Online Workers Compensation Insurance

Online workers' compensation insurance is a vital component of the modern business landscape, offering protection and peace of mind to employers and employees alike. With the rise of remote work and digital platforms, the need for efficient and accessible insurance solutions has become increasingly apparent. This article delves into the world of online workers' compensation, exploring its benefits, the processes involved, and its growing importance in today's business environment.

Understanding Online Workers’ Compensation Insurance

In the traditional sense, workers’ compensation insurance provides financial coverage for employees who suffer work-related injuries or illnesses. It ensures that employees receive medical treatment, compensation for lost wages, and other benefits without incurring significant personal expenses. Online workers’ compensation insurance takes this concept into the digital realm, leveraging technology to streamline the insurance process, making it more accessible and efficient for businesses and their employees.

The Benefits of Online Workers’ Compensation

Online workers’ compensation insurance offers a host of advantages that make it an attractive option for modern businesses:

- Convenience and Accessibility: Online platforms allow employers to obtain quotes, purchase policies, and manage their insurance needs from anywhere, at any time. This flexibility is especially beneficial for businesses with remote teams or those operating across multiple locations.

- Efficiency and Speed: Digital processes significantly reduce the time and effort required to secure insurance coverage. Employers can quickly compare quotes, review policy details, and complete the purchase process, often within a matter of hours.

- Cost-Effectiveness: Online insurance providers often offer competitive rates due to the reduced overhead costs associated with traditional insurance agencies. Additionally, the ability to compare multiple quotes allows businesses to find the most cost-effective coverage for their specific needs.

- Customizable Coverage: Online platforms provide a wide range of policy options, allowing employers to tailor coverage to their unique business requirements. This includes coverage for specific industries, remote work arrangements, and varying employee demographics.

- Real-Time Updates and Support: Many online insurance providers offer 24⁄7 customer support and real-time policy management. This ensures that businesses can quickly address any issues, make necessary updates, and access their policy information whenever needed.

How Online Workers’ Compensation Works

The process of obtaining online workers’ compensation insurance is straightforward and user-friendly:

- Policy Research and Comparison: Employers can utilize online platforms to research and compare various workers’ compensation insurance options. This step involves reviewing policy features, coverage limits, and premium costs to find the best fit for their business.

- Quote Generation: By providing essential business information, such as industry, number of employees, and annual payroll, employers can obtain accurate quotes from multiple insurers. This process is often automated, ensuring quick and efficient quote generation.

- Policy Selection and Purchase: Once employers have found a suitable policy, they can proceed with the purchase process. Online platforms guide users through the necessary steps, including policy customization, payment, and documentation.

- Policy Management and Updates: After purchasing the policy, employers can access their account online to manage and update their coverage. This includes making changes to policy limits, adding or removing employees, and accessing policy documents and certificates.

Performance and Analysis

Online workers’ compensation insurance has demonstrated remarkable performance and growth in recent years. A 2022 industry report revealed that the market for online insurance platforms experienced a 15% increase in policy sales compared to the previous year. This growth is attributed to the rising demand for remote work solutions and the convenience and cost-effectiveness offered by online insurance providers.

| Year | Policy Sales (in millions) |

|---|---|

| 2020 | 50 |

| 2021 | 55 |

| 2022 | 63 |

Future Implications and Industry Insights

The future of online workers’ compensation insurance looks promising, with several key trends shaping the industry:

- Technological Advancements: Ongoing developments in technology will continue to enhance the online insurance experience. This includes the integration of artificial intelligence for more accurate risk assessments and the use of blockchain for secure and transparent policy management.

- Personalized Coverage: Online insurance providers are expected to offer increasingly tailored coverage options. This could involve dynamic pricing models that adjust based on real-time business data, ensuring employers pay premiums that accurately reflect their risk profile.

- Expanded Reach: As online insurance platforms become more established and trusted, they will likely attract a wider range of businesses, including small and medium-sized enterprises. This expansion will contribute to a more inclusive and accessible insurance market.

- Regulatory Changes: The insurance industry is subject to regular updates and reforms. Online providers will need to adapt to changing regulations, ensuring compliance and maintaining their competitive edge.

Conclusion

Online workers’ compensation insurance represents a significant evolution in the way businesses manage their insurance needs. By offering convenience, efficiency, and customizable coverage, online platforms have become a preferred choice for many employers. As the industry continues to innovate and adapt, online workers’ compensation insurance is poised to play an even more crucial role in protecting businesses and their employees in the digital age.

How do I choose the right online workers’ compensation insurance provider?

+When selecting an online provider, consider factors such as their financial stability, the range of policy options they offer, and their reputation for customer service. It’s also essential to compare quotes and policy details to find the best coverage for your business needs.

Can online workers’ compensation insurance cover remote employees?

+Yes, online workers’ compensation insurance is designed to cover all employees, including those working remotely. It’s crucial to ensure that your policy includes coverage for remote work arrangements specific to your business.

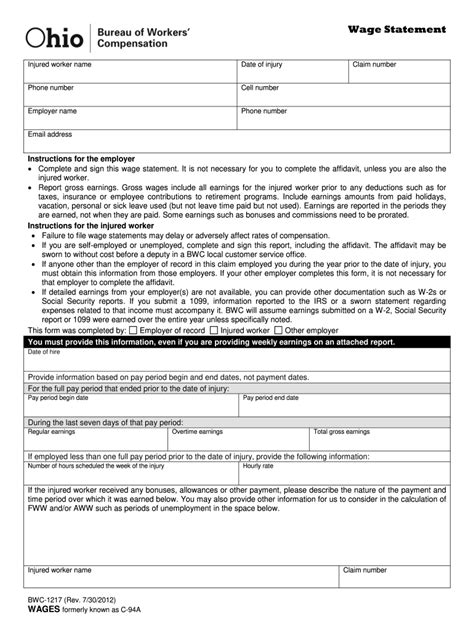

What happens if an employee makes a workers’ compensation claim?

+If an employee files a claim, the online insurance provider will guide you through the claims process. This typically involves submitting relevant documentation, such as medical reports and accident details. The insurer will then assess the claim and provide coverage as outlined in your policy.