Tesla Insurance State

In the ever-evolving landscape of the automotive industry, Tesla, the pioneer of electric vehicles, has taken a bold step by venturing into the realm of insurance. With a mission to provide comprehensive coverage tailored specifically for Tesla owners, the company has launched its own insurance program, known as Tesla Insurance. This innovative move not only showcases Tesla's commitment to offering a holistic ownership experience but also disrupts the traditional insurance market, challenging the status quo and setting new standards.

Tesla Insurance: Revolutionizing the Automotive Insurance Industry

Tesla Insurance, introduced by the visionary automaker, represents a paradigm shift in the way insurance services are delivered and experienced. By leveraging its extensive understanding of electric vehicles and advanced driver-assistance systems (ADAS), Tesla aims to provide a more accurate and fair pricing model for its customers. This initiative underscores the company’s dedication to ensuring that Tesla owners receive the best possible coverage while enjoying the unique features and technologies that make Tesla vehicles stand out.

The launch of Tesla Insurance is not merely a strategic business move; it is a testament to the company's unwavering focus on customer satisfaction and innovation. Tesla recognizes that insurance is an integral part of vehicle ownership, and by offering insurance services directly, the company can better cater to the specific needs and characteristics of its vehicles and drivers.

Understanding the Need for Specialized Insurance

Tesla vehicles, with their cutting-edge technology and unique design, present a distinct set of considerations when it comes to insurance. The company’s fleet of electric cars, equipped with advanced safety features and autonomous driving capabilities, offers an experience that traditional insurance providers may struggle to accurately assess and price.

For instance, Tesla's Autopilot, a sophisticated driver-assistance system, significantly reduces the risk of accidents, making Tesla vehicles some of the safest on the road. However, the traditional insurance model, which often relies on historical data and industry averages, may not fully account for the safety advantages offered by Tesla's technology. This discrepancy can lead to higher insurance premiums for Tesla owners, despite the reduced risk profile.

Furthermore, the maintenance and repair of Tesla vehicles often require specialized knowledge and equipment, which can drive up costs. Traditional insurance policies may not adequately cover these unique aspects, leaving Tesla owners vulnerable to unexpected financial burdens. By offering specialized insurance, Tesla aims to address these specific challenges, providing coverage that is both comprehensive and cost-effective.

The Benefits of Tesla Insurance

Tesla Insurance offers a host of advantages that cater specifically to the needs of Tesla owners. Here are some key benefits:

- Tailored Coverage: Tesla Insurance understands the unique features and safety advantages of Tesla vehicles. By offering tailored coverage, it ensures that customers receive the right level of protection without overpaying for features they don't need.

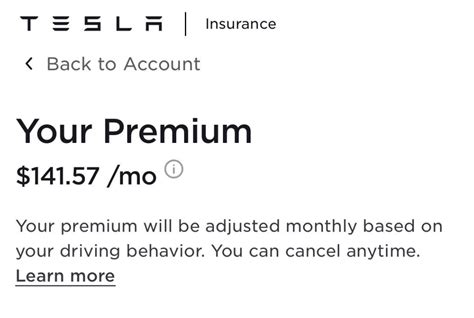

- Fair Pricing: Based on its extensive data and insights into Tesla vehicles, Tesla Insurance can provide more accurate pricing. This means Tesla owners can expect premiums that are fair and reflective of the actual risk profile of their vehicles.

- Comprehensive Protection: Tesla Insurance covers a wide range of scenarios, including accidents, theft, and damage. It also provides coverage for specialized repairs, ensuring that Tesla vehicles are restored to their original condition using genuine parts and expert technicians.

- Streamlined Claims Process: With Tesla Insurance, customers can benefit from a simplified and efficient claims process. The company's direct involvement in the insurance business means quicker resolution of claims, reducing the stress and hassle typically associated with insurance claims.

- Bundled Services: Tesla Insurance can be bundled with other Tesla services, offering customers a seamless and integrated ownership experience. This includes the option to bundle insurance with vehicle financing, maintenance plans, and even charging solutions, providing a convenient and cost-effective solution.

By offering these benefits, Tesla Insurance not only provides peace of mind to Tesla owners but also enhances the overall ownership experience. It demonstrates Tesla's commitment to providing a holistic and customer-centric approach, ensuring that every aspect of the Tesla journey, from purchase to maintenance and insurance, is seamlessly integrated and optimized.

Tesla Insurance by State: A State-by-State Analysis

As Tesla Insurance continues to expand its reach across the United States, it is essential to delve into the specifics of its availability and coverage on a state-by-state basis. Understanding the unique regulatory environments and market dynamics in each state provides valuable insights into the adoption and success of Tesla’s insurance program.

State-Specific Challenges and Opportunities

The insurance industry is highly regulated, and each state has its own set of laws and regulations governing insurance practices. These regulations can impact the availability, pricing, and coverage options offered by Tesla Insurance. For instance, states with more stringent regulations may pose challenges in terms of obtaining the necessary approvals and licenses for Tesla to operate as an insurer.

However, these state-specific challenges also present opportunities for Tesla to innovate and adapt its insurance offerings to meet local needs. By working closely with state regulators, Tesla can develop insurance products that comply with local laws while still delivering the unique benefits and advantages that set Tesla Insurance apart.

Additionally, the varying insurance markets across states offer Tesla a chance to fine-tune its insurance model. In states with a competitive insurance landscape, Tesla Insurance can position itself as a disruptor, offering more affordable rates and innovative coverage options. On the other hand, in states with a more concentrated insurance market, Tesla's entry can drive greater competition, leading to better deals and services for consumers.

