Most Cheap Car Insurance

Finding the most affordable car insurance can be a challenging task, as rates can vary significantly depending on various factors. However, by understanding the key elements that influence insurance costs and employing strategic approaches, it is possible to secure the most cost-effective coverage for your vehicle. This comprehensive guide will delve into the essential factors to consider when searching for the cheapest car insurance, offering valuable insights and practical tips to help you make informed decisions.

Understanding Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. Let’s explore some of the primary considerations that impact insurance rates:

Driver Profile and History

Your personal driving record and demographic details are among the most significant factors in car insurance pricing. Insurers closely examine your age, gender, marital status, and driving history to assess the level of risk they assume by insuring you. Younger drivers, particularly males, are often considered higher-risk and face higher premiums. Similarly, a history of accidents or traffic violations can lead to increased insurance costs.

Moreover, the length of your driving experience and the type of vehicle you drive also influence rates. New drivers with limited experience and those operating high-performance or luxury vehicles typically pay more for insurance.

| Driver Profile Factor | Impact on Insurance Rates |

|---|---|

| Age | Younger drivers (especially males) often pay more. |

| Gender | Statistically, males tend to have higher premiums. |

| Marital Status | Married individuals may receive lower rates. |

| Driving History | Accidents and violations increase costs. |

| Experience | New drivers with less experience pay more. |

| Vehicle Type | High-performance or luxury vehicles may have higher premiums. |

Location and Usage

Your geographic location and how you use your vehicle also impact insurance rates. Areas with higher population densities and higher crime rates often have elevated insurance costs due to the increased risk of accidents and vehicle theft. Additionally, the purpose for which you use your vehicle matters; personal use generally incurs lower rates compared to commercial use or frequent long-distance travel.

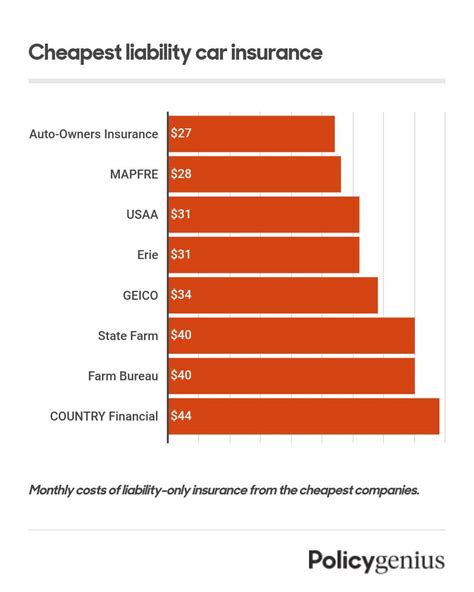

Coverage and Deductibles

The type and extent of coverage you choose directly affect your insurance premium. Comprehensive and collision coverage, which provide protection against damage to your vehicle, typically come with higher costs. On the other hand, liability-only coverage, which covers damage to others’ property or injuries caused by you, is generally more affordable.

Furthermore, the deductible you select can significantly impact your premium. A higher deductible means you'll pay more out-of-pocket before your insurance coverage kicks in, but it can lead to lower monthly premiums. It's essential to strike a balance between affordability and the level of protection you require.

Strategies to Find the Cheapest Car Insurance

Now that we’ve explored the key factors influencing car insurance costs, let’s delve into some practical strategies to help you secure the most affordable coverage for your vehicle.

