Insurance Enrollment Period

The insurance enrollment period is a critical time for individuals and families to secure their healthcare coverage for the upcoming year. It's a period marked by careful planning, thoughtful consideration, and strategic decision-making to ensure access to necessary medical services. This annual event is a cornerstone of the healthcare system, allowing people to review and update their insurance plans, ensuring they are prepared for any health challenges that may arise.

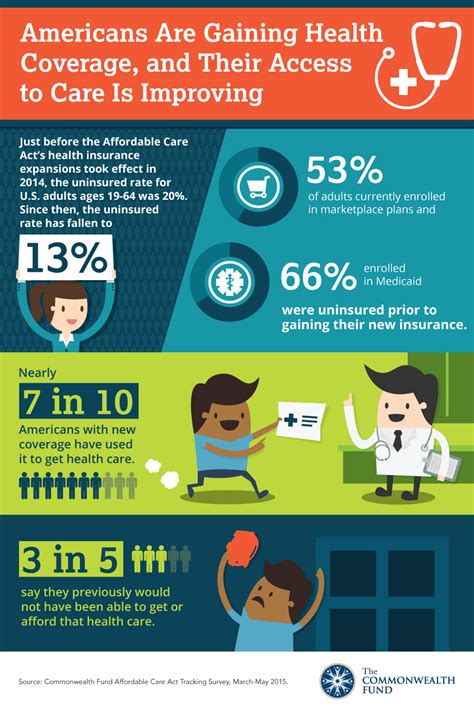

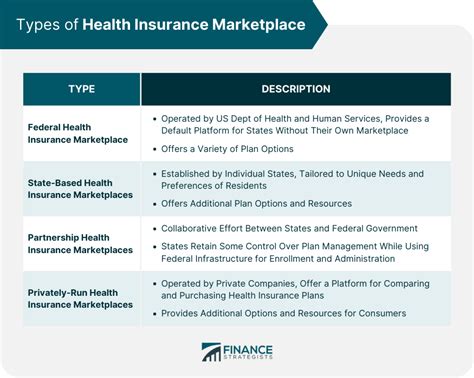

In the United States, the Open Enrollment Period (OEP) for health insurance typically occurs once a year, offering a chance for people to select or change their health plans. This period is vital as it provides an opportunity to assess and adjust insurance coverage, considering factors like family growth, income changes, and evolving healthcare needs. While the exact dates vary by state and type of insurance, understanding the enrollment period and its implications is crucial for making informed decisions about healthcare coverage.

Understanding the Insurance Enrollment Period

The insurance enrollment period is a designated timeframe during which individuals can enroll in, switch, or renew their health insurance plans. This period is often annual, though some states or insurance providers may offer special enrollment periods for certain qualifying events, such as marriage, divorce, birth or adoption of a child, or loss of other health coverage.

The enrollment period is a crucial time for people to review their insurance options, assess their healthcare needs, and make informed decisions about their coverage. It's an opportunity to ensure that their chosen plan provides the necessary benefits and coverage limits to meet their health requirements.

For those new to the process, it's important to understand that health insurance plans vary widely in their offerings. Factors like the monthly premium, deductible, copayments, and out-of-pocket maximums all play a role in the overall cost and coverage of a plan. Additionally, the specific benefits and services covered can vary significantly between plans, making the enrollment period a critical time for research and comparison.

Key Considerations During the Enrollment Period

-

Reviewing Existing Coverage: It's important to assess whether your current plan still meets your needs. Consider changes in your health status, prescription needs, or any new medical conditions that may require specialized care.

-

Comparing Plan Options: Different insurance providers offer a range of plans with varying benefits and costs. Compare premiums, deductibles, and coverage limits to find a plan that best suits your budget and healthcare requirements.

-

Understanding Network Providers: Health insurance plans often have networks of healthcare providers that they work with. It's crucial to check if your preferred doctors, hospitals, and specialists are in-network to ensure cost-effective care.

-

Evaluating Prescription Drug Coverage: If you rely on prescription medications, ensure that your plan covers the necessary drugs at a reasonable cost. Some plans may have preferred drug lists or require prior authorization for certain medications.