State-by-State Availability and Coverage

Tesla Insurance is currently available in several states across the U.S., with plans to expand its reach to additional states in the coming years. Here is an overview of Tesla Insurance’s availability and coverage by state:

| State | Availability | Coverage Highlights |

|---|---|---|

| California | Available | Comprehensive coverage for all Tesla models, including Autopilot and Full Self-Driving capabilities. Offers accident forgiveness and roadside assistance. |

| Texas | Available | Provides specialized coverage for Tesla's unique features, such as battery degradation protection. Includes rental car coverage and accident forgiveness. |

| New Jersey | Available | Offers competitive rates and tailored coverage for Tesla owners. Includes coverage for repairs using genuine Tesla parts and specialized technicians. |

| Illinois | In Pilot Phase | Currently in a pilot program, Tesla Insurance is offering limited coverage to select Tesla owners in Illinois. The pilot aims to gather data and feedback to refine the insurance offering before a full rollout. |

| Florida | In Development | Tesla is working towards obtaining the necessary approvals to launch Tesla Insurance in Florida. Expected coverage details include specialized repair services and enhanced roadside assistance. |

| Massachusetts | Pending Approval | Tesla has submitted an application to the Massachusetts Division of Insurance to offer Tesla Insurance in the state. Once approved, Tesla Insurance will provide comprehensive coverage tailored to Tesla's advanced technology. |

| New York | Not Yet Available | Tesla is exploring options to enter the New York insurance market. The company is engaging with state regulators to understand the requirements and potential challenges. |

It's important to note that Tesla Insurance's availability and coverage can change over time as the company expands its operations and navigates the regulatory landscape in each state. Tesla owners are encouraged to check the official Tesla Insurance website for the most up-to-date information on availability and coverage options in their respective states.

The Future of Tesla Insurance: Expanding Horizons

As Tesla Insurance gains traction and proves its worth, the future looks bright for this innovative insurance program. Tesla’s commitment to continuous improvement and its focus on customer satisfaction position Tesla Insurance to become a leading player in the automotive insurance industry.

Expanding Coverage and Services

Tesla Insurance is poised to expand its coverage and services to meet the evolving needs of Tesla owners. As the company introduces new vehicle models and technologies, such as the highly anticipated Cybertruck and the next-generation Roadster, Tesla Insurance will adapt its coverage to ensure comprehensive protection for these advanced vehicles.

Additionally, Tesla Insurance is likely to enhance its services by offering more flexible and customizable coverage options. This could include the ability for customers to tailor their policies based on their specific driving habits, preferences, and usage patterns. By leveraging data analytics and machine learning, Tesla Insurance can provide personalized recommendations and pricing, further optimizing the insurance experience for Tesla owners.

Collaborations and Partnerships

Tesla’s innovative approach to insurance has caught the attention of industry leaders and potential partners. As Tesla Insurance continues to grow, collaborations and partnerships with established insurance companies and technology providers could further enhance its offerings.

By partnering with insurance experts, Tesla can leverage their expertise in risk assessment and claims management, ensuring that Tesla Insurance remains financially sound and resilient. Additionally, collaborations with technology companies can drive innovation in areas such as digital claims processing, real-time risk assessment, and telematics-based insurance, further differentiating Tesla Insurance in the market.

Global Expansion

Tesla’s global presence and reputation as a pioneer in electric vehicles present a significant opportunity for Tesla Insurance to expand internationally. As Tesla continues its global expansion, introducing its vehicles to new markets, Tesla Insurance can follow suit, offering specialized coverage to Tesla owners around the world.

The launch of Tesla Insurance in international markets would require careful consideration of local regulations and market dynamics. However, Tesla's established brand recognition and its commitment to innovation make it well-positioned to navigate these challenges and offer a unique insurance proposition to Tesla owners globally.

Conclusion: A Bright Future for Tesla Insurance

Tesla Insurance represents a bold step forward in the automotive industry, challenging the traditional insurance model and offering a more customer-centric and innovative approach. By understanding the unique characteristics of Tesla vehicles and their drivers, Tesla Insurance provides specialized coverage that is both fair and comprehensive.

As Tesla Insurance expands its reach across the United States and potentially into international markets, it will continue to shape the insurance landscape, setting new standards for customer satisfaction and technological innovation. With its commitment to continuous improvement and its focus on delivering an exceptional ownership experience, Tesla Insurance is poised to become a leading force in the insurance industry, revolutionizing how we insure and protect our vehicles.

Can Tesla Insurance be customized to my specific needs?

+Yes, Tesla Insurance offers customizable coverage options to cater to the unique needs of Tesla owners. You can tailor your policy to include specific features such as battery degradation protection, roadside assistance, and accident forgiveness. Tesla’s goal is to provide flexible and personalized insurance solutions.

How does Tesla Insurance compare to traditional insurance providers in terms of pricing?

+Tesla Insurance aims to provide competitive pricing by leveraging its deep understanding of Tesla vehicles and their safety features. By analyzing extensive data, Tesla can offer fair and accurate premiums. However, actual pricing can vary based on factors such as location, driving history, and the specific coverage chosen.

What are the benefits of bundling Tesla Insurance with other Tesla services?

+Bundling Tesla Insurance with other Tesla services, such as vehicle financing or maintenance plans, offers several advantages. It provides a seamless and integrated ownership experience, simplifying the management of your Tesla-related expenses. Additionally, bundling can often result in cost savings and streamlined billing.

How does Tesla Insurance handle claims for Tesla vehicles with advanced driver-assistance systems like Autopilot?

+Tesla Insurance is well-equipped to handle claims for Tesla vehicles with advanced driver-assistance systems. The company’s understanding of these technologies allows for efficient and accurate claim assessments. Tesla Insurance aims to provide a streamlined claims process, ensuring a swift resolution and minimizing any inconvenience to the customer.