Health Insurance For Missouri

Navigating Health Insurance Options in Missouri: A Comprehensive Guide

In the realm of health insurance, understanding the intricacies and nuances of coverage is paramount, especially when exploring options within a specific state like Missouri. This comprehensive guide aims to provide an in-depth analysis of health insurance plans available in Missouri, shedding light on the key aspects that individuals and families should consider.

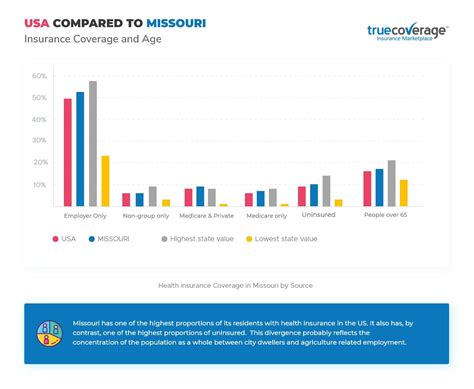

Understanding the Health Insurance Landscape in Missouri

Missouri, known for its vibrant cities and diverse landscapes, also presents a unique healthcare market with various insurance providers offering an array of plans. The state’s healthcare system, governed by federal and state regulations, ensures that residents have access to a range of affordable and comprehensive health insurance options.

One of the key considerations for Missourians is the availability of Affordable Care Act (ACA) compliant plans. These plans, mandated by the federal government, provide essential health benefits and protect consumers from excessive out-of-pocket costs. Missouri has embraced the ACA, offering a robust marketplace where individuals can compare and enroll in qualified health plans.

The state's Department of Insurance, Financial Institutions and Professional Registration plays a pivotal role in regulating and overseeing the insurance industry. This regulatory body ensures that insurance companies adhere to state laws, preventing fraud and ensuring consumer protection. It also provides valuable resources and guidance for Missouri residents navigating the complex world of health insurance.

Key Considerations for Health Insurance in Missouri

Plan Types and Coverage Options

When exploring health insurance in Missouri, individuals are presented with a variety of plan types, each tailored to different needs and budgets. Major Medical plans, also known as comprehensive plans, offer extensive coverage for a wide range of medical services, including doctor visits, hospital stays, and prescription medications. These plans are ideal for those seeking comprehensive protection against unexpected health issues.

For individuals with more specific healthcare needs, Specialty Plans such as dental, vision, and long-term care insurance, are available. These plans focus on particular areas of healthcare, providing dedicated coverage and often more affordable premiums compared to comprehensive plans.

Additionally, Missouri offers Short-Term Health Insurance plans, which provide temporary coverage for individuals between jobs or those who may not qualify for other types of insurance. These plans typically offer more limited benefits and shorter coverage periods but can be a cost-effective solution for those in transitional phases.

| Plan Type | Description |

|---|---|

| Major Medical | Comprehensive coverage for a range of medical services. |

| Specialty Plans | Focused coverage for specific healthcare needs (e.g., dental, vision) |

| Short-Term Health Insurance | Temporary coverage for transitional periods. |

Understanding Premiums and Out-of-Pocket Costs

One of the critical aspects of choosing a health insurance plan is understanding the financial implications. Premiums, the amount paid monthly to maintain coverage, can vary significantly based on the plan type, provider, and individual factors such as age and location. In Missouri, the average monthly premium for a major medical plan can range from 300 to 600, with costs varying depending on the level of coverage and deductible chosen.

Out-of-pocket costs, which include deductibles, copayments, and coinsurance, are another essential consideration. These costs represent the portion of healthcare expenses that the insured individual must pay directly. It's crucial to select a plan with a deductible and copayment structure that aligns with one's financial capabilities and expected healthcare needs.

For instance, a plan with a higher deductible may offer lower monthly premiums but require the insured to pay more out-of-pocket when utilizing healthcare services. Conversely, a plan with a lower deductible and higher premiums may be more suitable for individuals who anticipate frequent doctor visits or require specialized medical care.

Navigating the Enrollment Process

Enrolling in a health insurance plan in Missouri involves several key steps to ensure a smooth and successful process.

Assessing Eligibility and Coverage Needs

The first step is to assess one’s eligibility for different types of health insurance plans. Missouri residents may qualify for Medicaid, a government-funded program that provides healthcare coverage for low-income individuals and families. Those who do not qualify for Medicaid can explore private insurance plans offered by various providers.

When assessing coverage needs, individuals should consider factors such as their current health status, anticipated medical expenses, and the need for specialized services. For example, individuals with chronic conditions may benefit from plans with lower copayments for prescription medications or plans that cover specific therapies.

Comparing Plan Options and Benefits

Missouri’s health insurance marketplace, known as HealthCare.gov, offers a user-friendly platform for comparing available plans. Individuals can filter plans based on their specific needs, such as preferred providers, prescription drug coverage, and out-of-pocket costs. It’s crucial to review the summary of benefits and coverage to understand what is included in each plan.

Additionally, Missouri residents can explore employer-sponsored health insurance if they are employed. Many employers offer group health insurance plans, which can provide more comprehensive coverage and often come with lower premiums due to the group rate. Assessing the benefits and costs of employer-sponsored plans is an essential step in the enrollment process.

Maximizing Health Insurance Benefits

Once enrolled in a health insurance plan, Missouri residents can take several steps to maximize the benefits and ensure they receive the most value from their coverage.

Understanding Network Providers and In-Network Care

Most health insurance plans in Missouri operate within a Preferred Provider Organization (PPO) network. This means that the plan has negotiated rates with specific healthcare providers, known as in-network providers. Utilizing in-network providers can result in lower out-of-pocket costs and streamlined claims processes.

