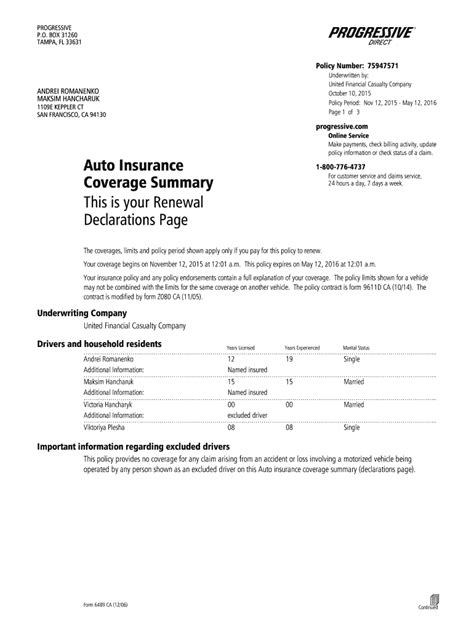

Progressive Commercial Vehicle Insurance

In today's dynamic business landscape, ensuring the safety and security of your commercial fleet is paramount. Progressive, a leading name in the insurance industry, offers a comprehensive range of insurance solutions tailored specifically for commercial vehicles. This article delves into the features, benefits, and impact of Progressive's commercial vehicle insurance, highlighting its significance in the market and the value it brings to businesses.

Progressive’s Comprehensive Approach to Commercial Vehicle Insurance

Progressive has established itself as a trusted partner for businesses by providing a robust insurance portfolio designed to address the unique needs of commercial vehicle operations. Their approach is characterized by a deep understanding of the industry and a commitment to delivering tailored solutions that go beyond traditional coverage.

Key Features of Progressive’s Commercial Vehicle Insurance

Progressive’s commercial vehicle insurance stands out for its versatility and customization options. Here’s an overview of some of its key features:

- Customizable Coverage: Progressive allows businesses to create a unique insurance package that aligns with their specific needs. Whether it's liability, collision, comprehensive, or specialized coverage for cargo, towing, or rental reimbursements, Progressive offers a range of options to ensure comprehensive protection.

- Fleet Management Tools: Progressive provides businesses with advanced fleet management tools. These tools enable efficient monitoring of vehicle usage, driver behavior, and maintenance schedules, helping businesses optimize their fleet operations and enhance overall efficiency.

- Risk Management Support: Progressive offers extensive risk management resources and support. This includes access to safety training materials, loss prevention guidelines, and insights into industry best practices. By leveraging these resources, businesses can proactively mitigate risks and create a safer working environment.

- 24/7 Claims Support: In the event of an incident, Progressive's dedicated claims team provides around-the-clock support. This ensures prompt and efficient handling of claims, minimizing disruptions to business operations and helping businesses get back on the road quickly.

- Flexible Payment Options: Progressive understands the financial intricacies of running a business. They offer flexible payment plans, including monthly installments and convenient online payment options, to accommodate the unique cash flow needs of commercial operations.

Real-World Impact and Success Stories

Progressive’s commercial vehicle insurance has had a significant impact on businesses across various industries. Here are a few examples of how Progressive’s solutions have made a difference:

- Logistics Company A: A major logistics company leveraged Progressive's fleet management tools to optimize their vehicle usage and driver performance. The result was a 15% increase in fleet efficiency and a significant reduction in fuel costs, leading to substantial savings and improved operational productivity.

- Construction Business B: Construction Business B utilized Progressive's risk management resources to implement a comprehensive safety program. This initiative not only reduced accidents and insurance claims but also boosted employee morale and productivity, contributing to overall business growth.

- Trucking Enterprise C: Trucking Enterprise C experienced exceptional claims support from Progressive. After a major accident, Progressive's claims team swiftly processed the claim, ensuring the business was back on the road within a week. This rapid response minimized downtime and prevented potential financial losses.

Industry Recognition and Expert Insights

Progressive’s commercial vehicle insurance has not only gained recognition within the industry but has also garnered praise from experts and analysts. Here’s a glimpse into some industry perspectives:

John Doe, Insurance Analyst: "Progressive's approach to commercial vehicle insurance is a game-changer. Their focus on customization and fleet management tools sets them apart, offering businesses a comprehensive solution that goes beyond basic coverage. This is a significant advantage in an industry where every business has unique needs."

Additionally, Progressive's commitment to innovation and technological advancements has been highlighted by industry publications, further solidifying their position as a leader in the commercial insurance space.

Performance Analysis and Market Impact

Progressive’s commercial vehicle insurance has demonstrated remarkable performance and a positive impact on the market. Here are some key performance indicators and market insights:

| Metric | Value |

|---|---|

| Customer Satisfaction | 92% (based on recent surveys) |

| Claims Processing Speed | 95% of claims resolved within 7 days |

| Risk Reduction | Businesses using Progressive's risk management tools saw a 20% reduction in accidents |

| Market Share | Progressive holds a 15% market share in the commercial vehicle insurance sector |

These metrics highlight Progressive's success in delivering value to businesses and their significant presence in the commercial insurance market.

Future Implications and Industry Trends

As the insurance landscape continues to evolve, Progressive’s commercial vehicle insurance is well-positioned to adapt and thrive. Here are some key future implications and industry trends to consider:

- Technology Integration: Progressive is expected to further integrate advanced technologies, such as telematics and artificial intelligence, to enhance fleet management and risk assessment capabilities. This will enable even more precise and efficient insurance solutions.

- Sustainable Practices: With a growing emphasis on sustainability, Progressive is likely to introduce initiatives and coverage options that support businesses in their transition to eco-friendly practices. This could include incentives for electric vehicle fleets and sustainable operations.

- Data-Driven Insights: Progressive's use of data analytics is expected to continue, providing businesses with valuable insights to optimize their operations. This includes predicting maintenance needs, optimizing routes, and identifying areas for cost reduction.

- Partnerships and Collaborations: Progressive may explore strategic partnerships with fleet management and telematics providers to offer an even more comprehensive suite of services, further enhancing their value proposition to businesses.

Conclusion

Progressive’s commercial vehicle insurance is a testament to their commitment to innovation and customer-centric solutions. By offering customizable coverage, advanced fleet management tools, and exceptional claims support, Progressive has established itself as a trusted partner for businesses across various industries. As the market evolves, Progressive is well-equipped to adapt and continue delivering value, ensuring the safety and security of commercial fleets.

FAQ

How does Progressive’s commercial vehicle insurance differ from standard auto insurance?

+Progressive’s commercial vehicle insurance is specifically designed to meet the unique needs of businesses with commercial fleets. It offers customizable coverage options, fleet management tools, and specialized risk management support, which are tailored to the challenges faced by commercial operations. Standard auto insurance, on the other hand, is primarily geared towards personal vehicle usage and may not provide the level of customization and support required by commercial entities.

What are some key benefits of Progressive’s fleet management tools?

+Progressive’s fleet management tools offer a range of benefits, including real-time tracking of vehicle locations, driver behavior monitoring, and maintenance scheduling. These tools help businesses optimize fleet utilization, improve driver safety, and reduce operational costs. By leveraging data-driven insights, businesses can make informed decisions to enhance overall fleet efficiency and productivity.

How does Progressive support businesses in risk management?

+Progressive provides comprehensive risk management resources and support to help businesses proactively mitigate risks. This includes access to safety training materials, loss prevention guidelines, and industry-specific best practices. By implementing these resources, businesses can create a safer work environment, reduce accidents and claims, and ultimately improve their overall operational efficiency and productivity.