Life Insurance What Is

Life insurance is a crucial financial instrument that provides a safety net for individuals and their loved ones, offering peace of mind and financial security during uncertain times. It serves as a vital tool for ensuring that families are protected and can maintain their standard of living even in the face of unforeseen circumstances.

In today's world, where life is full of uncertainties, life insurance stands as a testament to our preparedness and responsibility. It is a contract between an individual (the policyholder) and an insurance company, where the insurer promises to pay a sum of money (the death benefit) to the beneficiaries upon the policyholder's death. This benefit can be a lifeline for those left behind, helping to cover various expenses, from funeral costs to long-term financial obligations.

The concept of life insurance is not merely about providing a monetary payout; it's about safeguarding the future. It ensures that the policyholder's family can continue to pay for essential expenses such as mortgage payments, college tuition, and daily living costs. Moreover, it can provide a financial cushion to help the beneficiaries maintain their current lifestyle and achieve their long-term financial goals.

Understanding the Basics of Life Insurance

Life insurance policies come in various types, each designed to meet different needs and circumstances. The two primary categories are term life insurance and permanent life insurance, with several sub-types within each category.

Term Life Insurance

Term life insurance, as the name suggests, provides coverage for a specific period, or “term.” This type of policy is often chosen for its affordability and simplicity. The policyholder selects a coverage amount and a term, typically ranging from 10 to 30 years. If the policyholder dies during the term, the beneficiaries receive the death benefit. However, if the term expires without a claim, the coverage ends, and no benefit is paid out.

One of the key advantages of term life insurance is its cost-effectiveness. It is ideal for individuals who are looking for temporary coverage to protect their family during specific life stages, such as while their children are young or while they are paying off a mortgage. The premiums for term life insurance are generally lower compared to permanent life insurance, making it accessible to a wider range of people.

| Pros of Term Life Insurance | Cons of Term Life Insurance |

|---|---|

| Affordable premiums | No cash value if policy expires |

| Flexibility to choose term length | May not cover long-term needs |

| Suitable for specific life stages | Renewal may lead to higher premiums |

Permanent Life Insurance

Permanent life insurance, on the other hand, provides coverage for the policyholder’s entire life, as long as premiums are paid. This type of policy offers more than just a death benefit; it also builds cash value over time. The cash value can be used for various purposes, such as paying for policy premiums, borrowing against the policy, or even withdrawing cash in times of financial need.

Permanent life insurance is often chosen by individuals who want lifelong coverage and the added benefit of a cash accumulation component. The two main types of permanent life insurance are whole life insurance and universal life insurance, each with its unique features and flexibility.

| Pros of Permanent Life Insurance | Cons of Permanent Life Insurance |

|---|---|

| Lifetime coverage | Higher premiums compared to term life |

| Builds cash value | May require strict premium payments |

| Can be used for various financial needs | Complex policy structure |

The Importance of Life Insurance in Financial Planning

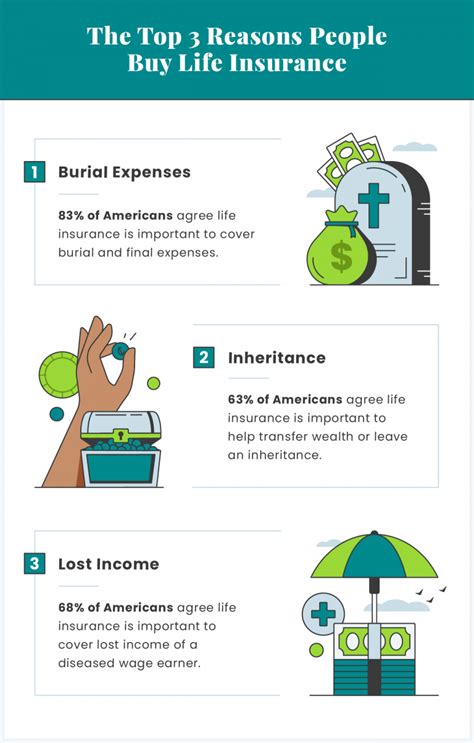

Life insurance plays a pivotal role in comprehensive financial planning. It ensures that an individual’s death does not result in financial hardship for their loved ones. The death benefit can help cover immediate expenses, replace lost income, and fund long-term financial goals.

