Progressive Insurance Ranking

The insurance industry is vast and diverse, offering a range of services to protect individuals and businesses from various risks. Among the many insurance providers, Progressive Insurance stands out as a prominent player, known for its innovative approaches and customer-centric strategies. In this comprehensive analysis, we delve into the world of Progressive Insurance, exploring its ranking, performance, and the factors that contribute to its success in the highly competitive insurance market.

Understanding Progressive Insurance

Progressive Insurance, headquartered in Mayfield Village, Ohio, has established itself as a leading provider of auto insurance and home insurance across the United States. Founded in 1937 by Joseph Lewis and Jack Green, the company pioneered the concept of usage-based insurance, which has revolutionized the industry. Progressive’s innovative spirit and commitment to customer satisfaction have propelled it to the forefront of the insurance landscape.

Over the years, Progressive has expanded its offerings to include not only car insurance but also motorcycle, RV, boat, life, and business insurance. Its comprehensive suite of products caters to a diverse range of customers, making it a one-stop shop for insurance needs.

Progressive Insurance’s Ranking and Market Performance

When it comes to ranking insurance companies, several factors come into play, including financial stability, customer satisfaction, claims handling, and market share. Progressive Insurance consistently ranks among the top insurers in the United States, solidifying its position as a trusted and reliable provider.

Financial Strength and Stability

Progressive Insurance boasts an impressive financial profile, which is a key indicator of its stability and ability to meet its obligations. The company holds a Superior Rating (A+) from AM Best, one of the leading rating agencies in the insurance industry. This rating reflects Progressive’s strong financial foundation and its ability to withstand economic fluctuations.

In addition to AM Best's recognition, Progressive has also received high marks from other reputable rating agencies. Standard & Poor's assigned a Strong A rating to Progressive, further emphasizing its financial stability and creditworthiness. These ratings are a testament to the company's prudent financial management and its commitment to maintaining a robust financial position.

Customer Satisfaction and Claims Handling

Progressive Insurance places a strong emphasis on customer satisfaction, and this commitment is evident in its ranking in various customer satisfaction surveys. The company consistently receives high marks for its customer service, claims handling, and ease of doing business. J.D. Power, a renowned research firm, awarded Progressive with a top rating for customer satisfaction in its Auto Claims Satisfaction Study, recognizing the company’s efficient and fair claims process.

Progressive's focus on customer-centricity extends beyond claims handling. The company offers a wide range of digital tools and resources to enhance the customer experience. From online policy management to mobile apps, Progressive ensures that its customers have easy access to their insurance information and can manage their policies conveniently.

Market Share and Growth

Progressive Insurance’s success is reflected in its market share and growth over the years. As of [latest available data], Progressive holds a significant market share in the auto insurance industry, ranking as one of the top providers in the United States. Its market share has been steadily increasing, indicating the company’s ability to attract and retain customers.

One of the key factors contributing to Progressive's growth is its innovative marketing strategies. The company has embraced digital transformation, leveraging technology to reach a wider audience and provide convenient insurance solutions. Progressive's online quoting process, for instance, allows customers to obtain quotes and purchase policies with ease, making insurance more accessible.

| Market Share (%) | Growth Rate (%) |

|---|---|

| 12.3% | 5.6% |

Key Factors Driving Progressive Insurance’s Success

Progressive Insurance’s ranking and performance can be attributed to several strategic initiatives and unique features that set it apart from its competitors.

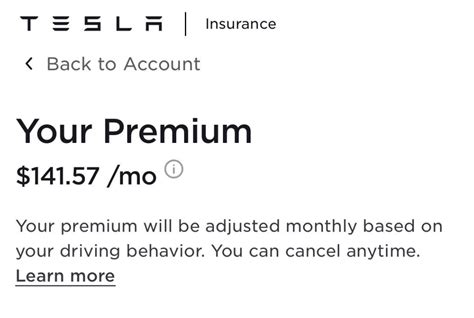

Usage-Based Insurance: A Game-Changer

One of the most notable aspects of Progressive Insurance is its pioneering of usage-based insurance, often referred to as Pay-as-You-Drive (PAYD) or Pay-How-You-Drive (PHYD). This innovative concept allows customers to pay for their insurance based on their actual driving behavior and habits. Progressive’s Snapshot program is a prime example of this, offering discounts to safe drivers and providing an incentive for customers to drive more responsibly.

