Staet Farm Insurance

Welcome to an in-depth exploration of State Farm Insurance, one of the leading insurance providers in the United States. With a rich history spanning over a century, State Farm has established itself as a trusted name in the industry, offering a comprehensive range of insurance products and services to millions of customers nationwide. In this article, we will delve into the company's origins, its evolution, and the key factors that have contributed to its success and longevity.

A Century of Service: State Farm’s Legacy

State Farm Insurance was founded in 1922 by George J. Mecherle, a former farmer and insurance salesman. Mecherle’s vision was to create an insurance company that would provide affordable and reliable coverage to the hardworking people of America, particularly those in the agricultural sector. The company’s humble beginnings can be traced back to a small office in Bloomington, Illinois, where Mecherle and his team began offering auto insurance policies to local farmers.

Over the years, State Farm experienced rapid growth, expanding its product offerings to include home, life, and health insurance. The company's focus on customer service and its commitment to providing comprehensive coverage at competitive rates quickly gained recognition. State Farm's innovative approach to insurance, coupled with its strong financial foundation, positioned it as a dominant force in the industry.

Today, State Farm is a household name, known for its iconic green triangle logo and its unwavering dedication to its customers. With over 19,000 agents and more than 70,000 employees, the company has grown into a multi-billion-dollar enterprise, offering a diverse range of insurance and financial services to individuals, families, and businesses across the United States.

The Comprehensive Coverage Offered by State Farm

State Farm’s comprehensive insurance portfolio caters to a wide array of customer needs. Here’s an overview of some of the key products and services they provide:

Auto Insurance

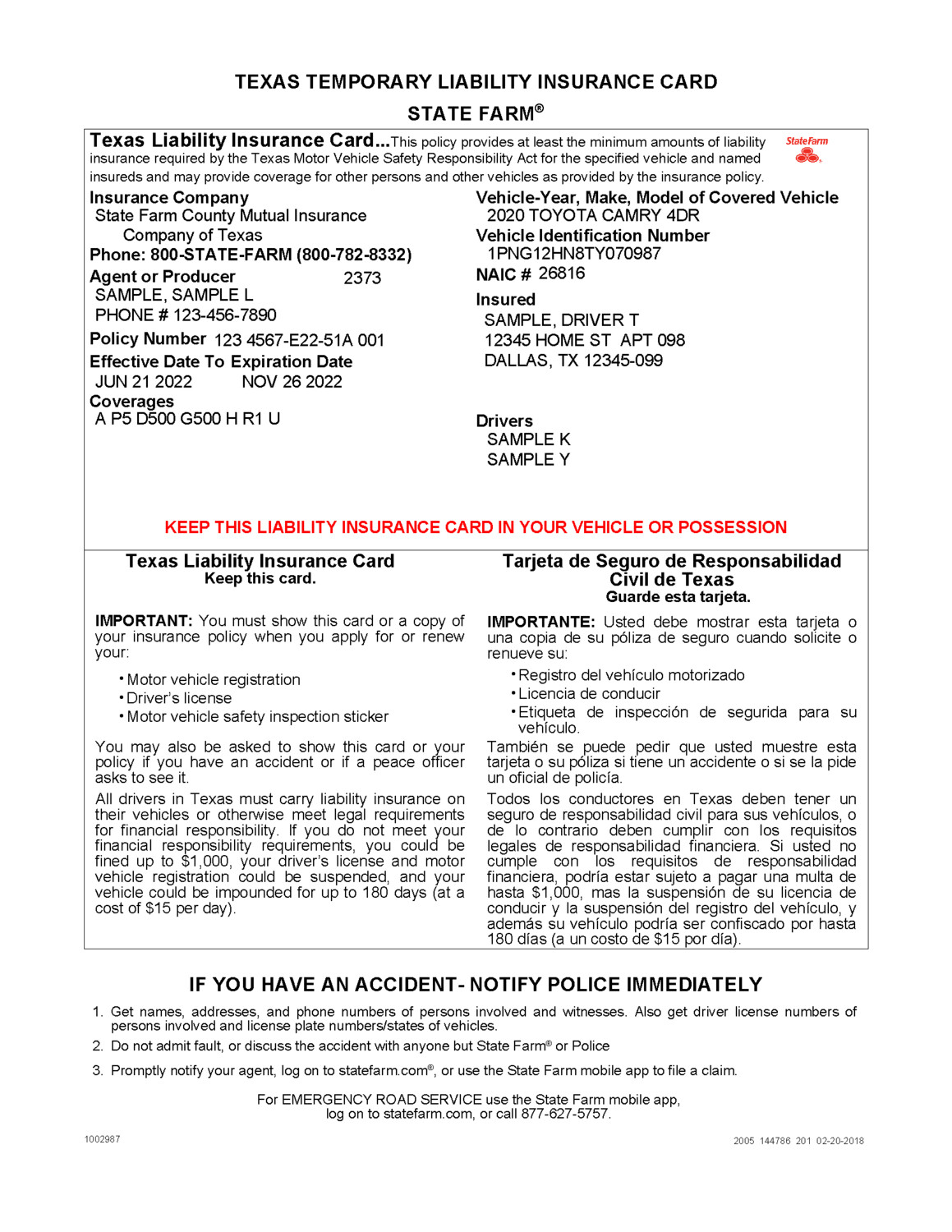

State Farm’s auto insurance policies are tailored to meet the diverse requirements of drivers. They offer coverage for standard vehicles, classic cars, motorcycles, and even rideshare drivers. The company provides a range of options, including liability, collision, comprehensive, and personal injury protection (PIP) coverage. State Farm’s innovative Drive Safe & Save™ program rewards safe driving habits with potential discounts on premiums.

