Insurance And Registration

In the world of automotive ownership, navigating the complex web of insurance policies and registration requirements is an essential aspect of responsible car care. This comprehensive guide aims to delve into the intricacies of these processes, offering a detailed roadmap for drivers to ensure their vehicles are not only legally compliant but also adequately protected.

Understanding Insurance Policies: A Comprehensive Guide

Insurance, a vital aspect of vehicle ownership, provides a safety net for drivers against various unforeseen circumstances. The insurance landscape is vast and intricate, offering a range of policies tailored to specific needs. Let’s explore the key types and their significance.

Liability Coverage: The Legal Necessity

Liability insurance is the bedrock of automotive insurance, covering the policyholder for bodily injury and property damage claims made by others in an accident where the insured driver is at fault. This coverage is mandatory in most states and is a legal requirement to operate a vehicle on public roads. A typical liability policy consists of three main parts: bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

Bodily injury liability protects the insured against lawsuits arising from injuries sustained by others in an accident caused by the insured driver. Property damage liability, on the other hand, covers damage to others' property, such as their vehicle, home, or other assets. Uninsured/underinsured motorist coverage is an essential add-on, providing protection against accidents caused by drivers who either lack insurance or have insufficient coverage to compensate for the damage caused.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and legal costs for injuries caused to others. |

| Property Damage Liability | Pays for repairs or replacement of others' property damaged in an accident. |

| Uninsured/Underinsured Motorist Coverage | Protects the insured when involved in an accident with an uninsured or underinsured driver. |

Comprehensive and Collision Coverage: Protecting Your Asset

While liability insurance is essential for legal compliance, it does not provide coverage for the insured vehicle itself. This is where comprehensive and collision coverage come into play. Comprehensive coverage is designed to protect against damage caused by events other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals.

Collision coverage, on the other hand, specifically covers damage to the insured vehicle in the event of a collision with another vehicle, an object, or a rollover. Both comprehensive and collision coverage are optional, but they are highly recommended to ensure your vehicle is protected against a wide range of potential risks. The cost of these coverages depends on various factors, including the make and model of your vehicle, your driving history, and the specific coverage limits you choose.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage are designed to cover the medical expenses of the insured driver and passengers, regardless of who is at fault in an accident. PIP coverage is a broader form of medical coverage, often including lost wages and funeral expenses, while Medical Payments coverage is more limited, focusing solely on medical expenses.

These coverages are particularly beneficial in states with a no-fault insurance system, where the insurance company pays for the policyholder's injuries and damages, regardless of who caused the accident. However, even in states with a tort system, where fault is determined and the at-fault driver's insurance pays for damages, PIP and Medical Payments coverage can provide an added layer of protection and peace of mind.

Uninsured Motorist Coverage: A Wise Choice

Despite the legal requirement for drivers to carry insurance, there are still a significant number of uninsured drivers on the road. Uninsured motorist coverage steps in to protect the insured driver in the event of an accident with an uninsured driver. This coverage pays for the insured’s bodily injury and property damage, ensuring they are not left to cover these costs out of pocket.

It's worth noting that uninsured motorist coverage often includes underinsured motorist coverage as well. Underinsured motorist coverage comes into play when the at-fault driver's liability limits are insufficient to cover the insured's damages. This coverage bridges the gap, ensuring the insured receives full compensation for their losses.

The Importance of Vehicle Registration

Vehicle registration is a critical process that officially records the ownership of a vehicle and allows it to be legally driven on public roads. It involves a series of steps, from obtaining the necessary documentation to paying applicable fees and taxes. Let’s explore the key aspects of vehicle registration.

Documentation and Identification Requirements

The first step in the registration process is gathering the necessary documentation. This typically includes proof of insurance, a valid driver’s license, and the vehicle’s title or registration certificate. In some cases, additional documents such as a bill of sale or proof of residency may also be required.

Once the documentation is in order, the vehicle must be identified through a unique Vehicle Identification Number (VIN). The VIN is a 17-character code that serves as the vehicle's unique fingerprint, providing critical information about the vehicle's make, model, and history. It is typically located on the driver's side dashboard, visible through the windshield, and is a crucial element in the registration process.

Title Transfer and Registration Renewal

When purchasing a vehicle, whether new or used, the title must be transferred to the new owner. This process involves filling out a title transfer form, often available from the Department of Motor Vehicles (DMV) or the state’s equivalent agency. The form requires details such as the buyer’s and seller’s information, the vehicle’s VIN, and the sale price. It must be signed by both parties and submitted to the DMV along with the required fees.

