Health Insurance For Family Of 4

Health insurance is an essential aspect of modern life, providing individuals and families with the peace of mind that comes from knowing they are financially protected in the event of unexpected medical emergencies. In the United States, navigating the health insurance system can be complex, especially when it comes to securing coverage for a family of four. This article aims to guide readers through the process of understanding and acquiring suitable health insurance, offering insights and strategies to make informed decisions.

Understanding Health Insurance for a Family of Four

For a family of four, health insurance serves as a vital safety net, ensuring that all family members have access to necessary medical care without facing crippling financial burdens. The complexity arises from the diverse range of plans, coverage options, and costs available in the market. It is crucial to approach this decision-making process with a comprehensive understanding of the family's unique needs and the intricacies of the insurance landscape.

Assessing Family Needs

Every family has its own set of healthcare requirements. Some families may have members with pre-existing conditions that require regular specialist care, while others might prioritize coverage for preventive services and check-ups. Assessing these needs is the first step towards choosing the right health insurance plan.

- Consider the age and health status of each family member.

- Identify any chronic illnesses or ongoing medical treatments.

- Evaluate the frequency of doctor visits and potential future healthcare needs.

- Understand the importance of mental health coverage and its relevance to your family.

Exploring Plan Options

Health insurance plans can vary significantly in terms of coverage, cost, and provider networks. It is essential to explore a range of options to find the best fit for your family's needs.

- Network-Based Plans: These plans offer coverage for a specific network of healthcare providers. Choosing a plan with a robust network can ensure that your preferred doctors and hospitals are covered.

- HMO (Health Maintenance Organization) Plans: HMOs typically offer lower premiums but require members to choose a primary care physician and obtain referrals for specialist care. They often have more limited provider networks.

- PPO (Preferred Provider Organization) Plans: PPOs offer more flexibility, allowing members to see any provider within their network without referrals. However, they tend to have higher premiums.

- EPO (Exclusive Provider Organization) Plans: EPOs are similar to PPOs but only cover in-network providers. They often have lower premiums but limited flexibility.

Key Considerations for Family Health Insurance

When selecting health insurance for a family of four, several key factors should be carefully considered to ensure comprehensive and cost-effective coverage.

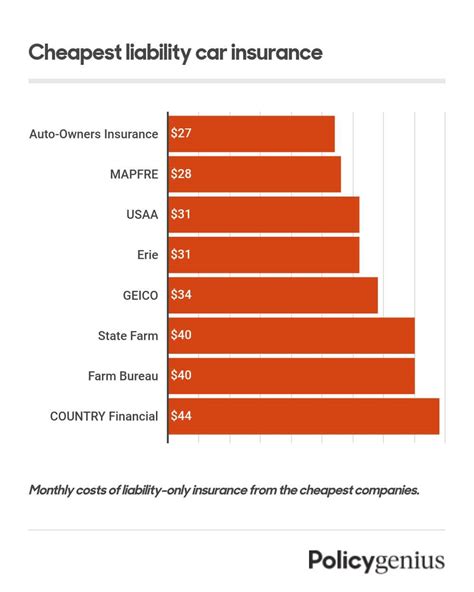

Premiums and Out-of-Pocket Costs

Premiums are the regular payments made to maintain health insurance coverage. Out-of-pocket costs refer to expenses such as deductibles, copayments, and coinsurance that policyholders must pay before the insurance coverage kicks in. These costs can significantly impact a family's budget, so it is essential to find a balance between affordable premiums and manageable out-of-pocket expenses.

| Plan Type | Premium | Out-of-Pocket Costs |

|---|---|---|

| HMO | Lower | Higher |

| PPO | Higher | Lower |

| EPO | Moderate | Moderate to High |

Coverage Benefits and Limitations

Understanding the coverage benefits and limitations of different plans is crucial. This includes examining what services are covered, such as prescription drugs, mental health services, maternity care, and specialized treatments. It is also important to review any exclusions or limitations that may impact your family's specific healthcare needs.

- Check for coverage of essential health benefits, including preventive care, emergency services, and hospitalization.

- Inquire about the prescription drug formulary and ensure that any necessary medications are covered.

- Evaluate maternity and pediatric coverage, especially if your family includes pregnant women or young children.

- Review any limits on annual or lifetime benefits to ensure they are sufficient for your family's potential healthcare needs.

Network of Providers

The network of healthcare providers associated with a plan can significantly impact your family's healthcare experience. Ensure that your preferred doctors, specialists, and hospitals are included in the plan's network. If you frequently travel or have family members who live in different regions, consider plans with national or broad regional networks.

Family-Specific Features

Some health insurance plans offer family-oriented features that can enhance coverage and support. These may include:

- Dental and vision coverage options specifically designed for families.

- Wellness programs that encourage healthy lifestyles and provide incentives.

- Telehealth services for convenient access to medical advice and consultations.

- Dependent coverage beyond the age of 26 for children who may need extended support.

