Insurance Offers

Insurance, a financial safety net in an unpredictable world, is a vital aspect of personal and business planning. The diverse array of insurance offers available today can be overwhelming, making it crucial to understand the options and make informed choices. This article delves into the world of insurance, exploring the various types, their benefits, and how to navigate the market to find the best deals.

Unraveling the Insurance Landscape

The insurance industry is vast, offering protection against an extensive range of risks. From life insurance, which provides financial security to loved ones in the event of a premature death, to health insurance, ensuring access to medical care, insurance products are tailored to meet specific needs.

Life Insurance: Securing Your Legacy

Life insurance is an essential component of any financial plan, especially for those with dependents. It offers a lump-sum payment, known as a death benefit, to the policyholder’s beneficiaries upon their death. This benefit can help cover funeral expenses, pay off debts, or provide ongoing financial support for the family.

| Life Insurance Types | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specific period, typically 10-30 years. It's ideal for those seeking temporary coverage, such as covering a mortgage or providing for children's education. |

| Whole Life Insurance | A permanent insurance policy that provides coverage for the policyholder's entire life. It also accumulates cash value, which can be borrowed against or withdrawn. |

| Universal Life Insurance | Offers flexibility in premium payments and death benefit amounts. The policyholder can adjust the coverage and premiums to meet changing needs. |

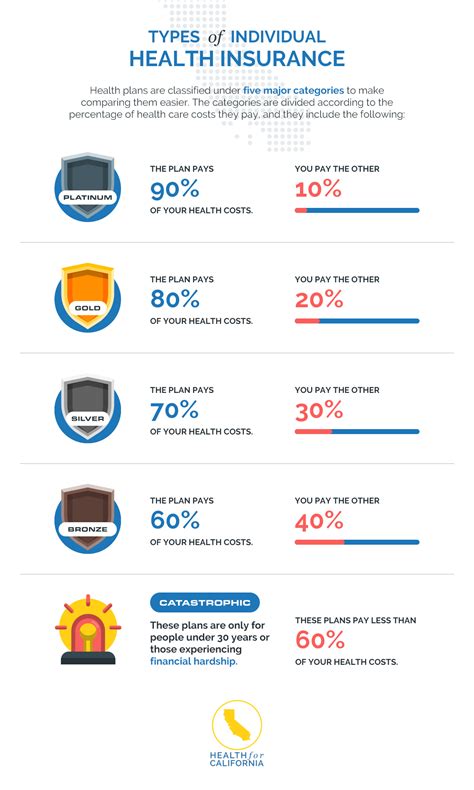

Health Insurance: Your Wellbeing, Covered

Health insurance is designed to protect individuals and families from the high costs of medical care. With the rising expenses of healthcare, having adequate health insurance is crucial.

Key considerations when choosing a health insurance plan include:

- Network Providers: Ensure your preferred healthcare providers are in-network to avoid higher out-of-network costs.

- Deductibles and Co-pays: Understand the annual deductible and co-payment amounts, as these can significantly impact your out-of-pocket expenses.

- Prescription Drug Coverage: Check if your required medications are covered and at what cost.

- Specialist Care: If you require specialist care, ensure the plan covers it without excessive additional costs.

Navigating the Insurance Market

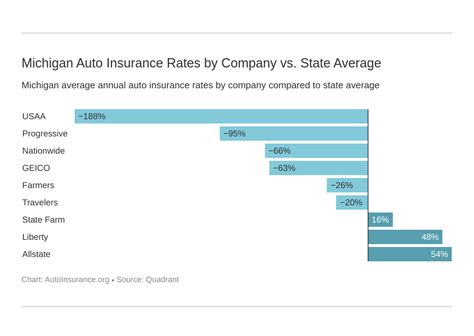

With so many insurance providers and products available, finding the best offer can be challenging. Here are some strategies to navigate the market effectively:

Compare Quotes

Obtain quotes from multiple insurance companies to compare prices and coverage. Online comparison tools can be a convenient way to do this, but it’s essential to read the fine print to understand the exact coverage and exclusions.

Understand Your Needs

Before shopping for insurance, assess your specific needs. Consider your financial situation, health status, and any potential risks you wish to insure against. This self-assessment will guide you toward the most suitable insurance products.

Check Provider Reputation

Research the reputation of insurance providers. Look for customer reviews and ratings to ensure the company has a history of prompt claim settlements and good customer service.

Seek Professional Advice

Consider consulting an independent insurance broker or financial advisor. They can provide unbiased advice and help you find the best insurance offers tailored to your needs. Brokers often have access to a wider range of products than what’s available to the general public.

The Future of Insurance

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of insurance:

Digitalization and Personalization

Insurance companies are increasingly embracing digital technologies to enhance the customer experience. From online policy management to real-time claim tracking, digitalization is streamlining the insurance process.

Additionally, the use of data analytics is allowing insurers to personalize policies based on individual risk profiles. This shift towards personalized insurance is expected to continue, offering customers more tailored coverage options.

Insurtech Innovations

Insurtech, a fusion of insurance and technology, is revolutionizing the industry. Startups and established insurers are developing innovative solutions, such as usage-based insurance for vehicles and smart home insurance that integrates with home automation systems.

These innovations aim to provide more accurate risk assessment, better customer experiences, and potentially lower premiums for policyholders.

Sustainable Insurance

With growing environmental concerns, the insurance industry is also moving towards more sustainable practices. This includes developing insurance products to support renewable energy initiatives and offering incentives for environmentally friendly behaviors.

FAQ

What is the average cost of life insurance?

+

The cost of life insurance varies widely based on factors such as age, health, and the amount of coverage needed. On average, a 30-year-old in good health can expect to pay around 25-35 per month for a 500,000 term life insurance policy. However, rates can range from as low as 10 to over $100 per month, depending on individual circumstances.

How does health insurance work for pre-existing conditions?

+

In many countries, including the United States, the Affordable Care Act (ACA) prohibits health insurance providers from denying coverage or charging more for pre-existing conditions. This means that even if you have a pre-existing condition, you can still obtain health insurance and your condition must be covered. However, there may be a waiting period before certain services related to the pre-existing condition are covered.

What is the difference between comprehensive and collision insurance for vehicles?

+

Comprehensive insurance covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. Collision insurance, on the other hand, specifically covers damage to your vehicle resulting from a collision with another vehicle or object. Both are optional coverages, but often required if you’re leasing or financing your vehicle.

In a rapidly changing world, insurance offers a vital layer of protection. By understanding the different types of insurance and how to navigate the market, you can make informed decisions to secure your financial future and peace of mind.