-

Considering Additional Benefits: Beyond basic medical coverage, some plans offer additional benefits like dental, vision, or mental health services. Evaluate if these benefits are necessary for your well-being and budget.

Navigating the Enrollment Process

Navigating the insurance enrollment process can be complex, but with the right tools and information, it becomes more manageable. Here's a step-by-step guide to help you through the process:

Step 1: Research and Compare Plans

Start by researching and comparing different health insurance plans. Consider factors like premiums, deductibles, co-pays, and out-of-pocket maximums. Understand the coverage limits and any exclusions or limitations in the plan. Utilize online tools and resources provided by insurance providers or government websites to compare plans side by side.

| Plan Type | Premium | Deductible | Co-pay | Out-of-Pocket Max |

|---|---|---|---|---|

| Bronze Plan | $350/month | $5,000 | $30 | $7,500 |

| Silver Plan | $400/month | $3,000 | $40 | $6,500 |

| Gold Plan | $500/month | $2,000 | $20 | $5,000 |

Step 2: Evaluate Your Healthcare Needs

Assess your current and potential future healthcare needs. Consider factors like your health status, prescription requirements, and any specialized care you or your family members may need. Evaluate the coverage for preventive care, chronic conditions, and any anticipated medical procedures.

Step 3: Understand Network Providers

Health insurance plans often have networks of providers, including doctors, hospitals, and specialists. It's crucial to ensure that your preferred healthcare providers are in-network to avoid higher out-of-pocket costs. Check the plan's provider directory and contact your healthcare providers directly to confirm their network status.

Step 4: Verify Coverage for Prescriptions

If you rely on prescription medications, verify that your plan covers them. Some plans have preferred drug lists or require prior authorization for certain medications. Ensure that your plan covers the medications you need and that the cost is manageable.

Step 5: Review Additional Benefits

Beyond basic medical coverage, some plans offer additional benefits like dental, vision, mental health services, or wellness programs. Evaluate if these benefits are necessary and beneficial for your well-being and budget.

Step 6: Enroll or Renew

Once you've made your decision, enroll in your chosen plan or renew your existing coverage. Ensure you have all the necessary documentation and information ready, such as personal details, income verification, and any required forms. Complete the enrollment process within the designated time frame to avoid any lapses in coverage.

Special Enrollment Periods

In addition to the annual Open Enrollment Period, there are special enrollment periods (SEPs) that allow individuals to enroll in or change their health insurance outside of the standard enrollment period. These SEPs are typically triggered by specific life events, such as:

- Marriage or divorce

- Birth or adoption of a child

- Loss of other health coverage (e.g., losing a job or aging out of a parent's plan)

- Moving to a new area

- Changes in income or household size

During a SEP, you can enroll in a new plan, switch to a different plan, or renew your existing coverage. It's important to note that the exact dates and requirements for SEPs can vary depending on your state and the type of insurance you're seeking. Always consult with your insurance provider or a healthcare professional to understand your options and ensure compliance with the enrollment process.

Conclusion

The insurance enrollment period is a crucial time for individuals and families to carefully review and select their health insurance plans. By understanding the enrollment process, researching plan options, and evaluating their healthcare needs, individuals can make informed decisions to ensure they have the necessary coverage for the upcoming year. Whether it's the annual Open Enrollment Period or a special enrollment opportunity, being proactive and well-informed is key to navigating the complex world of health insurance.

Frequently Asked Questions

When is the Open Enrollment Period for health insurance in the United States?

+

The Open Enrollment Period (OEP) for health insurance in the United States typically runs from November 1 to December 15 each year. However, it’s important to note that the exact dates may vary slightly depending on the state and the specific insurance provider.

Can I enroll in a health insurance plan outside of the Open Enrollment Period?

+

Yes, there are certain circumstances that may qualify you for a Special Enrollment Period (SEP), allowing you to enroll outside of the standard OEP. These circumstances typically include life events such as marriage, divorce, birth or adoption of a child, loss of other health coverage, or moving to a new area. It’s important to understand your eligibility for a SEP and the specific requirements to ensure a smooth enrollment process.

What happens if I miss the Open Enrollment Period and don’t qualify for a Special Enrollment Period?

