Comprehensive Automobile Insurance

In the complex world of insurance, few things can be as intricate and multifaceted as automobile insurance. While most people understand the need for car insurance, diving into the specifics of comprehensive coverage can quickly become a daunting task. This article aims to shed light on the ins and outs of comprehensive automobile insurance, offering a comprehensive guide for those seeking to navigate this essential aspect of vehicle ownership.

Unraveling Comprehensive Automobile Insurance

Comprehensive automobile insurance, often referred to as “full coverage,” is an essential part of a well-rounded insurance policy. Unlike liability-only insurance, which covers damage you cause to others, comprehensive insurance provides a broader scope of protection, safeguarding your vehicle against a wide range of unexpected events and circumstances.

This type of insurance is designed to cover damage to your vehicle that isn't caused by a collision. It's an all-encompassing protection net, ensuring your vehicle is protected against the unpredictable and often unforeseen incidents that can occur on the road.

The Scope of Comprehensive Coverage

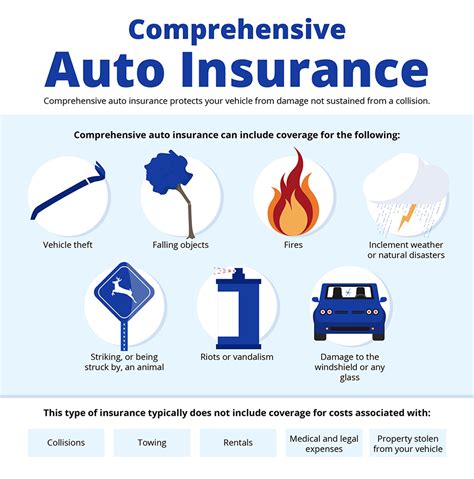

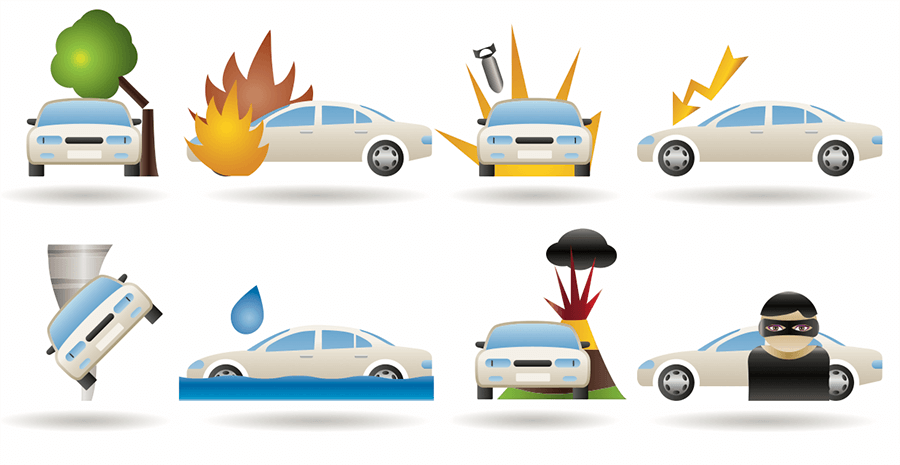

Comprehensive insurance covers a variety of incidents that are beyond the control of the driver, including:

- Vandalism and Theft: From a smashed window to a stolen car, comprehensive insurance has you covered. It provides financial protection against the cost of repairing or replacing your vehicle in case of intentional damage or theft.

- Natural Disasters: From floods and fires to hurricanes and earthquakes, nature can be unpredictable. Comprehensive insurance ensures your vehicle is protected against the financial losses that may arise from these natural calamities.

- Animal Strikes: Hitting an animal on the road can be a shocking and potentially dangerous experience. Comprehensive insurance covers the cost of repairs needed after such incidents.

- Falling Objects: Imagine driving under a bridge and suddenly, a heavy object falls onto your car. Comprehensive insurance steps in to cover the costs of repairing the damage.

- Glass Damage: Whether it's a crack in your windshield or a broken side window, comprehensive insurance covers the cost of glass repairs or replacements.

- Vandalism: Acts of vandalism can be upsetting and costly. Comprehensive insurance provides coverage for damage caused by intentional acts of mischief or vandalism.

It's important to note that comprehensive insurance typically comes with a deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. This deductible varies depending on your insurance provider and the level of coverage you choose.

Real-World Example: Comprehensive Coverage in Action

Let’s consider a scenario to illustrate the value of comprehensive insurance. Imagine you’re driving through a residential area late at night when suddenly, a deer runs into the road. Despite your best efforts to avoid it, you hit the animal, causing significant damage to the front of your vehicle. This is where comprehensive insurance comes into play.

In this case, your comprehensive insurance would cover the cost of repairs to your vehicle, ensuring you don't have to foot the entire bill out of pocket. This type of coverage provides peace of mind, knowing that you're protected against unexpected incidents like animal strikes.

| Coverage Scenario | Estimated Cost of Repair |

|---|---|

| Animal Strike | $2,500 - $5,000 |

| Vandalism (Graffiti) | $1,000 - $3,000 |

| Natural Disaster (Flood) | $5,000 - $10,000 |

Understanding the Benefits and Limitations

Comprehensive automobile insurance offers numerous benefits, providing a safety net for your vehicle against a wide range of potential risks. However, it’s crucial to understand the limitations and exclusions to ensure you’re not caught off guard in the event of a claim.