Registration renewal is a periodic requirement, typically occurring annually or biannually. This process ensures that the vehicle's registration remains up-to-date and compliant with state laws. It involves paying the applicable registration fees and providing proof of current insurance coverage. In some states, a vehicle inspection may also be required as part of the renewal process.

Fees, Taxes, and Penalties

Vehicle registration is not a one-time cost; it involves various fees and taxes that must be paid regularly. These fees cover the administrative costs of maintaining the vehicle registration system and may also include taxes based on the vehicle’s value or engine size. Failure to pay these fees on time can result in penalties, which can add up quickly and may even lead to the suspension of your registration.

It's important to note that the specific fees and taxes associated with vehicle registration vary widely depending on the state and the type of vehicle. Some states may also offer discounts or exemptions for certain types of vehicles, such as electric or hybrid cars, or for veterans or seniors.

Navigating the Insurance and Registration Process

Understanding the intricacies of insurance policies and registration requirements is crucial for any vehicle owner. By being informed and proactive, drivers can ensure they are adequately protected and in compliance with the law. Here are some key tips to navigate these processes smoothly.

Shop Around for Insurance

Insurance rates can vary significantly between providers, so it’s important to shop around to find the best coverage at the most competitive price. Online comparison tools can be a valuable resource, allowing you to quickly and easily compare quotes from multiple insurers. Additionally, consider speaking with an insurance agent who can provide personalized advice based on your specific needs and circumstances.

Understand Your Policy

Once you’ve chosen an insurance policy, take the time to thoroughly read and understand the terms and conditions. This includes knowing the specific coverages, limits, and exclusions. Being aware of these details can help you make informed decisions about any necessary adjustments to your policy and ensure you’re not caught off guard in the event of a claim.

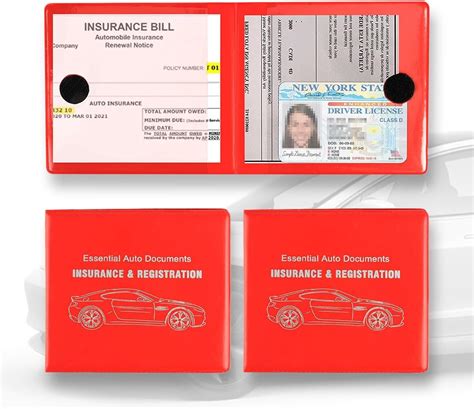

Stay Up-to-Date with Registration

Keeping your vehicle registration current is not only a legal requirement but also ensures you maintain your driving privileges and avoid costly penalties. Set reminders for yourself or use a registration renewal service to stay on top of your registration deadlines. It’s also important to keep your registration certificate and other vehicle documents in a safe and accessible place.

Utilize Online Resources

Many states now offer online services for both insurance and registration processes. These platforms can provide a wealth of information, from comparing insurance rates to checking the status of your registration. They may also allow you to complete certain tasks, such as renewing your registration or updating your address, without having to visit a physical DMV office.

Stay Informed about Changes

Insurance and registration requirements can evolve over time, so it’s important to stay informed about any changes that may affect you. This includes keeping up with state laws and regulations, as well as any updates from your insurance provider. Regularly reviewing your policy and registration status can help you stay ahead of any potential issues and ensure you’re always in compliance.

Conclusion

Navigating the world of insurance and registration can be complex, but with the right knowledge and resources, it becomes a manageable and essential aspect of vehicle ownership. By understanding the different types of insurance coverage and staying on top of your registration requirements, you can ensure your vehicle is protected and compliant with the law. Remember, being proactive and staying informed are key to a smooth and stress-free driving experience.

How often should I review my insurance policy?

+It’s a good practice to review your insurance policy annually or whenever your circumstances change, such as getting married, having children, or purchasing a new vehicle. Regular reviews ensure your coverage remains adequate and up-to-date with your needs.

Can I register my vehicle online?

+Yes, many states now offer online registration services, allowing you to renew your registration and update your vehicle information without visiting a physical DMV office. Check your state’s DMV website for specific details and requirements.

What happens if I let my insurance lapse?

+If you allow your insurance policy to lapse, you may face penalties, including fines and the suspension of your driver’s license and vehicle registration. It’s crucial to maintain continuous insurance coverage to avoid these consequences.

Do I need to carry proof of insurance in my vehicle?

+Yes, most states require you to carry proof of insurance, typically in the form of an insurance card, when operating a vehicle. This card should be easily accessible in case you’re involved in an accident or pulled over by law enforcement.