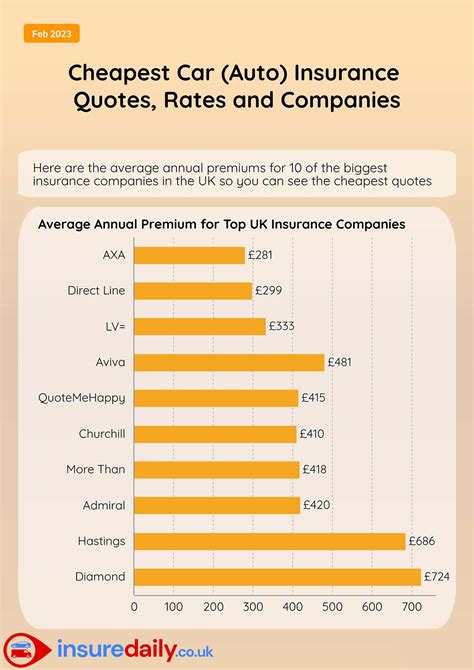

Compare Multiple Quotes

One of the most effective ways to find the cheapest car insurance is to obtain quotes from multiple providers. Insurance rates can vary significantly between companies, so it’s crucial to compare at least three to five quotes to ensure you’re getting the best deal. Online comparison tools and insurance brokerages can be invaluable resources for this purpose.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling your policies with the same provider. Many insurers offer substantial discounts for customers who bundle multiple policies, making it a cost-effective strategy to reduce your overall insurance expenses.

Improve Your Driving Record

Your driving record is a significant factor in determining your insurance rates. Maintaining a clean driving record by avoiding accidents and traffic violations can help you secure lower premiums. Additionally, completing a defensive driving course or other safe driving programs may entitle you to discounts from some insurers.

Raise Your Deductible

As mentioned earlier, your deductible directly impacts your insurance premium. By increasing your deductible, you can potentially lower your monthly payments. However, it’s essential to ensure that the increased deductible is manageable for you financially in the event of an accident or claim.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach where your insurance premium is based on your actual driving behavior and mileage. This type of insurance can be beneficial for low-mileage drivers or those with safe driving habits, as it rewards safe and responsible driving with lower premiums.

Shop Around Regularly

Insurance rates can fluctuate over time, and it’s important to stay updated on the market. Regularly shopping around for car insurance quotes, especially during significant life changes such as moving to a new location or purchasing a new vehicle, can help you identify potential savings opportunities.

Review Coverage and Policy Add-Ons

Review your current insurance policy regularly to ensure you’re not paying for coverage you don’t need. Assess whether your vehicle’s value has decreased and adjust your coverage accordingly. Additionally, be cautious of add-ons or optional coverage that may not be necessary for your specific situation.

Frequently Asked Questions

How can I lower my car insurance premium if I’m a young driver?

+

Young drivers often face higher insurance premiums due to their perceived risk. To mitigate this, consider adding a more experienced driver, such as a parent, to your policy as a named driver. Additionally, maintaining a clean driving record and completing a recognized safe driving course can lead to discounts. Finally, explore usage-based insurance, which may offer lower rates for safe driving habits.

Are there any discounts available for senior drivers?

+

Yes, many insurance providers offer discounts for senior drivers. These can include age-related discounts, safe driver discounts, and loyalty discounts for long-term customers. Additionally, some insurers provide discounts for taking defensive driving courses or maintaining a clean driving record.

What factors influence the cost of insurance for luxury vehicles?

+

The cost of insurance for luxury vehicles is influenced by several factors. These include the vehicle’s make and model, as luxury cars often have higher repair and replacement costs. Additionally, the risk of theft or vandalism is higher for such vehicles, leading to increased insurance premiums. The driver’s profile and location also play significant roles in determining the cost of insurance for luxury vehicles.

How do insurance companies determine the cost of insurance for commercial vehicles?

+

Insurance companies assess various factors when determining the cost of insurance for commercial vehicles. These include the type of business, the vehicle’s usage (e.g., delivery, passenger transport), the driver’s profile, and the geographic location. Additionally, the coverage required for commercial vehicles, such as liability, cargo, and physical damage, can impact the overall cost of insurance.

By understanding the factors that influence car insurance costs and employing the strategies outlined above, you can take control of your insurance expenses and secure the most affordable coverage for your vehicle. Remember, regular comparison shopping and staying informed about the latest insurance trends are key to making the most cost-effective decisions for your insurance needs.