For instance, the death benefit can be used to pay off outstanding debts, such as credit card balances or personal loans. It can also be instrumental in funding a child's education, starting a new business, or even covering the costs of long-term care for elderly family members. Life insurance provides a financial safety net that can protect a family's financial stability and help them navigate through difficult times.

Key Benefits of Life Insurance

- Financial Security: Life insurance provides a guaranteed payout upon the policyholder’s death, ensuring financial stability for beneficiaries.

- Income Replacement: The death benefit can replace the income lost due to the policyholder’s death, helping families maintain their standard of living.

- Debt Repayment: It can be used to pay off outstanding debts, reducing the financial burden on beneficiaries.

- Education Funding: Life insurance proceeds can be used to fund a child’s education, ensuring they have the resources for their future.

- Business Continuity: For business owners, life insurance can provide funds to keep the business running or to buy out a partner’s share in the event of their death.

Choosing the Right Life Insurance Policy

Selecting the appropriate life insurance policy is a critical decision that requires careful consideration of one’s financial situation, goals, and needs. The process involves evaluating different types of policies, understanding their features and benefits, and determining the right coverage amount.

Factors to Consider

- Coverage Needs: Determine the amount of coverage required to meet your specific needs, such as paying off debts, funding education, or providing long-term financial support for your family.

- Budget: Evaluate your financial situation and decide on a premium amount that aligns with your budget and financial goals.

- Policy Type: Choose between term life insurance for temporary coverage or permanent life insurance for lifelong protection and potential cash value accumulation.

- Health and Lifestyle: Your health and lifestyle can impact the premiums and terms of your policy. Be transparent about your health and activities to ensure accurate coverage.

Expert Tips for Choosing Life Insurance

- Consider your family’s future needs and financial goals when determining coverage.

- Review and compare policies from multiple insurance companies to find the best fit.

- Understand the policy’s terms and conditions, including any exclusions or limitations.

- Seek advice from a financial advisor or insurance broker to ensure you make an informed decision.

Conclusion

Life insurance is a powerful tool for securing the financial future of your loved ones. It provides a safety net that ensures your family can maintain their financial stability and continue to pursue their dreams, even in the event of your untimely death. By understanding the different types of life insurance and carefully selecting a policy that aligns with your needs, you can have peace of mind knowing that your family is protected.

Remember, life insurance is not just about financial security; it's about leaving a legacy of love and care for your family. It allows you to plan for their well-being and provides a sense of assurance that they will be taken care of, no matter what the future holds.

Frequently Asked Questions

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on your personal financial situation and goals. A common rule of thumb is to have 10-15 times your annual income as coverage. However, it’s best to consult a financial advisor or use an online life insurance calculator to get a more accurate estimate based on your specific needs.

Can I change my life insurance policy after purchasing it?

+

Yes, you can typically make changes to your life insurance policy, such as increasing or decreasing coverage, adding or removing beneficiaries, or switching policy types. However, it’s important to review the terms and conditions of your policy, as some changes may require a medical exam or impact your premiums.

What happens if I miss a premium payment on my life insurance policy?

+

Missing a premium payment can have serious consequences for your life insurance policy. Depending on the terms of your policy, you may have a grace period of 30 days or more to make the payment before the policy lapses. If the policy lapses, you may have the option to reinstate it, but this often requires evidence of insurability and may result in higher premiums.

Can I cancel my life insurance policy if I no longer need it?

+

Yes, you can cancel your life insurance policy at any time. However, it’s important to consider the potential consequences. If you have a term life insurance policy, you may not receive any refund of premiums paid. For permanent life insurance policies with cash value, you may be able to surrender the policy and receive the cash value, although this may be subject to surrender charges and tax implications.