+

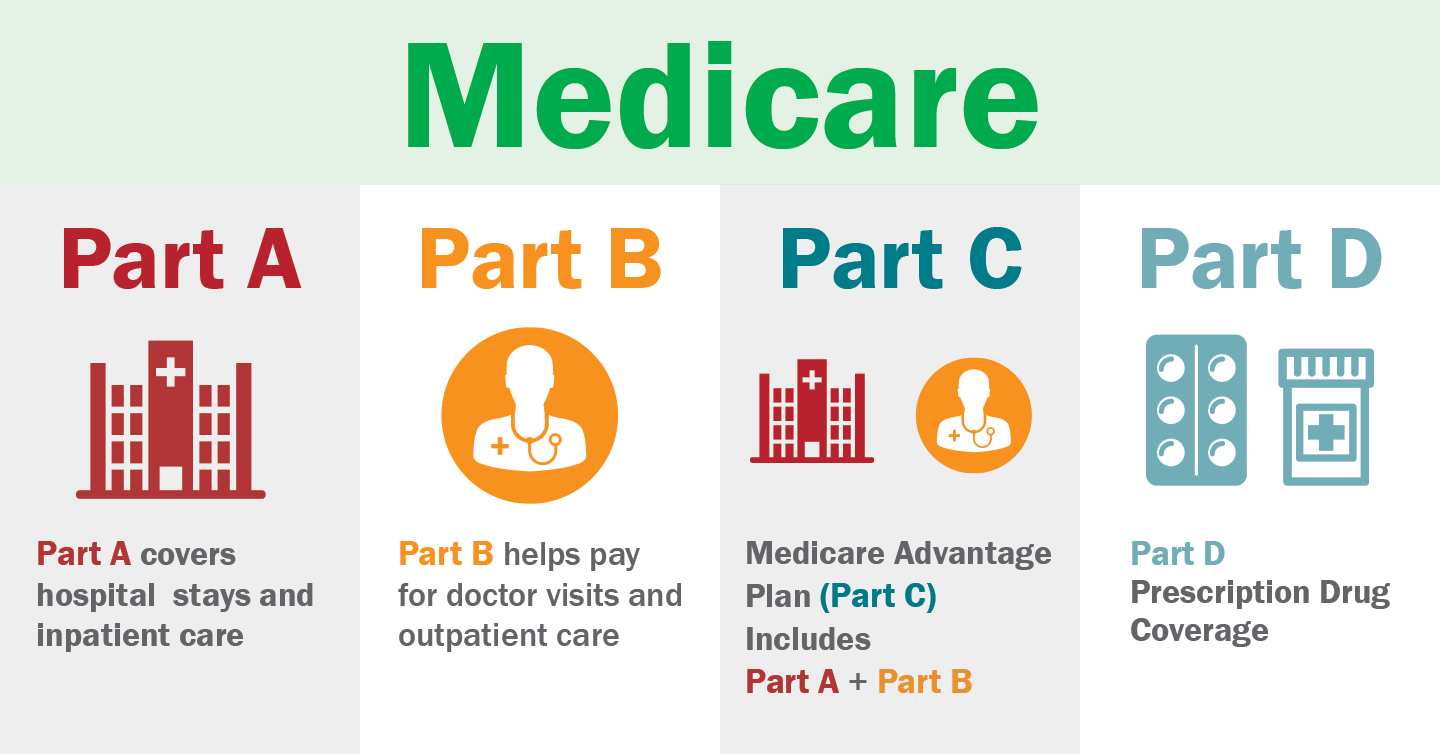

If you miss the Open Enrollment Period and don’t qualify for a Special Enrollment Period, you may be unable to enroll in a new health insurance plan until the next OEP. However, it’s important to note that you may still have coverage options through other types of insurance, such as short-term health plans or Medicare, depending on your age and eligibility. It’s advisable to consult with a healthcare professional or insurance provider to explore your options.

How can I compare health insurance plans during the enrollment period?

+

Comparing health insurance plans can be done through various resources. Many insurance providers offer online tools and resources to compare plans side by side. You can also utilize government websites, such as Healthcare.gov, which provides a marketplace for health insurance plans. These platforms allow you to filter and compare plans based on factors like premiums, deductibles, and coverage limits, helping you make an informed decision.