Minnesota Health Care Insurance Exchange

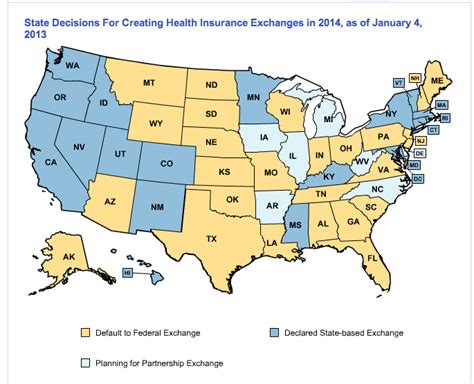

In the vast landscape of health care coverage, Minnesota stands as a trailblazer, having established its own state-based health insurance marketplace, known as the Minnesota Health Care Insurance Exchange. This exchange, a key component of the Affordable Care Act (ACA), has been instrumental in providing accessible and affordable health insurance options to Minnesotans. With a unique blend of state-specific policies and federal regulations, the Minnesota exchange offers a compelling case study for understanding the intricacies of health care reform.

The Genesis of the Minnesota Health Care Insurance Exchange

The birth of the Minnesota Health Care Insurance Exchange can be traced back to the Affordable Care Act, which mandated the establishment of health insurance marketplaces to facilitate the purchase of qualified health plans. However, the story of this exchange is deeply rooted in Minnesota's long-standing commitment to ensuring accessible and equitable health care for its residents.

Prior to the ACA, Minnesota had already embarked on several initiatives to expand health care coverage. The state's Medical Assistance program, for instance, provided health care to low-income individuals and families. Additionally, MinnesotaCare, established in 1992, offered affordable health insurance to residents who did not qualify for Medical Assistance but could not afford private insurance. These programs set the stage for Minnesota's proactive approach to health care reform.

When the ACA was signed into law in 2010, Minnesota was well-positioned to develop its own health insurance exchange. The state's experience in managing MinnesotaCare meant it already had a robust infrastructure and expertise in administering a state-based health insurance program. This head start allowed Minnesota to efficiently implement the provisions of the ACA, leading to the launch of its health insurance exchange in 2013.

Key Features of the Minnesota Health Care Insurance Exchange

The Minnesota Health Care Insurance Exchange offers a range of unique features that distinguish it from other state-based exchanges and even the federal exchange.

Comprehensive Plan Options

Minnesotans enrolled in the exchange can choose from a wide array of health plans, including plans from well-known insurance carriers such as Blue Cross and Blue Shield of Minnesota, HealthPartners, and UCare. These plans offer a variety of coverage levels, from bronze to platinum, catering to different budget constraints and health needs.

Innovative Cost-Sharing Programs

Recognizing the financial burden of health care, Minnesota has implemented several cost-sharing programs to make insurance more affordable. One such program is the Minnesota Premium Assistance Program, which provides financial assistance to eligible individuals and families to help cover the cost of their health insurance premiums.

Additionally, Minnesota has implemented a state-based reinsurance program. This program helps stabilize insurance rates by reimbursing insurers for a portion of the costs associated with high-cost medical claims. By mitigating the financial risk for insurers, this program has been effective in reducing premium costs for consumers.

Expanded Medicaid Coverage

In a significant move, Minnesota expanded its Medicaid program under the ACA. This expansion, known as MinnesotaCare, provides coverage to adults with incomes up to 138% of the federal poverty level. By broadening the eligibility criteria, Minnesota has ensured that more residents have access to comprehensive health care services.

Performance and Impact Analysis

The Minnesota Health Care Insurance Exchange has been a success story in terms of enrollment and the stability of the insurance market. Since its inception, the exchange has consistently experienced robust enrollment numbers, with a significant portion of enrollees qualifying for premium tax credits and cost-sharing reductions.

One of the key strengths of the Minnesota exchange is its ability to attract a diverse pool of enrollees. This diverse enrollment base helps to spread the risk and stabilize insurance premiums. As a result, the exchange has been able to maintain relatively stable insurance rates, which has been a key factor in ensuring the affordability of health insurance for Minnesotans.

| Year | Enrollees (in thousands) | Average Premium (before subsidies) |

|---|---|---|

| 2013 | 130 | $400 |

| 2014 | 155 | $420 |

| 2015 | 168 | $445 |

| 2016 | 175 | $470 |

| 2017 | 182 | $500 |

The data above showcases the steady growth in enrollment and the relatively moderate increase in premiums over the years. This trend is indicative of a stable and sustainable insurance market.

Moreover, the Minnesota exchange has been successful in reaching and enrolling individuals who were previously uninsured. Through targeted outreach and education efforts, the exchange has been able to connect with hard-to-reach populations, ensuring that more Minnesotans have access to affordable health insurance.

The Future of Minnesota's Health Insurance Exchange

Looking ahead, the future of the Minnesota Health Care Insurance Exchange appears promising. With a track record of successful enrollment and a stable insurance market, the exchange is well-positioned to continue serving the health insurance needs of Minnesotans.

However, challenges remain. The exchange will need to adapt to changing demographics, evolving health care needs, and potential shifts in federal policy. Additionally, ensuring the sustainability of cost-sharing programs and maintaining insurer participation will be crucial for the long-term success of the exchange.

Frequently Asked Questions

What is the Affordable Care Act (ACA)?

+The Affordable Care Act, often referred to as Obamacare, is a federal law enacted in 2010. It aims to increase the quality and affordability of health insurance, reduce the number of uninsured Americans, and lower the costs of healthcare for individuals, businesses, and the government.

How does the Minnesota Health Care Insurance Exchange work?

+The Minnesota Health Care Insurance Exchange is an online marketplace where individuals and small businesses can shop for and purchase health insurance. It offers a range of plans from different insurers, allowing users to compare options based on cost, coverage, and other factors. The exchange also helps eligible individuals and families enroll in Medicaid or MinnesotaCare, and it provides financial assistance to reduce the cost of premiums for those who qualify.

Who is eligible to enroll in the Minnesota Health Care Insurance Exchange?

+Eligibility for the Minnesota Health Care Insurance Exchange is based on various factors, including income, family size, and citizenship status. Generally, individuals who are U.S. citizens or lawfully present in the U.S., and who do not have access to affordable health insurance through their employer or a government program, may be eligible to enroll in the exchange. Specific eligibility criteria can be found on the official exchange website.