It's essential to review the plan's provider directory to ensure that one's preferred doctors and hospitals are included in the network. If a particular provider is not in-network, individuals may incur higher costs or have limited coverage for those services.

Managing Prescription Drug Costs

Prescription medications can be a significant expense for many individuals. Missouri residents can take advantage of their health insurance plan’s prescription drug coverage to manage these costs effectively. Many plans offer preferred drug lists, which outline the medications covered at different cost levels.

By understanding the plan's drug formulary and utilizing generic or preferred medications, individuals can minimize their out-of-pocket expenses. Additionally, some plans offer mail-order options for prescription refills, providing convenience and potential cost savings.

Staying Informed and Seeking Support

Navigating the complex world of health insurance can be challenging, but Missouri residents have access to various resources and support systems to assist them.

Utilizing Insurance Provider Resources

Health insurance providers in Missouri offer a wealth of resources to help their members understand their coverage and navigate the healthcare system effectively. These resources may include member portals, where individuals can view their benefits, review claims, and access educational materials.

Additionally, many providers offer customer service hotlines or dedicated member support teams. These teams can provide guidance on utilizing benefits, resolving claims issues, and answering specific questions about coverage. It's beneficial to familiarize oneself with these resources and reach out for assistance when needed.

Exploring Community Resources and Support

Missouri is home to numerous community organizations and non-profit groups dedicated to providing healthcare support and advocacy. These organizations often offer resources and programs to assist individuals in accessing healthcare services and understanding their insurance coverage.

For example, the Missouri Foundation for Health is a non-profit organization focused on improving the health and well-being of underserved communities in the state. They provide grants and support to community initiatives, educate residents about healthcare options, and advocate for policy changes to enhance access to quality healthcare.

Future Implications and Policy Considerations

The landscape of health insurance in Missouri is subject to ongoing policy changes and market dynamics. As the state continues to evolve its healthcare system, several key considerations and potential implications emerge.

Policy Initiatives and Market Trends

Missouri’s approach to healthcare policy can significantly impact the availability and affordability of health insurance plans. The state has historically been a leader in healthcare innovation, with initiatives such as the Missouri Health Net, a program designed to improve access to healthcare services for low-income residents.

Looking ahead, Missouri is exploring ways to further enhance healthcare accessibility and affordability. One potential policy initiative is the expansion of Medicaid eligibility, which could provide coverage to a larger portion of the state's population. Additionally, the state is considering measures to incentivize the adoption of value-based care models, which focus on quality outcomes rather than volume of services.

Market Competition and Consumer Choice

The health insurance market in Missouri is characterized by a competitive landscape, with multiple providers offering a diverse range of plans. This competition can drive innovation and provide consumers with a wider array of choices. However, it also presents challenges in terms of plan comparability and understanding the nuances of different offerings.

To navigate this complex market, Missouri residents can benefit from educational resources and tools that simplify plan comparisons. The state's Department of Insurance plays a crucial role in providing transparency and ensuring that consumers have the information they need to make informed choices. Additionally, consumer advocacy groups can play a vital role in advocating for clear and concise plan information, making it easier for individuals to select the right coverage for their needs.

Addressing Healthcare Disparities and Access

Despite the availability of health insurance plans, Missouri, like many states, faces challenges in ensuring equitable access to healthcare for all residents. Disparities in access and outcomes persist, particularly among underserved communities and rural areas.

Addressing these disparities requires a multifaceted approach, including targeted initiatives to improve healthcare infrastructure in underserved regions. The state can also explore strategies to enhance healthcare provider diversity and cultural competency, ensuring that all Missourians receive care that is sensitive to their unique needs and backgrounds.

Furthermore, promoting health literacy and empowering individuals to make informed healthcare decisions is crucial. Missouri can invest in educational campaigns and community engagement initiatives to raise awareness about preventive care, chronic disease management, and the importance of regular healthcare check-ups. By empowering residents to take an active role in their health, the state can reduce healthcare disparities and improve overall population health.

Conclusion: Empowering Missourians with Health Insurance Knowledge

Navigating health insurance options in Missouri is a complex but crucial process for ensuring access to quality healthcare. By understanding the landscape of available plans, assessing individual needs, and exploring resources and support systems, Missouri residents can make informed decisions about their health insurance coverage.

As the state continues to evolve its healthcare policies and market dynamics, staying informed and engaged is essential. Missourians can advocate for their healthcare needs, participate in community initiatives, and leverage the resources available to them. With a comprehensive understanding of health insurance, individuals can take control of their healthcare journey and make choices that align with their unique circumstances and priorities.

What is the average cost of health insurance in Missouri?

+The average cost of health insurance in Missouri varies based on factors such as age, location, and plan type. For major medical plans, the average monthly premium can range from 300 to 600. However, costs can be lower for specialty plans or short-term insurance, depending on individual needs and coverage requirements.

How can I find out if I qualify for Medicaid in Missouri?

+Eligibility for Medicaid in Missouri is determined by factors such as income, family size, and certain disability or medical conditions. You can find out if you qualify by visiting the official Medicaid website for Missouri or by contacting your local Medicaid office. They can provide guidance on the application process and assist you in determining your eligibility.

Are there any tax benefits associated with health insurance in Missouri?

+Yes, there are tax benefits associated with health insurance in Missouri. Premium tax credits are available to individuals and families who purchase qualified health plans through the Health Insurance Marketplace. These tax credits can help offset the cost of premiums, making health insurance more affordable. Additionally, certain medical expenses, such as out-of-pocket costs and qualified long-term care expenses, may be tax-deductible.