Homeowners Insurance

For homeowners, State Farm offers customizable coverage options to protect against various risks, including damage from natural disasters, theft, and liability claims. Their policies cover the structure of the home, personal belongings, and additional living expenses in the event of a covered loss. State Farm also provides specialized coverage for unique homes, such as condos, mobile homes, and rental properties.

Life Insurance

State Farm’s life insurance products provide financial protection for individuals and their families. The company offers term life, whole life, and universal life insurance policies, allowing customers to choose the coverage that best fits their needs and budget. State Farm’s life insurance policies can help secure your family’s future, cover mortgage payments, or provide funds for college education.

Health Insurance

In the realm of health insurance, State Farm offers a variety of plans, including individual and family policies, as well as group health plans for employers. Their comprehensive health insurance options cover medical, dental, and vision care, ensuring that policyholders have access to the healthcare services they need. State Farm also provides supplemental health insurance products, such as accident and critical illness coverage.

Additional Insurance Products

State Farm’s insurance portfolio extends beyond the traditional categories. They offer specialty insurance products for boats, RVs, and collector vehicles. Additionally, State Farm provides business insurance, including commercial property, liability, and workers’ compensation coverage, to protect small businesses and entrepreneurs.

Innovation and Technology: State Farm’s Digital Revolution

In an era defined by technological advancements, State Farm has embraced digital transformation to enhance the customer experience. The company has invested heavily in innovative tools and platforms to streamline the insurance process and provide convenient, accessible services to its policyholders.

One of State Farm's notable technological advancements is the introduction of the State Farm® Mobile App. This app allows customers to manage their insurance policies, file claims, and access important documents from their smartphones or tablets. Policyholders can also utilize the app's digital tools, such as the Claim Tracker and the Virtual Estimator, to track the progress of their claims and estimate repair costs.

State Farm has also embraced artificial intelligence (AI) and machine learning technologies to improve customer service and claim processing. Their virtual assistant, Amelia, powered by AI, provides 24/7 assistance to customers, answering common queries and guiding them through various insurance-related processes. Additionally, State Farm utilizes predictive analytics to identify potential risks and offer tailored insurance solutions to its customers.

Community Engagement and Social Responsibility

Beyond its insurance offerings, State Farm has a strong commitment to community engagement and social responsibility. The company actively supports various charitable initiatives and causes, both locally and nationally. State Farm’s agents and employees regularly participate in community service projects, volunteering their time and resources to make a positive impact.

One notable initiative is the State Farm Neighborhood of Good®, a platform that connects individuals and organizations with volunteer opportunities and resources. Through this program, State Farm encourages and empowers its employees, agents, and customers to give back to their communities, fostering a culture of goodwill and social awareness.

Awards and Recognitions

State Farm’s commitment to excellence and customer satisfaction has been recognized by numerous industry awards and accolades. The company has consistently ranked highly in customer satisfaction surveys, earning top spots in J.D. Power’s studies for auto insurance and homeowners insurance. State Farm has also been recognized for its financial strength and stability, with ratings from renowned agencies such as A.M. Best and Standard & Poor’s.

Additionally, State Farm has been acknowledged for its innovative use of technology, receiving awards for its mobile app and digital tools. The company's dedication to community involvement has also been celebrated, with accolades for its corporate social responsibility initiatives.

Conclusion: A Trusted Companion in the Insurance Journey

State Farm Insurance has undoubtedly left an indelible mark on the insurance industry, standing as a testament to the power of customer-centric innovation and financial stability. With a century of experience and a commitment to continuous improvement, State Farm continues to adapt and thrive in a rapidly changing market.

As we conclude this exploration of State Farm, it is evident that the company's success lies in its ability to provide comprehensive, affordable insurance solutions while prioritizing customer service and community engagement. State Farm's legacy inspires confidence, assuring policyholders that they have a trusted companion on their insurance journey.

What are the key benefits of choosing State Farm Insurance?

+State Farm offers a wide range of insurance products and services, ensuring customers can find comprehensive coverage tailored to their needs. The company’s focus on customer service and its commitment to innovation make it a reliable and trusted choice for insurance. Additionally, State Farm’s financial stability provides peace of mind to policyholders.

How does State Farm’s Drive Safe & Save™ program work?

+The Drive Safe & Save™ program rewards safe driving habits with potential discounts on auto insurance premiums. State Farm utilizes advanced technology to track driving behavior, and policyholders who maintain safe driving records may be eligible for reduced rates.

What sets State Farm apart from other insurance providers?

+State Farm’s commitment to customer service and its innovative approach to insurance set it apart. The company’s focus on digital transformation and its utilization of AI and machine learning enhance the customer experience. Additionally, State Farm’s strong financial standing and community engagement initiatives make it a trusted and socially responsible choice.