Affordable Insurance Car

Introduction: A Comprehensive Guide to Protecting Your Ride

Welcome to a detailed exploration of the world of car insurance, where we aim to uncover the secrets to securing the best coverage for your vehicle without breaking the bank. As a driver, understanding the intricacies of insurance policies is essential to making informed choices that safeguard your investment and provide peace of mind. In this article, we delve into the factors that influence affordability, offering practical tips and expert insights to help you navigate the often-complex realm of auto insurance.

The Importance of Affordable Insurance

In today’s fast-paced and cost-conscious world, finding an affordable insurance policy is not merely a luxury but a necessity. It allows individuals to protect their vehicles and themselves from financial setbacks while staying within their budgetary constraints. With a multitude of insurance providers and policies available, the challenge lies in identifying the one that offers the right balance of coverage and cost.

Our Expert Approach

Our team of insurance professionals has extensive experience in the industry, providing us with a unique perspective on the intricacies of auto insurance. Through this guide, we aim to empower you with the knowledge needed to make confident decisions about your coverage. By breaking down complex concepts and offering real-world examples, we strive to ensure that finding affordable insurance is an achievable goal for all drivers.

Understanding the Fundamentals of Car Insurance

The Basics of Auto Insurance Policies

At its core, auto insurance is a contract between you and an insurance provider. It’s a financial safeguard that covers a range of potential risks associated with owning and operating a vehicle. These risks can include accidents, theft, natural disasters, and even legal liabilities. Understanding the different types of coverage and their implications is key to selecting the right policy.

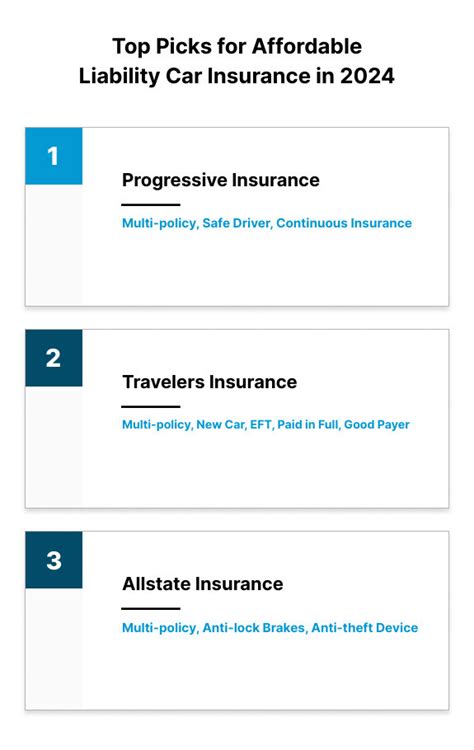

Liability Coverage

Liability insurance is a cornerstone of most auto insurance policies. It provides protection in the event you cause damage to another person’s property or injuries to others. This coverage is mandatory in many regions and is crucial for safeguarding your financial well-being in the event of an accident.

Comprehensive and Collision Coverage

These policies offer protection for your vehicle itself. Collision coverage steps in when your car collides with another vehicle or object, while comprehensive coverage extends to damage caused by non-collision incidents such as theft, vandalism, or natural disasters. While these coverages are optional, they are often recommended to ensure comprehensive protection.

Personal Injury Protection (PIP) and Medical Payments Coverage

These policies focus on the well-being of the insured driver and passengers. PIP covers medical expenses, loss of income, and other related costs, while medical payments coverage specifically addresses medical bills resulting from an accident. These coverages ensure that your health and financial stability are prioritized in the aftermath of an incident.

Factors Influencing Insurance Rates

Insurance providers calculate rates based on a variety of factors, each contributing to the overall cost of your policy. Understanding these factors can help you anticipate and potentially mitigate the costs associated with your insurance.

Your Driving Record

One of the most significant factors in determining insurance rates is your driving history. A clean record with no accidents or violations often leads to lower premiums. Conversely, a history of accidents or traffic violations can result in higher rates. It’s a stark reminder of the impact your driving behavior can have on your insurance costs.

Vehicle Type and Usage

The make, model, and age of your vehicle play a role in insurance rates. Generally, newer and more expensive cars tend to have higher premiums due to their replacement and repair costs. Additionally, the purpose for which you use your vehicle—whether for personal, business, or pleasure—can influence the type and cost of coverage you require.

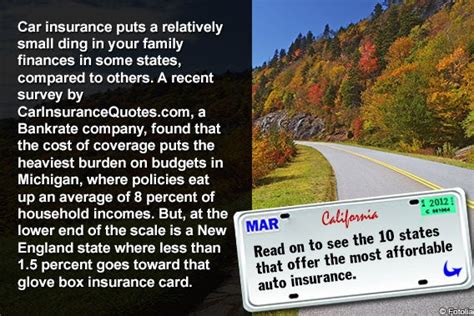

Location and Mileage

Where you live and how far you drive can also impact your insurance rates. High-crime areas or regions with a higher frequency of accidents may result in increased premiums. Similarly, the number of miles you drive annually can influence your policy, with higher mileage often associated with higher rates.

Credit History

Surprisingly, your credit score can also be a factor in determining your insurance rates. Many insurance providers consider credit scores as an indicator of financial responsibility, with higher scores often leading to lower premiums. It’s a reminder that maintaining a strong credit history can have benefits beyond traditional financial transactions.

