Comparing Auto Insurance Quotes

Securing the right auto insurance coverage is an essential step for every vehicle owner. With numerous insurance providers offering a wide range of policies, it can be a daunting task to find the most suitable and cost-effective option. Comparing auto insurance quotes is a crucial process that empowers you to make an informed decision, ensuring you get the best coverage for your needs at a competitive price. This comprehensive guide will delve into the intricacies of comparing auto insurance quotes, providing you with the tools and knowledge to navigate this complex landscape with ease.

Understanding the Basics of Auto Insurance

Auto insurance is a legal requirement in most countries and states, providing financial protection against physical damage, bodily injury, and other liabilities resulting from traffic accidents, natural disasters, and theft. It is a contract between you (the policyholder) and the insurance company, where you agree to pay a premium, and in return, the company promises to financially compensate you for losses as defined in your policy.

The primary types of auto insurance coverage include:

- Liability Coverage: Covers damages you cause to others in an accident, including bodily injury and property damage.

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle caused by incidents other than collisions, such as theft, fire, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for injuries sustained in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

The Importance of Comparing Quotes

Comparing auto insurance quotes is a critical step in the insurance shopping process. It allows you to evaluate the coverage options and premiums offered by different insurance companies, ensuring you get the best value for your money. With multiple insurers in the market, rates for similar coverage can vary significantly, so taking the time to compare quotes can lead to substantial savings.

Additionally, comparing quotes provides an opportunity to assess the reputation and financial stability of the insurance companies. You can read reviews, check ratings from independent agencies like AM Best and Standard & Poor's, and consider the company's claims handling process and customer service reputation. This ensures you choose a reliable insurer who will be there for you when you need them.

Factors Affecting Auto Insurance Quotes

Several factors influence the auto insurance quotes you receive. Understanding these factors can help you tailor your coverage needs and potentially lower your premiums.

Vehicle Details

The make, model, and year of your vehicle play a significant role in determining your insurance rates. Newer, more expensive, or luxury vehicles typically cost more to insure, as they are more expensive to repair or replace. Additionally, vehicles with advanced safety features or anti-theft systems may qualify for discounts.

Driver Information

Your driving record and personal details are key factors in insurance pricing. Insurers consider your age, gender, marital status, and driving history, including any accidents, violations, or claims you’ve made in the past. Younger, less experienced drivers and those with a history of accidents or traffic violations may pay higher premiums.

Coverage and Deductibles

The level of coverage you choose and your deductible amount directly impact your insurance premiums. Higher coverage limits and lower deductibles generally result in higher premiums, while lower coverage limits and higher deductibles can lead to lower premiums. It’s important to find the right balance between coverage and cost to suit your needs and budget.

Location and Usage

Your location and how you use your vehicle also affect your insurance rates. Urban areas often have higher rates due to increased traffic and risk of accidents or theft. Additionally, your daily commute distance and whether you use your vehicle for personal or business purposes can influence your rates.

Steps to Compare Auto Insurance Quotes

Now that we understand the basics and factors affecting auto insurance quotes, let’s delve into the process of comparing quotes.

Step 1: Gather Information

Before requesting quotes, gather all the necessary information about yourself, your vehicle, and your driving history. This includes your vehicle’s make, model, year, and VIN number; your driving record; and details about any previous insurance policies you’ve had.

Step 2: Determine Your Coverage Needs

Consider your specific needs and budget to determine the type and level of coverage you require. Assess the minimum coverage required by your state, but also consider additional coverage options that may be beneficial, such as collision, comprehensive, or uninsured motorist coverage.

Step 3: Research Insurance Companies

Research and shortlist reputable insurance companies. Look for companies with strong financial stability ratings and good customer service reputations. You can use online resources, reviews, and ratings to help you make informed decisions.

Step 4: Request Quotes

Request quotes from your shortlisted insurance companies. You can do this online, over the phone, or in person. Provide accurate and detailed information to ensure you receive accurate quotes. Compare the quotes based on the coverage offered, deductibles, and premium amounts.

