Cheapest Liability Auto Insurance

Finding the cheapest liability auto insurance is a common goal for many drivers, as it can significantly reduce the cost of owning a vehicle. Liability insurance is a fundamental component of car insurance, covering the policyholder's legal responsibility for bodily injury or property damage to others in an accident. This article aims to delve into the world of affordable liability auto insurance, providing a comprehensive guide to help drivers secure the best value for their insurance needs.

Understanding Liability Auto Insurance

Liability auto insurance is a crucial aspect of any car insurance policy. It offers protection in the event of an accident caused by the policyholder, ensuring that the financial burden of injuries or damages sustained by others is covered. This type of insurance is mandatory in most states and is designed to protect drivers from potentially devastating financial consequences.

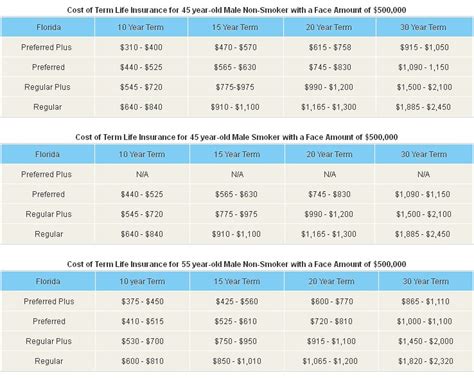

The cost of liability insurance can vary significantly depending on several factors, including the driver's location, driving history, and the chosen coverage limits. Understanding these variables is key to securing the cheapest liability auto insurance.

Coverage Limits

Coverage limits refer to the maximum amount the insurance company will pay for bodily injury and property damage in an accident. These limits are typically represented as three numbers, such as 100/300/100, which stand for 100,000 bodily injury per person</em>, <em>300,000 bodily injury per accident, and $100,000 property damage per accident. Choosing higher coverage limits provides more protection but can also increase the insurance premium.

| Coverage Type | Limit |

|---|---|

| Bodily Injury Per Person | $100,000 |

| Bodily Injury Per Accident | $300,000 |

| Property Damage Per Accident | $100,000 |

While higher limits offer more protection, it's important to strike a balance between coverage and affordability. For instance, a policy with limits of 100/300/100 provides a good level of protection for most drivers, but those with high-value assets or who frequently drive in high-risk areas might consider higher limits.

Location and Driving History

The cost of liability insurance can vary greatly depending on where the driver lives and their individual driving record. States with high accident rates or higher population densities often have higher insurance rates. Similarly, drivers with a history of accidents or traffic violations may face higher premiums, as they are considered higher risk by insurance companies.

However, even drivers with a less-than-perfect record can take steps to reduce their insurance costs. Maintaining a clean driving record over time can lead to reduced premiums, as can completing defensive driving courses or enrolling in usage-based insurance programs that reward safe driving habits.

