurance providers.

Personalized Coverage and Pricing

The future of driving insurance quotes lies in personalized coverage and pricing. With the help of advanced analytics, insurance companies can offer tailored policies that match the unique needs and circumstances of individual drivers, ensuring they receive the right level of coverage at a fair price.

Digital Transformation

The insurance industry is undergoing a digital transformation, with an increasing focus on online and mobile platforms. This shift allows for more efficient quote comparisons, easier policy management, and streamlined claims processes, enhancing the overall customer experience.

| Metric | Data |

|---|---|

| Average Annual Premium (2023) | $1,674 |

| Highest Premium Increase (2022-2023) | 12.5% in California |

| Average Savings by Shopping Around | $497 per year |

How often should I review my driving insurance quotes?

+

It’s a good practice to review your insurance quotes annually, especially when your policy renews. This allows you to stay up-to-date with market changes and ensure you’re still getting the best value for your money.

Can I negotiate my driving insurance quote?

+

While insurance quotes are based on standardized calculations, you can sometimes negotiate certain aspects of your policy. For instance, you might be able to discuss the terms of your deductible or explore additional discounts. It’s always worth asking if there are ways to reduce your premium.

What if I have a poor credit score?

+

A poor credit score can indeed impact your driving insurance quote. However, it’s important to remember that insurance companies consider a range of factors, and a less-than-perfect credit score doesn’t necessarily mean you’ll be denied coverage or face unaffordable premiums. Shopping around and comparing quotes can help you find a provider who offers competitive rates despite credit challenges.

Are there any alternatives to traditional driving insurance?

+

Yes, there are alternatives like usage-based insurance (UBI) and pay-as-you-drive (PAYD) plans. These options use telematics devices to monitor your driving habits, and your premium is based on how much and how safely you drive. UBI and PAYD plans can be particularly beneficial for safe, low-mileage drivers, as they offer the potential for significant savings.