Best Life Insurance In California

Life insurance is a crucial financial tool that provides peace of mind and security for individuals and their loved ones. With a diverse range of options available, choosing the best life insurance policy can be a daunting task, especially in a state as large and varied as California. This comprehensive guide will delve into the world of life insurance, offering expert insights and real-world examples to help Californians make informed decisions.

Understanding Life Insurance in California

California, being the most populous state in the US, has a vibrant life insurance market with numerous providers offering a wide array of policies. The state’s diverse population and unique regulatory environment create a complex yet competitive landscape for life insurance. Understanding the specific needs and nuances of the Golden State is essential when navigating this market.

Life insurance serves as a financial safety net, ensuring that your loved ones are taken care of in the event of your passing. It provides a death benefit, a sum of money paid to your beneficiaries, which can help cover a range of expenses, from funeral costs to long-term financial support for dependents.

Key Factors for Choosing the Best Life Insurance in California

Selecting the best life insurance policy involves careful consideration of several factors. Here are some key aspects to guide your decision-making process:

Coverage Amount

The coverage amount, or the death benefit, is a critical component of your life insurance policy. It should be sufficient to meet the financial needs of your beneficiaries. This amount should consider factors such as outstanding debts, future income requirements, and the cost of living in California.

| Considerations | Guidelines |

|---|---|

| Mortgage and Debts | Ensure the coverage amount can pay off any outstanding loans or mortgages. |

| Income Replacement | Calculate the annual income needed to support your dependents and multiply it by the number of years they will need support. |

| Funeral and Estate Costs | Include an estimated amount for funeral expenses and any potential estate taxes. |

Policy Type

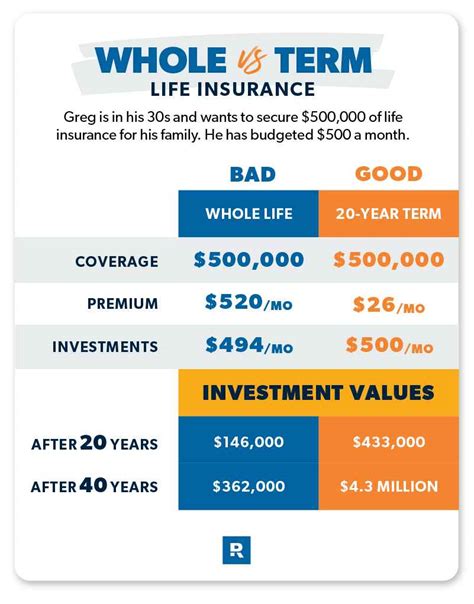

There are two primary types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and is often more affordable. Permanent life insurance, including whole life and universal life policies, offers coverage for your entire life and builds cash value over time.

Premium Affordability

The cost of your life insurance policy, known as the premium, is an essential consideration. Premiums can vary widely based on your age, health, and the type of policy you choose. It’s crucial to find a balance between the coverage you need and what you can afford to pay.

Company Reputation and Financial Strength

The stability and reliability of your life insurance company are vital. Choose a company with a strong financial rating from reputable agencies like AM Best, Moody’s, or Standard & Poor’s. This ensures the company will be able to pay out your benefits when needed.

Rider Options and Customization

Many life insurance policies offer riders, which are optional additions to your policy that can enhance your coverage. Riders can provide additional benefits like accelerated death benefits for terminal illnesses or waivers of premium if you become disabled.

Customer Service and Claims Process

The quality of customer service and the ease of the claims process can significantly impact your experience with a life insurance company. Research the company’s reputation for customer satisfaction and the efficiency of their claims handling.

Top Life Insurance Providers in California

The California life insurance market boasts a wide range of reputable providers, each with its own unique offerings and advantages. Here’s an overview of some of the top players:

Prudential

Prudential is a well-established name in the life insurance industry, offering a comprehensive range of products. Their policies often include flexible payment options and a variety of riders to customize your coverage. Prudential is known for its strong financial stability and has received high ratings from major agencies.

New York Life

New York Life has a long history of providing reliable life insurance coverage. They offer a variety of permanent life insurance policies, including whole life and universal life plans, which can provide lifetime protection and build cash value. New York Life’s policies often include optional riders for additional benefits.