Comparing Auto Insurance Providers

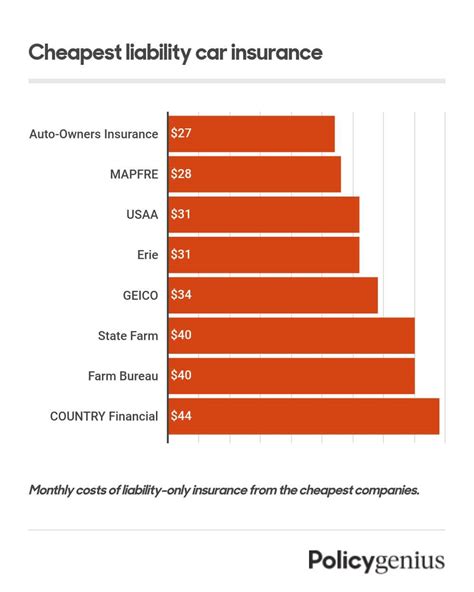

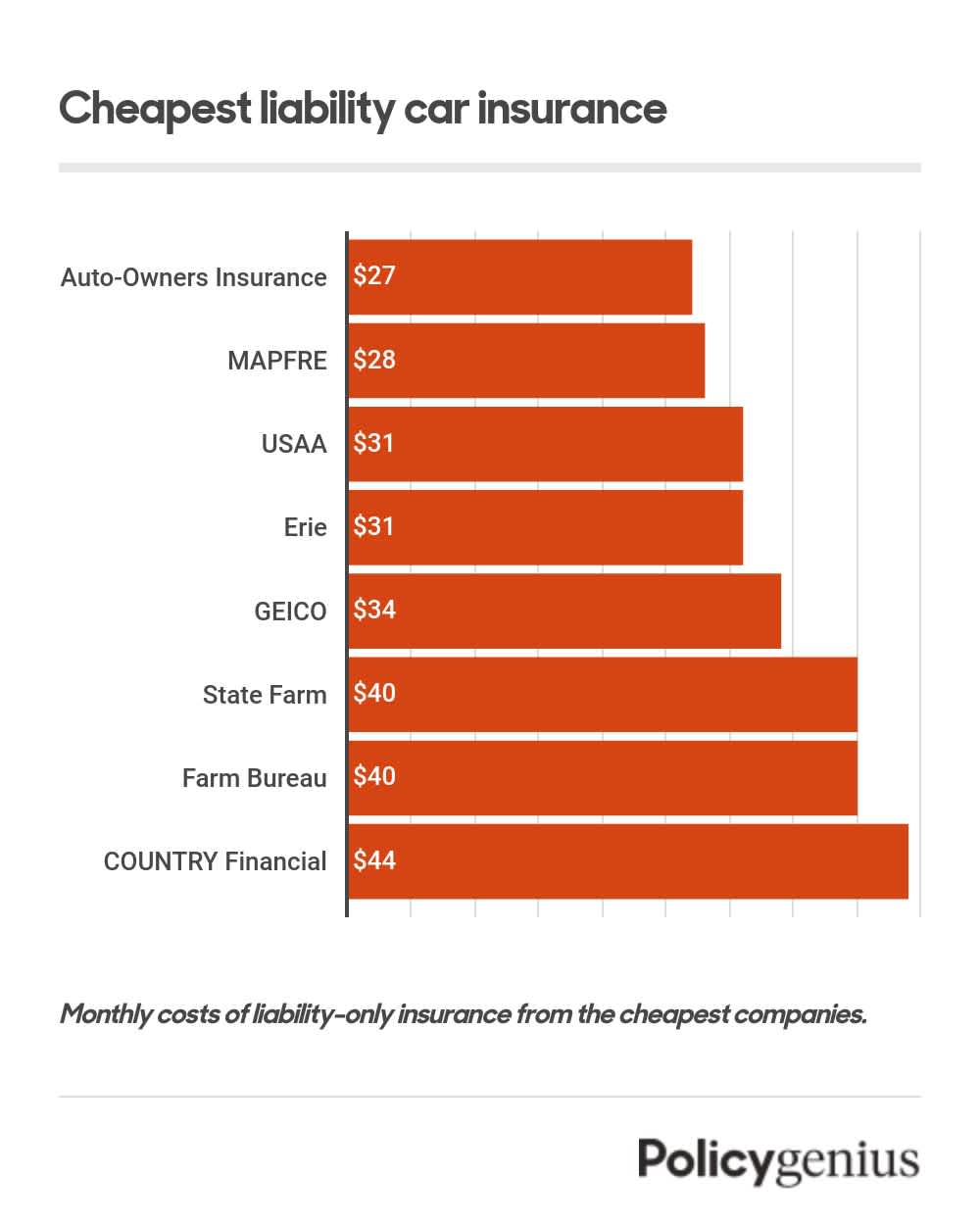

With numerous auto insurance providers in the market, comparing rates and coverage options is crucial to finding the cheapest liability auto insurance. Here’s a look at some of the top providers and their offerings.

State Farm

State Farm is one of the largest auto insurers in the United States, known for its competitive rates and comprehensive coverage options. The company offers a range of discounts, including those for good students, safe drivers, and vehicle safety features. State Farm’s liability insurance coverage is customizable, allowing drivers to choose coverage limits that fit their needs and budget.

GEICO

GEICO, an acronym for Government Employees Insurance Company, is another prominent player in the auto insurance market. GEICO is known for its competitive rates and efficient online services. The company offers a wide range of coverage options, including liability insurance, and provides discounts for military members, federal employees, and safe drivers. GEICO’s website and mobile app make it easy to get quotes, manage policies, and file claims.

Progressive

Progressive is a well-known insurance provider that offers a wide array of auto insurance products, including liability coverage. One of the unique features of Progressive is its Name Your Price tool, which allows drivers to choose the price they want to pay for their insurance and then suggests coverage options to match. Progressive also offers a Snapshot program, which uses a small device plugged into the car’s diagnostic port to track driving habits and provide discounts for safe driving.

| Insurance Provider | Key Features |

|---|---|

| State Farm | Customizable coverage, competitive rates, and a range of discounts. |

| GEICO | Online efficiency, military and federal employee discounts, and safe driver rewards. |

| Progressive | Name Your Price tool and Snapshot program for personalized and data-driven coverage. |

Other notable insurance providers include Allstate, which offers customizable liability coverage and a range of discounts, and USAA, which provides exclusive coverage for military members and their families, offering some of the most competitive rates in the market.