Benefits of Comprehensive Insurance

- Broad Coverage: Comprehensive insurance covers a wide array of incidents, providing protection against the unexpected. From natural disasters to vandalism, it ensures your vehicle is safeguarded against a variety of potential hazards.

- Peace of Mind: With comprehensive insurance, you can drive with confidence, knowing that you’re protected against financial losses resulting from unforeseen events. It provides a sense of security and peace of mind.

- Personalized Coverage: Insurance providers offer customizable plans, allowing you to tailor your coverage to your specific needs and budget. This ensures you’re not paying for coverage you don’t need.

Limitations and Exclusions

While comprehensive insurance offers extensive coverage, it’s not an all-encompassing solution. Here are some limitations and exclusions to be aware of:

- Wear and Tear: Comprehensive insurance doesn't cover normal wear and tear on your vehicle. This includes things like fading paint, worn tires, or mechanical breakdowns due to age or lack of maintenance.

- Negligence: If an incident occurs due to your negligence or intentional acts, your comprehensive insurance may not cover the damages. For example, if you damage your vehicle while performing a stunt, it's unlikely to be covered.

- Specific Exclusions: Different insurance providers may have specific exclusions in their policies. It's essential to carefully read and understand these exclusions to ensure you're aware of what's not covered.

- Deductibles: As mentioned earlier, comprehensive insurance typically comes with a deductible. This means you'll have to pay a certain amount out of pocket before your insurance coverage kicks in. The amount of the deductible can vary depending on your policy and provider.

Real-World Scenario: Understanding Exclusions

Imagine you live in an area prone to severe weather conditions. One day, a strong storm hits, causing a tree branch to fall onto your parked car, damaging the roof and windows. In this scenario, your comprehensive insurance would typically cover the cost of repairs.

However, let's say you recently had your car detailed, and the detailing service scratched the paint while cleaning the vehicle. In this case, your comprehensive insurance may not cover the cost of repainting the car, as it's considered a normal wear and tear issue rather than an unexpected event.

Selecting the Right Comprehensive Coverage

Choosing the right comprehensive coverage involves careful consideration of your needs, budget, and the value of your vehicle. Here are some key factors to keep in mind when selecting your coverage:

Assess Your Needs

Evaluate the risks and potential hazards you face on a daily basis. If you live in an area prone to natural disasters or high crime rates, comprehensive insurance becomes even more crucial. Consider the value of your vehicle and the potential financial impact of an unexpected incident.

Compare Providers and Policies

Different insurance providers offer varying levels of comprehensive coverage. Compare multiple policies to find the one that best suits your needs. Look at the coverage limits, deductibles, and any additional benefits or discounts offered.

Understand Policy Terms and Conditions

Read the fine print! It’s crucial to understand the terms and conditions of your policy, including any exclusions and limitations. This ensures you’re fully aware of what’s covered and what’s not.

Tailor Your Coverage

Most insurance providers offer customizable plans, allowing you to choose the level of coverage that suits your budget and needs. Consider factors like the age and value of your vehicle, your driving habits, and the risks you face on a daily basis.

Consider Additional Benefits

Some insurance providers offer additional benefits with their comprehensive insurance policies. These can include roadside assistance, rental car coverage, or even coverage for personal belongings inside your vehicle. Consider whether these additional benefits are worth the cost.

The Future of Comprehensive Insurance

As technology advances and the automotive industry evolves, the landscape of comprehensive insurance is also changing. Here’s a glimpse into the future of this essential coverage:

Autonomous Vehicles and Insurance

With the rise of autonomous vehicles, the role of comprehensive insurance may shift. As these vehicles become more prevalent, insurance policies may need to adapt to cover potential risks associated with self-driving technology.

Enhanced Safety Features

Advancements in automotive safety features, such as advanced driver-assistance systems (ADAS), are expected to reduce the number of accidents. This could potentially lead to a decrease in the need for comprehensive insurance, as the risk of certain incidents may be mitigated.

Data-Driven Insurance

The use of telematics and data analytics is already transforming the insurance industry. Insurers are increasingly using real-time data to assess risk and set premiums. This trend is expected to continue, with insurance policies becoming more personalized and accurate.

The Rise of Electric Vehicles

As electric vehicles (EVs) gain popularity, insurance providers will need to adapt their policies to cover the unique risks associated with these vehicles. This includes considerations such as battery replacement costs and charging station infrastructure.

Conclusion

Comprehensive automobile insurance is an essential component of vehicle ownership, providing broad coverage against a wide range of unexpected incidents. By understanding the scope, benefits, and limitations of this coverage, you can make informed decisions to protect your vehicle and your finances. As the automotive industry evolves, so too will the world of comprehensive insurance, ensuring that drivers are always protected on the road ahead.

Does comprehensive insurance cover mechanical breakdowns?

+No, comprehensive insurance typically doesn’t cover mechanical breakdowns or normal wear and tear. It’s designed to protect against unexpected incidents like collisions, theft, and natural disasters.

What happens if I have a claim under my comprehensive insurance?

+If you have a claim, you’ll need to contact your insurance provider and follow their claims process. This usually involves providing details of the incident, obtaining estimates for repairs, and potentially paying your deductible.

Can I choose my own repair shop with comprehensive insurance?

+This can vary depending on your insurance provider and policy. Some insurers may have preferred repair shops, while others allow you to choose your own. It’s best to check your policy or contact your insurer to confirm.