Step 5: Evaluate and Negotiate

Carefully evaluate the quotes you receive, considering not just the premium amounts but also the coverage details and the reputation of the insurance company. If you find a quote that suits your needs, you can negotiate with the insurer to see if they can offer a better rate or additional discounts.

Step 6: Choose the Right Policy

Once you’ve found the best quote, review the policy documents carefully to ensure the coverage matches what was quoted. Ensure you understand the terms and conditions, including any exclusions or limitations. If everything is in order, you can proceed with purchasing the policy.

Additional Tips for Saving on Auto Insurance

In addition to comparing quotes, there are several strategies you can employ to save money on your auto insurance:

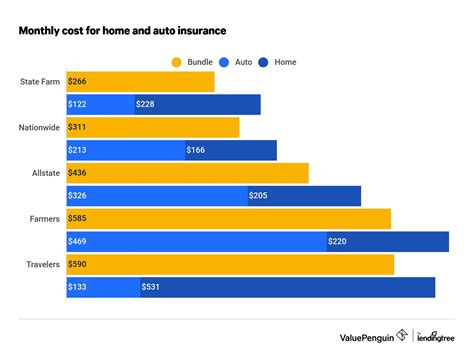

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance, with them.

- Safe Driving Discounts: Maintain a clean driving record to qualify for safe driver discounts. Some companies also offer discounts for completing defensive driving courses.

- Telematics Programs: Consider enrolling in a usage-based insurance program where your driving behavior is monitored through a device or app. Safe driving habits can lead to significant discounts.

- Review Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure you're not paying for unnecessary features or lacking essential protection.

- Pay Annually or Semi-Annually: Some insurance companies offer discounts for paying your premium in full annually or semi-annually rather than monthly.

The Future of Auto Insurance

The auto insurance industry is evolving rapidly, with technological advancements and changing consumer needs driving innovation. The rise of connected cars, autonomous vehicles, and telematics is shaping the future of auto insurance.

Connected cars and autonomous vehicles are expected to significantly impact auto insurance. With advanced safety features and reduced accident risks, these vehicles could lead to lower insurance premiums. Additionally, telematics programs that monitor driving behavior in real-time are becoming more common, offering personalized insurance rates based on individual driving habits.

Emerging Technologies and Their Impact

Emerging technologies like artificial intelligence, machine learning, and blockchain are also transforming the auto insurance landscape. AI and machine learning algorithms can analyze vast amounts of data to identify patterns and trends, helping insurers make more accurate risk assessments and offer personalized insurance products.

Blockchain technology, with its decentralized and secure nature, has the potential to revolutionize insurance claims processing. It can streamline the verification and settlement of claims, reducing fraud and improving efficiency.

The Role of Digital Transformation

Digital transformation is another key trend in the auto insurance industry. Insurers are increasingly leveraging digital technologies to enhance the customer experience, improve operational efficiency, and reduce costs. Online quote comparisons, digital claims processing, and mobile apps for policy management are just a few examples of how technology is transforming the industry.

Conclusion

Comparing auto insurance quotes is a vital step in ensuring you get the best coverage for your needs at a competitive price. By understanding the factors that influence insurance rates and following a systematic process to compare quotes, you can make an informed decision and potentially save hundreds of dollars annually. Additionally, keeping abreast of the latest trends and technologies in the auto insurance industry can help you stay ahead of the curve and make the most of the evolving insurance landscape.

What is the average cost of auto insurance in the US?

+The average cost of auto insurance in the US varies significantly depending on factors like location, vehicle type, and driver profile. According to the Insurance Information Institute, the national average annual premium was 1,674 in 2021. However, rates can range from under 1,000 to over $3,000 based on individual circumstances.

How often should I compare auto insurance quotes?

+It’s recommended to compare auto insurance quotes annually or whenever your circumstances change significantly. This could include buying a new vehicle, moving to a different location, getting married, or turning 25 (a significant age for insurance rates). Regular comparisons ensure you’re always getting the best deal.

Can I switch insurance companies mid-policy term?

+Yes, you can switch insurance companies at any time, even mid-policy term. However, if you cancel your current policy before it expires, you may be subject to a short-rate cancellation fee. It’s important to understand the terms of your current policy and calculate the cost-effectiveness of switching before making a decision.