MetLife

MetLife is another industry giant, offering a wide range of life insurance products, including term and permanent policies. They are known for their competitive rates and excellent customer service. MetLife’s policies often include features like accelerated benefits for critical illnesses and waivers for premium payments during certain circumstances.

State Farm

State Farm is a well-known provider of various insurance products, including life insurance. They offer both term and permanent life insurance policies, with a focus on providing customizable coverage to meet individual needs. State Farm’s policies often include features like child riders and long-term care riders.

MassMutual

MassMutual is a highly regarded provider of life insurance, offering a range of term and permanent policies. Their policies are known for their flexibility, allowing for adjustments to coverage amounts and terms as your needs change. MassMutual also offers innovative features like their LifeBridge program, which provides support for policyholders facing terminal illnesses.

Performance Analysis and Case Studies

To provide a more tangible understanding of the benefits and advantages of different life insurance policies, let’s explore a few case studies.

Case Study: John’s Term Life Policy

John, a 35-year-old resident of San Francisco, chose a 20-year term life insurance policy with a coverage amount of $1 million. His policy, provided by Prudential, offers an affordable premium due to his young age and good health. The policy provides peace of mind for John’s family, ensuring they would be financially secure if something were to happen to him during his working years.

Case Study: Sarah’s Whole Life Policy

Sarah, a 45-year-old resident of Los Angeles, opted for a whole life insurance policy with a coverage amount of $500,000. Her policy, provided by New York Life, builds cash value over time, which she can access through policy loans or withdrawals. This feature provides flexibility for Sarah, allowing her to use the cash value for various financial needs, such as funding her child’s education or supplementing her retirement income.

Case Study: Mike’s Universal Life Policy

Mike, a 55-year-old resident of Sacramento, chose a universal life insurance policy with a coverage amount of $750,000. His policy, provided by MetLife, offers flexibility in terms of premium payments and coverage amounts. This flexibility is particularly beneficial for Mike, as it allows him to adjust his coverage and premiums as his financial situation changes, ensuring he always has adequate protection.

Future Implications and Industry Insights

The life insurance industry in California is continually evolving, driven by advancements in technology, changing consumer needs, and shifts in the economic landscape. Here are some key trends and insights to consider:

Digital Transformation

Many life insurance companies are embracing digital technology to streamline the application and claims processes. This shift towards digital platforms offers greater convenience and efficiency for consumers, allowing for faster approvals and easier management of policies.

Increasing Focus on Health and Wellness

The industry is seeing a growing trend towards rewarding policyholders who maintain healthy lifestyles. Some companies offer discounts or rewards for maintaining good health, which can lower the cost of premiums. This shift encourages policyholders to adopt healthier habits, benefiting both their personal well-being and their financial situation.

Customizable Policies

Life insurance providers are increasingly offering customizable policies that can be tailored to individual needs. This allows consumers to choose the coverage and features that best fit their unique circumstances, providing a more personalized and effective solution.

Frequently Asked Questions

How much life insurance do I need in California?

+

The amount of life insurance you need depends on your personal circumstances, including your financial obligations, the number of dependents you have, and your future financial goals. As a general rule, your coverage amount should be sufficient to cover your outstanding debts, provide for your dependents’ future needs, and potentially fund your estate plans.

What are the main types of life insurance policies available in California?

+

The two primary types of life insurance are term life insurance, which provides coverage for a specified term, and permanent life insurance, which offers lifelong coverage. Permanent life insurance includes whole life and universal life policies, which build cash value over time.

How do I choose the right life insurance company in California?

+

When choosing a life insurance company, consider factors such as their financial stability, reputation, and the range of products and services they offer. Look for companies with strong financial ratings from reputable agencies and read reviews from current and past customers to get an idea of their customer service and claims handling.

Can I customize my life insurance policy in California?

+

Yes, many life insurance policies in California offer customization options through riders. Riders can provide additional benefits, such as accelerated death benefits for critical illnesses or waivers of premium if you become disabled. These riders can help tailor your policy to your specific needs and circumstances.

What is the average cost of life insurance in California?

+

The cost of life insurance in California, known as the premium, can vary significantly based on several factors, including your age, health, and the type of policy you choose. Generally, term life insurance policies are more affordable than permanent life insurance policies, but the specific cost will depend on your individual circumstances.