Comparing and Choosing the Right Plan

With a clear understanding of your family's needs and the various plan options, you can now make an informed decision. Compare plans based on the key considerations outlined above, and don't hesitate to seek advice from insurance brokers or financial advisors who specialize in health insurance.

Online Tools and Resources

Utilize online tools and resources to streamline the comparison process. Many insurance providers and third-party websites offer comparison features that allow you to input your family's needs and preferences to generate a list of suitable plans. These tools can provide valuable insights and help narrow down your options.

Seeking Professional Guidance

If you find the process overwhelming, consider consulting with an insurance broker or financial advisor. These professionals can provide personalized advice based on your family's unique circumstances and help you navigate the complexities of health insurance.

Reading Plan Documents

Before making a final decision, carefully review the plan documents and summary of benefits and coverage. These documents provide detailed information about what is covered, the costs associated with different services, and any limitations or exclusions. Ensure that you understand the terms and conditions before committing to a plan.

Enrolling in Family Health Insurance

Once you have chosen the right plan, the next step is enrollment. The process can vary depending on the insurance provider and the type of plan you have selected. Generally, you will need to provide personal and family information, including names, dates of birth, and social security numbers. You may also need to select a primary care physician (if applicable) and choose any additional coverage options, such as dental or vision insurance.

Open Enrollment Periods

In the United States, the Affordable Care Act (ACA) establishes open enrollment periods during which individuals and families can enroll in or change their health insurance plans. These periods typically occur once a year, and missing the deadline may result in limited options for acquiring insurance coverage. However, qualifying life events, such as marriage, birth, or loss of other coverage, can trigger special enrollment periods that allow for changes outside the open enrollment window.

Employer-Provided Insurance

If you or your spouse is employed, check with your employer about their health insurance offerings. Many employers provide health insurance as a benefit, and these plans can often be more comprehensive and cost-effective than individual plans. Additionally, employer-provided insurance may offer family-friendly features and discounted rates.

Maximizing Your Health Insurance Benefits

Once you have enrolled in a health insurance plan, it's essential to understand how to make the most of your coverage. This involves familiarizing yourself with the plan's benefits, utilizing preventive care services, and being mindful of your out-of-pocket expenses.

Understanding Your Plan's Benefits

Take the time to thoroughly understand your health insurance plan's benefits and coverage. This includes knowing the specifics of your coverage, such as the types of services covered, any limits or exclusions, and the costs associated with different medical procedures. Being informed can help you make better healthcare decisions and avoid unexpected expenses.

Utilizing Preventive Care

Most health insurance plans cover a range of preventive care services, such as annual physical exams, immunizations, and screenings for various conditions. Taking advantage of these services can help identify potential health issues early on, when they are often more treatable and less costly to manage. Additionally, many preventive care services are covered at no cost to the patient under the ACA.

Managing Out-of-Pocket Expenses

While health insurance provides valuable financial protection, it's important to be mindful of your out-of-pocket expenses. These can include deductibles, copayments, and coinsurance. By staying informed about your plan's cost-sharing requirements, you can budget effectively and make decisions that minimize your out-of-pocket costs.

- Understand your plan's cost-sharing structure and what you are responsible for paying.

- Consider using in-network providers to avoid higher out-of-network costs.

- Explore options for reducing out-of-pocket costs, such as using generic medications or negotiating medical bills.

FAQs

What is the Affordable Care Act (ACA)?

+

The Affordable Care Act, commonly known as Obamacare, is a federal law that aims to increase the quality and affordability of health insurance for Americans. It established the open enrollment periods for health insurance and mandated that all individuals have health insurance coverage or face a tax penalty (which has since been eliminated). The ACA also expanded Medicaid coverage and required insurance plans to cover pre-existing conditions.

Can I include my extended family members in my health insurance plan?

+

Health insurance plans typically cover immediate family members, which include spouses and dependent children. However, the definition of “dependent children” can vary by plan and may extend coverage to grandchildren, stepchildren, or legally adopted children. Extended family members like aunts, uncles, cousins, or in-laws are generally not covered under a family health insurance plan.

How can I reduce my health insurance costs as a family of four?

+

There are several strategies to reduce health insurance costs for a family of four. These include choosing a plan with a higher deductible and lower premiums, enrolling in government-subsidized plans if eligible, taking advantage of employer-provided insurance if available, and considering health savings accounts (HSAs) to save for future medical expenses.

What should I do if I need to make a claim on my health insurance policy?

+

To make a claim, you will need to provide documentation of the medical services received, including bills, invoices, and any necessary medical records. It’s important to keep accurate records of your healthcare expenses and to follow the specific claim procedures outlined by your insurance provider. This may involve submitting forms or using an online claims portal.

Are there any tax benefits associated with health insurance for families?

+

Yes, there are tax benefits associated with health insurance for families. Premium payments for health insurance plans are generally tax-deductible, which can help reduce your taxable income. Additionally, if you have a high-deductible health plan and a health savings account (HSA), contributions to the HSA are also tax-deductible, and the funds can be used to pay for qualified medical expenses tax-free.