Strategies for Securing Affordable Car Insurance

Shop Around and Compare Quotes

One of the most effective ways to find affordable insurance is to compare quotes from multiple providers. Each insurer has its own methodology for calculating rates, so exploring various options can reveal significant differences in premiums. Online comparison tools and direct quotes from insurers can provide a comprehensive view of the market, ensuring you make an informed decision.

Bundle Your Policies

Bundling your insurance policies, such as combining auto and home insurance, can often result in substantial savings. Many insurers offer discounts when you bundle multiple policies, recognizing the convenience and loyalty such a decision entails. It’s a strategy that not only saves you money but also streamlines your insurance management.

Opt for Higher Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower premiums. This strategy works best for individuals who are confident in their ability to cover unexpected costs and are comfortable with a higher initial financial burden in the event of an accident or claim.

Explore Discounts and Rewards

Insurance providers often offer a range of discounts and rewards to attract and retain customers. These can include safe driver discounts, loyalty rewards, and discounts for specific occupations or affiliations. By researching and understanding the eligibility criteria for these discounts, you can potentially reduce your insurance costs significantly.

Maintain a Good Driving Record

As mentioned earlier, your driving record is a crucial factor in determining insurance rates. By maintaining a clean record, you not only avoid the immediate consequences of accidents or violations but also position yourself for lower premiums over time. Safe driving is not only a responsible choice but also a financially prudent one.

Real-World Examples and Case Studies

A Tale of Two Drivers

To illustrate the impact of personal factors on insurance rates, let’s consider the hypothetical case of two drivers, John and Sarah.

John, a 30-year-old with a clean driving record, recently purchased a new sedan. He lives in a suburban area with low crime rates and a moderate frequency of accidents. John commutes to work, driving approximately 15,000 miles annually. He has excellent credit and a stable financial history.

Sarah, a 22-year-old student, drives an older compact car. She resides in an urban area with a higher crime rate and a higher frequency of accidents. Sarah uses her vehicle for occasional travel and drives approximately 8,000 miles per year. She has a few minor traffic violations on her record and her credit score is average.

Based on these factors, John is likely to receive lower insurance rates due to his age, driving record, and the characteristics of his location and vehicle. Sarah, on the other hand, may face higher premiums due to her age, driving history, and the nature of her urban environment.

Case Study: The Power of Comparison

Let’s delve into a real-world example to showcase the benefits of shopping around for insurance. Imagine a family seeking auto insurance for their primary vehicle, a mid-range SUV. By obtaining quotes from five different insurers, they discovered a range of premium offers.

| Insurer | Annual Premium |

|---|---|

| A | $1,200 |

| B | $1,450 |

| C | $1,150 |

| D | $1,380 |

| E | $1,520 |

Despite the relatively similar vehicles and driving histories, the family found a $320 difference between the lowest and highest annual premiums. This case study emphasizes the importance of comparison shopping to ensure you’re not overpaying for insurance.

Expert Insights and Industry Trends

The Rise of Telematics and Usage-Based Insurance

The insurance industry is witnessing a transformation with the advent of telematics and usage-based insurance policies. These innovative approaches use real-time data, often collected through smartphone apps or onboard vehicle sensors, to assess driving behavior and provide personalized insurance rates. By incentivizing safe driving habits, these policies offer the potential for significant savings, especially for cautious and defensive drivers.

Insurtech: Disrupting the Traditional Insurance Model

The insurance landscape is being reshaped by the emergence of insurtech startups. These digital-first companies leverage technology to streamline insurance processes, offering convenient online platforms and often providing more competitive rates. Their focus on efficiency and data-driven decision-making challenges traditional insurers to adapt and innovate, ultimately benefiting consumers with improved services and potentially lower costs.

Future Implications and Emerging Trends

Looking ahead, the insurance industry is poised for continued evolution. As autonomous vehicles become a reality and electric cars gain popularity, the traditional insurance model will need to adapt to these technological advancements. Insurers are already exploring ways to integrate these changes into their policies, ensuring that the insurance landscape remains dynamic and responsive to the needs of modern drivers.

Conclusion: Empowering Your Insurance Journey

Navigating the world of car insurance is a complex but essential task for any vehicle owner. By understanding the fundamentals, exploring your options, and adopting strategic approaches, you can secure affordable insurance that provides the protection you need without straining your finances. Remember, the key to success lies in education, comparison, and a willingness to explore the evolving landscape of insurance.

As you embark on your insurance journey, keep in mind the expert tips and real-world examples provided in this guide. Stay informed, shop around, and make confident decisions to ensure your vehicle and your financial well-being are adequately protected.

FAQ

How often should I review my car insurance policy?

+It’s recommended to review your insurance policy annually or whenever significant changes occur in your life, such as a new vehicle purchase, a move to a different location, or a change in marital status. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

What are some common mistakes to avoid when choosing car insurance?

+Common pitfalls include underestimating the value of comprehensive and collision coverage, failing to explore all available discounts, and neglecting to read the fine print of your policy. Understanding the nuances of your coverage and taking advantage of discounts can lead to significant savings.

Can I switch car insurance providers mid-policy term?

+Absolutely! You have the freedom to switch providers at any time, even mid-policy. However, it’s essential to ensure a smooth transition by coordinating with both the new and previous insurers. Make sure your new policy is active before canceling the old one to avoid any gaps in coverage.