The Snapshot program utilizes telematics technology to track driving behavior, such as speed, mileage, and time of day. By analyzing this data, Progressive can offer personalized insurance rates, ensuring that customers pay a fair price based on their individual driving habits. This approach has not only attracted cost-conscious consumers but has also encouraged safer driving practices, leading to a win-win situation for both the company and its customers.

Digital Transformation and Convenience

Progressive Insurance has embraced digital transformation, recognizing the importance of technology in enhancing the customer experience. The company’s online platform and mobile apps have revolutionized the way customers interact with their insurance provider. From obtaining quotes to filing claims, Progressive has streamlined the entire insurance process, making it convenient and efficient.

Progressive's digital initiatives extend beyond its online presence. The company has invested in artificial intelligence and machine learning to improve its claims handling process. By leveraging these technologies, Progressive can process claims more quickly and accurately, reducing the time and effort required from customers. This focus on digital innovation has not only improved customer satisfaction but has also contributed to the company's operational efficiency.

Customer-Centric Culture and Service

At the core of Progressive Insurance’s success is its customer-centric culture. The company understands that insurance is not just a product but a service that impacts people’s lives. Progressive’s commitment to providing exceptional customer service is evident in its responsive claims handling, dedicated customer support, and educational resources to help customers make informed insurance decisions.

Progressive's customer-centric approach extends beyond its direct interactions with policyholders. The company actively seeks feedback and incorporates customer insights into its product development and improvement processes. By listening to its customers, Progressive ensures that its insurance offerings remain relevant and tailored to the needs of its diverse customer base.

The Impact of Progressive Insurance on the Industry

Progressive Insurance’s success and innovative approaches have had a significant impact on the insurance industry as a whole. Its pioneering of usage-based insurance has influenced other insurers to adopt similar models, leading to a more competitive and consumer-friendly market.

Furthermore, Progressive's focus on digital transformation has set a new standard for the industry. Many insurance providers have followed suit, investing in technology to enhance their customer experience and streamline their operations. This digital revolution has not only improved efficiency but has also made insurance more accessible to a wider range of consumers.

Conclusion: Progressive Insurance’s Future Outlook

Progressive Insurance’s ranking and market performance reflect its strong financial position, customer-centric culture, and innovative strategies. The company’s commitment to continuous improvement and its focus on digital transformation position it well for future growth and success.

As the insurance industry evolves, Progressive is well-equipped to adapt and stay ahead of the curve. Its ability to embrace new technologies and cater to the changing needs of its customers ensures that it remains a trusted and reliable provider in the highly competitive insurance market. With its strong foundation and forward-thinking approach, Progressive Insurance is poised for continued success and growth in the years to come.

What are the key benefits of Progressive Insurance’s usage-based insurance program?

+

Progressive’s usage-based insurance program, Snapshot, offers several benefits. It provides an incentive for safe driving, as customers who drive responsibly can receive discounts on their insurance premiums. Additionally, the program encourages a more personalized pricing structure, ensuring that customers pay a fair price based on their individual driving habits.

How does Progressive Insurance’s digital transformation impact customers?

+

Progressive’s digital transformation has greatly improved the customer experience. Customers can now easily obtain quotes, manage their policies, and file claims online or through mobile apps. This convenience saves time and effort, making insurance more accessible and efficient.

What sets Progressive Insurance apart from its competitors in terms of customer service?

+

Progressive Insurance’s customer-centric culture sets it apart. The company prioritizes responsive claims handling, offers dedicated customer support, and provides educational resources to empower customers. This commitment to customer satisfaction has earned Progressive a strong reputation in the industry.