Tips for Lowering Liability Auto Insurance Costs

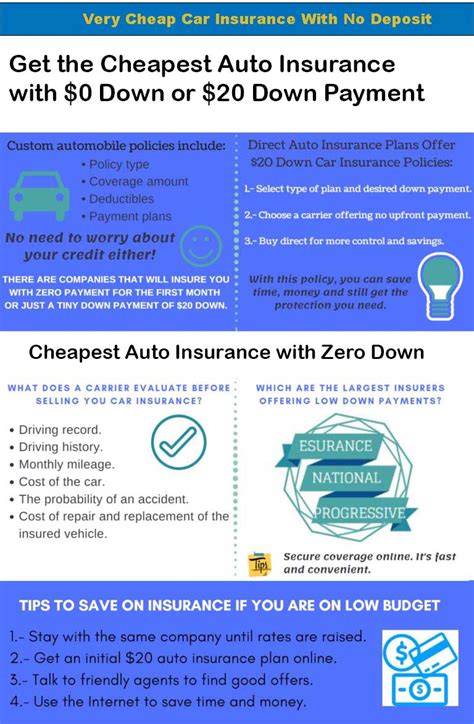

Apart from choosing the right insurance provider, there are several strategies drivers can employ to reduce the cost of their liability auto insurance.

Bundle Policies

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts. Many insurance providers offer multi-policy discounts, so it’s worth considering bundling your insurance needs with a single provider.

Raise Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By raising your deductible, you can lower your insurance premium. However, it’s important to choose a deductible amount you can comfortably afford in the event of an accident.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep insurance costs low. Most insurance companies offer discounts for safe driving, and maintaining a clean record over time can lead to substantial savings. It’s also worth noting that some insurers may forgive a single violation or accident if you have a long-standing history of safe driving.

Consider Usage-Based Insurance

Usage-based insurance programs, like Progressive’s Snapshot, monitor your driving habits and provide discounts for safe driving. These programs can be a great option for drivers who are confident in their safe driving skills and can potentially lead to significant savings.

Future Trends in Liability Auto Insurance

The auto insurance industry is evolving, and several trends are likely to impact the cost and availability of liability auto insurance in the coming years.

Telematics and Usage-Based Insurance

Usage-based insurance programs are expected to become more prevalent, as they provide a more accurate assessment of a driver’s risk profile. These programs can help drivers save money by rewarding safe driving habits, and they also allow insurers to more precisely price policies based on actual driving behavior.

Autonomous Vehicles and Liability

The rise of autonomous vehicles is likely to have a significant impact on liability insurance. As these vehicles become more common, the question of liability in accidents will shift from the driver to the manufacturer or software provider. This could lead to new insurance products and a redefinition of liability coverage.

Data-Driven Insurance

Advancements in data analytics and machine learning are enabling insurers to more accurately assess risk and price policies. This data-driven approach can lead to more precise insurance rates and potentially lower costs for drivers with favorable risk profiles.

Conclusion

Finding the cheapest liability auto insurance requires a combination of research, comparison, and an understanding of the various factors that influence insurance rates. By comparing quotes from multiple providers, leveraging discounts and bundling policies, and maintaining a safe driving record, drivers can significantly reduce their insurance costs. Additionally, staying informed about industry trends and future developments can help drivers make more informed decisions about their insurance coverage.

In a rapidly evolving insurance landscape, staying proactive and informed is key to securing the best value for your insurance needs.

How much does liability auto insurance typically cost?

+The cost of liability auto insurance can vary widely depending on several factors, including the driver’s location, driving history, and chosen coverage limits. On average, liability insurance can range from a few hundred dollars to over a thousand dollars per year. However, it’s important to note that these are just averages, and actual costs can be significantly higher or lower based on individual circumstances.

What are the minimum liability insurance requirements by state?

+Each state has its own minimum liability insurance requirements. These typically include bodily injury liability and property damage liability coverage. The specific limits can vary widely, so it’s important to check the requirements for your state. For example, California requires a minimum of 15,000 bodily injury liability per person, 30,000 bodily injury liability per accident, and 5,000 property damage liability, while Massachusetts requires 20,000 bodily injury liability per person, 40,000 bodily injury liability per accident, and 5,000 property damage liability.

How can I lower my liability auto insurance costs?

+There are several strategies to reduce your liability auto insurance costs. These include shopping around and comparing quotes from multiple insurers, maintaining a clean driving record, taking advantage of discounts for safe driving or defensive driving courses, bundling your auto insurance with other policies (like homeowners or renters insurance), and considering usage-based insurance programs that reward safe driving habits.

What happens if I can’t afford liability auto insurance?

+If you’re unable to afford liability auto insurance, it’s important to explore options to reduce costs. This could include negotiating with your insurer, shopping around for more affordable coverage, or considering usage-based insurance programs that might offer lower rates based on your actual driving habits. However, it’s crucial to maintain at least the minimum required liability insurance to avoid legal penalties and financial consequences in the event of an accident.